Six Ways to Dress Up QLACs

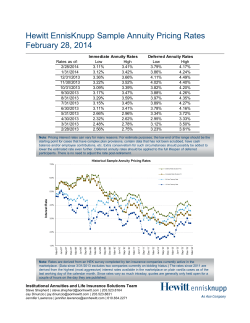

Retirement Income Journal The information forum of the decumulation industry. May 7, 2015 Six Ways to Dress Up QLACs By Kerry Pechter Wed, May 06, 2015 From the time he reached age 70½ until he died at 84, a retired auto executive (we’ll call him Bill Clemens) deeply resented the IRS compulsion to take a distribution from his half-million dollar 401(k) plan each year. Living easily on an executive-level pension and Social Security, with no mortgage or car payments, he and his wife didn’t need the extra $20,000 or so in RMD income. They liked the accompanying bump up in annual income taxes even less. If Bill had had access to a Qualified Longevity Annuity Contract, he would probably have leapt at the chance to cut his annual RMD by up to 25% for up to 15 years. Today, QLAC issuers and distributors are hoping that lots of retirees like Bill will do exactly that. Last week, we wrote about the issuers of QLACs and some of the websites that promote these deferred income annuities. This week, we’ll look at QLAC sales and marketing strategies that issuers and distributors intend to use. So far, the most popular (but not the only) hook for selling QLACs is as a tool for postponing RMDs and taxes on up to $125,000 in qualified money until as late as age 85, especially for healthy people who don’t rely on their RMDs for current income. But is the potential tax savings great enough to justify the loss of liquidity on an eighth of a million dollars for 15 years? Inquiring minds want to know. A remedy for RMDs Almost as soon as QLACs were announced by deputy Treasury Secretary Mark Iwry last July, advisors and manufacturers talked about marketing QLACs as a way to cut RMDs. They would appeal to America’s Bill Luckabaughs, and spin the QLAC as a way to stop Uncle Sam from reaching so deeply into their pockets at age 70½. Thrivent and Pacific Life, for instance, are two QLAC issuers who are stressing the RMD angle. Pacific Life’s QLAC announcement led off with a headline about RMDs. At Thrivent, annuity vice president Wendy McCullough intends to lead with the RMD angle. “We say, ‘Look, if you have more required minimum distribution than you need in income, invest the difference in a QLAC. The QLAC is for people who do need their 401(k) for income but who don’t need their entire RMD,” McCullough told RIJ during a recent interview. “Another thing we see happening: New retirees have more and more qualified than non-qualified assets,” she added. “Up until now, they couldn’t get longevity protection at later ages. It was never an option. With the QLAC, you’ll reduce your tax bill and get longevity protection at the same time.” One of the slides in a Pacific Life QLAC webinar this week showed an estimate of potential cumulative tax reduction of $41,409 from the purchase of a $125,000 maximum purchases of a QLAC of $41,409 between ages 70½ and 84, assuming an average annual growth rate of the IRA assets during that period of six percent. (Click on Pacific Life chart, below at left.) The Pacific Life example assumed a 65-year-old man paying income tax at the rate of 30%. A retiree with a 30% tax rate has an annual pre-tax income north of $200,000, however. People with that kind of money may have more ambitious tax reduction strategies and probably have no fear of ever running out of money. Not all manufacturers recommend leading with the RMD angle. One doubter is Dan Herr, vice president, Annuity Product Management, at Lincoln Financial, which has rolled out QLACs to the MGA (managing general agent) channel and is preparing to distribute them through its wholesaler, Lincoln Financial Distributors, and broker-dealer, Lincoln Financial Network. Lead with longevity protection “I struggle a little with the idea that the RMD deferral is the main reason you buy it,” Herr told RIJ. “If I don’t need that future income, if I’m just getting it out for the RMD exclusion, the benefit is fairly small. There’s a large proportion of retirees who need assistance with lifetime income, and that’s where our focus is going to be. That’s where the real need for education is. I don’t want to minimize the RMD. It’s an added benefit. And there’s a benefit in having clarity. But we’re in the business of providing income guarantees. “We’ll position the QLAC the same way we positioned the DIA: as a tool to help clients and advisors address longevity income needs by deferring income up to age 85. It contains an element of tax deferral, but its main purpose should be to provide an efficient way to manage longevity risk. That’s the heart and soul of what a longevity annuity should be,” Herr said. Indeed, the maximum annual tax savings is less than $1,000. The current limit on contributions to a QLAC is the greater of $125,000 or 25% of tax-deferred savings. By excluding that amount from the calculation of the RMD, a retiree would reduce his taxable distribution by about $4,900 according to current tables and his annual income tax bill by about $1,000. This raises questions about the logic of selling on the basis of RMD reduction. If high net worth clients can afford to give up access to $125,000 for up to 15 years, would they care about reducing taxes by $1,000 to $2,000 a year, especially if they are essentially just “kicking the can down road,” as one Pacific Life presenter conceded in his