New Venture Challenge – Business Plan Laura Shapland NadimVasanji

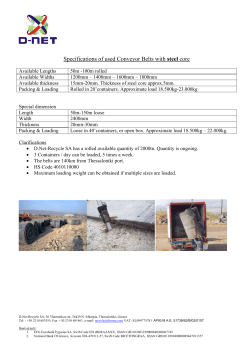

New Venture Challenge – Business Plan Team members: Laura Shapland NadimVasanji Ali Jetha AmitKoren Table of Contents EXECUTIVE SUMMARY .................................................................................................................................... 1 COMPANY OVERVIEW AND ACHIEVEMENTS ................................................................................................... 2 MARKET OPPORTUNITY .................................................................................................................................. 3 SERVICE DESCRIPTION..................................................................................................................................... 6 GO-TO-MARKET STRATEGY ........................................................................................................................... 10 CUSTOMER ACQUISITION STRATEGY ............................................................................................................ 13 COMPETITION ............................................................................................................................................... 14 MANAGEMENT TEAM ................................................................................................................................... 15 FINANCIAL PROJECTIONS .............................................................................................................................. 17 EXIT OPPORTUNITY ....................................................................................................................................... 20 BUSINESS RISKS ............................................................................................................................................ 21 APPENDIX ..................................................................................................................................................... 24 1. RE-USABLE PLASTIC CONTAINER SPECIFICATIONS ......................................................................................................24 2. RPC PROCESS FLOW DIAGRAM ............................................................................................................................25 3. SALES PROSPECTS ..............................................................................................................................................26 4. DETAILED INCOME STATEMENT ............................................................................................................................27 5. KEY FINANCIAL ASSUMPTIONS .............................................................................................................................28 6. WAREHOUSE ECONOMICS ...................................................................................................................................30 7. LIST OF TRADING AND TRANSACTION COMPARABLES .................................................................................................32 8. SALES HURDLES.................................................................................................................................................33 9. BOX SUPPLIERS .................................................................................................................................................34 10. WASHING MACHINES.......................................................................................................................................35 11. INTERVIEWS AND REFERENCES ............................................................................................................................36 12. ENDNOTES ....................................................................................................................................................37 Executive Summary Boomerang Logistics facilitates the adoption of reusable plastic containers (RPCs) in the foodservice industry, thereby enabling our customers to realize significant economic and environmental benefits. Although restaurants are pushing for reductions in packaging waste, their suppliers currently do not have the capabilities and resources to implement RPCs – Boomerang Logistics will change this. Boomerang Logistics, will purchase the RPCs, rent them to the supplier, and through a partnership with distributors, manage the reverse logistics. This solution will save manufacturers 10% on packaging costs, eliminate underutilized freight by up to 25%, and reduce waste and disposal costs for restaurants. Boomerang Logistics will initially target food manufacturers and processers that supply quick service restaurant (QSR) chains. This is an attractive starting market because it features a number of attributes that make the adoption of reusable containers both feasible and valuable, including frequent deliveries, concentrated distribution, and an emphasis on efficiency and margins. To drive substitution from corrugated cardboard to the RPC model, Boomerang will have to incentivize all supply chain participants. Manufacturers reap the most benefits, through reduced packaging costs, freight optimization, and less product damage. Distributors will generate a new revenue stream by filling “empty miles” on the return trip to the distribution center. Finally, restaurants will achieve drastic reductions in packaging waste reducing their disposal costs. With this solution, Boomerang will be able to effectively compete against the corrugated cardboard box, the de facto standard in the foodservice industry. In addition, Boomerang’s solution presents both cost and technological advantages over competitors in the RPC space. The company’s short-term goal is to secure a pilot customer and implement our service in that customer’s supply chain. This will require $35,000 in initial funding from the founders and a value-added investor. Boomerang Logistics’ 2-year goal is to build and fill a fully scaled 20,000 sq. ft. facility supporting four washing lines, with a total capacity of 6 million box cycles per year. This single facility 1 will require $2.5MM in funding and is expected to generate a 10-year IRR of 37%, returning 4x invested capital. Once Boomerang has proven the economic model for a single new warehouse, the company will aggressively expand by establishing new facilities regionally and then nationally. Within 5 years, the company expects to reach EBITDA of $13.7MM with recurring revenues representing 60% of total revenues. The attractive cashflow generation and recurring revenue will make Boomerang an attractive acquisition target for both strategic and financial buyers. Based on comparables, Boomerang Logistics estimates an enterprise value of close to $83MM generating significant returns for investors. To execute on its strategy, Boomerang Logistics has assembled a strong launch team with diverse professional and personal backgrounds. The team will be supported by a board of advisors with more than 50 combined years of experience in food manufacturing and food service logistics. In the nearterm, Boomerang Logistics will seek to add to its team a President & COO with senior-level expertise in operations within the foodservice supply chain. Company Overview and Achievements Boomerang Logistics’ mission is to enable our customers to realize the economic and environmental benefits that RPCs offer. At present, Boomerang Logistics is in the inception phase. It will be incorporated upon completion of the New Venture Challenge competition at the University of Chicago Booth School of Business. To date, the founders have had very positive discussions with companies such as Meat Works (a supplier of meat products to McDonald’s) and Dogs R Us (a Chicago-based hot dog chain), who have both indicated interest in adopting Boomerang Logistics’ service. The company’s immediate goal is to secure a pilot customer and implement the service in that customer’s supply chain. The launch team has been working together since September 2009 and has demonstrated strong commitment and a shared vision. The team also distinguished itself in Prof. Deutsch’s Building the New Venture Class by winning 1st place in the operational execution competition. Upon completion of a 2 successful pilot, the team will bring on a President & COO with significant operations expertise within the foodservice industry. Boomerang Logistics has also added two advisors to its team – Hank Lambert and Nashir Vasanji – with over 50 years combined experience in foodservice operations and logistics. Market Opportunity The Problem Consider a company such as Meat Works, a meat processor based in southern Wisconsin that supplies McDonald’s with beef patties, bacon, and other meat products. From 2003 to 2009, input food prices grew at an annual rate of 7.5%1 while fast food prices grew by only 4.2% per