How to Cost Justify a Contract Lifecycle Management

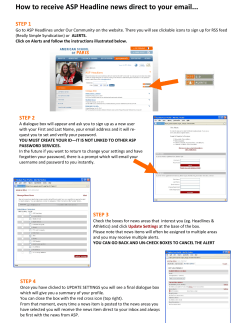

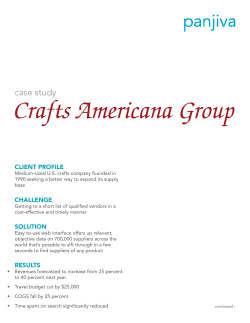

CONTRACT LIFECYCLE MANAGEMENT How to Cost Justify a Contract Lifecycle Management Solution We’ve all heard the ancient Chinese toast, “May you live in interesting times,” and few of us would doubt we’re living in them now. In this economic climate, it’s hard to justify largedollar expenditures for business process solutions; but harder still to imagine continuing disorganized, outmoded “business as usual” procedures. The desire for a full-bodied contract lifecycle management (CLM) system is usually triggered by an unpleasant (often recurring) event in the life of a company’s contracts: discovering (in afteraction documents) that you left significant money on the table through overlooked incentives; or incurring a sizeable penalty for late-delivery or noncompliance. Pain is often a driving factor in the search for a better way. If you’re looking to achieve greater efficiency through contract workflow automation, this article will help you connect the dots in a way that wins over target stakeholders. Diagnose and Describe the Problem With Your Existing System (or Lack Thereof) Throughout the diagnostic and exploration process, take the time to document your findings: for your own stakeholders and for potential vendors or consultants. Others will have their own way of approaching a potential new engagement and in formulating their recommendations – but your documented research may still save steps down the line. Before exploring solutions to a process, get a really good feel for the present one. Sketch out the complete lifecycle or workflow of a typical contract – from beginning to end. How many people handle the document and when, in what order? Where is it reposed? Is it accessible throughout the process, or are multiple copies in circulation? Identify as many specific steps and players as you can in terms of sequencing of events. Identify all the known difficulties with this process over the last year. • Where do the bottlenecks happen, and do they happen rarely or with some regularity? • How often does the company incur penalties for late delivery or other non-compliance issues? • Are incentives or bonuses in multiple contracts being offset or contradicted by other clauses elsewhere in those documents? • What other additional opportunities might your organization be missing through neglect or mismanagement? • Are redundant systems in use, for filing and managing your present contract volume? • Other measurable or describable impacts you’ve observed within the contracting lifecycle. Based on a better understanding of the present system and its shortcomings, now build a wish list of all the things you’d like to see in a CLM solution. You may not get all of them in any one product, but try to make your list as exhaustive as possible and prioritize them in order of greater to lesser importance. Such items as these: • Seamless interface with existing Microsoft/Windows applications • Central repository for all contract information • “Need to know” access coupled with robust security protocols • Turnkey report generation, easy to customize • Automated alerts and email notifications • Robust search capability • Clause-based versus template-based architecture • Ability to handle buy-side contracts, sell-side, or both, within one central contract repository. Pause also to assess the political environment – where can you expect resistance or pushback in the promotion of a new CLM solution? Who (which people or departments) will be your natural allies in making a change and how can you leverage their influence? Who is most likely to feel threatened or anxious and how might those concerns be resolved or minimized? Your legal, IT and finance departments “curate” a corporate repository of contract clauses that allow your buyside and sell-side to quickly assemble custom contracts that are backed with robust security protocols, searchability, email notifications, and automated alerts. Identify Potential Solutions and How They Fit With Your IT Architecture Now you’re ready to take a moment to consider how a potential solution would fit within your IT application portfolio. Do a little “quick and dirty” research with one or two trusted allies in your IT Department to determine what makes the most sense. • Do you have an existing Enterprise Content/Document Management solution that you need to integrate with? If so, conduct a quick Google search on some of the companies or software products you’ve heard about that integrate with that environment. • Do you have an existing CRM or ERP application that has contract management functionality you’ve already licensed or could purchase? If so, how well does the solution integrate with Microsoft Office tools you currently use for document creation and email notifications? And, how easily and dynamically can you modify the application as your business rules change? • What is your IT organization’s position on buying vs. building “departmental” application solutions? What’s your sense of urgency for getting something now (buy) vs. later (build)? Improved productivity and efficiencies, risk and penality reductions and economies of scale are benefits that build the business case for transitioning to modern CLM methods. Put Legs Under Your Concept Once you know more about the various CLM solutions and how they fit within your IT architecture, it’s time to synthesize your best recommendation for change. Here’s where you look for ways to quantify the costs and benefits, to help your company move from the “current state” of contract management within your company to the “future state” you hope to bring about. To make an effective business case, be sure to consider hard costs and benefits (the things that can be quantified) as well as soft costs and benefits (intangible items that can make or break a project). Some of this information you can gather in-house; the rest from interviews with prospective vendors and others within your organization. How vendors answer your questions will be some indicator of how well they understand your business and the statistical benefits they’re able to document. Hard cost (pricing) data, which will vary by vendor or solution, might include items such as: • Hardware • Software • Training (for users and for internal IT support staff) • On- and Off-site support services • Labor costs (contract or salaried with benefits) In weighing hard (quantifiable) benefits of CLM, look at these key areas of potential “pain relief.” • Improved productivity and efficiencies. With a robust CLM solution, companies can see up to a 50% reduction in the front-end time associated with negotiating and approving contracts. They can typically pare 2 or more days from the typical 60 days sales outstanding. SEC filing times can be reduced from as much as 10 days to as little as 3-5 days per filing. • Risk and penalty reductions. Systematic monitoring of contract terms and conditions allows operators to recover 5-10% of a contract’s value in leakage: costs associated with missed deadlines, regulatory penalties, other failures of oversight. • Economies of scale. In a manual contracting environment, companies have to hire 1 more person to get 1 more unit of capacity. Streamlining and standardizing the contract workflow allows companies to expand their business exponentially. Potential soft benefits include: • More transparency in the workflow; and speedier correction of any bottlenecks • Implementation of best practices which can enhance your company’s competitive position and its reputation within your industry • More effective handling of contract milestones, yielding an increase of contract renewals • Potential entree to new clients or customers as a result of your enhanced CLM capabilities Invite the Vendor for a Visit By now you should have a fairly clear picture what you’re looking for in a CLM solution, and which potential vendors or solution providers are the best fit for your company’s needs. Invite them (one by one) for a conversation. A good sales representative will ask questions about your process and workflow so the demo addresses the items most important to you. Have your questions written down in advance, based on your research and cost/benefit calculations. Share any gaps with the vendor and see what help they can give you in filling in the blanks. Having listened to concerns within your organization, ask potential vendors about a variety of “best case” and “worst case scenarios.” The best solution providers know how to address the issues and challenges inherent in adopting a new solution. The CLM Matrix Solution As this diagnostic process shows, the best process outcome is to find a way to do more with less. CLM Matrix believes that companies can do MORE by spending LESS on inefficient, convoluted or duplicative processes. But before any solution can be implemented, be prepared to document the business case benefits that justify the overall project investment in a CLM software solution. And as we continue to live in these very interesting times, such solutions will make your company less susceptible to unpleasant contact lifecycle events in 2011 and beyond. About CLM Matrix CLM Matrix is the market leader in Contract Lifecycle Management (CLM) software solutions on Microsoft Office and SharePoint technology platforms. Our solution extends the functionality of traditional contract management software by adding features such as: · Rule-based document creation · Clause libraries · Policy-based approval workflow · Automated reminders and alerts · Real time user defined reporting · Integration with legacy enterprise software · Contract compliance tracking · Multi-language capabilities · Support for global environments · Fully configurable to specific process and document types without code (wizard driven) To learn more about CLM Matrix and our award winning software solutions, please visit clmmatrix.com or contact us directly at 1.800.961.6534. ©2011 CLM Matrix. All rights reserved. CLM Matrix makes no warranties, expressed or implied, in this summary. CLM Matrix is a registered trademark of C-Lutions, LLC. Other product names may be trademarks of their respective companies.

© Copyright 2026