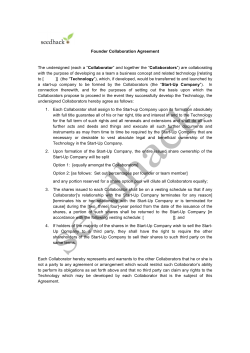

Start-Up Guide Hedge Fund Prime Finance Business Advisory Services