CALU SPECIAL REPORT | APRIL 2015

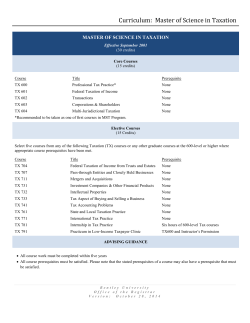

® CALU SPECIAL REPORT | APRIL 2015 April 2015 CALU Special Report Budget 2015: Positioning for the Fall Election by 2019-20. The budget documents note the conservative nature of these estimates, indicating they were determined after adjusting downward gross domestic product (GDP) estimates provided by private sector forecasters, and the inclusion of a contingency fund starting at $1 billion in 2014-15 and increasing to $3 billion by 2019-20. Introduction The budget papers also highlight how well Canada has performed since the end of the recession (June 2009) in comparison with other G7 countries, noting: On April 21 Finance Minister Oliver tabled his first budget, which is described with the lengthy moniker “Strong Leadership: A Balanced Budget, Low-Tax Plan for Jobs, Growth and Security”. While many of the key proposals had been leaked to the media in advance of budget day, there is much more in Budget 2015 that should satisfy a number of constituents going into the fall election. In this Special CALU Report we’ll try to synthesize over 500 pages of text and graphs into those key elements which are relevant to CALU members and your clients. The Fiscal Position The Conservative party had publicly gone “on the record” that they planned to deliver a balanced budget for the 2015-16 fiscal year. But with the price of oil going into a tailspin at the beginning of this year, the government was forced to delay the release of the budget, re-evaluate the federal finances and take corrective measures, including the multi-billion dollar sale of shares in General Motors. This time was apparently put to good use as the Finance Minister announced there will be a surplus of $1.4 billion in the upcoming fiscal year, increasing to $4.8 billion -1- CALU Special Report | April 2015 Canada has the lowest overall marginal effective tax rate on new business investment at approximately 17.5%; Canada has the highest real GDP growth since the start of the recovery; and Canada is still on target to reduce the federal debt to GDP ratio to 25% by 2021, and to reduce this ratio to pre-recession levels by 2017. The budget papers also summarize the impact of tax relief provided by successive Conservative budgets, indicating that Canadian families and individuals will receive approximately $37 billion in tax relief and increased benefits in 2015-16 due to tax changes since 2006. In a similar vein, it is estimated that federal budgets since 2006 (including this budget) will reduce taxes on businesses by almost $15 billion in 2015-16. With this background, Budget 2015 announced the government’s intention to implement measures which focus on three key areas: ® Special Report 1. Supporting jobs and growth, 2. Helping families and communities prosper, and 3. Ensuring the security of Canadians. Below is a discussion of those key budget proposals that will impact CALU members and their clients. RRIF Minimum Withdrawal Factors Registered Retirement Saving Plan (RRSP) annuitants are required under the Income Tax Act (the “Act”) to annuitize or transfer their RRSP funds into a registered retirement income fund (RRIF) no later than the end of the year in which they reach age 71. The Act further prescribes a minimum amount that must be withdrawn from a RRIF on an annual basis (the “RRIF minimum factor”), with a minimum of 4% of the beginning of year balance at age 65, increasing to 7.38% by age 71, and 20% from age 94 onwards. The current RRIF minimum percentages for ages 71+ were determined in 1992 and, according to the budget documents, the factors were based on providing a regular stream of payments from age 71 to 100 assuming a 7% nominal rate of return on RRIF assets and indexing at 1% annually. It should be noted that the same age-based factors are used to determine the minimum amount that must be withdrawn annually, starting at age 71, from a defined contribution registered pension plan (RPP) (including individual pension plans (IPPs)) and pooled registered pension plans (PRPPs). When these factors were determined, interest rates on long-term Government of Canada bonds ranged from 6-8%, and mortality tables indicated that a male aged 65 would on average live to age 80 and a female aged 65 would on average live to age 84. However, since then long-term interest rates have declined dramatically, and combined with increasing lifespans, could result in RRIF holders outliving their retirement savings. The premature withdrawal of funds also exposes those withdrawals and any re-invested Conference for Advanced Life Underwriting www.calu.com President – Kevin