year.2 As a result, profits of companies like Meat Works are being squeezed, with typical net margins of only 2-3%.3 At the same time, McDonald’s is applying significant pressure on its suppliers to reduce packaging waste.4 Meat Works can address both of these challenges by replacing corrugated cardboard boxes with reusable plastic containers (RPCs), enabling better net margins and less environmental waste. Unfortunately, this option is not currently available to Meat Works because the company: 1. Lacks capabilities to retrieve containers from restaurants for re-use; 2. Is unable to invest the large up-front capital required to purchase the containers; and 3. Cannot integrate traditional RPCs into existing automated packaging processes. The Boomerang Logistics Solution Boomerang Logistics’ turnkey RPC solution solves each problem for Meat Works and allows it to immediately realize the economic and environmental benefits of RPCs. In particular, Boomerang Logistics will: 1. Partner with the restaurant and distributor, in this case McDonald’s and Martin-Brower, to manage the reverse logistics process including retrieval, inspection, sanitization and finally delivery back to Meat Works for re-use; 2. Purchase the containers and supply them to Meat Works on a pay-per-use basis, eliminating upfront costs and delivering savings immediately; and 3. Utilize new, innovative RPCs that can be easily integrated into the existing carton-erecting equipment that manufacturers use. 3 The Benefits By implementing Boomerang Logistics’ RPC solution, Meat Works could increase its bottom line by 10%. Meat processors like Meat Works generate approximately $75M in revenue and approximately $2M in profit on sales volume of 1.25M cases. As corrugated cardboard prices have increased (including a 10% increase as recently as April, 2010)5, packaging has become a significant expense for meat processors. At $0.55 per corrugated cardboard case, Meat Works spends ~$690,000 per year on transport packaging, more than one third of its total profit. Moreover, because the corrugated cases Meat Works currently uses are not strong enough to support optimal pallet stacking, the freight utilization of each truckload shipped is 25% less than it would be with RPCs6. This represents a savings opportunity of 270 truckloads, reducing freight expense by $130K7. Overall, Meat Works could save 10% on their packaging costs and eliminate underutilized freight, resulting in an immediate bottom line improvement of $200K with no up-front investment. In addition to cost savings, the Boomerang RPC solution would enable Meat Works to help McDonald’s achieve its environmental sustainability goals8. RPCs, over their life-cycle (including reverselogistics and washing), require 39% less energy, produce 95% less solid waste and generate 29% less greenhouse gas emissions compared to single-use corrugated cardboard cases.9 Finally, RPCs enable value-added technology like RFID because costs can be amortized over the life of the container. This type of technology can improve inventory management, product traceability and reduce recall size in the foodservice supply chain. Target Market Boomerang Logistics will initially target food processers that supply quick service restaurant (QSR) chains because they feature a number of attributes that make the adoption of reusable containers both feasible and valuable: 1. Frequent deliveries –restaurants have high velocity product flows with low levels of overall inventory, minimizing the float of containers required to operate the system; 4 2. Concentrated distribution –QSR chains are typically served by a single distributor in each region, reducing pick-up locations for transport to Boomerang’s sanitization facility; 3. Standardized operating procedures – restaurant outlets follow stringent rules and regulations, enabling rapid deployment of new procedures; 4. Potential for value added technology – new box technologies, such as RFID, have particular value for food service companies including inventory tracking and recall management; and 5. Emphasis on efficiency and margins – QSR chains compete on price, and according to The Hale Group10, supply chain optimization is the key to competing successfully. In the United States, there are approximately 250,000 quick service restaurant outlets (defined here as restaurants where consumers pay before service).11 Each outlet receives approximately 450 cases packaged in corrugated cardboard per week12, which translates into 5.9 billion corrugated cases per year in the US. At an average cost of $0.55 per case, this market represents a $3.2B opportunity of which 65% ($2.1B) is immediately addressable based on the current mix of packaging technology used by restaurants. Boomerang Logistics will begin operations in the state of Illinois, which accounts for approximately 5%, or $110M, of this market.13 Why Now? A confluence of trends on both the demand and supply side of this target market make now the optimal time for Boomerang Logistics to enter: • Rising input prices are causing manufacturers to seek new efficiencies, in particular in low valueadded items such as packaging; • Nationwide, demand for green packaging is projected to increase 3.4 percent annually to $43.9 billion in 2013, with foodservice and transport packaging growing the fastest14; • QSR chains are increasingly focused on sustainable practices and reducing packaging waste (e.g., McDonald’s 2009 Best of Green report states that the company is moving towards 100% sustainable packaging in Europe by the end of 201015); and • In a recent survey completed by the National Restaurant Association, 62% of consumers responded that they would choose a restaurant based on how environmentally-friendly it is16. Further, 40% of restaurants and 31% of QSRs planned to devote more resources to green initiatives in 201017. 5 Finally, innovations in container technology have enabled applic applications of reusable plastic containers (RPCs) that were previously unviable unviable. Compared to other types of RPCs, those made from corrugated plastic are less expensive and can be successfully integrated into automated carton-erecti erecting machines. However, corrugated plastic containers have typically not been used in foodservice18 because the t fluted construction (i.e., air flutes in the middle of the plastic) makes them difficult to wash and dry. dry Recently, innovations in the manufacturing process have enabled the efficient icient production of “edge-sealed” “edge corrugated plastic containers,, which can be easily washed and dried. The combination of these market and technology trends indicates that there is a unique opportunity in the U.S. foodservice market today. today As RPC penetration in the U.S. approaches levels achieved in Europe, this market represents a billion dollar opportunity19 that is ripe for Boomerang Logistics. Service Description Let’s follow a Boomerang RPC as it moves through the system for Meat Works: 6 1. Meat Works receives and uses RPC to package goods Meat Works receives palletized boxes from Boomerang Logistics. For manufacturers who hand-pack their products or use carton-erecting machines, boxes are introduced into the manufacturing process exactly as they are with current transport packaging. Boomerang’s RPCs, constructed from corrugated plastic, are introduced into existing packaging machinery because they are very similar in form to corrugated cardboard boxes. The plastic material, however, is thirty times stronger than corrugated cardboard, and because of its resistance to moisture and humidity, can be reused up to 100 times20. Moreover, the strength of the RPCs enables optimal pallet stacking, which can translate to significant freight savings for Meat Works. 2. Martin-Brower delivers goods to restaurant Martin-Brower receives shipments from the manufacture and delivers goods to restaurants as it currently does today, tracking exactly the number of containers delivered to each location with its existing systems. 3. McDonald’s unpacks, folds and stores RPCs Upon receipt of the shipment, McDonald’s employees store boxes until needed. Once used, employees fold the RPC and place it in the Boomerang portable RPC storage container. This process requires no more time than it currently takes employees to unload, collapse and move transport packaging to dumpsters or recycling bins. However, since McDonald’s reduces its quantity of waste, it can save on disposal costs. The portable storage container has a footprint of only 3 sq. ft. and depth of 4 ft., and holds up to 75 containers. Since, distributors typically deliver between 2-3 times per week21, one portable container supports between 150-225 RPCs/week, enough for a typical Boomerang customer. 