The I T F

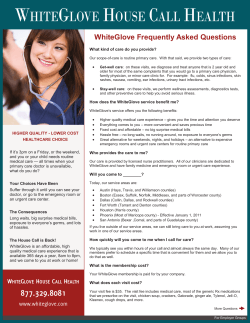

August 2010 The T h e M a ga z i n e f o r A c c o u n t s R e c e i va b l e M a n a g e r s EATURING:How to Improve Collections.....Cover & P7 • The Four C’s of Coaching Skills.....Cover & P10 F CURRENT: President’s Message.....P3 • Member News.....P4 The Four C’s of Coaching Skills How to Improve Collections By Jim Lackey Implementing a few simple steps can lead to collection success and more satisfied patients. I By: Nancy Friedman, The Telephone Doctor W hat better time to help our employees than now? Everyone seems to need a little TLC rather than being beaten down. If your employees aren’t doing what you need or want them to do, there are only two reasons for that. They either don’t want to or they don’t know how. Our 4 C’s of Coaching DVD can help you determine which it is and how to help them which in turn will help your company and your customers. When most people think of the word “COACH,” they imagine someone on the sidelines screaming at their players to do a better job. That may be true in sports situations, but in the business world, a coach needs to have a completely different approach in order to help employees improve performance. Let’s have a look at the role of a manager / coach and how that integrates with employee development. Where does traditional training come in? How does training relate to coaching? And what are the differences between training, coaching and counseling? Continued on page 10 www.WMCAWEB.org n the current economic environment, healthcare organizations are increasingly challenged to ensure that they collect all of the revenue that is due to them while remaining sensitive to the financial challenges of their patients. As patients’ out-of-pocket responsibility increases, healthcare financial managers should make it easy for patients to satisfy their financial obligations in the most efficient and effective manner. Implementing a few simple technologies and processes can help to optimize revenues. Offer Multiple Payment Options Healthcare is seen as a slow moving sector of our economy. From the Food and Drug Administration’s approval process to the construction of new facilities, healthcare advancements are measured in years and decades. However, financial responsibility for healthcare services has a rapid and stealth-like shift. Due to employers’ decisions, at the advice of the insurance industry, to encourage consumerism in the purchasing of healthcare services, the patients, not the payers, are emerging as the primary payer for services. As a result, an increasing number of consumers are paying their bills online. As online bill payment has risen, payment by check has declined. (See The Majority of Healthcare Consumers Prefer Credit/Debit Cards over Checks at www.hfma.org/rcs). More than 63 million U.S. households, or roughly three-quarters of all households with Internet access, regularly use online payment services, according to the 2008 Consumer Banking and Bill Payment Survey conducted by Fiserv, Inc. And consumers reported paying 49 percent of their monthly bills by check in 2005—down from 72 percent only five years before, according to the American Banker Association’s 2005/2006 Study of Consumer Payment Preferences. To meet changing consumer preferences and make it easier for hospital patients to pay their bills, healthcare providers are finding it necessary to offer multiple payment options to substantially increase the likelihood of payment. These options include online bill payment, automatic bill payment, and credit/debit cards in addition to checks. Educate Patients Ensuring that patients understand their financial responsibility is an integral part Continued on page 7 The Voice • August 2010 • P1 P2 • August 2010 • The Voice www.WMCAWEB.org Vol. 46 • No. 3 2009–2010 Officers • President • Patty Werdin St. Clare Hospital & Health Services 707 14th Street Baraboo, WI 53913-1539 Phone: 608-356-1331 [email protected] The • Vice President • Jennifer Tarantino Aurora Health Care 3305 W. Forest Home Ave. Milwaukee, WI 53215 Phone: 414-389-2318 [email protected] • Past President • Kathy Pinnow Columbia/St. Mary’s Hospitals P.O. Box 503 Milwaukee, WI 53201-0503 Phone: 414-319-3090 [email protected] • Secretary • Diane Hamm Hess Memorial Hospital, Inc. 1050 Division Street Mauston, WI 53948 Phone: 608-847-1863 [email protected] Directors • Sandy Bowe • St. Joseph’s Hospital 2661 County Highway I Chippewa Falls, WI 54719 Phone: 715-726-3477 [email protected] • Deb Gustafson • Beloit Memorial Hospital 1969 W. Hart Road Beloit, WI 53511 Phone: 608-364-5123 [email protected] • Jacklyn Lippe • 108 Wind Sail Ct. Random Lake, WI 53075 Phone: 414-640-9375 [email protected] • Philip Rohs • Apex 5404 Pheasant Hill Rd. Monona, WI 53716 [email protected] • Marlene Schmidt • St. Vincent Hospital P.O. Box 13508 Green Bay, WI 54307-3161 Phone: 920-433-8115 [email protected] • Connie Schmiege • Memorial Health Center 135 S. Gibson Street Medford, WI 54451 Phone: 715-748-8152 [email protected] • Jay Wittchow • Children’s Hospital of Wisconsin P.O. Box 1997 Milwaukee, WI 53201 Phone: 414-266-6253 [email protected] • Brian Potter • Ex-Officio Board Member Wisconsin Hospital Association P.O. Box 259038 Madison, WI 53711 Phone: 608-274-1820 [email protected] Staff • Jim Brick, Business Manager • Credit Management Control, Inc. P.O. Box 589 Waukesha, WI 53187 Phone: 262-542-6508 • Fax: 262-542-6601 [email protected] • Dennis Schommer, Voice Editor • Reedsburg Area Medical Center 2000 North Dewey Avenue Reedsburg, WI 53959 Phone: 608-768-6203 [email protected] www.WMCAWEB.org T h e M a ga z i n e f o r A c c o u n t s R e c e i va b l e M a n a g e r s A Message from the WMCA President Hello All, By now you had a chance to view our new Voice formatting. This was one area where the board took a hard look at wanting to continue producing more cost effectively. I personally • Patty Werdin • think Dennis Schommer, WMCA President Editor did a great job with this task. Thank you, Dennis! Let us know what you think; we would love for you to share your feedback. We also are looking for articles to feature in The Voice, so if you or anyone that you know would like to contribute, please feel free to contact Dennis. In May we had our joint workshop with our friends the WAHAM folks in Green Lake, Wisconsin. What a beautiful hotel in a serene setting. Thank you to all who participated. WMCA always strives to provide quality educational sessions at the quarterly workshops as well as at the Annual Conference. Speaking of the Annual Conference...I am hoping you will be joining us August 11, 12 and 13, 2010 at the Country Springs Hotel in Pewaukee, Wisconsin. Invaluable Networking Golf Outing sponsored by United Credit Service Inc. on Wednesday. Some of the topics we are planning on for Thursday and Friday are Medicare updates, Medicaid updates, Healthcare Reform and we even have a representative confirmed from CGI to speak about the RAC process. The registration material was sent out in July. Hope you all had a chance to get your registrations in. If there are any questions, please feel free to contact me or any board member. I am excited about seeing many friends again at the Annual Conference. Until then... Hope you are continuing to have a great summer! Sincerely, Patty Werdin WMCA President Mission Statement of WMCA Wisconsin Medical Credit Association is dedicated to the improvement and efficiency of medical credit management. Wisconsin Medical Credit Association began in 1962 and has been serving its members for 48 years. WMCA members are comprised of leaders from the patient financial services and revenue cycle departments from hospitals, health systems, clinics and physician offices. Additionally, WMCA serves associate business members from collection agencies, billing services, electronic data vendors, and attorney and consulting firms who focus on the same disciplines. Wisconsin Medical Credit Association is dedicated to the improvement and efficiency of medical credit management in the Patient Financial Services and Revenue Cycle arenas. The Voice • August 2010 • P3 Don’t try to be perfect—just be excellent “Perfect” is the ultimate praise. But trying to attain perfection can cause stress, hinder efficiency, and create unnecessary conflicts with the people around you. Perfectionists are frequently perceived as: • Critical • Overwhelmed • Unable to see the big picture • Stressed-out and anxious • Rarely able to enjoy their accomplishments A more productive goal is excellence: meeting the highest standards agreed upon for oneself or by the group. The person concentrating on excellence focuses on: • Continued personal and professional growth • Job satisfaction and customer service • Clear