webinar. Conversely, if a $500,000 (or smaller) IRA represents someone’s entire retirement savings, and he or she needs the entire RMD for current income, will that person be able to afford a QLAC? Not least, there’s the question of whether the tax savings is worth the loss of $125,000 in potential liquidity and the potential growth on that amount. “An advisor’s best luck would be to lead with the tax piece. That’s where we’re headed with it,” said Matt Carey, a Wharton MBA candidate and co-founder of Abaris, a DIA and (soon-to-be) QLAC sales site based in Philadelphia. “But when you explain to people what it is, you find that [the tax savings] it’s not that big a deal. I have a lot of clients—and speaking as a ‘client’ myself—it would be pretty nice to have a smaller RMD at age 70½. But the tax piece alone isn’t enough. You’ve got to do both.” A ‘bob and a lure’ “For those who can afford to buy the maximum QLAC, $125,000 is not that much money,” said Sean Ruggiero, founder of an IMO in Coeur d’Alene, Idaho, as well as an educational website called Safemoneysmart. “Even some of the union workers out here are retiring with $1 million in retirement savings, or $1.3 million. We did a calculation, and the tax savings is not earthshaking. Especially when you consider the fact that you can’t touch the money for 10 or 15 years.” But effective producers often need only the slimmest of conversation-starters in order to establish a relationship with a prospect, and Ruggiero thinks the QLAC’s RMD aspect can easily do that. Producers can use it as a “bob and a lure” to attract attention and pave the way to the sale of another insurance product. One advocate of that approach is Eric Estrada (aka “Thetaxfreeninja”), the marketing director of Synergy Annuity, an IMO in Houston. “You can earn more trust and bring in more assets by explaining that this is a smart tax move. Ninety percent of high net worth clients want the adviser to make recommendations about taxes, but only 10% do,” he told RIJ. “One producer and I wrote QLAC with 25% of the 401(k) and put the balance into a fixed indexed annuity. Then, because the client was healthy, we took the RMDs and bought a life insurance policy. The death benefit from the life insurance will recoup all the taxes and the distributions that were taken out. That was two annuity sales and maybe a life policy sale from one strategy.” But Estrada leads with the RMD angle. “We love the QLAC for RMD planning. It’s hugely overlooked. We have a long history of working with advisors who partner with tax professionals, and the biggest complaint is around RMDs. RMDs tend to get overlooked,” he said. “Everyone is on the Social Security bandwagon, or talking about decumulation. That’s the right thing to be doing. But we also have to talk about the money that’s on the sidelines in qualified accounts. Clients typically have no idea what to do with it. And until now, they haven’t had a solution for preserving it.” Estrada and others pointed out that some retirees look at their IRAs as their legacy or “leave behind” money, and they resent RMDs for whittling away at it every year. Asset retention strategy One of drawbacks of QLACs for commission-paid agents and fee-based advisers involves compensation. The typical commission on a QLAC will be only about half the commission (3% vs. 6%) that a producer can earn selling an equivalent FIA. For a fee-based adviser, recommending a QLAC means “annuicide”: a reduction of assets under management. If $125,000 leaves an investment portfolio and goes into a QLAC, a fee-based adviser charging one percent of assets loses $1,250 in annual revenue. Carey believes he can show fee-based advisers that QLACs are a net gain for adviser and client. “We think fee-based advisors will eventually drive most of our sales,” he told RIJ. The logic is that, if you have a client who is afraid of outliving his or her money, even if it means five or 10 or 15 percent less assets-under-management for you, this will help you establish credibility and trust with the client, and, in the long run, help you keep the rest of their assets.” More ways to position QLACs Brainstorming sessions have produced other ideas for positioning QLACs. Although some people regard the QLAC’s mandatory return-of-premium death benefit (a cash refund during the income stage is an option some issuers offer) as a necessary evil (it protects heirs but reduces the income payment), it can be a plus. If you accept the premise that annuities sell best when positioned as win-win protection and not as a potential sunk cost, then QLACs with both death benefits and cash refunds might be the most appealing: If the client doesn’t live long enough to get the income, his beneficiary gets a nice lump sum. The opportunity cost associated with loss of liquidity might be seen as a small price to pay for guaranteed higher consumption or a guaranteed legacy. [One issuer noted that a QLAC without a cash refund during the income period makes no sense, because it creates an unacceptable scenario. Beneficiaries of a person who died a day before the income start date would receive the premium but beneficiaries of a someone who died a day after the income start date would receive nothing.) QLACs may also be a hedge against the risk of rising out-of-pocket medical costs in old age. “I’ve been approached by people in elder law who are interested in this