4. Martin-Brower collects and returns RPCs to warehouse The distributor’s driver collects the empty RPCs from the restaurant during the next regularlyscheduled delivery. For a typical delivery, the driver makes 3 trips22 from the truck to the facility with a 7 hand truck (dolly) to deliver goods. The new Boomerang process requires the driver to make one additional trip – to pick up the portable container, empty the folded RPCs into a pallet-sized bulk container on the truck, and then return the portable container to the restaurant. Back at the distribution center, the pallet-sized containers are unloaded and stored until they are picked up by Boomerang Logistics. This new process requires about three minutes of additional driver labor per stop, or thirty minutes total (10 drop-offs per route). Boomerang will pay the distributor 130% of these costs (which translates to $0.04 per RPC, or approximately $25 per route per day), creating a new source of revenue for what would otherwise be “empty miles”. 5. Boomerang transports RPCs back to sanitizing facility On a semi-weekly basis, a contracted 3rd Party Logistics provider (3PL) collects a truckload of RPCs from the distributor’s warehouse and delivers them to Boomerang’s sanitizing facility. 6. Boomerang inspects, sanitizes and palletizes RPCs Upon receipt of empty RPCs from Martin-Brower, containers are unloaded and put on a conveyor to be scanned into the system. Prior to washing, a warehouse employee removes all labels and packaging mastic (specially developed by 3M for easy removal23) from the RPCs. Containers deemed unfit for use are returned to the RPC manufacturer to be granulated and then re-formed. Satisfactory RPCs are sanitized in high-throughput washing/drying machine. Dry boxes will then be re-palletized according to box size and shipped back to Meat Works. 7. Tracking throughout the system The complexity of open loop systems increases the importance of diligently tracking the RPCs throughout the supply chain. The containers are valuable assets for Boomerang Logistics, representing relatively high capital costs and requiring an optimized turnover rate. Prior to each use, every RPC will be labeled with a unique barcode. Within Boomerang Logistics’ facilities, automated barcode scanning equipment will monitor the flow of RPCs. Throughout the rest of the RPC process, Boomerang Logistics 8 will leverage the existing information systems distributors use to monitor forward logistics of products. These systems can be easily utilized to track the flow of empty containers back from the restaurants to the distribution facility24. Unit Costs to Provide the Boomerang Service Once at scale in a given location, the cost of providing the Boomerang Logistics service for a typical customer using boxes with dimensions of 15”x12”x12” would break down as follows:. 0.1 0.65-0.70 Freight Savings* Total Value 0.55 - 0.60 0.07 0.01 Box Washing Tracking 0.08 0.37 Warehouse overhead Total Cost 0.09 0.13 Box Cost (incl. loss) Reverse Logistics Cardboard Comparable * Freight savings apply to customers with dense products Based on these economics, Boomerang is able to profitably price boxes at a rental price of $0.50, representing 10% cost savings for manufacturers. The key assumptions underlying these unit costs are: • Box Cost – (1) $7 cost per RPC; (2) 60 re-uses of the box; (3) 5% annual box loss – based on case studies of corrugated plastic containers in closed-loop supply chains25 • Reverse Logistics – (1) full truckloads at scale – based on discussion with foodservice distributors and a bottom’s up costing of what it would cost the distributor to perform reverse logistics tasks26. Includes hiring a third party logistics provider to perform logistics from distribution facility to Boomerang’s warehouse and then on to the manufacturer. • Box washing – (1) 2 machine operators for each line (2) each machine can wash 6 boxes/minute or ~1.5MM boxes per year (3) includes energy, water and detergent costs27 • Tracking – Paper-based disposable barcode stickers will be utilized • Warehouse overhead – includes warehouse rent, and direct labor at the central warehouse 9 Asset management A key operational consideration for Boomerang Logistics is to ensure appropriate asset utilization. Box shrinkage and long cycle times through the supply chain generate large working capital costs for the company. Competitors, including IFCO (containers) and CHEP (pallets), use bright colors to distinguish their assets and provide convenient storage options, minimizing damage and loss to 5%. Boomerang Logistics will implement similar strategies. In addition, a number of risk-sharing strategies could be implemented as needed if loss rates exceed 5%: • Tiered pricing: manufacturers can be charged an initial price representing 5% cost savings with an additional 5% rebate based on box cycle times; • Target-based incentives: distributor margins can be indexed to retrieval rates; and • Restaurant lottery: outlets receive lottery tickets based on box return rate; every quarter restaurants are selected for financial rewards. Go-To-Market Strategy Boomerang Logistics has developed a stage-based go-to-market approach to appropriately scale and grow the business. The go-to-market strategy is grounded in four key operational milestones: 1. Execution of a 6 month pilot project in a single supply chain 2. Establishment and scaling of initial warehouse facility 3. Regional roll-out 4. National roll-out 1. Pilot Program To date, two potential pilot participants, Meat Works (a manufacturer) and Dogs R Us (a Chicagobased QSR) have expressed interest in a pilot program. The goal of the pilot will be to prove the operational viability of the business model and to prove the benefits of the service offering. Upon completion of the pilot, Boomerang Logistics will prove: • Average RPC durability and damage/loss rates; • Value to manufacturers of additional freight utilization per trip; • Effectiveness of tracking procedure; 10 • Average RPC cycle time in days; • Value of reduced disposal costs to restaurant; and • Average reduction of environmental waste per month. In addition, a successful pilot will enable Boomerang to use the pilot customer as a reference when speaking with prospective customers in the following phase of the business. In order to conduct the pilot with minimal capital costs, Boomerang will make three adjustments to the future business process. First, Boomerang will outsource RPC washing and drying. Discussions are on-going with potential service provider Corbi Plastics. Second, Boomerang will rely on the distributor’s tracking infrastructure rather than build a tracking system for its own facility. Third, boxes will be shipped directly to the manufacturer’s site such that Boomerang will not need a warehouse. To fund the pilot, Boomerang will require $35,000 in initial funding. These funds will be used to pay for start-up expenses, boxes, and service providers as well as to fund working capital. (Further details provided in Financing Section). 2. Establishment of initial warehouse and scaling Following a successful pilot, Boomerang Logistics will use the confirmed value proposition to sell its service to additional customers. Upon obtaining three letters of intent from restaurant chains, the company will confidently invest in the first warehouse, the fundamental scaling unit for the business. The initial warehouse will be the prototype on which all future warehouses will be modeled. Through operation of this facility, Boomerang will develop expertise in the sanitization and RPC handling process. At its core, the scale of a Boomerang warehouse is limited by the geographic concentration of potential customers. Given the importance of reverse logistics costs to the business economics, maintaining reasonable transport costs and delivery times is paramount. Based on discussions with distributors who also face a similar optimization problem, Boomerang will initially target manufacturers and restaurants within a 150 mile radius of downtown Chicago. 11 A fully scaled Boomerang warehouse will be a 20,000 square foot facility, supporting 4 washing and drying lines, with a total capacity 6 million box cycles per year (approximately 2 large national restaurant chains and 7 medium-sized regional chains). The scaled facility will include state-of-the-art tracking and sorting capabilities. For a facility of this size, the initial capital cost is $2,500,000, including $600,000 in sales and marketing spend over the first two years to quickly build customer volume. The economics of a single facility are highlighted below (excluding headquarters SG&A). Single Warehouse - at scale (NOTE: first warehouse is forecasted to ramp more slowly) Thousands Year 1 2 3 4 5 Box Cycles 3,120 4,742 5,959 5,959 5,959 End Customer Outlets Served 1,352,000 119 149 149 149 Large restaurant chains 2 2 2 2 2 Regional restaurants 4 7 7 7 Revenues $ 1,560 $ 2,371 $ 2,980 $ 2,980 $ 2,980 $ 6 5,959 149 2 7 2,980 $ 7 5,959 149 2 7 2,980 $ 8 5,959 149 2 7 2,980 $ 9 5,959 149 2 7 2,980 $ 10 5,959 149 2 7 2,980 Costs Variable Costs Warehouse Costs Depreciation Total Variable Costs $ 648 710 703 2,061 $ 634 710 619 1,963 $ 621 710 549 1,881 $ 608 710 536 1,855 $ 596 710 520 1,826 $ - $ - $ - $ - $ - $ 6 603 610 $ 5 445 450 $ 127 127 $ 123 123 $ 1,026 $ 1,198 $ 1,535 $ 1,551 $ 378 400 420 1,199 Marketing and Sales - start-up Marketing Sales Total Marketing and Sales $ 75 225 300 Capital Expenditures Warehouse infrastructure Boxes Total CAPEX Cashflow IRR $ $ 328 1,938 2,266 $ 562 710 628 1,900 $ 45 135 180 $ 86 1,027 1,113 (1,784) $ 37% $ 691 710 787 2,188 $ 676 710 826 2,212 $ 30 90 120 $ 662 710 867 2,239 $ - $ - $ 5 792 797 $ 193 193 $ 203 203 $ 13 1,121 1,134 (194) $ 662 $ 1,401 $ 1,405 $ 487 As highlighted, a single facility is expected to generate a 10-year IRR of 37% returning close to 4x invested capital. For details of customer ramp-up, refer to the Customer Acquisition Strategy section. 