3 0 1 8 5

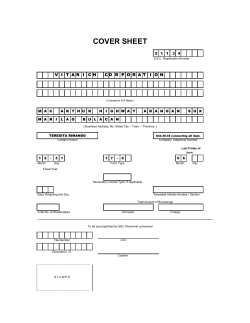

COVER SHEET D I Z ON 6 F L R CO P P E R S I L V E R 3 0 1 8 5 SEC Registration Number M I N E S , I N C . (Company’s Full Name) S U N P L A Z A C E N T R E S H AW COR . P R I N C E T O N GR E E N H I L L S B L V D S T . , B RG Y . WA C K - WA C K , E A S T , MA N D A L U Y O NG C I T Y , ME T RO MA N I L A , P H I L I P P I N E S (Business Address: No. Street City/Town/Province) Atty. Francis Gustilo 570-9754 (Contact Person) (Company Telephone Number) 1 2 3 1 2 0 - I S Month Month Day (Form Type) Day (Fiscal Year) (Annual Meeting) (Secondary License Type, If Applicable) CFD Dept. Requiring this Doc. Amended Articles Number/Section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier STAMPS Remarks: Please use BLACK ink for scanning purposes. 1 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS NOTICE IS HEREBY GIVEN THAT an Annual Meeting of Stockholders of Dizon Copper-Silver Mines, Inc. (DCSMI) will be held on 14 December 2012 (Friday) at 11:30 AM at 4th Floor, Sunplaza Centre, Shaw Blvd corner Princeton St., Barangay Wack-Wack, Greenhills East, Mandaluyong City, Metro Manila. The Agenda of the meeting are as follows: 1. Call to Order 2. Determination of Quorum 3. Approval of the Minutes of the Previous Stockholders’ Special Meeting of 30 May 2012. 4. Ratification of the Acts, Resolutions and Proceeding of the Board of Directors, Corporate Officers and Management up to December 30, 2012 5. Election of the Board of Directors and Independent Directors. 6. Appointment of Independent Auditors 7. Other business as may properly be brought the meeting and open forum 8. Adjournment Only stockholders of record at the close of business on November 16, 2012 are entitled to notice of, and vote at this meeting. Any stockholder who does not expect to attend the meeting in person and desires to be represented thereat is requested to date and sign the proxy enclosed herewith and mail it back using the return envelope. Proxies should be mailed on time so as to be received by the Corporate Secretary for validation on or before 7 December 2012. Only proxy forms submitted on time will be validated. A copy of the Annual Reports of the company for the year ended 31 December 2011 and Interim Financial Statements as of September 30, 2012 containing the financial statements for the year 2011 accompanies this notice. FRANCIS V. GUSTILO Corporate Secretary 2 SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 20 OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: [X] Preliminary Information Statement [ ] Definitive Information Statement 2. Filed by the registrant DIZON COPPER SILVER MINES, INC. 3. Filed by the party other than the registrant 4. Name of registrant as specified in the charter 5. Jurisdiction of Incorporation 6. SEC I.D. No. 30185 7. BIR TIN 310-000-841-269 8. Address 6th Flr, Sunplaza Center, Shaw Blvd cor. Princeton St., Bgy.Wack-Wack, Greenhills East, Mandaluyong City, MM. 9. Telephone No. 570-9754 10. Date, Time and Place of the meeting of Security Holders NONE DIZON COPPER SILVER MINES, INC. MANDALUYONG CITY December 14, 2012 11:30 AM 4th Flr, Sunplaza Centre, Shaw Blvd cor. Princeton St., Bgy. Wack-Wack, Greenhills East, Mandaluyong City. 11. Name of persons other than the Registrant Filing Proxy Statement 12. Securities registered pursuant to Section 8 and 12 of the Code : 13. NONE Title of each Class Number of Shares Outstanding and Amount of Debt Outstanding COMMON CLASS B 78,006,687 Are any or all of registrants securities listed on the Stock Exchange? Yes: X_ No: ___ Shares are listed at the Philippine Stock Exchange, Ayala Triangle, Ayala Avenue, Makati City. 3 PART I INFORMATION REQUIRED IN INFORMATION STATEMENT 1. GENERAL INFORMATION Item 1. DATE, TIME AND PLACE OF MEETING OF SECURITY HOLDERS The enclosed Proxy is solicited for the Annual Stockholders’ Meeting of DIZON COPPERSILVER MINES INC. (DCSMI or the Company), or any adjournment thereof (the “Annual Meeting”), details of which are as follows: (a) Date Time Place : : : Complete Mailing Address of Company : 14 December 2012 11:30 A.M. 4th Flr, Sunplaza Centre, Shaw Blvd cor. Princeton St., Bgy. Wack-Wack, Greenhills East, Mandaluyong City, MM. 6th Flr, Sunplaza Centre, Shaw Blvd cor. Princeton St., Bgy.Wack-Wack, Greenhills East, Mandaluyong City, Mr. Delfin S. Castro, Jr. Chairman and President (b) Item 2. Approximate Date on which copies of the Information Statement are first to be sent or given to security holders entitled to notice of and to vote at the Annual Meeting : 26 November 2012 DISSENTERS RIGHT OF APPRAISAL The appraisal right of the stockholder is not applicable in this meeting since there are no corporate actions or matters included in the proposed agenda of the meeting which may need the exercise by the stockholders of their appraisal right. The term appraisal right refers to a stockholder’s right to demand payment of the fair value of his shares, after dissenting from a proposed corporate action involving a fundamental change