lloyds bank news lloyds bank news

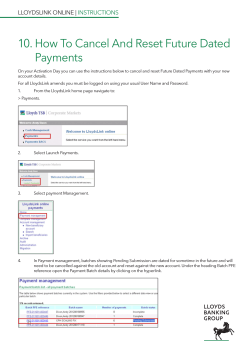

250 YEARS OF LLOYDS BANK lloydsbank.com Greater London Edition LLOYDS BANK NEWS Highwayman still at large Black Horse Spitfire flies Page 2 Page 6 2nd June 1765 Exciting new bank on the horizon By Wyndham Clarke, Business Correspondent Two of Birmingham’s most successful businessmen have announced they are to launch a new kind of bank. The bank is the brainchild of Sampson Lloyd II, an iron merchant, and John Taylor, a manufacturer of buttons. Named Taylors & Lloyds, after its founders, it is expected to be sited in Dale End, close to where Mr Taylor’s and Mr Lloyd’s businesses are based. The news was well received in Birmingham’s manufacturing quarter, where a recent series of inventions and improved manufacturing techniques have been likened to an ‘industrial revolution’ by experts. Recent technological advances made by some of the city’s most brilliant minds – James Watt, Josiah Wedgwood, Matthew Boulton to name just three – have placed Birmingham at the front of this new revolution, so the opportunities that Taylors & Lloyds will bring are great news for Birmingham. It’s hoped that this new bank will help Birmingham prosper by providing investment and other resources for the town’s embryonic industrial sector. If it succeeds, more branches in Birmingham and even in the wider West Midlands area could follow. We wish Taylors & Lloyds luck. Colmore Row branch, Birmingham, c.1870 Britain’s first drive-thru bank Lloyds man wins Nobel Prize Lloyds Bank announces new partnership Page 7 Page 6 Page 7 1765 1772 1822 Lloyds Bank began life as Taylors & Lloyds in Birmingham, in 1765. It was founded by Sampson Lloyd II, John Taylor and their two respective sons. Each invested £2,000. Robert Herries established a bank in London’s West End in 1772. He went on to invent the ‘circular note’, forerunner of today’s traveller’s cheque. The bank was acquired by Lloyds in 1893. The original symbol of Lloyds Bank was a beehive. It was introduced in 1822, following a highway robbery in which £4,002 of Taylors & Lloyds banknotes were stolen. LLOYDS BANK NEWS 2 8th September 1822 Highwayman still at large By Helen Jones, Crime Correspondent The identity of the daring highwayman who robbed a mail coach of £4,002 in Taylors & Lloyds banknotes was still a mystery last night. The robbery, which took place between Birmingham – where Taylors & Lloyds has its office – and London, has puzzled London’s Bow Street Runners, as well as magistrates in Birmingham. In a further twist to the story, it is believed that members of the public have, as yet, failed to come forward with any information concerning the robbery – despite the £1,000 reward on offer. One theory is that the current craze of highwaymanworship could be to blame. As regular readers are no doubt aware, the executions of highwaymen are often witnessed by many thousands of spectators. Whether this hero-worship is the reason, or whether it boils down to an understandable fear of armed and dangerous highwaymen remains to be seen. Do you have any information that can help in the recovery of the Taylors & Lloyds banknotes? If so, please contact: Taylors & Lloyds, 7 Dale End, Birmingham. ADVERTISEMENT 5th October 1822 Taylors & Lloyds introduces its first logo By Michael Persaud, Banking Correspondent In a move that has stunned the banking industry, Taylors & Lloyds has announced the introduction of what it calls a visual branding device or ‘logo’ on all its banknotes. According to a spokesman, the bank is making this move because of the robbery of £4,002 in Taylors & Lloyds banknotes last month by an unknown highwayman. After offering a £1,000 reward for the recovery of the stolen banknotes, the bank had high hopes that members of the public would come forward with information. To date though, and despite the reward, they’ve had little response. This newspaper understands that the bank subsequently discovered that the issue wasn’t one of willingness to come forward, but instead was one of illiteracy. With most of the country unable to read, it is believed that this created complications when it came to identifying the banknotes: banknotes whose primary identifying feature is the written name of the bank. In order to prevent this happening in future, the bank has decided to place a small symbol – or logo as they’re calling it – on each of their new banknotes. It’s hoped that this new pictorial way of identifying banknotes will mean that anybody, even a child, will be able to recognise a Taylors & Lloyds banknote in the future. So what is the design? After much deliberation the bank has chosen a beehive, long famous as a signifier of thrift and industry, as their ‘logo’. Our design correspondent, Harry Ead, gave his views on this new concept. “The Egyptians were using symbols to depict people and places over 1,500 years ago, and public houses have been using this idea for quite a while too. All in all, I think this bank may have an incredibly good idea on their hands. Who knows, in years to come we may be able to recognise a type of drink or an item of clothing just by its logo. It may sound like I have a touch of the fever but I honestly think this idea will catch on.” Time will tell. 1853 1865 1884 With the death of James Taylor, grandson of one of the founders, the association between the families ended. The bank was renamed Lloyds & Co. After 100 years in business, Lloyds & Co. converted from a private partnership to a joint-stock bank. It became Lloyds Banking Company Ltd. Lloyds Banking Company Ltd. inherited the famous black horse symbol in 1884. This sign dates back to the 17th century, when it was used by a goldsmith in the City of London. LLOYDS BANK NEWS 3 ADVERTISEMENT 7th November 1853 Taylors & Lloyds changes name to Lloyds & Co. By Nicholas Saunders, Business Correspondent In a move that sees the end of 88 years of history, Birmingham bank Taylors & Lloyds has announced it is changing its name to Lloyds & Co. The bank has been run by two Birmingham families – the Taylors and the Lloyds, since its foundation in 1765 – and it is thought that it’s the death of the Taylor family’s senior member, Mr James Taylor, which has caused the name change. Sources close to the family told us that following Mr Taylor’s death, his youngest son Mr William Francis declined to become a partner for personal reasons. Mr William Francis’s older brother, Mr James Arthur, has not been offered a partnership. And so, for the first time in 88 years, there won’t be a Taylor at Taylors & Lloyds. With the end of the association between the two families, the bank has, in a logical move, decided to rename itself Lloyds & Co. It is not known whether it will keep its beehive logo. 21st March 1884 Lloyds Banking Co. inherits black horse logo By George Baker, Business Correspondent Lloyds Banking Co. announced the takeover of London bank Barnetts, Hoares & Co. yesterday. The move will give Lloyds Banking Co. its very first office in London, at 62 Lombard Street – a street famous for its banks. In an intriguing twist to the story, the takeover also sees Lloyds Banking Co. inherit a black horse. The sign of the black horse has been suspended in Lombard Street since 1677, a period in time when door numbers were unknown, and symbols were hung outside buildings to let people know who worked there. Over time, businesses have become known by their signs, and as businesses move in and out of buildings along Lombard Street they often inherit these signs and adopt them as their own. With the takeover of Barnetts, Hoares & Co., Lloyds Banking Co. will be keeping the well-known black horse sign. It is believed that the bank will also now adopt their new equine symbol and add it to their own beehive logo on their cheques and stationery. 1887 1911 1912 Our office in Lombard Street in the City of London was the first British bank to be lit by electric light. With the takeover of Armstrong & Co. in 1911, Lloyds Bank acquired a presence in France. This marked the start of overseas expansion. Lloyds Bank made the official move from Birmingham to the City of London in 1912. The new Head Office was located in Lombard Street. LLOYDS BANK NEWS 4 Exeter branch, 1942, following an air raid One of the first Cashpoint® machines in use, 1972 A clerk in the Hemel Hempstead branch, early 1920s The Black Horse Spitfire, 1940 Corn Street branch, Bristol, 1945 1914 1940 1947 With the outbreak of the First World War, Lloyds Bank employed women as clerks for the first time. They replaced men who had joined the armed services. During World War II, Lloyds Bank was not only keeping people’s finances safe. When the air raid sirens sounded, it opened up its huge underground vaults – to the people. At this time, many women did not have their own bank accounts. Lloyds Bank began advertising to women to encourage them to open their own accounts and to be financially independent. LLOYDS BANK NEWS 5 Lloyds Bank advert, 1989 Old black horse signage from a Lloyds Bank branch The Olympic Torch Relay outside a Lloyds TSB branch, 2012 Pudsey Bear lending