3-4. Regional and national roll-outs Once the company has established the economic model for a single new warehouse, growth will come from the establishment of new facilities in the Midwest region and then nationally. Expansion will be completed in a modular fashion – each warehouse will have the same tracking and washing setup. Prior to establishing each warehouse, the company will secure letters of intent equivalent to half the capacity of the warehouse by targeting restaurant chains in the region with whom Boomerang has 12 existing relationships. A national footprint will allow the company to serve national manufacturers whose goods may be transported across geographic coverage areas. Customer Acquisition Strategy Selling Boomerang’s model will require agreement from all three participants in the quick service restaurant (QSR) supply chain: the manufacturer, the distributor and the restaurant chain. Discussions with executives in this supply chain have highlighted a delicate balance of power. For manufacturers and distributors, the quick service restaurant’s business often makes up a large portion of total revenues. For this reason, the QSR chain has strong market power and can push its objectives through the supply chain. Thus, while the manufacturer will ultimately be the customer that leases our RPCs, Boomerang Logistics will target QSR chains to make the initial sale. To target these companies, Boomerang Logistics will employ a direct sales model at the corporate level, pushing for chain-wide adoption of the RPC solution. Because QSRs are strongly motivated by the environmental benefits of the RPC model, Boomerang will sell to the VP of sustainability or equivalent. Once the company has entered preliminary discussions with an interested QSR chain, it will seek introductions to regional distributors and manufacturers. Given the complexity of this sales process, Boomerang will direct significant sales efforts towards large, national chains (e.g., McDonald’s, KFC, Burger King, etc.). The goal is to sign up two such chains, which would account for about 50% of total RPC rental volume. As Boomerang adds warehouses, these large customers (~250 outlets per region) will be the first ones served, enabling the company to quickly build scale in new markets. The remaining 50% capacity in each regional facility will be filled by seven medium-sized regional chains (~65 outlets each). For the first warehouse and the regional roll-out, Boomerang will target chains in Illinois (see Appendix 3 for a preliminary list of potential chains). 13 Based on discussions with potential customers to date, we anticipate certain common objections to arise from each party during the sales process. The key to minimizing the sales cycle and closing the deals will be anticipating these potential hurdles and our responses. For example: • For manufacturers, food safety is a crucial element to ensure longevity of the brand - past recalls have put companies out of business28. Boomerang’s sanitization process fully complies with FDA and USDA regulations. Furthermore, all washing facilities will obtain AIB Gold Standard certification; • For distributors, there may be concern that retrieved Boomerang boxes would contaminate other deliveries on the distributor’s truck. To combat this concern, Boomerang will provide pallet-sized containers on each truck to isolate returned containers; and • For QSRs, storage space in restaurants is extremely limited so it is essential that the RPC storage bin has a very small footprint. As such, the storage bin has been designed to take up only 3 sq. ft.; 80% of restaurants surveyed indicated that this amount of space was available29. For a comprehensive list of the hurdles we expect to encounter most frequently, see appendix 8. Competition The primary competition for Boomerang Logistics is the cardboard box, the de facto standard in the foodservice industry. The corrugated cardboard industry has historically responded aggressively to the introduction of reusable plastic containers in other applications, including intense public relations efforts to discredit the viability of RPCs. However, this industry has significantly less leverage moving forward, due to their low net margins (2% to 5%) and a growing emphasis from restaurants on waste reduction. Boomerang Logistics will face additional competition in the RPC space from container pooling incumbents such as IFCO (International Food Container Organization), Tosca Ltd, and CAPS (Container and Pooling Services). However, the market is at a nascent stage, offering tremendous growth 14 opportunities. One final source of competition may be plastic container manufacturers, who currently have a strong position selling RPCs to closed-loop supply chains. However, the operational complexity of moving into open-loop systems would represent a strong barrier to entry for RPC manufacturers. The table below illustrates Boomerang Logistics’ advantages over each key competitor in addressing the foodservice industry. Competitor Examples International Paper Key Advantages Boomerang Advantage • Dominant packaging material (~90% of market30) • Lower cost, reduced waste, less product damage • Concentrated industry • Cardboard industry net margins are only 2-5% so will not be able to match price aggressively31 IFCO • Open-loop pooling model for produce distributed through grocery stores • Focus on foodservice and quick service restaurants Tosca • Open-loop pooling model for produce and meat distributed both through grocery stores and food service outlets • Use of corrugated plastic containers that integrate seamlessly into existing manufacturing and packaging processes CAPS • Pooling model principally geared towards pallets and bulk containers • Focus on individual cases rather than bulk containers Buckhorn • Lower cost, reduced waste, less product damage • Rental model lowers up-front capital investment requirements • Strong presence in closedloop systems • Turnkey solution including reverse logistics and asset management Cardboard Box Smurfit Stone Manufacturers Georgia Pacific Container Pooling Services Orbis Plastic Box Manufacturers Technology Container Corp. Management Team Boomerang Logistics has assembled a strong launch team with diverse professional and personal backgrounds. The team will be supported by a board of advisors with more than 50 combined years of experience in meat manufacturing and foodservice logistics. After the pilot, the team will bring on a 15 President & COO. This individual will have significant senior-level foodservice and logistics expertise (e.g., supply chain management, network optimization, etc.). At that time, we also expect that key members of our Board of Advisors would join the Board of Directors of the company. The company is currently led by the following individuals: • Laura Shapland, Chief Executive Officer: Laura worked as manager of a restaurant. In addition, she brings over 7 years of experience with BP working across the energy supply chain. Her indepth understanding of complex energy logistics led to millions of dollars in cost savings. Laura will be responsible for coordinating the team’s efforts to launch the pilot and will represent Boomerang Logistics for the sales and financing activities. • Nadim Vasanji, Chief Financial Officer: Nadim has significant experience in financial modeling and analysis, new product development, sales strategy execution and development of go-tomarket strategies through his experience at McKinsey & Company and TD Capital Private Equity Investors. Nadim will monitor project execution relative to the financial plan and will be responsible for fundraising efforts at each stage of growth. • Ali Jetha, Chief Operating Officer: Ali has a background in organizational management, business process engineering and performance improvement gained during his management consulting experience at Arthur D. Little. Ali has also worked on start-ups in the entertainment and solar generation spaces. Ali will ensure the sourcing, procurement and set-up of the facilities is carried