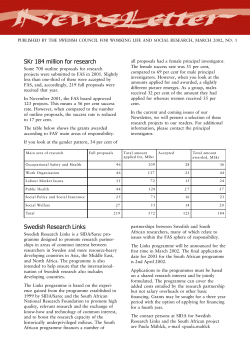

H o w t o f... b u s i n e s s ... I