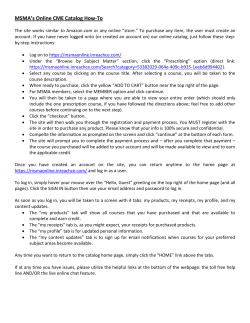

Document 196995