as an alternative to long-term care insurance,” Matt Carey told RIJ. “We’re still in the early stages of thinking about DIAs and QLACs as alternatives to LTCI.” While “it would be really expensive to buy a longevity annuity to pay for nursing home costs,” he noted, it would provide cash for any type of medical expense, including home health care. He also sees an opportunity, if and when partial annuitization becomes available, to market QLACs to people whose pensions have been terminated and paid out as lump sums. “The good thing about it is that it provides cash [that you can use for any type of medical expense]” Carey added that when pensions are terminated and employees get offered a lump sum, if there’s ever a provision for partial annuitization, that might present a window of opportunity to offer a QLAC. Finally, a QLAC with a flexible start date could, like a DIA, serve to offset the loss of income for couples when one spouse dies and the survivor has to live on one Social Security payment. By the same token, either a QLAC or DIA could be positioned as a way for retirees who already taken the minimum Social Security benefit at age 62 to fix their mistake and “add back” the late-life income they forfeited by not waiting until age 67 or age 70 to claim. In a perfect world, advisers and producers could recommend annuities based on their fundamental strengths—a guarantee of lifelong income and a mortality credit. But because so many affluent annuity prospects worry more about taxes than outliving their money (and because low interest rates don't compensate them for inflation risk and liquidity features dilute the mortality credit), the primary basis for marketing annuities will be tax deferral. © 2015 RIJ Publishing LLC. All rights reserved. QLACs Who’s Doing What with QLACs Now By Kerry Pechter Thu, Apr 30, 2015 Which of the following hashtags is trending on Twitter: #awristwatchwhosetimehascome? #weneverpromisedhillaryarosegarden? #qualifyinglongevityannuitycontracts? If you guessed the third one, you’re probably in the insurance business. By all accounts, few people outside the annuity industry have heard of QLACs. Fewer know what QLACs let retirees do: defer taxable distributions from up to $125,000 in qualified money until as late as age 85. But a subset of the annuity world is fairly jazzed about QLACs, and for good reason: They could open up billions of rollover IRA dollars to sellers of deferred income annuities. To date, seven life insurers have issued QLACs, with more to come. Home offices and IMOs (insurance marketing organizations) have begun acquainting agents and producers with this strange new acronym and the product behind it. In this article, and in an article next week, we’ll tell you about: • Life insurers that issue QLACs. • Independent websites that promote them. • Strategies for selling them. (Coming next week in RIJ.) Clearly, this product (which has also been cleared for use in 401(k)-type plans) is in its earliest stages. But many people feel that curiosity about the tax benefits of QLACs will open the door to broader conversations about other guaranteed lifetime income products with people who may not have known about any of them before. And the potential market—some $25 trillion in qualified savings—is irresistible. Life insurers that issue QLACs In July 2014, the Treasury Department announced specific guidelines for QLAC designs—e.g., no premium greater than 25% of qualified savings (up to $125,000) and a mandatory return of premium death benefit in the deferral period. So QLACs don’t vary much from issuer to issuer. Some contracts offer more income start-date flexibility than others. Prices will obviously fluctuate with interest rates and carrier appetite. AIG. AIG’s American General unit issued its American Pathway QLAC last December. Contract owners who choose a cash refund option can accelerate or delay their income start date by up to five years, and have several inflation-adjustment options. Americo Financial Life and Annuity. This final-expenses specialist filed an applied for approval to issue its DIA as a QLAC last September. “We have had a DIA for many years, and quickly made the adjustments to meet QLAC requirements,” said Todd Adrian, Americo’s senior marketing manager, product development. “Our DIA is pretty straight forward with no special features or flexibility beyond Treasury requirements.” First Investors Life. Carol Springsteen, president of this unit of The Independent Order of Foresters, told RIJ recently,“We will be endorsing our current deferred income annuity contract to facilitate a QLAC version. We plan to endorse our new Flexible Pay Longevity Annuity product to be a QLAC as well.” Lincoln Financial. “We launched our DIA in November 2013, and added the QLAC status in February 2015,” said Dan Herr, vice president, annuity product management. “We released it on a limited basis, in certain firms—mainly in the MGA (managing general agent) channel—where it was an easy rollout. The national rollout will be in mid-May. Our contract can be offered with or without the return of premium after the income start date.” Pacific Life. The company with the humpback whale logo introduced its QLAC on April 6. Christine Tucker, vice president of marketing in Pacific Life’s Retirement Solutions Group, said in a release that the company is offering the resources of its Retirement