and reasonable expectations To go from perfectionism to the pursuit of excellence, follow this advice: • Get real. When you find yourself becoming frantic about a goal, stop and ask, “Is this problem really worth the level of frustration I’m experiencing?” • Establish clear expectations. If you know what’s expected of you, you can better track your progress and draw boundaries when needed, which help you move forward with the project instead of trying to make it better. • Identify your triggers. Learn to recognize the factors that lead or contribute to your perfectionist thinking and behaviors—and avoid them. • Delegate. Many perfectionists mistakenly believe that they—and only they—can complete the task at hand. Allow other people to assist you, which will increase the odds that the group will more easily reach excellence. • Know what’s important. Ask yourself, “What’s most important about this project?” Consult with your supervisor, colleagues, and employee. Analyzing your objectives, then narrowing down key points and agreements, allows everyone to measure his or her performance accurately. • A strong sense of accomplishment In Shakespeare’s time, mattresses were secured on bed frames by ropes. When you pulled on the ropes the mattress tightened, making the bed firmer to sleep on. Hence The best way to appreciate your job is to imagine yourself without one. —Oscar Wilde the phrase...”goodnight, sleep tight.” An Excellent Company...Expect Something Special “Where Total Performance Is the Standard.” a wholly owned subsidiary of Asset Management Outsourcing, Inc. Contact: Randy Lengling • 1-800-759-9121 • Ext 2050 AMO Recoveries, Inc 6737 W. Washington Street, Suite 3118 • West Allis, WI 53214 Metro Milwaukee Area WI Medical Credit Association, Inc. Purposes and Objectives • T o promote good will and better understanding between medical managers and associates • T o stimulate interest in educational activities for its members • T o hold regularly scheduled meetings (clinics, workshops and seminars) where members may receive instruction and exchange views and experiences • T o collect, correlate and disseminate materials and information to assist its members to better understand and apply principles of good medical credit procedures • T o keep current on passage and modifications of laws needed for the equal and just protection of patients, hospitals, clinics and doctor’s offices • T o coordinate and improve methods of medical credit procedures, patient and insurance collection DEDICATED TO THE IMPROVEMENT AND EFFICIENCY OF MEDICAL CREDIT MANAGEMENT P4 • August 2010 • The Voice www.WMCAWEB.org THE LINE UP Wednesday, August 11, 2010 11:00 am–2:00 pm WMCA Golf Outing and Invaluable Networking Sponsored by United Credit Service, Inc. Willow Run Country Club (next to Country Springs Hotel) Thursday, August 12, 2010 8:00 am–9:00 am Continental Breakfast and Registration 8:45 am–9:00 am President’s Welcome, Patty Werdin, WMCA President 9:00 am–10:15 am Wisconsin Jerry Augustine, Brewers Analyst for FOX Sports Jerry, who played for the Brewers from ‘75–’84, will share some anecdotes and then offer an open Q & A session. 48th Annual Conference E ERENC Wednesday–Friday, August 11–13, 2010 Country Springs Hotel, Pewaukee NF O C L UA N N A erences! Y H tos from pastY -conf pho e thes FRIDA 0 48EnjToy A D S 0 dne 3, 2 1 -1 we ST 11 AUGU Coun try Hote s g n Spri ee k Pewau 10:15 am–10:30 am 10:30 am–12:00 pm Instructions Information Overload: How to Manage Medicare’s John Bartell, Partner, Bay Area Healthcare Consulting This presentation will be an interactive discussion on how to manage and disseminate CMS’s instructions. Examples will be taken from the NGS and CMS websites on how to extract key data for identification and routing to appropriate personnel throughout your organization. A review of present and future CMS instructions will also be discussed. 12:00 pm–1:00 pm l Break Lunch / Short Business Meeting A special presentation honoring Steve Baseley 1:00 pm–2:15 pm EDS Presentation Maria Schwartz, Professional Relations Representative HP Enterprise Services (EDS) Maria will provide an overview of the various programs, including the newBasic Plan, and update you on changes. If you have any questions or specific topics you would like her to cover, please send an e-mail to [email protected] prior to August 2nd. 2:15 pm–2:30 pm Break 2:30 pm–3:30 pm Open Forum Kenlyn Gretz, President & CEO, Americollect This forum will give you an opportunity to ask questions regarding billing, collections, or anything related to the revenue cycle as well as teach you about specific processes. 