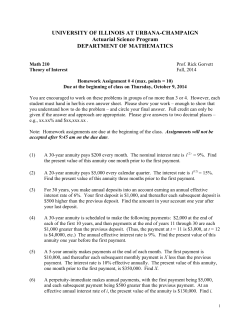

annuity worksheet

annuity worksheet With your financial goals in mind, you should begin any annuity selection process by asking the questions listed below. After you have answered them, your financial planning professional can help you make additional decisions regarding the best annuity for your needs. How do I want to pay into my annuity — through a single payment, or through flexible premiums? With a single-premium annuity, you pay the issuing insurance company a one-time lump sum. The required minimum contribution will vary. With a flexible-premium annuity, you make a series of payments to the insurer over time. You determine the payment schedule (monthly, quarterly, semiannually or annually) and amounts (they can remain steady or fluctuate). How do I want my money to be paid out — fixed or variable? Fixed payout is a guaranteed stream of payments over the life of the annuity. The payout rate is set by the insurance company and the fixed payout amount may be made monthly, quarterly, semiannually or annually. You may have the opportunity to establish a rising income option at the outset of the annuity contract. This will typically provide lower initial income payments, in return for higher income payments in future years. These higher payments are designed to at least partially offset the antici- How do I want my money to be allocated — fixed or variable? Fixed annuities earn a steady interest rate set by the insurance company and guarantee an income pated higher cost of living in the future. Variable payout is a stream of payments in which the payout amounts may vary with the performance of the subaccounts you chose to invest in. stream for your lifetime or a specific duration of time. Visit sec.gov/answers/annuity.htm for more details. Variable annuities let you allocate your money across professionally managed stock, bond and cash equivalent subaccounts. Current value and payout amounts may vary with subaccount performance. They offer greater potential returns but are riskier than fixed annuities. Visit sec.gov/answers/ annuity.htm for more details. How soon do I want payments to begin — immediately, or deferred to a later date (such as my future retirement)? Immediate annuities turn the money you provide into regular income right away — usually within 1 to 3 months. Deferred annuities begin regular payouts in the future. A portion of early withdrawals may be subject to a surrender charge. Comparing annuity Different annuities offer a wide range of choices, prices, features and flexibility. Use the following chart to compare annuity contracts you are considering. Write in the names of the companies or specific plans you are comparing under Contract A, B or C. Then compare the features listed on the left for each. Skip items that do not apply or that don’t interest you. FEATURES Initial minimum premium Guaranteed rate of return Current rate of return Projected rate of return 3–5 year rate of return Portfolio options Sales charge Surrender charges/Penalties Surrender value Other fees Special features CONTRACT A CONTRACT B CONTRACT C

© Copyright 2026