Document 247800

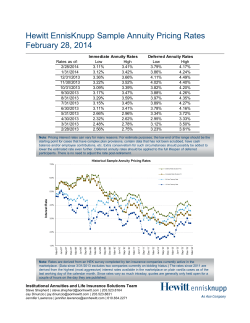

Annuities are insurance-based financial vehicles that can provide many benefits sought by retirementminded investors. There are a number of reasons why people buy annuities. Deferral of taxes is a big benefit, and so is the ability to put large sums of money into an annuity — more than is allowed annually in a 401(k) plan or an IRA — all at once or over a period of time. Annuities offer flexible payout options that can help retirees meet their cash-flow needs. They also offer a death benefit; generally, if the contract owner or annuitant dies before the annuitization stage, the beneficiary will receive a death benefit at least equal to the net premiums paid. Annuities can help an estate avoid probate; beneficiaries receive the annuity proceeds without time delays and probate expenses. One of the most appealing benefits of an annuity is the option for a guaranteed lifetime income stream. When you purchase an annuity contract, your annuity assets will accumulate tax deferred until you start taking withdrawals in retirement. Distributions of earnings are taxed as ordinary income. Withdrawals taken prior to age 59½ may be subject to a 10% federal income tax penalty. Fixed annuities pay a fixed rate of return that can start right away (with an immediate fixed annuity) or can be postponed to a future date (with a deferred fixed annuity). Although the rate on a fixed annuity may be adjusted, it will never fall below a guaranteed minimum rate specified in the annuity contract. This guaranteed rate acts as a “floor” to help protect owners from periods of low interest rates. Any guarantees are contingent on the claims-paying ability of the issuing insurance company. The information in this article is not intended to be tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Emerald. © 2014 Emerald Connect, LLC 1230 East Chestnut Street Chilton, WI 53014 Of course, there are contract limitations, fees, and charges associated with annuities, which can include mortality and expense risk charges, sales and surrender charges, investment management fees, administrative fees, and charges for optional benefits. Surrender charges may apply during the contract’s early years in the event that the contract owner surrenders the annuity. Variable annuities are not guaranteed by the FDIC or any other government agency; nor are they guaranteed or endorsed by any bank or savings association. P.O. Box 125, 505 Hwy. 67 Kiel, WI 53042 (920) 894-7835 Variable annuities are long-term investment vehicles designed for retirement purposes. They are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the variable annuity contract and the underlying investment options, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest. R A NC E TH INSU L A E H LIFE & M EN TS I N V E ST M ENT R ETI R E NS & E T A IO E ST NG OP T PL A N N I Variable annuities offer fluctuating returns. The owner of a variable annuity allocates premiums among his or her choice of investment subaccounts, which can range from low risk to very high risk. The return on a variable annuity is based on the performance of the subaccounts that are selected. Any guarantees are contingent on the claims-paying ability of the issuing insurance company. The investment return and principal value of an investment option are not guaranteed. Variable annuity subaccounts fluctuate with changes in market conditions. When a variable annuity is surrendered, the principal may be worth more or less than the original amount invested. *Securities and Advisory Services offered through Packerland Brokerage Services, Inc., an unaffiliated entity. Member FINRA & SIPC Why Do People Buy Annuities? Carol Jodar Ricker - James Gresens* - Daniel Carlson* - Glen Riesterer* - James Wilbert *- Ruth Reiss - Julie Osladil* N EWSLETT SPRING ER Permit No. 34 Brillion, WI PRSRT STD U.S. POSTAGE PAID 2014 I understand that golf is merely a game and retirement planning is your life, but they can be compared. What makes it a good analogy is that on each hole you have a clearly defined goal – get the ball in the hole in as few shots as possible. When planning for your retirement, your goal is to save enough money for retirement (the hole) by a certain age (number of shots). Golf is similar in that some want to go out and whack the ball around and don’t care what their final score is and that’s great. Others take the sport very seriously and take lessons, play a round, or hit the range every day. As Denis Waitley once said, “the results you achieve will be in direct proportion to the effort you apply”. As in golf, there is a lot to learn about planning for retirement. It takes time and a great deal of patience to see your investments grow. You know your eventual objective is to have enough money saved to retire how you want, whether it be to travel the world, visit children and grandchildren, or spend most of your time on the golf course (the latter will be me). What you choose to do is up to you, but the end goal is the same. Too many people don’t take this approach towards long-term investing. Their hope is that someone else will do it for them or they’ll get a “mulligan”. In reality, saving for retirement and putting the ball in the hole is only one person’s responsibility – YOURS! You can use a swing coach or a financial advisor, but there is only so much help they can provide. A golf instructor can’t swing the driver or make that tough putt, but they can give you tips and ideas on how you can improve. In the same respect, a financial advisor cannot save the money for you, but they can educate you on investment planning and wise financial decisions. It’s still up to you to make that putt and implement your retirement plan. No one but you can make those decisions. Teaming up with your Riesterer Financial advisors will help you stay out of the rough! Now, who’s up for a round of golf? Da n Carlso CO RN ER MAKING YOUR HOME FALL-PROOF Getting around your home safely can be a challenge if you have injuries or health problems that make it easy for you to fall. Many health problems can increase your risk of falling— poor eyesight, balance problems caused by disease like stroke or Parkinson’s disease, side effects of medicines, weakness or pain in the legs and feet, and confusion or dementia. For people with these conditions, common things like loose rugs, poor lighting, and household clutter can become a big safety issue. But there are easy things you can do to make your home a lot safer. Key Points ■ Some common hazards in the home might make you more likely to fall. But you can make your home safer with a few simple measures. ■ Preventing falls can help you live a more independent life. The complete article is posted on our website at www.rfsadvisors.net. Did You Know ■ Our government’s projected budget deficit for fiscal year 2014 is $750 billion. For every $1 of expected tax revenue, our government anticipates spending $1.25 (source: Treasury Department). Aging Well: ■ Falls can lead to serious injuries. Hitting your head can cause a head injury. A fall can break a bone, resulting in surgery and months of therapy. n ■ An individual that has earned income up to the maximum Social Security wage base each year who then waits to take his/her Social Security retirement benefit until age 70 will receive +77% more income per month than if he/she had taken a retirement benefit early at age 62 (source: Social Security) HE AL TH Plan Your Approach DON’T RENEW THAT CD! 3.5% Earn Apy with a GBU* Preferred 8 tax-deferred annuity. $10,000 minimum deposit. 2.0% Minimum Guarantee. Call today as rates may change at any time. *GBU Financial Life is a 121 year old fraternal benefit society domiciled in PA. If you do not have the internet just stop in the office and we will print you a copy. This information comes from WPS Health Insurance website. Rhubarb Cake Cream: ½ cup butter 2 cups sugar 1 egg Add: 2 cups flour 1 tsp. baking soda Mix in: 1 cup sour milk (3 tsp. lemon juice or vinegar plus 1 cup milk) Fold in: 3 ½ cups rhubarb, cut into bite sized pieces Spray 9” x 13” pan. Put batter into pan. Topping-Mix Together: ½ cup sugar 1 tsp. cinnamon ½ cup chopped nuts Sprinkle over batter. Bake for 45 minutes at 350°

© Copyright 2026