3:30 pm Adjourn 5:00 pm–7:00 pm Vendor Faire The annual Vendor Faire is your opportunity to meet the WMCA Associate Members and to see how their companies can help your facilities and clients. It’s also a chance to win raffle prizes donated by the generous WMCA Associate Members. Friday, August 13, 2010 8:00 am–9:15 am Hot Breakfast 9:15 am–10:15 am RAC-Recovery Audit Contractor Update Mary Hoffman, Project Director of the Clinical Audit Division of CGI Meet a member of the CGI staff who is willing to share her extensive RAC knowledge & experience. In this session you will receive an update on the RAC review process and what has been learned since the project became operational in Wisconsin. If time allows, a question and answer session will follow. 10:15 am–10:30 am Break 10:30 am–12:00 pm H ow Health Care Reform May Impact You and Your Organization Rich Donkle, CPA, Director of Financial Consulting Service, Wisconsin Rural Health Cooperative This session will review some of the changes we know health care reform will bring, and discuss the implications for Wisconsin providers. Although there are many issues to be resolved in implementing this reform, there are some things that will affect your organization immediately, with more changes to come. Learn about the many changes that will impact providers, both as providers of health care services, and as business organizations during this presentation. 12:00 pm www.WMCAWEB.org Adjourn The Voice • August 2010 • P5 State Collection Service, Inc. Meet o u r D i re c to r o f R e ve n u e Cyc l e ! t'PSNFS71PG0OUBSJP Systems’ Healthcare Division (creators of Artiva Healthcare) t&YQFSJFODFXPSLJOHXJUITPNF of America’s largest healthcare providers including Healthcare Corporation of America and Catholic Healthcare West Steve Beard, Director of Revenue Cycle, State Collection Service, Inc. t'FBUVSFETQFBLFSBU numerous national seminars and conferences With over 25 years of experience in the receivables management industry, Steve Beard has the solutions to meet your outsourcing needs. As State Collection Service’s new Director of Revenue Cycle, let Steve’s extensive knowledge of the entire revenue cycle – including first-hand experience with Artiva Healthcare, our newest technology offering – work for you! Contact us at 800.477.7474 S e r v i ce. I nt e g r i t y. Re s u l t s. Credit Management Control Celebrating 30 years of making debt collections look like a piece of cake. You know that collecting on accounts receivable isn’t easy, but after three decades of experience in the industry, CMC makes it look that way. We’ve made a lot of changes over the years, in everything from collection technology and strategic processes to our ownership. But our commitment to being the best in the industry has never changed and it never will. The CMC Sales Team: Brian White Sondi Grassman Bonnie Lee Superior CUSTOMER SERVICE Excellent RECOVERY RATES Committed NEW OWNERS POWERFUL Technology Enhanced PERFORMANCE Proven EXPERIENCE 877-225-PAID www.creditmgt.com SINCE 1980...PROFESSIONAL CREDIT SERVICES. FRONT-LINE MANAGEMENT. BOTTOM LINE CONTROL. P6 • August 2010 • The Voice www.WMCAWEB.org Continued from cover article... How to Improve Collections of the collection process. Developing a policy, sticking to it, and clearly outlining the policy can help patients understand what is expected of them when they arrive for service. Healthcare businesses are increasingly finding it necessary to include financial counseling or advisory services during admission or discharge to assist patients in understanding the process of letters, explanations of benefit, and statements that will begin to fill patients’ mailboxes after the clinical visit has been forgotten. Verify Eligibility Providers that verify patients’ insurance coverage and benefits before service to avoid unnecessary accounts receivable days, staff time dealing with denied claims, and the costs associated with sending multiple statements to patients. Automated eligibility verification processes reduce the time and expense of verifying coverage by contacting the payers electronically with added frontoffice efficiencies. A