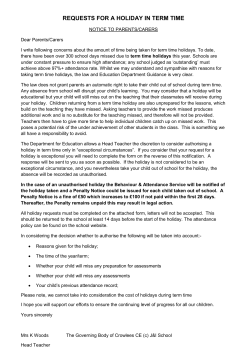

Holidays and leave EMPLOYMENT RELATIONS DOL 11657D FEB 13