out according to plan and that potential operational problems are handled appropriately and rectified swiftly. Ali will take on the role of VP Logistics once the new President and COO is hired. • Amit Koren, Chief Marketing Officer: Amit brings 5 years of experience in management consulting with Monitor Group, including significant work in manufacturing, logistics, information technology, and sales force management. Amit will be working closely with Laura on the sales effort to raise awareness of the services provided by Boomerang Logistics. Amit will build the sales pipeline to ensure the warehouse capacity is rapidly optimized. The Board of Advisors is comprised of the following individuals: 16 • Hank Lambert. Hank has over 30 years experience in the food service industry. Most recently, Hank served as Senior Vice President at Arrowstream, Inc., a supply chain management software solution provider. Prior to Arrowstream, Hank served as VP & GM of Pinnacle Foods Corp, a branded foodservice operator, and before that as President of Nabisco Foodservice Company as well as the Director of the International Foodservice Manufacturers Association. Hank was also the founder and CEO of EFS Network Inc, a supply chain management company for the foodservice industry. • Nashir Vasanji. Nashir has over 20 years of experience in the meat processing industry. He currently serves as Director at Canada Gold Beef, a food manufacturing and distribution company. Prior to this role, he served for 20 years as COO of New Foods Classics, a value-added food service manufacturer. Financial Projections Boomerang’s financial projections are based on a bottom’s up assessment of the number of warehouses the company can roll-out. A snapshot of the company’s 5-year income statement is displayed below: Thousands Number of warehouses Number of box cycles Rental Price Revenue Recurring Revenue Year $ 1 2 3 1 3 6 2,371 11,388 24,804 0.50 $ 0.50 $ 0.50 $ 1,186 5,694 12,402 21% 46% 4 5 10 15 44,585 70,325 0.50 $ 0.50 22,292 35,162 56% 63% Variable Costs Gross Margin Gross Margin $ 287 $ 898 76% 1,366 $ 4,328 76% 2,949 $ 9,453 76% Warehouse Costs SG&A $ $ 400 709 1,510 1,577 3,330 2,514 EBITDA EBITDA Margin $ (211) $ -18% 1,241 $ 22% 3,609 $ 29% 7,910 $ 13,695 35% 39% Depreciation Expense EBIT $ $ 319 $ (530) $ 1,495 $ (254) $ 3,290 319 5,951 1,958 Interest Expense Net Income Net Margin $ $ $ (530) $ -45% 113 $ (366) $ -6% $ $ $ $ $ $ $ $ 394 $ (75) $ -1% 5,256 $ 8,225 17,036 26,937 76% 77% 5,860 3,267 $ $ $ $ 788 $ 1,171 $ 5% 9,100 4,142 9,479 4,215 1,294 2,922 8% The company makes positive net income starting in year four with strong EBITDA margins beginning in year two. EBITDA generated in year 5 is in excess of $13MM. Additionally, the rental business model has 17 an added feature of delivering a strong recurring revenue stream – by year 4, over half of the company’s revenues are recurring. Financing strategy Boomerang’s financing strategy is tightly linked with the operational milestones set out in the go-tomarket strategy. The company will seek to first fund a pilot program, then fund the establishment of a scaled warehouse and subsequently fund expansion on a warehouse by warehouse basis. Pilot Program The company’s founders will invest $35,000 to fund the pilot described in the go-to-market section. Activity Start-Up Expenses (Incorporation, etc.) Purchase of 2,000 boxes (@ $9 each) Payment to service providers Box rental income Other (including sanitation audit) Total Pilot Funding Required Cost (10,000) (18,000) (3,810) 4,000 (5,000) (32,810) Sources of Funding Founder Investment Total Funding 35,000 35,000 First Warehouse Subsequent to a successful pilot, Boomerang will seek to raise $2,500,000 in venture capital to fund the first warehouse to be located in Chicago, IL. This round of funding will be used to outfit the warehouse with the required tracking and washing technology as well as to finance initial boxes and sales and marketing expenses to build scale. Activity Warehouse Setup Marketing Sales Operating Costs and Initial Box Procurement Other SG&A and buffer Total Warehouse Funding Required Sources of Funding VC Investment Total Funding Cost (395,000) (150,000) (450,000) (1,400,000) (105,000) (2,500,000) 2,500,000 2,500,000 18 Regional Roll-Out After establishing the economic viability of a single warehouse/washing facility, Boomerang will embark on an aggressive regional roll-out. Funding for the roll-out is expected to be a mix of debt and equity. Given the attractive economics and cashflow generation of a single warehouse unit, Boomerang forecasts that 45% of each warehouse’s start-up expenses can be funded with debt. Additionally, to support the aggressive roll-out, Boomerang will seek $4.5MM from a value-added growth equity investor. The growth equity investment will be staged over two years and bridge the company to the point whereby equity portions of new facilities can be funded internally through company cashflows. National Roll-Out Starting in the 4th year of operations, subsequent new warehouses can be funded entirely through a mix of 45% debt financing and internal cashflows. 5-Year statement of cashflows: Cash Flow Operations Net Income Add: Depreciation Total Cashflow Operations (32,810) Investing Boxes Washing Equipment Tracking Infrastructure Machinery Other Total Cashflow Investing Financing Equity Founders VC Growth Equity (529,986) 319,116 (210,869) (366,072) 1,494,753 1,128,681 (74,731) 3,289,749 3,215,018 (1,473,231) (160,000) (15,000) (30,000) (39,700) (1,717,931) (5,191,757) (640,000) (30,000) (60,000) (97,300) (6,019,057) (7,225,967) (880,000) (45,000) (90,000) (145,000) (8,385,967) 2,500,000 2,000,000 Cash Beginning Balance Net Cashflow Cash Ending Balance 2,921,572 9,479,463 12,401,034 (9,926,134) (12,067,471) (1,200,000) (1,520,000) (60,000) (75,000) (120,000) (150,000) (200,800) (255,000) (11,506,934) (14,067,471) 35,000 2,500,000 Debt (45% of each new warehouse) Total Cashflow Financing 1,170,880 5,951,124 7,122,004 35,000 0 2,190 2,190 2,250,000 3,375,000 4,500,000 5,625,000 2,500,000 4,750,000 5,375,000 4,500,000 5,625,000 2,190 571,200 573,390 573,390 (140,376) 433,014 433,014 204,051 637,066 637,066 115,070 752,136 752,136 3,958,563 4,710,699 19 While the company requires significant funding over time to build a national model, the company will cease to need external equity starting in Year 5. Exit Opportunity After five years, the scale and attractive recurring revenue characteristics of Boomerang Logistics will make the company an attractive acquisition target for numerous industry players. Potential acquirers and acquisition rational are presented below: Potential Acquirer Acquisition Rationale Distributor • Competitor • • 3PLs • Plastic box manufacturer Financial buyer • • • • Environmental benefit can differentiate distributor to both retailers and suppliers Platform to expand service offering into foodservice Leverage warehouse footprint to cross-sell complementary service Attractive way to solve reverse-logistic capacity utilization problem Offer service to other industries Improve ability to market and sell core plastic box product Attractive cashflow generation and recurring revenue Use company as a platform to expand service offering to other geographies and industries Investor Returns After 5 years, based on comparables, Boomerang Logistics could be worth close to $80MM. At this exit valuation, equity investors will all realize significant returns on their invested capital. Exit Model EBITDA in Year 5 EV/EBITDA Multiple at Exit 13,694,784 6.1x (Based on transaction and trading comps) Enterprise Value Debt Equity Value 82,974,643 15,750,000 67,224,643 Equity Holders Founders VC Investor Growth Equity Funded 35,000 2,500,000 4,500,000 Ownership 25% 40% 35% Proceeds 16,806,161 26,889,857 23,528,625 MOIC 480.2x 10.8x 5.2x 20 There have been several prior successful equity investments in this space. For example, iGPS, a private company funded by Pegasus Capital Advisers, was formed in 2006 by the former CEO of CHEP Americas, a wooden pallet pooling company. Additionally, Container and Pooling Solutions (CAPS) a bulk container pooling company has developed a pooling solution for business-to-business reusable liquid and dry material containers. The company is owned by Lazard Alternative Investments and has grown 73% over the past 3 years32. Additional Growth Opportunities Once Boomerang Logistics develops operational expertise in QSR supply chains, there are a number of additional attractive growth opportunities. Pharmaceutical companies, for example, could benefit tremendously from value-added technologies made possible by RPCs, such as end-to-end temperature monitoring of certain products. Implementing such technologies in single-use disposable containers is cost-prohibitive, but with RPCs, the costs of sensors and recording devices can be amortized over many uses. Fast moving consumer goods (FMCG) that