Strategies Group and Advanced Marketing Group to help “financial professionals examine the application of QLACs in a variety of financial strategies.” Principal Financial. The Principal announced its QLAC on February 3. The Principal's DIA and its QLAC include a return-of-premium death benefit if the contract owner(s) die during the deferral period. A return of unpaid premium rider for the income period is optional. Thrivent Financial. “We were able to launch on January 16,” vice president Wendy McCullough told RIJ. “It was a little bit onerous because we had to build processes for remedying excess contributions, among other things, in ways that the IRS would accept. Now we’re rolling it out to our captive force. We’ve noticed that the newer retirees have more qualified than non-qualified assets, and up until now they couldn’t get longevity protection at later age. With QLAC, they have that option.” Issuers in the wings. The biggest DIA issuers haven’t announced QLACs yet. New York Life, which has a 42% share of the DIA market, and Northwestern Mutual, have each filed for state approval of their QLAC and expect to launch products this summer. A MassMutual spokesman said, “We continue to actively evaluate” as an option for IRA owners and retirement plan participants.”A Guardian Life spokesperson said “Guardian is planning to launch its first QLAC later this year.” MetLife “has yet to enter the market but we hope to soon,” a company spokesman told RIJ recently. Websites that promote QLACs So much for the manufacturers; what about the distributors? QLACs are insurance products, so captive (for the big mutual company QLACs) and independent agent channels will account for most sales. A number of insurance and annuity websites have begun offering calculators, educational material, FAQs, and quotes about QLACs, along with connections to live licensed agents via toll-free numbers. Go2income.com Jerry Golden, who created the world’s first guaranteed minimum income benefit rider while at Equitable Life in the late 1990s and sold a retirement income planning tool to MassMutual in the mid-2000s, has since launched a venture called Golden Retirement LLC. A beta version of its proprietary QLAC payout quote tool can be seen at go2income.com. “The QLAC is going to open up a lot of people’s eyes to the benefits of income annuities in general,” Golden told RIJ this week. Immediateannuities.com. Through this site, insurance executive-turned-web- entrepreneur Hersh Stern and his licensed agents has been providing quotes and selling SPIAs directly to the public for many years. A couple of years ago, he added indexed annuities. He is now offering QLACs as well. There’s a QLAC education page on the website, a payout calculator, a QLAC FAQ page, and a video of Christina Benz, Morningstar’s director of personal finance, about QLACs. IncomeSolutions.com. This website, created by the Hueler Companies, is an open-architecture platform where participants in certain retirement plans (Vanguard plans, for instance) and others can get competitive bids on immediate and deferred income annuities when they change jobs or retire. In April, Income Solutions started offering QLACs from The Principal and AIG, two publicly held insurers that use third-party distribution. Myabaris.com. Matt Carey, a licensed insurance agent and MBA candidate at the Wharton School, who once worked on retirement issues at the Treasury Department, has started a business that specializes in the sale of DIAs and, starting in June, QLACs. “The QLACs we can sell right now are from AIG, Lincoln Financial, Pacific Life, and Principal,” Carey told RIJ. He and a partner are acting as agents for individuals and for advisers who otherwise don’t handle insurance sales. They hope to make buyer-behavior data available to the carriers they represent. Safemoneysmart.com. Coeur d’Alene, Idaho insurance wholesaler Sean Ruggiero created this website for his business, but plans to convert it to a non-profit educational site to help insurance producers learn more about retirement income, including QLACs. “QLACs are a big deal. They will have a big impact on clients and advisers—but not immediately,” Ruggiero told RIJ. Stantheannuityman.com. The sponsor of this site, Stan Haithcock, is well known in the insurance world as a speaker, a producer and a promoter of annuities as income products rather than accumulation products. He has also written an instant book about QLACs, which he makes available on his site. Synergyannuity.com. “We love the QLAC. RMD planning is hugely overlooked,” said Eric Estrada, the product and marketing guru at this Houston-based IMO. “Right now, everyone is on the Social Security planning bandwagon. But clients have no idea about what to do with money on the sidelines in qualified accounts.” Qlacs.com. Someone had to claim the “qlacs” domain. The owner is Alternative Brokerage, an IMO whose founder is Bob Phillips, a former chair of the National Association of Fixed Annuities. Fidelity.com. The retirement giant, which has an online platform where consumers can compare and purchase deferred income annuities from Guardian, MassMutual, MetLife, New York Life and The Principal, will soon offer QLACs. (Only one of its DIA issuers—The Principal—has announced a QLAC yet.) “We don’t have them right now, but we anticipate offering them in the second half of the year,” a Fidelity phone