Wark, LL.B, CLU, TEP Administrative Assistant – Susan Carolan Administrator, Membership & Accounting – Jenna Mantle Communications Consultant – Caroline Spivak, ICD.D Administrative Consultant – Val Osborne amounts to income taxes as well as the possible clawback of the Guaranteed Income Supplement (GIS), Old Age Security (OAS) and other benefits, further increasing the risk that RRIF holders won’t have sufficient funds to meet their needs throughout their retirement years. In late 2014, CALU formed the RRIF Minimum Working Group, chaired by Clay Gillespie, to highlight these concerns to the federal government. The Working Group developed an awareness strategy which included CALU publishing an article on the RRIF Minimum Rules by Moshe Milevsky; making representations to a number of Members of Parliament (MPs) and senior policy advisors; making a 2015 pre-budget submission to the House of Commons Finance Committee; and appearing before Conference for Advanced Life Underwriting Suite 504 - 220 Duncan Mill Road North York, ON M3B 3J5 Tel: 647-799-1006 • www.calu.com April 2015 | CALU Special Report -2- the House Finance Committee which resulted in the Finance Committee formally recommending that the Department of Finance (Finance) review the RRIF factors. We are pleased to report that CALU’s concerns have been addressed in Budget 2015. In particular, the budget proposes to adjust the RRIF minimum withdrawal factors that apply from ages 71 to 94, on the basis of a 5% nominal rate of return and 2% indexing. The new RRIF factors will permit holders to preserve more of their RRIF savings in order to provide income at older ages, while continuing to ensure that the tax deferral provided on RRSP/RRIF savings serves a retirement income purpose. There will be no change to the minimum withdrawal factors that apply in respect of ages 70 and under, which will continue to be determined by the formula 1/(90 – age). The new RRIF factors will apply for the 2015 and subsequent taxation years. To provide flexibility, RRIF holders who at any time in 2015 withdraw more than the reduced 2015 minimum amount will be permitted to re-contribute the excess (up to the amount of the reduction in the minimum withdrawal amount provided by this measure) to their RRIFs. Recontributions will be permitted until Feb. 29, 2016 and will be deductible for the 2015 taxation year. Similar rules will apply to those receiving annual payments from a defined contribution RPP or a PRPP. The chart below illustrates the RRIF capital remaining at the end of each year based on the current and proposed RRIF factors. Please refer to Schedule A for a comparison of the new and current factors. It is estimated that this change will result in approximately $670 million of tax relief over the next four federal fiscal years. Capital Preserved Under the RRIF Factors Age 71 Capital Preserved ($) Age Existing RRIF factors New RRIF factors Difference (% more remaining) 71 100,000 100,000 - 80 64,000 77,000 20 85 47,000 62,000 32 90 30,000 44,000 47 95 15,000 24,000 60 10,000 67 1006,000 Notes: 1. For an individual 71 years of age at the start of 2015 with $100,000 in RRIF capital making the required minimum RRIF withdrawal each year. 2. Age 71 capital preserved at older ages is expressed in terms of the real (or constant) dollar value of the capital (i.e., the value of the capital adjusted for inflation after age 71). The calculations assume a 5% nominal rate of return on RRIF assets and 2% inflation. -3- CALU Special Report | April 2015 ® Special Report Tax Free Savings Account Top-Up One of the most anticipated tax measures of Budget 2015 was a change to the Tax Free Savings Account (TFSA) annual contribution rate of $5,500 – and the government has delivered on this. The new annual contribution limit is $10,000, effective Jan. 1, 2015, but the automatic indexing of the annual contribution limit has been eliminated. The budget documents indicate that this measure will cost the federal government approximately $1.1 billion over the next four years – but notes that in the long run, due to de-indexing of the contribution limit, the loss of revenue will be not much more than what would have been expected under the current rules. Donations Involving Private Shares or Real Estate In response to requests from registered charities, new rules were introduced in the 2008 federal budget that reduced the capital gain realized on the donation of certain securities (including shares in public corporations, units in a mutual fund trust and an interest in a segregated fund policy) to nil. This effectively increased the value of the charitable donation by eliminating