WorldWide Service Please talk to us first The Financial Ombudsman Service.

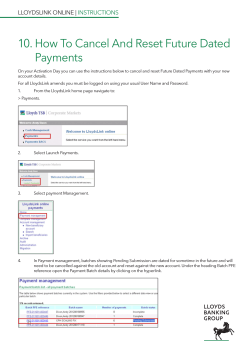

WorldWide Service The Financial Ombudsman Service. Please talk to us first This is a free, independent, dispute resolution service for customers of most UK banks, building societies, insurance companies and other financial organisations. It can deal with most personal disputes from household insurance and personal pension plans to your bank accounts, stocks and shares. We are able to resolve most of the complaints we receive, so hope you will always contact us first. The Financial Services Ombudsman Scheme will only consider your complaint after you have been through our internal procedures. Lloyds TSB WorldWide Service 1 Waterloo Place PO Box 349 London SW1Y 5NJ Contacts details for the Financial Ombudsman Service are: The Financial Ombudsman Service South Quay Plaza 183 Marsh Wall London E14 9SR Please remember that the Financial Ombudsman Service will only consider your complaint once you’ve tried and failed to resolve it with us. Tel: 08457 301 996 From overseas: +44 20 7839 2099 Lines are open 9am-5pm Monday to Friday. Tel: 0845 080 1800 Website: www.financial-ombudsman.org.uk Please contact us if you’d like this in Braille, large print or on audio tape Offshore PhoneBank is a registered business name of Lloyds TSB Offshore Holdings Limited. Offshore PhoneBank is provided by the Isle of Man branch of Lloyds TSB Offshore Limited. Please note that to help us maintain security and quality of service for our customers, we may record or monitor your call. We accept calls made through RNID Typetalk. Lloyds TSB Bank plc. Registered office 25 Gresham Street, London EC2V 7HN. Registered in England and Wales no. 2065. Authorised and regulated by the Financial Services Authority. We subscribe to The Lending Code; copies of the Code can be obtained from www.lendingstandardsboard.org.uk Lloyds TSB Offshore Limited. Registered Office: PO Box 160, 25 New Street, St. Helier, Jersey JE4 8RG. Registered in Jersey, number 4029. Regulated by the Jersey Financial Services Commission. We abide by the Jersey Code of Practice for Consumer Lending. Member of the Financial Services Compensation Scheme. To register for Internet banking with Lloyds TSB go to www.lloydstsb-offshore.com/wws OB905 (April 2010) How to voice your concerns Resolving your complaints with us Do you have a complaint? Lloyds TSB sets out to provide the highest level of customer service. If something has gone wrong, we want to know about it. We will do everything in our power to put it right. To ensure we deal promptly, effectively and fairly with any concerns our customers may have, we have established this complaints procedure. These are the steps we ask you to take if you have a complaint about our service. Our staff will help you with any questions you have. Step 1: Take your complaint to your usual contact Step 2: If you remain dissatisfied, please refer directly to one of the following: Step 3: If your complaint remains unresloved Complaints issue How to contact us by telephone How to contact us by post Ask the Bank to issue a final responce General banking products/services related to banking accounts Tel: 0845 6033655 Fax: 01624 610299 From overseas: Tel: +44 1539 738738 Fax: +44 1624 610299 Lloyds TSB Offshore Limited PO Box 12, Peveril Buildings Douglas Isle of Man, IM99 1SS. [email protected] Credit cards Platinum: 0845 606 2174 From overseas: +44 845 606 2174 For Gold Cards: 0845 606 2173 From overseas: +44 845 606 2173 For any other Lloyds TSB cards: 0845 606 2172 From overseas: +44 845 606 2172 Lloyds TSB, Service Recovery Card Concerns, 5th Floor Sussex House, 1-9 Gloucester Place, Brighton, BN1 4BE. Life insurance, pension and investment products/services Monday to Friday 9am to 5pm* From UK: 0845 608 0016 From overseas: +44 1444 418911 Lloyds TSB, Client Relations Department, Ground Floor, 25/27 Perrymount Road, Haywards Heath, West Sussex, RH16 3SP. Endowment mortgages Monday to Friday 8am to 6pm* From UK: 0845 716 6777 From overseas: +44 131 655 6000 Scottish Widows plc, 15 Dalkeith Road, Edinburgh EH16 5BU. Initially, please put your concerns directly to the person you usually deal with. Please provide the following information: • Your name and address • Details of your complaint • The relevant Bank details – i.e. your account number and branch sort code, card, policy or investment number • How you think the problem should be resolved • Photocopies of any supporting paperwork. We will acknowledge your complaint promptly and remain in contact until we have completed a full enquiry and sent you a formal written response. * UK time If the team handling your complaint is unable to resolve it to your satisfaction, we will provide a final response. This outlines your complaint and gives our considered response. If you aren’t satisfied with our response or if we haven’t completed our investigations within eight weeks of receiving your complaint, you may wish to take your complaint to the Financial Ombudsman Service. The Financial Ombudsman Service will carry out an independent review. You can approach the Financial Ombudsman Service directly. We can provide you with the contact details for this service. Our service promise to you When you contact us about a complaint, we will try to resolve it within five working days from receipt. When we are unable to do so, we will write to confirm receipt of your complaint within the same timescale and will tell you who will be handling your complaint; this may be another specialist area within the bank. • We will aim to give you a full response as soon as possible and will write with regular updates, including details of our progress and the options available to you. We will send these updates at least once a month, commencing four weeks after we receive your complaint. • We will explain the next steps to take if we’re unable to reach an acceptable resolution. Our response for complaints relating to life, pensions, investments and endowment mortgages may take longer: up to eight weeks depending on the complexity of the complaint. • We will not close your account or threaten to do so as a response to a valid complaint you have made. We always aim to resolve your complaint at this stage. However, if you are dissatisfied with our initial response, we may refer your complaint to an appropriate manager or specialist area for further investigation – see Step 2. To help us maintain security and quality of service for our customers, we may record or monitor your telephone calls.

© Copyright 2026