How to Send P2P Payments with DCU’s Bill Pay Service

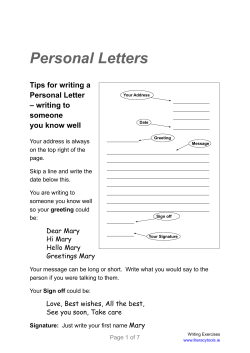

How to Send P2P Payments with DCU’s Bill Pay Service Pay a friend back for dinner, chip in for a group vacation or send money to a child at college using just their email address. Through this secure method, your account information will not be shared with the payee, and the payee’s account information will not be shared with you. Once you have gone through these steps, you will be able to quickly and easily send payments in a few clicks. Step 1: Add Payee To send money to a friend, first set them up as a Payee under "Add a Person". You will need their first name, last name and email address. Make sure you have selected “Add a Person”, and are not attempting to add an individual under the “Add a Bill” option (adding them as a bill will require their bank account information or address to mail a check). You will assign a unique keyword to the payee, and will need to provide them with that keyword. The payee will be prompted to enter this keyword as a way to verify their identity prior to submitting their account information. Step 2: Request Code to Activate Payee Select a method to receive the Activation Code for this payee (Activation Code process only applies to newly added Payees or one that has not been activated). This is a security measure used as verification. You may choose to receive a call with the activation code, a text message or an email. Step 3: Enter Activation Code: Once the code has been sent, a box will appear allowing you to enter it in for submission. Once the code has been submitted, then the payee is activated. Step 4: Payee Provides Account Information Your payee will receive an email letting them know you want to send them a payment. They will follow the link in the email, enter the keyword you selected (to verify their identity) and then enter their account information for funds to be deposited. Greetings! Mary Sample plans to send you a payment through their financial institutions payment service. Since this is the first time Mary Sample has identified you as a potential recipient of a payment, an extra step is required to securely authenticate you and your deposit account information. Mary Sample should have provided you with a keyword prior to your receipt of this email. You will need the keyword to complete the steps below. If you do not have or do not remember the keyword, please contact Mary Sample. For security purposes we do not recommend this keyword be shared via email. A phone call is much safer. Once you have the keyword, you may then continue with the instructions below: 1. Click on the link below or copy and paste the link into your browser. https://www.billpaysite.com/merchconfirmXXXSampleLink 2. Enter the keyword provided to you by Mary Sample. 3. Click the 'Next' button. 4. You are now ready to tell us where to deposit your payments from Mary Sample. Enter the Routing Number (RTN) and bank account number of the account into which you want your funds deposited. Instructions to help you identify the RTN and bank account number are available on the site. Your bank account information is never shared with Mary Sample. 5. Please indicate if this is a checking or savings account. 6. Click on the 'Finish' button. You are now authenticated and any pending or future payments will be free to process without delay or further need for authentication. A message will be sent to Mary Sample notifying them you have completed the authentication process. When a payment is processed to you from Mary Sample you will receive a new message confirming the payment, date and the amount. Within 3 business days of that message, your Financial Institution should be able to provide confirmation of the deposit. Step 5: Schedule Payment Your activated payees will be listed on the left. Check who you want to send payment to, enter the amount and select the date you would like the payment processed. Your payee should receive confirmation of payment within 3 business days of the processing date. You can schedule a one-time payment, or schedule recurring payments.

© Copyright 2026