ICAEW (ACA) Cambridge Ways to Study

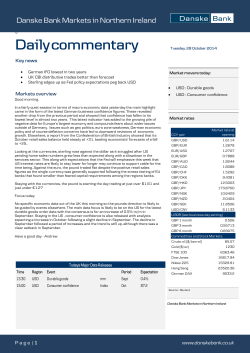

ICAEW (ACA) Cambridge To book call 03300 603 200 Or visit bpp.com/aca BPP Cambridge Third Floor, Lion Yard, Cambridge, CB2 3NA Ways to Study In Centre Face-to-Face Online Classroom This is ideal if you want to study at a steady pace and can commit to specific study times at a specific location. Our expert tutors bring their passion, enthusiasm and industry experience to the classroom making sessions highly engaging and motivational. This is ideal if you want the flexibility of studying whenever and wherever you want combined with tutor support. You are supported by a library of online content which includes a comprehensive suite of online lectures. Study at your own pace, with access to the library of online content which includes a comprehensive suite of online lectures and the ability to interact with tutors and fellow students through our online forums. How to progress through the ACA There are 15 papers in the ACA qualification. • 6 CFAB papers (also called Knowledge Level) which are Computer Based Exams with a 55% pass mark. • 6 Application level exams, with sittings in March, June, September and December and a 55% pass mark. • 3 Advanced level papers with sittings in July and Novemberwith a 50% pass mark. Students can progress through the papers in any order they wish. Common routes are to sit all CFAB papers before sitting the Application level papers (the “tiered approach”) or to pair up CFAB papers with Application papers and work through CFAB and Application at the same time (“pillar” approach). There is also a choice about whether to “decouple” the Advanced Case Study from the other two Advanced Level papers. Students who choose to sit the Advanced Case Study separately from the other two Advance Level papers ensure they give the Case Study sufficient attention. 1 ICAEW (ACA) Cambridge To book call 03300 603 200 Or visit bpp.com/aca Our courses All of our courses follow BPP’s 3 steps formula for exam success – Learn > Practise > Rehearse – proven to increase your chances of passing. Taught Course Revision Course Rehearse – Mock Exam We ensure you do not waste a minute of study time. Our expert tutors will guide you through the syllabus knowledge in our market leading course notes, making it as easy to understand as possible through the use of real life examples. Key topics and techniques are illustrated through interactive examples and our tutors will be happy to answer any questions you have as you go. Passing exams is all about successfully applying what you know. Through the use of handpicked past paper questions, our expert tutors will help you to develop your exam technique. The full range of exam skills will be covered – from understanding exactly what the examiner wants, to planning your answers and presenting them in a way that gets the most marks, all whilst managing your time. All our revision courses include Mock Exams within the price (this includes marking). These Mock Exam are written by the ICAEW to replicate as closely as possible the real exam content and standard. Replicate the real exam experience with time pressure and get your exam marked, to finish your preparation. This includes an early introduction to how topics are examined and therefore how to build this into your studies. Two course exams can be submitted for marking and feedback as the course progresses. Comprehensive guidance on exactly what to study in between lessons. Full access to a range of pre-recorded lectures, so you can revisit any tricky topics or refresh key brought forward knowledge. Key syllabus topics are recapped in a very efficient way, and priorities for the exam clearly identified. Our revision notes summarise all the syllabus knowledge you need to comfortably pass the exam, and our Practice and Revision Kit includes all questions and answers from the current syllabus. Full access to a suite of online walkthroughs of key past paper questions and topic recaps. Integrated Course Resit Course - Not successful in your last exams? All of our Online Classroom classes integrate Taught and Revision. Online Retake Courses – Application and Advanced level If you were unsuccessful in your previous attempt, our Online Classroom Retake courses are the perfect preparation for your next sitting. On booking your course, you will benefit from: •A named tutor who will support you through your retake course. Your tutor will provide answers to specific questions and provide guidance on your exam technique •Access to the “Discussion Forum” which will allow you to interact with tutors and fellow retake students. You will also see answers to other student queries •Online walkthroughs of key past questions and answers from the ICAEW Question Bank •Targeted question practice to improve your exam skills and technical knowledge •A Retake Work Programme will guide your study up to the start of your retake course •Lecture recordings of all of our Revision Notes, so you can recap your areas of weakness •ICAEW Mock exams which are marked providing you with constructive feedback on how to improve on your current performance •Recorded debriefs of the ICAEW mock exams for your paper. This is an opportunity to understand how to improve your technical knowledge, interpret the question requirements, listen to advice on improving your time management and to understand what the examiner is looking for In Centre Advanced level retake courses In London, we run in centre retake courses for Advanced Level papers to the July and November exams. 2 Certificate Level 2014 Accounting Assurance In Centre Face to Face Day 1 Day 2 Integrated Course Weekday 9.00am - 4.15pm Option 1 13 Oct 14 Oct Online Classroom In Centre Face to Face Day 1 Day 2 Integrated Course Weekday 9.00am - 4.15pm Option 1 21 Oct 22 Oct Online Classroom Day 3 15 Oct Day 4 16 Oct Day 5 17 Oct Day 6 20 Oct Fee GBP 481 Business and Finance Fee GBP Integrated Course Start Date Fee GBP Fee GBP Integrated Course 23 Oct 386 Start Date Start any time 336 Fee GBP Integrated Course Start any time 386 Start Date Management Information Law Online Classroom Online Classroom Start any time Integrated Course 336 Principles of Tax Online Classroom Fee GBP Start Date Online Classroom Day 3 Fee GBP Integrated Course Start any time Fees include the ICAEW material, open books and VAT 336 Start Date Fee GBP Integrated Course Start any time 336 Start Date Start any time 336 Professional Level to September 2014 Financial Accounting and Reporting Tax Compliance Online Classroom Online Classroom Fee GBP Integrated Course Start Date Fee GBP Integrated Course 2 Jun 726 Start Date Audit and Assurance Financial Management Online Classroom Online Classroom 3 Jun Fee GBP Integrated Course Start Date Fee GBP Integrated Course 3 Jun 730 Start Date Business Strategy Business Planning: Taxation Online Classroom Online Classroom 3 Jun Fee GBP Integrated Course Start Date 679 654 Fee GBP Integrated Course 2 Jun Fees include the ICAEW material, open books and VAT 654 Start Date 2 Jun 679 Professional Level to December 2014 Financial Accounting and Reporting Tax Compliance Online Classroom Online Classroom Fee GBP Integrated Course Start Date Fee GBP Integrated Course 1 Sep 726 Start Date Audit and Assurance Financial Management Online Classroom Online Classroom 2 Sep Fee GBP Integrated Course Start Date Fee GBP Integrated Course 2 Sep 730 Start Date Business Strategy Business Planning: Taxation Online Classroom Online Classroom 2 Sep Fee GBP Integrated Course Start Date 679 654 Fee GBP Integrated Course 1 Sep Fees include the ICAEW material, open books and VAT 654 Start Date 1 Sep 679 Advanced Level to November 2014 - Old Syllabus Technical Integration Case Study Online Classroom Online Classroom Fee GBP Fee GBP Integrated Course Integrated Course 16 Jun Start Date 1610 Start date 7 Jul 786 Advanced Level to November 2014 - New Syllabus Corporate Reporting Strategic Business Management Case Study Online Classroom Online Classroom Online Classroom Fee GBP Integrated Course Start Date Fee GBP Integrated Course 14 Jul Fees include the ICAEW material, open books and VAT 868 Start Date Fee GBP Integrated Course 21 Jul 721 Start Date 7 Jul 786

© Copyright 2026