his support during the BBC Children in Need Appeal, 2014 Early Lloyds Bank payment card 1949 1961 1962 In 1949, Lloyds Bank abolished the marriage bar. This had required all women to resign on marriage. The bank also granted female staff ‘permanent’ status. Lloyds Bank wanted to make banking faster and simpler so opened one of the UK’s first drive-thru branches. They didn’t really take off but many US banks have ‘drive-thru’ ATMs today. The computerisation of branch accounting systems at Lloyds Bank began in 1962. That year saw the installation of the bank’s first computer, at the Pall Mall branch in London. LLOYDS BANK NEWS 6 ADVERTISEMENT 10th March 1941 Bank staff buy Spitfire for the war effort By Nick Mott, Home Affairs Correspondent Some Dig for Victory whilst others Keep Calm and Carry On, but Lloyds Bank staff across the country have topped them all by raising the £7,000 needed for a brand new Spitfire. Following the army’s withdrawal from Dunkirk, the RAF have become Britain’s last defence against invasion. Every day, huge swarms of Luftwaffe bombers blot out the sky on their way to bomb our cities, and every day the RAF see them off. But at a great cost. In August alone, Fighter Command lost 40% of its fighters – the only planes capable of downing the enemy’s bombers – so the addition of a brand new Spitfire will be a huge boost for the war effort. As with most wartime information, the eventual destination of the Lloyds Bank Spitfire is shrouded in secrecy, but one thing we do know is that the plane will be named The Black Horse in honour of the bank. Up to 12,000 Lloyds Bank staff have each contributed an average of 12 shillings to the Spitfire fund. 10th December 1948 Lloyds man wins Nobel Prize for literature 30th July 1948 Lloyds Bank manager helps keep Olympic Flame alight By Jerry Halksworth, Sports Correspondent The Olympic Flame for the 1948 Olympic Games arrived in London yesterday. The flame, which has travelled from Olympia in Greece, arrived in the Olympic Stadium to the cheers of thousands of spectators. But many people who had witnessed this incredible journey may have asked themselves, who was the mysterious man who has been following the Torch since it landed at Dover two days ago? Well, we can exclusively reveal, it was the manager of the Teddington branch of Lloyds Bank! Ever since the Olympic Flame landed at Dover aboard the destroyer HMS Bicester, the Lloyds Bank manager has been following just a few feet behind it in his Morris Minor. Sitting safely on By Sonia Magris, Arts Correspondent the seat next to him has been a hurricane lamp containing a spare flame (also lit in Olympia), so should anything happen to the Olympic Torch during its relay across the country it could be re-lit from an appropriate source. We were unable to speak to the manager himself as he was understandably tired after his duties, but a spokesman for Lloyds Bank did manage to speak to us. “Along with the rest of the country, we’re doing everything we can to help with these post-war Olympic Games. Many of our staff are volunteering and we’ve opened a special temporary branch at the stadium for visitors to the Games. The dedication of Teddington’s branch manager is exactly the kind of thing we love to see at Lloyds Bank.” Lloyds Bank staff across the country were jumping for joy yesterday as a former Lloyds Bank clerk, Mr Thomas Eliot – or T.S. Eliot as he’s known to his readers – was awarded the 1948 Nobel Prize for literature at a glittering ceremony in Stockholm. After being presented with his award by King Gustav V of Sweden last night, Mr Eliot admitted he was lost for words – even though he’s a poet. “My business may well be with words,” he said in his acceptance speech, “but today, here at the Nobel Academy in Stockholm, words are beyond me.” Mr Eliot worked as a clerk in the Colonial and Foreign department in the Lombard Street office of Lloyds Bank between 1917 and 1925. It was whilst working at the bank that Mr Eliot wrote his masterpiece The Waste Land. One colleague remembers Mr Eliot often being inspired while at work, stating that “he would often in the middle of dictating a letter, break off suddenly, grasp a sheet of paper, and start writing quickly when an idea came to him.” Rumour has it that he was also in the habit of occasionally inviting friends from the Bloomsbury Set to see him at work in the bank. Both Mr George Bernard Shaw and Ms Virginia Woolf are believed to have visited, as has his American friend Mr Aldous Huxley. Mr Huxley has since described Mr Eliot, sitting at