Essential guidance and critical updates on how for your organisation

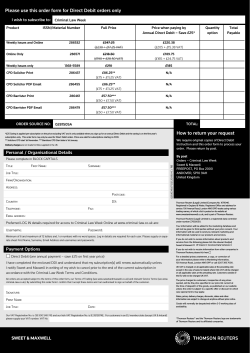

Monday 18 October 2010 QEII Conference Centre, Westminster Register by 27 August and save up to £79 “great all-round update on tax issues affecting our sector” Andy Gibb, British Red Cross Expert speakers include: Helen Donoghue director Charity Tax Group Essential guidance and critical updates on how to formulate a winning tax and VAT strategy for your organisation Get expert direction, clarification and money-saving taxation and VAT guidance on: • VAT on shared services • Gift Aid • Direct tax • Utilisation of surplus assets • Comprehensive Spending Review Organised by: • Property strategies • VAT relieved purchases • Sponsorship In association with: • Partial exemption • VAT efficiencies • International tax issues • Income streaming Graham Elliott partner haysmacintyre Andrea Sofield VAT partner Grant Thornton Socrates Socratous partner SocVat Deborah Jennings senior indirect tax manager KPMG Andrew Robinson associate director Grant Thornton Luke Savvas tax partner Buzzacott Clive Fathers partner Grant Thornton Paul Knight tax senior manager BDO Conference partners: Media partners: REGISTER TODAY Call: 020 7819 1200 • Fax: 020 7819 1210 • Email: [email protected] • Website: www.civilsociety.co.uk/vatandtax Monday 18 October 2010 QEII Conference Centre, Westminster An essential day’s learning on charity VAT and tax The VAT and tax regime for charities continuously evolves and it is essential to stay up-to-date with changes if you want to keep your charity’s VAT and tax to a minimum. With considerable sums involved and many traps for the unwary, even experienced charity managers will benefit from a day reviewing and refreshing knowledge across a broad range of issues. Don’t miss this essential and intensive day’s learning and the chance to hear the UK’s leading advisers on charity VAT and tax review the fundamentals and explain the latest developments in this complex area. 09:00 Registration Welcome to Charity Finance VAT & Tax Conference 2010 09:40 Chair’s welcome and opening address An Overview of VAT and tax issues charities need to consider for 2011 · Progress on the consultation on VAT on shared services · An update on the proposals on Gift Aid reform and simplification · Key findings from the CTG Tax Map study, looking at the wider impact of tax on the sector · What is happening on tax on development - is CIL being replaced? · What charities can expect from the Comprehensive Spending Review (due to be published on 20 October) Helen Donoghue director Charity Tax Group Session 1 10:10 VAT relieved purchases · Advertising, including Pay Per Click services · Direct Mailing Packages, including impact of new postal service rules · Facilities for use by disabled, and qualifying medical equipment · Construction projects, including both the zero and reduced VAT rates · Importing VAT-free services, whether it works, and if so how Graham Elliott partner haysmacintyre 10:50 Morning coffee 11:20 Partial exemption made easy! · The importance of identifying the VAT liability of supplies · The need for accurate record keeping and understanding basic principles · Differentiating between business and non business activities · Getting to grips with ‘partial exemption’ calculations · Worked example using the standard method · Review of alternative special methods · What to do before the VAT rate is increased and the impact on the calculations Session 2 Socrates Socratous partner SocVat REGISTER TODAY Call: 020 7819 Email: [email protected] 1200 • Fax: 020 7819 1210 • Website: www.civilscociety.co.uk/vatandtax Session 3 12:00 Achieving greater efficiency through cost optimisation · What practical solutions are out there for charities to work around the impact of VAT and tax increases? · How can charities share VAT and tax resources and work together in order to drive down costs? · Planning ahead to introduce VAT efficiencies and thinking more laterally for the future Deborah Jennings senior indirect tax manager KPMG 12:40 Graham McKay senior indirect tax manager KPMG Lunch Session 4 14:00 Gift aid and direct tax update · Gift Aid reform - where are we on the current consultation? · Gift Aid development and proposals · Practical aspects of Gift Aid, the pitfalls and opportunities. · New requirements for recognition as a charity for tax purposes · The “fit and proper persons” test for charity managers and HMRC’s current stance on policing · Direct tax - other recent developments Luke Savvas tax partner Buzzacott Session 5 14:40 International