the tax liability arising from the disposition of the security. Since the introduction of this measure the charitable sector has made ongoing representations to the government to expand the exemption from tax to the donation of private shares or real estate. However, Finance has resisted this change primarily due to valuation concerns – how would the charity or the Canada Revenue Agency (CRA) verify the appropriate amount to receipt for a gift that may be illiquid and/or whose value cannot be easily ascertained? It appears that Budget 2015 has come up with an elegant solution to the valuation issue by exempting individual and corporate donors from tax on the sale of private shares or real estate to an arm’s-length party, if the cash proceeds are donated within 30 days. If a portion of the cash proceeds is donated, the exemption from capital gains tax would apply to that portion. This measure will apply to donations in respect of dispositions occurring after 2016. There is no draft legislation included in the Notice of Ways and Means Motion accompanying Budget 2015, so it is not clear whether debt of any sort received on the sale may qualify as “cash proceeds” in order to gain access to the exemption from tax. As well, it is not clear how this measure might apply on death, where the estate sells the shares or real estate and donates the proceeds to a charity. Anti-avoidance rules will ensure that the exemption is not available in circumstances where, within five years after the disposition: the donor (or a person not dealing at arm’s length with the donor) directly or indirectly re-acquires any property that had been sold; in the case of shares, the donor (or a person not dealing at arm’s length with the donor) acquires shares substituted for the shares that had been sold; or in the case of shares, the shares of a corporation that had been sold are redeemed and the donor does not deal at arm’s length with the corporation at the time of the redemption. Where the anti-avoidance rules apply, the exemption will be reversed by including the previously exempted amount in the income of the donor in the year of the reacquisition by the donor (or the non-arm’s-length person) or the redemption. It is estimated that this measure will reduce federal revenues by about $265 million over the 2016-17 to 2019-20 period. Conference for Advanced Life Underwriting Suite 504 - 220 Duncan Mill Road North York, ON M3B 3J5 Tel: 647-799-1006 • www.calu.com April 2015 | CALU Special Report -4- Small Business Tax Rate and Dividend Tax Credit The small business deduction currently reduces to 11% the federal corporate income tax rate applying to the first $500,000 per year of qualifying active business income of a Canadian-controlled private corporation (CCPC). There is a requirement to allocate the annual eligible income limit of $500,000 among associated corporations. Access to the small business deduction is phased out on a straight-line basis for CCPCs having between $10 million and $15 million of taxable capital employed in Canada. Budget 2015 proposes a two percentage-point decrease in the 11% small business tax rate. The reduction will be effective as follows: Jan. 1, 2016, the rate will be reduced to 10.5%; Jan. 1, 2017, the rate will be reduced to 10%; Jan. 1, 2018, the rate will be reduced to 9.5%; and Jan. 1, 2019, the rate will be reduced to 9%. The reduction in the small business rate will be prorated for corporations with taxation years that do not coincide with the calendar year. In conjunction with the proposed reduction in the small business tax rate, Budget 2015 also proposes to adjust the gross-up factor and dividend tax credit (DTC) rate applicable to non-eligible dividends (generally dividends distributed from corporate income taxed at the small business tax rate). Specifically, Budget 2015 proposes to adjust the gross-up factor applicable to non-eligible dividends from 18% to 17% effective Jan. 1, 2016, 16% effective Jan. 1, 2018 and 15% effective Jan. 1, 2019. The corresponding DTC rate will also be adjusted, moving from 13/18 to 21/29 of the gross-up amount effective Jan. 1, 2016, 20/29 of the gross-up amount effective Jan. 1, 2017, and 9/13 of the gross-up amount effective Jan. 1, 2019. -5- CALU Special Report | April 2015 Expressed as a percentage of the grossed-up amount of a non-eligible dividend, the effective rate of the DTC in respect of such a dividend will be 10.5% in 2016, 10% in 2017, 9.5% in 2018 and 9% after 2018, in line with the proposed reductions in the small business tax rate. It is estimated that this measure will reduce taxes for small businesses and their owners by $2.7 billion