How To Appeal Your Property Assessment

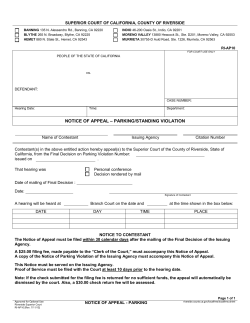

How To Appeal Your Property Assessment A Very Brief Michigan Assessment History CPI = consumer price index (inflation) losses = destroyed or removed property additions = items not previously assessed State Equalized Value (SEV) 50% Of the True Market Value of Your Home Taxable Value (TV) Lesser of SEV or CV Capped Value (CV) (Last Years Taxable Value – losses) x (100% +(CPI or 5%) + additions) = New Capped Value What is a mil? A mil is $1 for every $1000 of taxable value. If your total millage is 40 mils and your taxable value is $50,000 your taxes will be $2000 Headlee Amendment v. Proposal A Two Different Constitutional Amendments In 1978 the Headlee Amendment passed to limit the amount of revenue government could collect. It basically limits revenue increases to the CPI (inflation). If the revenue exceeds that amount, the millage must roll back. In 1994 Proposal A passed. Unlike Headlee, it was concerned with the taxable value of individual property. It capped annual increases in your taxable value at the CPI (inflation) or 5% whichever is less. Millages are applied against the taxable value. How can my property values be declining and my taxes still go up? Capped Value SEV Proposal A capped your taxable value at the rate of the CPI (inflation) each year but the State Equalized Value may have increased at a much faster rate. Those who have been living in their home since the passage of Proposal A in 1994 are likely paying far less than people who moved in later. When property changes hands the cap is removed and takes the SEV as it’s new taxable value. If your property declines in value, and the value does not decline to match or go below the Taxable Value, your taxes will go up. ..\Desktop\clip_image002.gif This year the CPI (inflation) will be 1.6% and will likely allow the capped value to increase under Proposal A. Can Your Millage Increase Without Voter Approval? State law requires that notice of a public ‘Truth in Taxation’ hearing be published by a local government which proposes to increase the millage to generate revenue equal to the previous year’s. This occurs when revenue drops below last years revenue plus any increases in the CPI. The increased millage rate must be established by a resolution adopted by the local unit of government before it conducts the public hearing. The elected officials of that body must then approve the increase, but it does not require a vote of the people. This is almost a perfect year to appeal your assessment. If you correctly appeal an improper assessment, you may bring your SEV closer to, or below your Capped Value. Should I Appeal my Assessment? 1. Is my State Equalized Value (SEV) half of what I could sell my house for? 2. Can I present the information in a reasonable and accurate manner to enhance my chance of success? 3. Am I willing to do the work necessary to prove my case? How Your Property’s Market Value is Calculated. The Assessing Department conducts sales studies each year by reviewing all sales data, but excluding most foreclosures. In the past the analysis was conducted over a two-year period. Because of the decline in market value, the state now allows sales from a one-year period, to better reflect the current market. The sales from October 1, 2012 through September 30, 2013will be used for the 2014 sales study. Should I get an appraisal? If you feel the tax savings warrant it. Who Makes Up the Board of Review? •The Local Board of Review is supposed to be made up of your peers. •Back when everyone knew each other and there was only town and farmland it worked well. They truly knew what your property was worth. •Today, city and township governments usually appoint important people in the community, real estate agents or friends of the administration. About the Board of Review •All Boards of Review are Open Meetings. This means you may take anyone with you and may sit in on other hearings to get a feel for the process. •They must give you an opportunity to be heard. •They are not required to take abuse. •You are not required to take abuse. •The Board is there to determine the value of your property, not your taxes Call Your Assessors Office •In Detroit you must first appeal to the Assessors Review in early February before you can appeal to the Board of Review. •Check your city or township to see when they have their Board of Review and how to schedule your appeal. It must be sometime in March. •Some cities or townships allow for written appeal if you choose, which will afford you the same access and rights. •MAKE 4 COPIES OF ALL EVIDENCE . Appeal Preparation: The First Step Go to your Assessors Office and get your field or real estate summary and your valuation statement. Some cities have this info online. Is their description of your property accurate? (ex. number of baths, fire place, square footage, number of rooms.) If you need help with the calculations, ask the assessor to assist you. Note any errors on a sheet of paper. Tell the assessor – those errors may be corrected without formal appeal. General Property Information [Back to Non-Printer Friendly Version] [Send To Printer] Parcel: 33 005 02 0113 000 Data Current As Of: 5:46 PM 2/10/2010 Property