tax issues for charities · Tax and VAT implications of selling goods and services overseas · Tax and VAT consequences of operating in other jurisdictions · Receiving donations from overseas donors · Relocating employees internationally Andrew Robinson associate director Grant Thornton 15:20 Andrea Sofield VAT partner Grant Thornton Clive Fathers partner, head of employment solutions Grant Thornton Afternoon coffee Session 6 15:40 Troubleshooting for not for profit organisations – VAT & tax pitfalls to avoid (CASE STUDY BASED) · Case study based - tax and practical issues · Income streaming · Sponsorship, advertising, sale of logo · Commercial participation, reciprocal arrangements · Utilisation of surplus assets · Property strategies - trading, rents and conferencing facilities Paul Knight tax senior manager BDO 16:20 Round-up & closing remarks 16:30 Networking drinks reception sponsored by Zurich “A thorough and interesting conference on a tricky subject area” “A very broad spread of topics, covered well with relevance to many parts of the sector. Definitely money well spent“ Nick Ryan, SSAT Samantha Dent, Youth Music Conference partners: Register by 27 August and save up to £79 REGISTRATION FORM Save up to £79 when you book by 27 August 2010 Early bird bookings received by 27 August 2010 Not-for-profit delegate Commercial delegates Bookings received Bookings by 17 September received after 2010 17 September 2010 £170 + VAT (£199.75) £199 + VAT (£233.83) £249 + VAT (£292.58) £420 + VAT (£493.50) £449 + VAT (£527.58) £499 + VAT (£586.33) Please note that hotel accommodation is not included in the registration fee. However, should you require accommodation Civil Society Media has arranged special rates for delegates attending the event. Visit www.civilsociety.co.uk/hotels for details DELEGATE DETAILS Mr Mrs Ms Miss Other First name Surname Job title Organisation Email Address Postcode Charity number Tel Fax Mobile I am unable to attend in person but would like to purchase the event documentation for £95 (no VAT). VAT & Tax Conference 18 October 2010 REGISTER NOW visit the website at www.civilsociety.co.uk/vatandtax post this form to civil Society Media Ltd, FREEPOST SW7 154, London SW4 0YY fax this form to 020 7819 1210 call us on 020 7819 1200 email us at [email protected] PAYMENT DETAILS Amount to be paid I will pay by Visa Mastercard Visa Delta Maestro Card number Three digit security number on rear of card Cardholder name Expiry date Start date Issue date (switch only) Cheque (made payable to Civil Society Media Ltd) Signed Date Please contact us if you require a VAT receipt. Payment must be received prior to attending. PROMO CODE: WEB Mr Mrs Ms Miss Other First name Surname Job title Email Mr Mrs Ms Miss Other First name Surname Job title Email Please copy form to register extra additional delegates ACCESS AND DIETARY REQUIREMENTS Please give details of any access or dietary requirements Additional delegates VENUE DETAILS: The QEII Conference Centre Broad Sanctuary Westminster London SW1P 3EE Telephone: 020 7222 5000 www.qeiicc.co.uk Please note that speakers and topics were confirmed at the time of publishing, however, circumstances beyond the control of the organisers may necessitate substitutions, alterations or cancellations of the speakers and/or topics. As such, Civil Society Media Ltd reserves the right to alter or modify the advertised speakers and/or topics if necessary. Any substitutions or alterations will be updated on our web page as soon as possible. Personal details: Charity Finance VAT & Tax 2010 is produced by Civil Society Media Ltd. By registering to attend you are agreeing to be contacted with information relating to your delegate place and future events. Please tick if you do not wish to be contacted about associated products from Civil Society Media by phone or by post . Please tick if you would like to receive emails about products and services from Civil Society Media . Substitution and cancellation policy: Delegate substitutions are allowed. Refunds on cancellations will only be issued (less a 15% administration charge) up to and including 14 days prior to the event. Refunds will not be issued after this date. Confirmation of cancellations MUST be in writing and sent or faxed to Civil Society Media at the address and number listed above. Please tick if you wish to receive carefully screened, work related emails from selected third parties . To opt-out of such communications at any time, please write to Civil Society Media, FREEPOST SW7 154, London SW4 0YY, or email us on [email protected]

© Copyright 2026