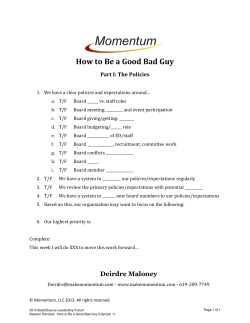

How to Set up a Family Budget