corollary benefit to the automation offered at admission or check-in is the fact that valuable coding and billing resources deal with far fewer eligibility-related denials from insurance companies, resulting in an increase in payments and greater utilization of resources in the back office. Collect Payment Up Front Requesting payment at the time of service has enabled providers to significantly increase collections. When front-office staff members inform patients early in the scheduling or www.WMCAWEB.org preregistration process that their financial responsibility is due at the time of service, patients are much more likely to pay their copayments up front. One general practice provider experienced an increase in cash collections in excess of $30,000 per month merely by asking for up-front payments when the practice administrator realized that the intake staff felt uncomfortable asking for payment. She implemented a script, similar to one used in the fast-food industry, and required a receipt be given with payment or the patient would receive a free office visit. Develop Clear Patient Statements A provider taking part in HFMA’s 2001 PATIENT FRIENDLY BILLING® study found that presenting statements in consumerfriendly formats reduced calls from patients who had questions about their bills by 37 percent and improved collection rates. (The same study found “dissatisfaction with the format of medical bills” was among patients’ chief complaints and reason for ignoring medical bills). Eliminating office jargon and codes helps patients to understand what they are being charges for, increasing the likelihood that they will pay their medical bills promptly and in full. Offer Payment Plans Despite having other best practices in place, some patients (especially the uninsured, underinsured, and those with high-deductible plans) may be unable to pay their full responsibility at one time. Offering payment plans and options saves on collection expenses and reduces write-offs. By training staff to offer payment plans when practical, providers can ease patients’ financial burden and improve collections. Care should be taken to ensure that any payment plan process developed by the healthcare business is compliant with the Payment Card Industry Data Security Standards (PCI-DSS) dealing with the storage and processing of credit/ debit card information. Not only is the process important, but also the technology and security standard more critical. Track Payments To minimize the possibility of internal fraud— an unfortunate but real possibility—providers should keep a close eye on collections. Cash payments, especially those in small denominations, are difficult to track. Providers should issue a receipt for payment at the time of service, with a copy for the provider’s records. Maintaining accurate records of all payments can help decrease instances of fraud. In addition, providers should segregate employee collection duties so no single staff member has overall responsibility. Lockboxes provide an option for eliminating employee access to incoming payments entirely, while reducing labor costs and freeing up resources for more productive and revenuegenerating functions. Refining the Collection Strategy Practicing efficient revenue cycle management can help healthcare financial managers improve both collections and patient satisfaction. Jim Lacy is CFO and counsel, ZirMed, Inc. Louisville, KY, and a member of HFMA’s Kentucky Chapter ([email protected]). Reprinted, by permission, from Revenue Cycle Strategist, November, 2009, pages 7–8. Copyright 2009 by the HEALTHCARE FINANCIAL MANAGEMENT ASSOCIATION. The Voice • August 2010 • P7 WMCA MEMBERSHIP APPLICATION Just complete the application below and send it with your check to: WMCA • P.O. Box 1507 • Waukesha, WI 53187 name of hospital, clinic, doctors office, other (circle one) address city contact person controller or financial officer date of application phone state zip title email address administrator/ceo did anyone refer you to this organization? please list so we may thank them. __________________________________________________________________________________________ Individual Hospital $250.00 __________________________________________________________________________________________ • note membership fee includes “VOICE” subscription Mulitple Hospital System $350.00 if multi-hospital system, please