are shipped to “break-bulk” facilities represent an additional opportunity. As an example, consider shampoo sold at the pharmacy chain CVS. In order to minimize the inventory carried at the stores, CVS no longer sends entire cases of each type of shampoo to its outlets. Instead, it takes a few bottles of several types of shampoos and places them in a plastic tote, which is then delivered to the store, emptied, and returned to the distribution facilities. CVS has achieved significant savings by utilizing RPCs in the closed-loop part of its supply chain (distribution center to stores), but the open-loop part (manufacturers to distribution centers) still utilize corrugated cardboard containers. Business Risks Long sales cycle – open-loop model requires obtaining agreement from multiple parties across the entire supply chain. We will mitigate this by targeting quick service restaurant chains that have 21 significant leverage within the supply chain, standardized operating procedures at outlets, and sufficient scale to justify the sales investment. Raw material costs – business model depends on ability to procure plastic containers costeffectively. Plastic prices will move in-line with oil prices – a key raw material input, but variable margins are high enough (~20%) to absorb temporary price increases. Additionally, RPCs can be ground and reconstituted into new containers, thereby reducing the economic impact of the input prices. Container loss – economic viability of business depends on the number of paid uses for each container. A provision of 5% annual loss/damage has been built into the financial projections, which is slightly higher than the current loss at comparable container pooling companies such as CHEP and IFCO. Boomerang Logistics will mitigate this risk by providing positive incentives for supply chain partners to appropriately manage assets. Data integration with the information systems of manufacturers and distributors will enable accurate tracking of containers and enforcement of this policy. Sanitization– sanitizing RPCs in compliance with FDA regulations and AIB (American Institute on Baking) standards is a baseline requirement for Boomerang Logistics. Based on discussions with plastic manufacturers, food service executives, and FDA officials, there is considerable evidence that the sealed-edge, corrugated plastic box will enable full sanitization and adhere to all regulatory requirements for incidental food contact. Duration of contractual terms with customers – the typical duration of contracts between food manufacturers and their corrugated cardboard suppliers is one year. Because Boomerang Logistics is investing in customer-specific assets, it would be desirable to obtain longer-term contracts with customers to ensure Boomerang Logistics can recover its investment in those containers. If customers balk at this request, there is a risk that some customers will depart after the first year, leaving Boomerang Logistics with customized containers not suitable for any other applications. This risk is mitigated by several factors: 1) containers can be ground and recycled into new containers for 22 significantly less than the price of purchasing a brand new container; 2) because the RPC solution is embedded with multiple parties in the supply chain, it tends to be naturally “sticky”; 3) the major investments in Boomerang Logistics’ washing and distribution facilities are not customer-specific, and so the investment at risk with each customer is limited only to their containers. 23 Appendix 1. Re-usable plastic container specifications PROPERTIES PLASTIC CORRUGATE PAPER CORRUGATE Weight for test 0.15 lbs. / sq. ft. 0.15 lbs. / sq. ft. Water Absorption in 24 hrs 0.02% 75% Edge Crush Test 45 lbs. sq. ft. 5 lbs. sq. ft. Flat Crush Test 80 lbs. / sq. inch 3 lbs. / sq. inch Tear Strength 1700 grams 10 grams Tensile Strength 4,000 lbs. / sq. inch 200 lbs. / inch Impact Dart Test 320 inches / lb. 32 inches / lb. Heat Def. Load @ 66 lbs. per sq. inch 174 degrees Not Applicable Living Hinge 21,000 cycles Source: http://www.coroplast.com/advan.htm 1,000 cycles 24 2. RPC process flow diagram 25 3. Sales prospects Pilot phase No. 1 2 3 4 5 6 7 8 9 10 11 12 Company Mr. Submarine Pockets Taco Fresco Dogs R Us Wow Bao Brandy's Superdawg Gold Coast Dogs Al's Beef Portillo’s HomeMade Pizza Co. Alonti # U.S. IL as a % of Segment Locations # IL Locations total business Sandwich 26 26 100.0% Sandwich 12 12 100.0% Mexican 11 11 100.0% hot dogs 4 4 100.0% Asian 3 3 100.0% gyros 3 3 100.0% hot dogs 2 2 100.0% hot dogs 8 8 100.0% hot dogs 18 16 88.9% hot dogs 18 16 88.9% pizza/pasta 26 16 61.5% catering 26 5 19.2% Source: http://www.centerstagechicago.com/restaurants/styles/fast-food.html First Warehouse Phase Revenues # U.S. No. Company ($M) Locations 1 Jimmy John's $497 970 2 Culvers $644 394 3 White Castle $568 415 4 Steak n Shake $700 502 5 Chipotle $1,330 837 6 Boston Market $648 541 7 Panera Bread $2,648 1,323 8 Popeye’s $1,593 1,582 9 Dunkin' Donuts $5,500 6,395 10 Einstein/Noah's Bagels $393 496 11 Qdoba $448 454 12 Hardee's $1,680 1,758 13 Jamba Juice $444 729 14 Little Caesars $1,055 2,500 15 Long John Silver's $800 1,022 Source: QSR.com Fast 50, company websites and Google Approximate # IL Locations 500 76 76 69 90 51 105 120 478 34 30 104 42 119 47 IL as a % of total business 51.5% 19.3% 18.3% 13.7% 10.8% 9.4% 7.9% 7.6% 7.5% 6.9% 6.6% 5.9% 5.8% 4.8% 4.6% 26 4. Detailed Income Statement Year Pilot Revenues Number of warehouses Number of new warehouses Large Chains (250 outlets) Number of regional customers (65 outlets) Number of box cycles Rental Price 1 2 3 4 5 1 1 3 2 6 3 10 4 15 5 2 2,371,200 0.50 2 5 11,388,000 0.50 2 15 24,804,000 0.50 2 33 44,584,800 0.50 2 58 70,324,800 0.50 1,185,600 5,694,000 12,402,000 22,292,400 35,162,400 208,904 54,673 23,712 287,289 76% 989,682 262,576 113,880 1,366,139 76% 2,129,149 571,913 248,040 2,949,102 76% 3,782,438 1,028,005 445,848 5,256,291 76% 5,900,513 1,621,499 703,248 8,225,261 77% Fixed Warehouse Costs Warehouse Rental Warehouse Labor Fixed Warehouse Costs 90,000 310,000 400,000 270,000 1,240,000 1,510,000 540,000 2,790,000 3,330,000 900,000 4,960,000 5,860,000 1,350,000 7,750,000 9,100,000 Depreciation Expense Boxes (Including Loss) Washing Machine Storage Bins Other Infrastructure Depreciation Expense 294,646 16,000 970 7,500 319,116 1,402,583 64,000 5,670 22,500 1,494,753 3,093,849 136,000 14,900 45,000 3,289,749 5,615,644 232,000 28,480 75,000 5,951,124 8,967,903 352,000 47,060 112,500 9,479,463 250,000 225,000 60,000 75,000 10,000 26,000 63,180 709,180 500,000 585,000 60,000 195,000 100,000 10,000 53,000 73,680 1,576,680 750,000 1,035,000 120,000 345,000 100,000 10,000 82,000 72,130 2,514,130 750,000 1,485,000 180,000 495,000 100,000 60,000 114,000 82,605 3,266,605 750,000 1,935,000 300,000 645,000 200,000 60,000 145,000 107,355 4,142,355 (210,869) (529,986) 1,241,181 (253,572) 3,608,768 319,019 7,909,504 1,958,380 13,694,784 4,215,322 112,500 393,750 787,500 1,293,750 (529,986) - (366,072) - (74,731) - 1,170,880 - 2,921,572 - (529,986) -45% (366,072) -6% (74,731) -1% 1,170,880 5% 2,921,572 8% Revenue Variable Costs Reverse Logistics Washing Supplies Tracking Labels Variable Costs Gross Margin - 9,600 7,620 3,600 SG&A Management Salaries Sales Customer Service Marketing Finance HR Legal/Insurance HQ Costs Total SG&A EBITDA EBIT 1,980 (1,620) Interest Expense (10%) - Taxable Income Taxes (@39%) Net Income Net Margin (1,620) 27 5. Key Financial Assumptions Box Costs: • $7 per box to start based on quotation from edge-sealed manufacturer Carter Associates • 8% price decline for first 5 years resulting from increasing volume o Scale discounts provided by Carter Associates o Assumption that edge sealing process becomes more efficient • 60 uses per box based on comparable data from box suppliers and Wal-Mart Canada case study Customer Volume: • Mix of large national customers (average of 250 outlets per customer) and regional chains (average of 65 outlets per customer) • 40 boxes delivered per product line per outlet (based on discussions with distributors) • 3 product lines per customer converted to Boomerang Logistics solutions • 4 week box cycle time based on interviews with industry experts and competitors Provision for box loss: • 5% provision based on implementation of incentive pricing model and comparable information from analogues (IFCO, Technology Container Corporation) Reverse Logistics costs: • $0.05 per case delivered from distributor warehouse to Boomerang washing facility and to manufacturer o Full truck-load freight rates o 100 miles of trucking distance • $0.04 per case fee paid to distributor for retrieval from restaurant o 120 boxes per pick-up location (3 product lines) o 2 pick-ups per week o 3 minutes per pick-up, 10 locations per delivery run o Driver wage of $19.50 per hour (source: payscale.com) o 30% distributor margins on service • Costs fall