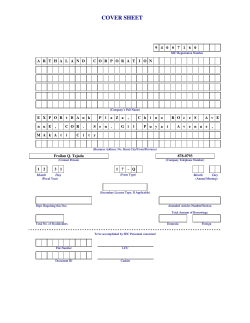

Document 254608