Address [collapse] 25613 ROUGE RIVER DEARBORN HEIGHTS, MI 48127 Owner Information [collapse] BOGAERT, DAVID & ROSE 25613 ROUGE RIVER DEARBORN HEIGHTS, MI 48127 Unit: 33 Taxpayer Information [collapse] SEE OWNER INFORMATION General Information for Tax Year 2009 [collapse] Property Class: School District: State Equalized Value: CONST 401 D26 - CRESTWOOD-D26 $73,400 0 Date Filed: Principal Residence Exemption (2009 May 1): Principal Residence Exemption (2009 Final): Principal Residence Exemption (2010 May 1): 05/01/1994 Assessed Value: Taxable Value: Map # Date of Last Name Chg: 03/18/2002 100.0000 % 100.0000 % 100.0000 % Previous Year Info MBOR Assessed Final S.E.V. Final Taxable $96,300 $97,500 $96,300 $97,500 $74,071 $72,406 2008 2007 Land Information Acreage: Zoning Code: Land Value: Land Improvements: Renaissance Zone: ECF Neighborhood Code: $73,400 $73,400 [collapse] 0.23 Frontage: Depth: Mortgage Code: Lot Dimensions/Comments: $44,000 $2,322 N/A 040R Legal Information for 33 005 02 0113 000 84.00 Ft. 127.51 Ft. N/A B70.91 N126.88 S128.15 [collapse] 05H113 114A LOT 113 AND THE SLY 1/2 OF LOT 114 VALLEY VIEW SUB T2S R10E L74 P70 71 WCR Sales Information 0 sale record(s) found. Sale Date Sale Price Instrument Grantor Grantee Terms Of Sale Liber/Page Building Information 1 building(s) found. Description Residential Building 1 Floor Area Yr Built Est. TCV 1532 Sq. Ft. 1954 $85,715 General Information Floor Area: Garage Area: Foundation Size: 1532 Sq. Ft. 336 Sq. Ft. 1532 Sq. Ft. Estimated TCV: Basement Area $85,715 1260 Sq. Ft. Year Built: Occupancy: 1954 Single Family Year Remodeled: Class: Tri-Level?: Percent Complete: 100% Heat: AC w/Separate Ducts: NO Wood Stove Add-on: 0 C NO Forced Heat & Cool NO 1st Floor Rooms: Bedrooms: Style: 5 0 RANCH Water: Sewer: N/A N/A Area Detail - Basic Building Areas Height 1 Story 1 Story Foundation Crawl Space Full Bsmnt. Exterior Comm. Brick Comm. Brick Area 272 Sq. Ft. 1260 Sq. Ft. Heated 1 Story 1 Story Area Included in Size for Rates Area Detail - Overhangs Height Exterior Basement Finish Recreation: Living Area: Walk Out Doors: 0 Sq. Ft. 0 Sq. Ft. 0 Plumbing Information 3-Fixture Baths: Ceramic Tile Floor: Ceramic Tile Wains: 1 1 1 Percent Good: Percent Good: No Concrete Floor Area: 0 0 0 Sq. Ft. 3-Fixture Baths: Ceramic Tile Floor: Ceramic Tile Wains: Ceramic Tub Alcove: 1 1 1 1 Fireplace Information Interior 1-Story: 2nd On Same Stack: 1 1 Garage Information Garage # 1 Area: Foundation: Year Built: Auto Doors: 336 Sq. Ft. 42 Inch 1954 1 Exterior: Common Wall: Finished?: Mech Doors: Brick 1 Wall YES 0 Porch Information CPP: 16 Sq. Ft. Foundation: Standard Now To Work! • Ask your assessor for a list of the houses sold to determine their assessment of your home. Make sure that their choices are similar in size, age, and have the same qualities as your home. •Look at the SEV of similar homes in your neighborhood. •Ask a local real estate office for the list of homes that have sold in your area. Begin the Inspection on Your Home •Check your basement for cracks, leaks, or seepage. •Are your walls cracked from settling or your roof line sagging? •You are not required to give access to the interior of your home to the assessor. •Take Pictures. Where You Live is Important Do you have areas of mixed zoning, noxious odors, excessive noise, large amounts of traffic, and access to all utilities? Perform an Outside Inspection of Your Home Do you have easements of any type on your property? Any public utilities right of ways or encroachment by your neighbors? Does your property flood? Do you have standing water after a heavy rain? Are you in a flood plain? Note these problems on your list. Check your field/property sheet. Take pictures. P.A 415 of 1994 (Mathieu-Gast) Amended Section 211.27 MCL “The assessor shall not consider the increase in true cash value that is a result of expenditures for normal repairs, replacement, and maintenance in determining the true cash value of property for assessment purposes until the property is sold…” You may choose to file Form 865 with the Michigan Department of Treasury but filing is voluntary. Exempt from Consideration. Outside painting Repaint or repair masonry Repair or Replace •Siding •Roof •Porches •Steps •Sidewalks •Drives Replace •Awnings •Gutters or downspouts •Windows or doors •Insulation and weather stripping Exempt from Consideration. Rewiring Replacing plumbing and light fixtures Replace woodwork Replace furnace Interior plastering Replace •Ceiling •Walls •Floor surfaces Remove partitions Replace water heater Repainting or decorating After you Appeal at Your Local Board of Review When you receive the determination of the Board of Review you may appeal the decision. The determination will inform you of your rights and how to contact the State for an appeal. The State will send you a form and assign you a docket number. Return the form and copies of everything you have submitted to the Board of Review. Your hearing will be local but not necessarily in your city. You must pay your taxes while they are under appeal. If they find in your favor they will pay you interest. This process may take more than a year. You must keep your taxes paid but you may appeal the next year and they will be heard at the same time.

© Copyright 2026