rep told RIJ this week. Next week: How to Market QLACs. © 2015 RIJ Publishing LLC. All rights reserved. RetirePreneur: Lowell Aronoff By Jenna Gottlieb Tue, May 05, 2015 What I do: I run a company that facilitates the sale of financial products. In the U.S. we have focused on the annuity markets. CANNEX provides a surveying service for immediate income annuities. Each participating carrier provides us with its unique pricing method. We re-program these algorithms onto our server and then provide distributors and advisors with apples-to-apples comparisons of prices. Each price is specific to the adviser’s customer, we show only those carriers that the advisor is licensed with, and each quoted carrier guarantees its annuity quote. We provide similar guaranteed surveys of the singlepremium deferred income annuity market. We also provide a variety of analytical tools to help advisers calculate and explain retirement income needs. These include a product that calculates an optimal allocation between three classes of retirement income generators—managed accounts, annuities with guaranteed living benefit riders and income annuities. My clients are: Primarily insurance companies and distributors, – including broker-dealers, insurance marketing organizations and banks. We avoid working directly with consumers because we do not want to compete with our distributor clients who are in a better position to offer personalized advice. Where I came from: I started my career in Montreal working in Prudential of England’s actuarial department. I found myself drawn to programming actuarial functions so I took a job with a start-up organization called CANNEX that was still a few months away from launching its first product—a method to instantly survey the income annuity market. To me, entrepreneurship means: Pursuing an idea or dream. This involves trading some financial security for more control of your destiny. What made me strike out on my own: At the time I had a fabulous opportunity. The concept/product was needed and I was confident that it would make a difference. I was young enough that I had no personal or financial commitments. I could put all my time and energy into the company without needing to draw a salary for more than two years. Who owns CANNEX: The three principal owners are Alex Melvin, Moshe Milevsky and me. Most of the other shareholders are family and friends who helped us out when Alex and I bought the company from the founding shareholders. The rest are employees who have purchased shares over the years. My business model: Fundamentally, we charge everyone who benefits from the service. Our flagship product is an income annuity exchange. Carriers pay to be included and distributors pay for the illustrations they receive from the service. By charging both carriers and distributors we can keep our fees lower. My biggest obstacle at the beginning: CANNEX started before personal computers were popular and the World Wide Web had not yet been envisaged. At the time, getting technology into the hands of advisors to allow them to communicate with our mini-computer was an issue, as was gaining trust and getting acceptance for a start-up organization that changed the way annuities are sold. How we changed the way annuities are sold: Before CANNEX, advisors would typically lug telephone-book-sized rate books to each client’s home where they would discuss the client’s need, and then do a different calculation by hand for each insurance company based on a few numbers found in each insurance company’s rate book in order to figure out how much each company was prepared to offer their client. Why we expanded to the U.S.: It was working in Canada, and there was no U.S. competitor. The service was needed and we had experience expanding to Australia. We eventually sold our Australian operation because distance made management difficult. The U.S. was and is a natural market, with similar needs, the same time zones, and largely the same opportunity as our Canadian service. Our biggest ongoing challenge: Keeping experienced, excellent staff happy, challenged and motivated. This involves absorbing the input of very capable individuals in setting the company’s priorities. When people become overworked, which happens when you grow quickly, it’s important to find creative ways to split the overworked person’s job in two. Another challenge in running a twocountry company is determining priorities. Our software development resources are not split between the two countries. The same person will work on a U.S. project one week and a Canadian project the next. My retirement philosophy: I don’t think retirement is a good idea for people who are healthy and thoroughly enjoy their work. I’m lucky enough to fall into both those categories. Like most people, I have a hard time planning more than five or 10 years out, so I have no plans to retire in the foreseeable future. If and when I do retire I would buy an income annuity—but not for the usual reasons. I am constitutionally a saver, so whether I buy an income annuity or not, there is no real danger that I would run out of money. However, there is a risk that I would spend far below my means. A guaranteed check that I know will be there every month for the rest of my life would help counter my natural tendency to avoid spending. © 2015 RIJ Publishing LLC. All rights reserved.

© Copyright 2026