by 3% per year as a result of scale with distributor Box washing costs: • $80,000 cost per machine (dryer and washer), 10 year life • Machine capacity of 1.5MM boxes per year (6 boxes per minute) • 750 gallons of water per day per machine ($0.00108/gallon of water) • 724.64 kW/shift of energy cost ($50/shift) • $8,000 of detergent cost per year (estimate from washing machine supplier) • 2 workers per machine per hour ($8 in fully loaded cost per hour) Tracking costs: • $15,000 in CAPEX per warehouse (estimate from American Bar Code and RFID) o Includes conveyors, IT license, scanning sensor and 3 hand-held scanners 28 • Variable cost of $0.01 per box for printed barcode label Warehouse Marketing and Sales • $150,000 over first two years for marketing – regionally promotion • $450,000 over first two years for sales – sales rep and relevant selling budget Other warehouse costs: • Warehouse rental at $4.50/sq ft for 20,000 sq ft facility • 3 forklifts at a cost of $10,000 each • Warehouse furniture and IT at $30,000 Other warehouse capital costs: • $20 per storage box at each restaurant’s facility • $30 per collapsible pallet box, 10 boxes provided to each distributor Corporate SG&A: • Management Salaries - 5 person management team with fully-loaded salaries starting at $50,000 in year 1 ramping to $150,000 by year 5 • Customer service – scales based on 15 customers per rep, $60,000 fully-loaded cost • HR – 1 resource starting in year 4 at $50,000 fully loaded cost, $10,000 each year for outsourced payroll and benefits management • Legal/Insurance - $1,000 legal fees per new customer, insurance of $24K in year 1 scaling to $120K in year 5 (based on quote for property and workers comp insurance). • Finance – 1 FTE at $100,000 fully-loaded cost in year2 scaling to 2 FTEs in year 5 Headquarters expense: • Headquarters expenses were scaled based on estimates of HQ headcount noted below: HQ People Management CSR Finance HR Total • • • 5 1 5 1 1 5 2 1 6 7 8 5 3 1 1 10 5 5 2 1 13 Occupancy costs at 150 sq ft/person, $30/sq ft IT costs at $5,000 per person Furniture and other costs at $1,000 per person Interest expense: • 10% interest rate based on rates reported by the SBIC 29 6. Warehouse Economics First Warehouse (slow ramp) Year 1 2 3 4 5 6 7 8 9 10 Revenues Number of Large Customers Number of Medium Customers Product Lines per Customer Number of new large customers Number of new med customers Number of box cycles Rental Price 1 2 3 1 2 2,371,200 0.50 2 5 3 1 3 5,148,000 0.50 2 7 3 0 2 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 Revenue 1,185,600 2,574,000 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 Variable Costs Reverse Logistics Washing Tracking Operating Expenses Gross Margin 208,904 54,673 23,712 287,289 76% 439,935 118,699 51,480 610,114 76% 493,981 137,403 59,592 690,976 77% 479,161 137,403 59,592 676,156 77% 464,786 137,403 59,592 661,781 78% 450,843 137,403 59,592 647,838 78% 437,317 137,403 59,592 634,312 79% 424,198 137,403 59,592 621,193 79% 411,472 137,403 59,592 608,467 80% 399,128 137,403 59,592 596,123 80% Fixed Costs Warehouse Rental Warehouse Labor Washing Labor Other Labor Fixed Costs 90,000 310,000 120,000 190,000 400,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 Depreciation Expense Boxes (Including Loss) Washing Machine Storage Bins Other Infrastructure Depreciation Expense 294,646 16,000 970 7,500 319,116 627,199 16,000 3,070 7,500 653,769 744,680 16,000 4,520 7,500 772,700 782,869 16,000 4,840 7,500 811,209 823,016 16,000 4,840 7,500 851,356 708,667 16,000 4,840 7,500 737,007 560,845 16,000 4,840 7,500 589,185 511,286 16,000 4,840 7,500 539,626 498,338 16,000 4,840 7,500 526,678 482,717 16,000 4,840 7,500 511,057 Warehouse SG&A Marketing Expense - Warehouse Sales Expense Total Warehouse SG&A 75,000 225,000 300,000 45,000 135,000 180,000 30,000 90,000 120,000 - - - (120,806) -10% 420,117 16% 685,925 23% 782,235 26% 756,463 25% 884,755 30% 1,046,102 35% 1,108,781 37% 1,134,455 38% 1,162,420 39% (1,519,620) 36% (760,177) 868,019 1,402,500 1,407,083 710,573 700,336 1,305,596 1,534,930 1,550,845 Income Margin Cashflow IRR - - - - 30 Subsequent warehouses (faster ramp) Year 1 2 3 4 5 6 7 8 9 10 Revenues Number of Large Customers Number of Medium Customers Product Lines per Customer Number of new large customers Number of new med customers Number of box cycles Rental Price 2 0 3 2 0 3,120,000 0.50 2 4 3 0 4 4,742,400 0.50 2 7 3 0 3 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 2 7 3 0 0 5,959,200 0.50 Revenue 1,560,000 2,371,200 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 2,979,600 Variable Costs Reverse Logistics Washing Tracking Operating Expenses Gross Margin 274,874 71,939 31,200 378,012 76% 405,274 109,347 47,424 562,045 76% 493,981 137,403 59,592 690,976 77% 479,161 137,403 59,592 676,156 77% 464,786 137,403 59,592 661,781 78% 450,843 137,403 59,592 647,838 78% 437,317 137,403 59,592 634,312 79% 424,198 137,403 59,592 621,193 79% 411,472 137,403 59,592 608,467 80% 399,128 137,403 59,592 596,123 80% Fixed Costs Warehouse Rental Warehouse Labor Washing Labor Other Labor Fixed Costs 90,000 310,000 120,000 190,000 400,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 90,000 620,000 240,000 380,000 710,000 Depreciation Expense Boxes (Including Loss) Washing Machine Storage Bins Other Infrastructure Depreciation Expense 387,692 24,000 1,300 7,500 420,492 593,046 24,000 3,240 7,500 627,786 751,434 24,000 4,360 7,500 787,294 789,969 24,000 4,840 7,500 826,309 830,481 24,000 4,840 7,500 866,821 667,077 24,000 4,840 7,500 703,417 582,348 24,000 4,840 7,500 618,688 513,022 24,000 4,840 7,500 549,362 499,808 24,000 4,840 7,500 536,148 483,889 24,000 4,840 7,500 520,229 Warehouse SG&A Marketing Expense - Warehouse Sales Expense Total Warehouse SG&A 75,000 225,000 300,000 45,000 135,000 180,000 30,000 90,000 120,000 - - - 61,495 4% 291,369 12% 671,330 23% 767,134 26% 740,998 25% 918,345 31% 1,016,600 34% 1,099,045 37% 1,124,985 38% 1,153,248 39% (1,784,474) 37% (194,013) 661,883 1,400,768 1,405,262 487,319 1,025,765 1,198,294 1,534,529 1,550,515 Income Margin Cashflow IRR - - - - 31 7. List of trading and transaction comparables Transaction Comparables Company Transaction Value Transaction Valuation $MM EV/EBITDA LMS Intellibound 41 N/A Transerra International Logistics 52 N/A World Commerce Services, LLC 8 7.84x Adcom Express, Inc. 11 12.26x Concert Group Logistics, Inc. 18 20.67x ICS Logistics, Inc. 45 8.81x Christian Salvesen plc 775 7.43x Average Transaction comparable (excl. Concert, Adcom) 8.03x Acquiror Msouth Equity Partners CH Robinson WLG Inc. Radiant Logistics, Inc. Express-1 Expedited Solutions Inc Prime Infrastructure Group Norbert Dentressangle SA Trading Comparables EV $MM Multple EV/EBITDA Description Competitors Brambles (CHEP) IFCO Systems Average competitors 12,689 759 7.62x 8.50x 8.06x Pallet and bulk container pooling company Container pooling company Material Handling and Packaging Company Ball Corporation Bemis Co. Inc. British Polythene Industries plc Constar International Inc. Intertape Polymer Group Inc. Myers Industries Inc. Pactiv Corp. Silgan Holdings Inc. AEP Industries Inc. Material Handling and Packaging Group average 7,428 3,581 184 207 409 447 4,752 2,979 396 7.75x 7.68x 3.84x 3.92x 9.40x 7.99x 6.60x 6.69x 7.74x 6.85x Supplier of metal and plastic packaging Manufacturer of pressure sensitive flexible packaging Manufacturer of polythene products including printed film for food industry Producer of plastic containers for food Develops plastic and paper based products and associated packaging systems Manufacturer and distributer of polymer products Manufacturer of consumer/foodservice packaging Supplier of metal and plastic packaging Manufacturer of plastic films and polypropelene packaging solutions Logistics and Transport Companies CH Robinson Worldwide Con-way Inc. Expeditors International of Washington Inc. JB Hunt Transport Services Inc. Werner Enterprises Inc. Logistics and Transport Group average 10,208 2,448 7,486 5,204 1,554 16.62x 8.38x 17.55x 11.27x 6.12x 11.99x Third party logistics provider Transport, logistics and supply chain services Logistics services include air and ocean cargo Surface transportation and delivery services Truckload shipment surface transport Weighted Average (30% transaction, 30% competitors, 30% Material Handling, 10% T&L) 25% discount for size and liquidity 8.1x 6.1x For the purpose of valuation estimations and equity returns, 6.1x EV/TTM EBITDA used. This multiple reflects a 25% discount to the average computed transaction and trading multiple. 