over the 2015-16 to 2019-20 taxation years. Lifetime Capital Gains Exemption Increase for Farmers and Fishers Owners of farm and fishing businesses have been the focus of several tax measures over the last few years, including enhancing the capital gains exemption credit to the same level as is available for owners of small business corporations in 2014. To allow farm and fishing business owners to maintain more of their capital for retirement, the Budget proposes to increase the Lifetime Capital Gains Exemption (LCGE) applicable to capital gains realized on the disposition of qualified farm or fishing property to $1 million for dispositions that occur on or after April 21, 2015. After 2015, the LCGE for owners of farms and fishing businesses will be the greater of $1 million and the indexed LCGE for owners of qualified small business shares (currently $813,600 in 2015). The Budget estimates this will save owners of farm and fishing businesses approximately $50 million in capital gains taxes over the next four years. Form T1135 Simplified Reporting Many clients and advisors have been grappling with onerous Form T1135 reporting of foreign property – this is required for individuals, corporations and trusts that own, at any time in a taxation year, specified foreign property with a total cost more than $100,000. The form will be simplified to reduce the compliance burden for taxation years that begin after 2014. If the ® Special Report taxpayer’s total cost of specified foreign property is less than $250,000 throughout the year, the taxpayer will be able to report these assets to the CRA under a new simplified foreign asset reporting system. The current reporting requirements will unfortunately continue to apply to taxpayers with specified foreign property with a total cost of $250,000 or more. Registered Disability Savings Plans – Relief extended to 2018 To facilitate the establishment of registered disability savings plans (RDSPs) for individuals who may not have capacity to enter into such arrangements, the government had announced in 2012 a temporary measure to allow a qualifying family member to become a planholder. This measure, which would otherwise have applied only to the end of 2016, has been extended by Budget 2015 to the end of 2018. This extension is intended to provide provinces and territories with additional time to make changes to laws and procedures to allow for the appointment of an appropriate legal representative for disabled individuals without undue legal or procedural difficulty. Tax Avoidance of Corporate Capital Gains – New anti-avoidance rules The Budget contains proposed amendments to section 55 of the Act, which is an anti-avoidance measure that aims to prevent corporate tax planning involving the conversion of capital gains to tax-free intercorporate dividends. The measures specifically address recent planning challenged by the CRA in the courts, and also make additional changes. These measures are applicable to dividends paid after April 20, 2015, and so anyone considering corporate planning will want to ensure a careful review of the proposed changes before proceeding. Other Budget 2015 Measures of Interest The following is a summary of other budget proposals that may be of interest to CALU members: In 2017 the government will implement a new rate-setting mechanism for Employment Insurance (EI) premiums and any cumulative surplus in the EI operating account will be returned to employers and employees through lower EI premium rates. It is anticipated that this will reduce EI premium rates by approximately 20% starting in 2017. The small business deduction is available on up to $500,000 of active business income of a Canadiancontrolled private corporation. The government plans to conduct a review of the active versus passive business income rules for purposes of the small business deduction in response to concerns expressed by some taxpayers such as owners of self-storage facilities and campgrounds. A new Home Accessibility Tax Credit will provide up to $1,500 in tax relief in order for qualifying individuals, including seniors and persons with disabilities, to make accessibility and safety related home improvements to their principal residence. Through the Employment Insurance program, Compassionate Care Benefits provide financial assistance to people who have to be away from work temporarily to care for a family member who is gravely ill with a significant risk of death. The government plans to extend the duration of benefits from the current six weeks to six month, effective January 2016. A national strategy on financial literacy will be launched in 2015-16 