his desk in the bank in his three-piece suit and tie, as “the most bank-clerky of all bank clerks.” It’s not known at the time of going to press if Mr Eliot has any designs on returning to work at the bank. 1971 1972 1995 By the 1960s, Lloyds Bank had offices across the globe. In 1971, it rationalised operations by merging its main international subsidiaries, BOLSA and Lloyds Bank Europe. In December 1972, Lloyds Bank installed its first Cashpoint® machine at Brentwood in Essex. By 1988, more than 2,000 were in operation up and down the country. In December 1995, Lloyds Bank and TSB merged to form Lloyds TSB. However, it was another four years before the new bank became a high street name. LLOYDS BANK NEWS 7 12th April 1961 1st October 2014 Britain’s first drive-thru bank Lloyds Bank partners with BBC Children in Need By Marisha Piltz, Motoring Correspondent By Ashley Redwood, Charity Correspondent Lloyds Bank’s first drive-thru branch opened early for business yesterday. The bank, which offers all the usual banking services and is based in High Wycombe, allows customers to drive directly up to a teller’s window and do their banking without having to leave the comfort of their own car. The idea of being served whilst in your car has been a huge success in America where they even have drive-thru restaurants and chemists, and it’s hoped that it will catch on over here too. It’s thought that the bank is initially trialling the concept to see whether or not to expand the idea into other branches, so who knows, maybe one day all banks will be drivethru banks. It’s an exciting time for Lloyds Bank as they launch their pioneering new three-year partnership with BBC Children in Need. They’ll be working closely with schools across the country to help millions of children raise even more money to help make a difference to the lives of disadvantaged children and young people across the UK, as well as developing skills to improve their own futures. Expectations are high for this unique partnership; it’s expected to double donations raised by schools by 2017. 13th August 2012 Lloyds TSB is proud partner of London 2012 Olympic and Paralympic Games By Tate Respinger, Sports Correspondent The London 2012 Olympic Games drew to a stunning conclusion last night with a closing ceremony every bit as big on glamour and entertainment as the opening ceremony. Was it really only two weeks ago that we sat in the stadium, jaws on the floor, as the Queen jumped from an aeroplane and Mr Bean played the piano alongside Sir Simon Rattle? In that time the whole country has been taken on a roller coaster journey along every emotion known to man. Disappointment to euphoria, anxiety to elation, we’ve been yanked around like a balloon in a gale. But perhaps the greatest thrill of all has been the rediscovery of belief. Belief that the country can do what it says it can, belief that we can do this kind of stuff better than anyone in the world, belief in our awe-inspiring sportsmen and women, and a belief in the people of this country who during the past two weeks have been truly inspirational. Every day at the Games was made special not just by the athletes, but by the spectators and the Games Makers too. Many of those self-same Games Makers have come from the Games’ proud partner, Lloyds TSB. So, what was it like to be a Games Maker? “It was definitely hard work but really enjoyable. 11-hour shifts and barely a moment to sit down, but definitely the best thing I’ve ever, ever done,” Jane Rendell of Lloyds TSB told us. “There was such an intense feeling of being a part of history. As volunteers we Alison Brittain, Group Director, Retail at Lloyds Banking Group explained, “BBC Children in Need is one of the most enduring and best loved charities in the UK and we are immensely proud to be embarking on this unique and exciting partnership with them. I’m really looking forward to helping schools across the UK make an even bigger difference in their fundraising.” Commenting on the partnership, David Ramsden, Chief Executive of BBC Children in Need, added “We are sure that Lloyds’ experience of working with schools and communities will help weren’t rewarded in cash, but we were rewarded in emotion, passion and drive. It’s definitely made me determined to volunteer again. I even got to see Andy Murray and Laura Robson!” us to change thousands more young lives across the UK.” As well as working with schools, we’ve been told that Lloyds Bank colleagues across the UK will also be fundraising and volunteering their time. They’re hoping to