32 8. Sales Hurdles Sales Hurdle Manufacturer The value of the transport packaging itself is small compared to the product inside (typically valued around $2633). Therefore, manufacturers are very sensitive to any process change which may production downtime Food safety is a crucial element to ensure longevity of the brand - past recalls have put companies out of business35 Distributor Manufacturers bear most product damage costs and will carefully scrutinize packaging changes Labor drives cost. It will require additional labor to track and retrieve Boomerang boxes Boomerang boxes will break the cold chain, bacteria will multiply and goods will become unfit for sale Restaurant Retrieved Boomerang boxes may contaminate other deliveries on the distributor’s truck With limited storage space, QSRs will struggle to store empty containers until the next scheduled distributor visit (typically 2-3 days). Plastic is not green Solution The Boomerang solution integrates seamlessly into current processes at cartonerector and pre-formed automated facilities (while we currently cannot accommodate wrap-around packaging, this process is used in only 35% of production facilities34) Boomerang’s sanitization process fully complies with FDA and USDA regulations. Furthermore, all washing facilities will obtain AIB Gold Standard certification. In addition, our proprietary tracking system will increase traceability – a key concern when there is an outbreak RPCs typically reduce product damage by up to 2%36 Based on discussions with distributors, they will be able to utilize their current tracking systems to track boxes. Distributors will be paid for incremental labor cost from picking up boxes at restaurants RPCs are impermeable, enabling distributors to reduce the quantities of damaged goods due to icepacks. At a later stage, Boomerang Logistics will expand its service offering to include RPCs that provide enhanced insulation and temperature sensors. Pallet sized containers on truck will separate empty containers. Distributors already provide service for milk crates The foldable nature of our RPCs mean storage space required is limited. To facilitate this process, Boomerang Logistics will provide each outlet with a portable container that can be used to store the RPCs until the distributor can retrieve them. The dimensions of this container will be 24” L x 18” W x 48” D (footprint of 2 sq. ft), and it will be able to hold approximately 100 empty RPCs. 99% of damaged Boomerang RPCs will be recovered37 and granulated to make new RPCs, reducing overall waste. 33 9. Box suppliers The following RPC box price quotations have been received: Asset Material Source Quote Corrugated Plastic RPC (12”x16”x18” unsealed) Corrugated Plastic RPC (15”x12”x12” sealed edge) Corrugated Plastic RPC (12”x16”x18” unsealed) Flip-Box (400mmx400mmx220mm) 4mm polypropylene Kiva Plastics $5.85 for 10,000 4mm polypropylene Carter Associates $7.71 for 50,000 $8.47 for 10,000 4mm polypropylene (Tri-Ply) Amatech/Polycel $4.86 for 5,000 Expanded polypropylene Overath GmBH €15 each 34 10. Washing machines Boomerang is currently exploring a number of conveyor based washing machines and blow-off dryers. Example drawings and pictures of the machine can be found below. It is estimated that a suitable washing and drying machine can be acquired for $80,000. Manufacturer/ Distributor Equipment Quote Condition Includes Dryer? Douglas Machines Corp. Sorma USA Better Engineering Loeb Industrial Fintech Inc. New New New Used New Yes No Yes No Yes Douglas Machines Tunnel Washer $92,042 $57,770(delivered) $225,000 $10,000 N/A Sorma USA – RPC washing Machine Water Conservation Design Yes Yes No Leasing/ Rental Option? Leasing Leasing Leasing Rental Leasing Loeb Industrial – Used machine 35 11. Interviews and references Name Nashir Vasanji WITHHELD Mike Thompson Manolis Alpogianis Jessica Moore Robert Nagel Meredith Neizer David Barber Paul Knechtel Eric Hahn Andrew Parkinson Rick Blasgen Kevin Dolan Kevin Sproule Tayler Wilkerson Dan Trainor Dan Delorey Jim Kulbeth Tom Stafford Richard Smith Al Farrell Fred Heptinstall Kevin Gillespie Anita Ricklefs John Koontz Bob Aiken Jay Greyson Joe Marcy Bob Fox Title Former COO President and CEO Founder Marketing Associate Partner President President of Operations Founder Founder Founder of Peapod President & CEO Transportation & Logistics expert Manager Supply Chain Expert Sales Reusable Packaging Specialist President Executive VP, Sales & marketing Manager CFO President of RPCs Representative Office Manager Research Chemist Partner, Former CEO of US Foodservices Managing Director & Principal Professor & Department Head Consultant - Food Packaging Company New Foods Classics Fair Oaks Farms America's Dog HomeMade Pizza Company CEO Partners, Inc. Alliant Logistics (Arm of U.S. Foodservices) Gordon Food Services, Canada 100 Mile Market Locavore Distributors Peapod Council of Supply Chain Management Professionals McKinsey and Company McMaster-Carr Industrial Supply Logistics Management Institute American Barcode and RFID Technology Container Corp Universal Package Systems Kiva Plastics Corbi Plastics iGPS IFCO North America USDA AIB IIT NCFST/FDA Division of Food Processing Science and Technology Bolder Capital Supply Chain Equity Food Science & Technology at Virginia Tech Bob Fox Consulting Sector Manufacturer Manufacturer End-Customer End-Customer Foodservices Experts Distribution & Logistics Distribution & Logistics Distribution & Logistics Distribution & Logistics Distribution & Logistics Distribution & Logistics Distribution & Logistics Distribution & Logistics Distribution & Logistics Tracking Systems RPC Manufacturer RPC Manufacturer RPC Manufacturer Outsourced Washing Incumbent competitor Incumbent competitor Regulatory Agency Regulatory Agency Regulatory Agency Private Equity Private Equity Food Sanitation Food Sanitation 36 12. Endnotes 1 Food and Agriculture Association of the UN: http://www.fao.org/worldfoodsituation/FoodPricesIndex/en/ Big Mac Index, Economist Magazine 3 Based on conversations with WITHHELD, former COO of New Foods Classic, a Canadian meat processor 4 McDonald’s social responsibility report: http://www.McDonald’s.ca/en/community/environment_reduce.aspx 5 http://www.purchasing.com/article/455776-Corrugated_box_prices_hiked_by_9_5_10_.php 6 Interview with WITHHELD, former COO of New Foods Classics a food processor; http://www.fhwa.dot.gov/reports/tswstudy/Vol2-Chapter3.pdf; http://www.fhwa.dot.gov/reports/tswstudy/Vol2Chapter3.pdf 7 Interview with WITHHELD, former COO of New Foods Classics a food processor 8 2003 McDonald’s environmental scorecard program; Green and Growing; Restaurants & Institutions Sept 2007. 9 Live cycle inventory of reusable plastic containers and display-ready corrugated containers used for fresh product applications. Prepared for Reusable Pallet & Container Coalition by Franklin Associates, a Division of Eastern Research Group, Inc. , November 2004 10 Hale Group, Foodservice 2020: Global, Consolidated and Structured, 2010 11 Sources: http://www.census.gov/epcd/naics02/def/ND722211.HTM; http://en.wikipedia.org/wiki/Restaurant; McDonald's 2010 10-K; http://www.wikinvest.com/industry/Fast_Food_Restaurants_(QSR) 12 Interview with WITHHELD, President of Operations at Gordon Foods Canada (Distributor) 13 Calculated based on McDonald’s store share in Illinois. http://www.nationmaster.com/graph/foo_mcd_res-foodmcdonalds-restaurants; http://www.mcillinois.com/all-restaurants/ 14 Green Packaging to 2013, report by the Freedonia Group 15 http://www.scribd.com/doc/19454153/2009-McDonald’s-Best-Of-Green-09 16 National Restaurant Association’s 2008 Restaurant Industry Forecast 17 National Restaurant Association’s 2010 Restaurant Industry 18 Conversations with corrugated plastic suppliers Kiva Plastics and Amatech Inc. 19 European RPC penetration levels http://www.palletenterprise.com/articledatabase/view.asp?articleID=638 20 80 lbs/sq in flat-crush test for corrugated plastic as compared to 3 lbs / sq in for corrugated cardboard (http://www.coroplast.com/advan.htm) 21 Interview with WITHHELD, former President and COO of Peapod 22 Interview with WITHHELD, President of Operations at Gordon Foods Canada (Distributor) 23 Interview with WITHHELD at Kiva Plastics 24 Interview with WITHHELD, CIO of Reyes Holding, the parent company of Martin-Brower 25 Interview with WITHHELD at Technology Container Corporation 26 Interviews with foodservice distributors 27 Interview with WITHHELD at Better Engineering regarding specifications of their washing machine for foodservice applications 28 http://www.nj.com/news/index.ssf/2007/10/topps_meat_co_folds_after_mass.html 29 Phone survey with restaurant managers at 15 quick service restaurant chains in Illinois 30 2008 Fibre Box Association Annual Report. http://www.fibrebox.org 31 Datamonitor USA. Industry Profile: Containers & Packaging in the United States. December 2009. 32 http://www.usecaps.com/about/index.html 33 Interview with WITHHELD, former President of Peapod 34 Need reference here 35 http://www.nj.com/news/index.ssf/2007/10/topps_meat_co_folds_after_mass.html 36 http://www.foodlogistics.com/print/Food-Logistics/The-ABCs-Of-RPCs/1$88 37 Recovery rate based upon interview with IFCO RPC President WITHHELD 2 37

© Copyright 2026