under the guidance of the Financial Literacy Leader. The federal government is continuing to assess a voluntary target benefit pension option for federally regulated plans, and will consider changes to income tax rules to appropriately accommodate target benefit plans. Conference for Advanced Life Underwriting Suite 504 - 220 Duncan Mill Road North York, ON M3B 3J5 Tel: 647-799-1006 • www.calu.com April 2015 | CALU Special Report -6- Previously Announced Measures The government had been busy announcing several new programs and tax measures over the past year, but reiterated these in the budget documents. Perhaps the most significant of these are the Family Tax Cut and the enhanced Universal Child Care Benefit (UCCB), announced in October 2014. The Family Tax Cut is a non-refundable tax credit of up to $2,000 for couples with children under the age of 18, effective for the 2014 taxation year, which allows income splitting between eligible spouses. The UCCB proposal provides an increased benefit of $160 per month for children under the age of six and a new benefit of $60 per month for children aged six through 17, effective for the 2015 taxation year. Another measure previously announced is the doubling of the children’s fitness tax credit which is also proposed to be refundable. What’s Not Included in Budget 2015? There are no new proposals affecting the taxation of life insurance, transfers of life insurance policies, the determination of the capital dividend account (CDA) of a private corporation or deductibility of interest on funds borrowed for the purpose of earning income. While there are several positive tax changes affecting seniors (i.e., TFSAs, RRIF minimum factor, the Home Accessibility Tax Credit) as well as a discussion on health care fund issues, there is no specific -7- CALU Special Report | April 2015 discussion in Budget 2015 on the need to develop a federal/provincial strategy on funding issues relating to long term care expenses, as advocated by CALU. The federal government had previously announced plans to introduce an Adult Fitness Tax Credit. The government indicates that it intends to establish an expert panel to study the potential scope of such a credit. There was no commentary relating to whether Finance will be introducing changes to the rules introduced in Budget 2014 relating to graduated rate estates, charitable gifts on death and the taxation of spousal/alter ego/joint partner trust on death (effective in 2016). Summary Finance Minister Oliver has tried to deliver a budget that will position the Conservative government for success in the next election. On first blush this budget (including the measures announced last fall) should have significant appeal to seniors, small business owners and families. Time will tell how this will impact Conservative support at the polls this coming fall. ® Special Report Schedule A Comparison of Current and Proposed RRIF Minimum Factors Si Existing and New RRIF Factors Age (at start of year) Existing Factor (%) New Factor (%) 71 7.38 5.28 72 7.48 5.40 73 7.59 5.53 74 7.71 5.67 75 7.85 5.82 76 7.99 5.98 77 8.15 6.17 78 8.33 6.36 79 8.53 6.58 80 8.75 6.82 81 8.99 7.08 82 9.27 7.38 83 9.58 7.71 84 9.93 8.08 85 10.33 8.51 86 10.79 8.99 87 11.33 9.55 88 11.96 10.21 89 12.71 10.99 90 13.62 11.92 91 14.73 13.06 92 16.12 14.49 93 17.92 16.34 94 20.00 18.79 95 & over 20.00 20.00 Conference for Advanced Life Underwriting Suite 504 - 220 Duncan Mill Road North York, ON M3B 3J5 Tel: 647-799-1006 • www.calu.com RRIF (% Withdraw 7.38% 7.48% 7.59% 7.71% 7.85% 7.99% 8.15% 8.33% 8.53% 8.75% 8.99% 9.27% 9.58% 9.93% 10.33% 10.79% 11.33% 11.96% 12.71% 13.62% 14.73% 16.12% 17.92% 20% 20% 20% 20% 20% 20% 20% April 2015 | CALU Special Report -8- ® Special Report About CALU The Conference for Advanced Life Underwriting (CALU) is a national professional membership association of established financial advisors (life insurance, wealth management and employee benefits), accounting, tax, legal and actuarial professionals. For more than 20 years CALU has engaged in political advocacy and government relations activities relating to advanced planning issues on behalf of its members and the members of its sister organization, Advocis, The Financial Advisors Association of Canada. Through these efforts, CALU represents the interests of some 11,000 insurance and financial advisors and in turn the interests of millions of Canadians. For more information please visit www.CALU.com. Conference for Advanced Life Underwriting Suite 504 - 220 Duncan Mill Road North York, ON M3B 3J5 Tel: 647-799-1006 • www.calu.com - 11 - CALU Special Report | April 2015

© Copyright 2026