list which facility(s) you are enrolling MEMBERSHIP INFORMATION Dues are $250/$350 per year payable January 1st, or when necessary, are prorated per month for a partial year. Provider membership is open to all hospitals, clinics, doctors’ offices, nursing homes and other providers of healthcare. Associate membership is open to collection agencies, insurance companies and other organizations providing services to the medical credit industry. SPECIAL NOTE: Memberships are in the name of the individual hospital, clinic, etc. Benefits of memberships are available to all employees of each member facility. P8 • August 2010 • The Voice www.WMCAWEB.org 2010 Meeting Calendar ANNUAL MEETING August 12 & 13, 2010 Country Springs Hotel/Pewaukee WORKSHOP October 22, 2010 Hotel Sierra/Green Bay VISIT OUR WEBPAGE AT: HTTP://WWW.WMCAWEB.ORG (Job Listing Information) www.WMCAWEB.org 2425 Airport Road P.O. Box 83 Portage, WI 53901 608-742-4124 If you answer YES to any of these questions you need to call 800-873-2560 TODAY! • Do you want an agency that collects more accounts than they return? (Efforts Exhausted?) • Do you want an agency that does not set limits for litigation amounts? And Collects on all balances? (Why the limits? Not enough profit for who?) • Do you want a live contact? Tired of voice mail, being just another number and lost in the shuffle? (You deserve immediate service!) Your goals are not too high to expect your agency to work all accounts—not just the easy recoveries. You deserve an agency that will recommend litigation on small as well as larger balances. We guarantee you will receive prompt, professional and courteous service. Specializing in Medical Recovery with a combined 100+ years of experience. The Voice • August 2010 • P9 Continued from cover article... The Four C’s of Coaching Skills continued... The process starts with training. That’s the first step. Let’s say you’re training a group. What usually happens is most of the group understands, learns and benefits from the information you’ve taught. Unfortunately, not everyone “gets it.” What do we do about that small percentage of employees—often good, conscientious people—who may need personalized attention after training? Those are the ones who need coaching. Remember that coaching is strategically guiding someone into improving performance. It’s analyzing feedback to see the areas where the training hasn’t taken hold. Is remedial training needed? That’s where the coaching comes in. These are the people who need one-on-one customized help to develop their skills. OK, we’ve talked about training and coaching. Where does counseling come in? Concurrence: It’s critical. Unless you and the trainee agree (concur) that there is a gap, and they commit to the improvement that’s needed, you won’t be able to coach to your full capacity for effectiveness. We need to achieve concurrence. Both you and the employee need to concur there is an issue. Once that’s done, we can go on to the content. Content: Next, identify the content that needs to be improved. What needs to be done? What are some of the issues involved? Normally where coaching is needed, it’s either due to the fact that the employee doesn’t know how to do the job (they just don’t ‘get To be most effective, coaching should be done in private; especially when it becomes an on the spot type of coaching. It’s important to remember to never embarrass the employee. That’s not coaching, that’s just being mean! We’re going to give you the Telephone Doctor® Four Step Model for effective coaching in a call center or business environment. We call it the 4 C’s of Coaching. The 4 C’s are: 2. Content 3. Commitment 4. Congratulations or Continuation Let’s cover them one by one: Congratulations or Continuation: Once you and your team member have found the content that needs to be corrected, you give them the instruction on how to do it right and there is commitment it will be done. Lastly, it’s time for CONGRATULATIONS. Let them know they’ve done a good job. This is critical. It’s most important you don’t leave that part out. If more work is needed, we cycle back through with continuation. Figure out what work is needed to reach the congratulations step. Much coaching takes place to fill a perceived need. You find out that there’s a gap in the performance of an employee, and then plan a coaching approach that should improve the performance of that employee. It’s nice and orderly to be able to think about what you’re going to do. Formulate your plan and decide when you’re going to do your coaching. Counseling is helping someone explore, and possibly resolve, personal problems. Counseling is utilized if, for whatever reason, the employee isn’t performing. It’s for that special situation when training and coaching haven’t worked, where the employee is not willing, or is unable to do the job. Especially if there is some distraction that is not job related. 