help raise at least £2 million a year to help change the lives of disadvantaged children and young people. Keep an eye out for some of the exciting fundraising events that will be happening in branches near you, and you may even get a visit from Pudsey himself. Team GB won 65 medals at the 2012 Olympic Games 2012 2013 2014 Lloyds TSB was the Official Banking and Insurance Partner of the London 2012 Olympic and Paralympic Games. On 9th September 2013 Lloyds TSB once again became two separate banks. The familiar black horse logo was given a makeover for the relaunch of Lloyds Bank on the high street. For over 30 years Lloyds Bank Foundations have distributed over £575m to local charities. During 2014 in Greater London they awarded £3,383,388 to 97 charities. Walworth Garden Farm pictured is one of them. LLOYDS BANK NEWS 8 1 2 3 Across 1 Robbery investigators (3,6,7) 7 Small follower of the Olympic Torch (6,5) 8 Not just a safe place for money in WW2 (5) 10 Where it all began (10) 12 Sampson Lloyd II loved heavy metal (4) 13 The best bear in charity (6) 4 6 5 7 9 8 10 11 12 Answers: Across – 1 Bow Street Runners, 7 Morris Minor, 8 Vault, 10 Birmingham, 12 Iron, 13 Pudsey. Down – 1 Buttons, 2 Women, 3 Two Million, 4 TS, 5 Drive In, 6 Logo, 9 Huxley, 11 Help. 13 Down 1 Lloyds founder John Taylor made them (7) 2 Were encouraged to open their own bank accounts in 1947 (5) 3 Amount colleagues are aiming to raise for BBC Children In Need in 2015 (3,7) 4 First initials of poet and former Lloyds bank clerk (2) 5 Retro cinema style bank (5,2) 6 Lloyds Bank beehive stamp (4) 9 A brave new author visited his poet friend at the bank (6) 11 Our commitment to ___ing Britain Prosper (4) 30th July 2015 Still a cornerstone of your community By James Downing, Regional Editor Up and down the country, Lloyds Bank remains firmly at the heart of its communities. And it’s not just local businesses and customers that benefit. The bank has given special responsibilities for supporting local charities and community projects in your region to its Local Directors. At a more senior level, it has also appointed dedicated Community Ambassadors. This sets it apart from other high-street banks, showing its ongoing commitment to local communities. As a Community Ambassador for Greater London, Jonathan Shawcross plays a key role in Lloyds Bank’s Helping Britain Prosper initiative. Supporting communities and the economy across the region, he brings together different groups in ways other organisations can’t. He uses his connections with MPs, mayors and the media to secure publicity and opportunities for local causes. His key priority is to create lasting legacies for communities. “What we’re doing isn’t unique, but nobody else is doing it on the same scale or in the same way,’ he says. At a more grass-roots level, Local Directors like Jess Dixon oversee groups of branches across the London area, organising activities to bring employees together in aid of local causes. a cheque for £45,000. Jess is proud of the money they’ve raised but insists it’s all about satisfaction – not acclaim. Her prime motivation is people. “We remember lots of our customers by name and say hello to them in the street. We love our community.” From the elderly to the next generation, Local Directors like Jess try to involve and engage with all parts of the community. One of her favourite moments was at last year’s Stonewall’s Youth Pride Brunch, hosted by Sir Ian McKellen and supported by Lloyds Bank. “It was wonderful seeing all these young people standing up for being who they are. It was a privilege to support them. We had a real feeling of making a difference.” “Businesses are trying harder to help their local communities these days,” she says. “But we definitely lead the way in the financial sector. We do more than others. The level we work at is truly unique.” They support a variety of local charities as well as a few national ones. Recent activities include bake sales and a quiz night for BBC Children In Need aiming to raise a mouth-watering £8,000! Two colleagues skydiving raised £3,000 for the Alzheimer’s Society. They have just presented St John’s Hospice with BBC Children in Need quiz night Today It’s an exciting time as our pioneering new threeyear partnership with BBC Children in Need gets underway. We are supporting one in four first-time buyers to get on the housing ladder. As part of our commitment to Helping Britain Prosper, we are increasing our net lending to small businesses and Mid Markets companies by over £2bn each year.

© Copyright 2026