1. Concurrence we’re working with an intelligent, conscientious employee who wants to do a good job. With some coaching, the job will be done right. it’) or doesn’t want to do the job. You need to find out which it is. The coach and the employee need to agree on the content, the issue and the problem. Only then can they make a commitment to solve it. Commitment: The coach and the trainee need to agree. They can then make a commitment to solve the problem. Normally Nancy Friedman is President of Telephone Doctor, a customer service training company in St. Louis, MO. She is a featured speaker at association, chamber and corporate meetings. To receive our free monthly email article on customer service and a free subscription to the Telephone Doctor Newsletter, The Friendly Voice, go here www. telephonedoctor.com or call 314-291-1012. Visit our webpage at http://www.wmcaweb.org P10 • August 2010 • The Voice www.WMCAWEB.org Simplify—It’s the key to working smarter Efficiency at work is more important than ever in these days of budget cutbacks and ever-growing productivity demands. One of the key elements of working smarter is simplifying the way you work, and where you work. Here are some tips: • Schedule routine tasks into four segments: early morning, late morning, early afternoon, and late afternoon. Decide which tasks you perform best to what time of day. • Organize your workspace. Remove from your space anything that you don’t need constant access to, like a stapler or three-hole punch. Keep papers in appropriate baskets: pending, action, active project, or to be filed. Deal with paperwork when you do administrative work. • Keep a to-do list to manage projects and activities. The list can help you maintain a focused list of priorities. Toll Free (800) 799-7469 Three skills for better negotiation Negotiating is a make-or-break skill, whether you’re a CEO in charge of a merger or a parent trying to sort out a sibling squabble. Follow these tips to negotiate agreements productively: • Keep an open mind. Brainstorm ideas. Listen to outlandish proposals. Entertain unusual possibilities. This will expand opportunities for agreement. • Treat people fairly. When people feel you’re being fair with them, they’re more likely to make real commitments. If they think you’re trying to cheat them, they’ll walk away in a huff. You won’t get commitment unless the other party feels you’re sincerely trying to do what’s right. • Listen actively. Don’t plan what you’re going to say while the other side is talking. Pay attention to what they’re saying so you know where they’re coming from and what they really want. When your response makes it clear that you’ve really been listening, they’ll be more willing to listen to your proposals. Begin at the top Mountaineer Ed Viesturs has conquered the 14 tallest mountains in the world— without extra oxygen. One secret of his success, and his longevity in a dangerous sport, is his approach to planning. Viesturs doesn’t plan his upward climb first. He begins by planning his descent from the peak. This tells him how much time he’ll need to reach his base camp before darkness falls—which tells him what time he should start climbing. In other words, he assumes from the beginning that he’ll achieve his goal of reaching the summit, and he plans his strategy around that. Maybe everyone should make plans by anticipating success, and then working backward for safety. www.outsourceinc.org Your Partner In Receivables Management www.WMCAWEB.org The Voice • August 2010 • P11 STD PRSRT US POSTAGE PAID MADISON WI PERMIT #2783 The Account Recovery Service Payment Monitoring Pre-collection Collection Over 50 years of successful medical collection experience. Service by professionals . . . for professionals. 3031 N. 114th Street Milwaukee, WI 53222 (414) 479-3800 800-598-5521 • Chuck Worgull

© Copyright 2026