in the corporation. As provided in Title X of the Corporation Code, a stockholder may exercise his appraisal right in the following instances; 1. In case any amendment to the articles of incorporation has the effect of changing or restricting the rights of any stockholders or class of shares, or of authorizing preferences in any respect superior to those of outstanding shares of any class, or of extending or shortening the term of corporate existence; 2. In case of sale, lease exchange, transfer, mortgage, pledge or other disposition of all or substantially all of the corporate property and assets as provided in this Code; and 4 3. In case of merger or consolidation. In the exercise of the appraisal right, Title X of the Corporation Code, provides the procedure on how it may be exercised: 1. A dissenting stockholder files a written demand within 30 days after the date on which the vote was taken. Failure to file the demand within the 30-day period constitutes a waiver of the right. Within ten (10) days from demand, the dissenting stockholder shall submit the stock certificates to the corporation for notation that such shares are dissenting shares. From the time of demand for payment until either abandonment of the corporate action or purchase of the shares by the corporation, all rights accruing to the shares shall be suspended, except the stockholders’ right to receive payment of the fair value of his shares. 2. If corporate action is implemented, the corporation pays the stockholder the fair value of his shares upon surrender of the certificate/s of stock. Fair value is determined by the value of shares on the day prior to the date of which the vote was taken, excluding appreciation/depreciation in anticipation of such corporate action. 3. If the fair value is not determined within 60 days from date of action, it will be determined by 3 disinterested persons (one chosen by the stockholder, another chosen by the corporation, and the last one chosen by both). The findings of the said appraisers will be final, and their award will be paid by the corporation within 30 days after such award is made. Upon such payment, the stockholder shall forthwith transfer his shares to the corporation. No payment shall be made to the dissenting stockholder unless the corporation has unrestricted retained earnings. 4. If the stockholder is not paid within 30 days from such an award, his voting and dividend rights shall be immediately restored. Item 3. Interest of Certain Persons in or Opposition to Matters to be Acted Upon 1. Substantial interest of directors / officers of the Registrant in any matter to be acted upon other than election to office – None 2. No director or executive officer, or associate of the foregoing persons, has any substantial interest in the matters to be acted upon by the stockholders at the Special Meeting. 3. No director has informed the Company in writing of any intention of opposing any action intended to be taken by the Company during the Annual Meeting. 2. Item 4. CONTROL AND COMPENSATION INFORMATION Voting Securities and Principal Holders Thereof a. Class of Voting Securities: Common Class B Number of Shares Outstanding as of October 31, 2012 Number of Votes Entitled 5 78,006,687 One (1) vote per share b. The record date for those who shall be entitled to vote is September 30, 2012. c. Manner of Voting Article I, Sections 3, 4 and 5 of the Amended By-Laws of the Company provides: “Section 3 Quorum – A quorum at any meeting of the stockholders shall consist of a majority of the voting stock of the Corporation, and a majority of such quorum shall decide any question at the meeting, save and except in these matters where the Corporation Law, as amended, require affirmative vote of a greater proportion. “Section 4. Proxy – Stockholders may vote at meetings either in person or by proxy duly given in writing to the Secretary for inspection and record prior to the opening of said meeting. “Section 5. Vote – Voting upon all questions at all meetings of the stockholders shall be by shares of stock and not per capita.” d. Securities Ownership of Certain Record and Beneficial Owners Management Securities Ownership of Certain Record and Beneficial Owners and Owners of record of more than Five (5) percent of the Company’s Shares of Common Stock as of September 31, 2012 were as follows: Title of Class Common Class B Name, Address of Record Owners and Relationship with issuer Name of Beneficial Owners and Relationship w/ Record Owner PCD NomineeCorp. G/F, Makati Stock Exchange Ayala Ave., Makati City Various Stockholders Client No relationship with issuer 6 Citizenship Filipino No. of Shares held Nature of Ownership (Record or Beneficial) 71,596,131 (record) Percent 90.53% Under PCD the following brokers have 5% ownership as of September 30, 2012 No. of Name of Shares Title of Name, Address of Record Beneficial Citizenship held Class Owners and Relationship Owners and Nature of with issuer Relationship w/ Ownership Record Owner (Record or Beneficial) Angping & Associates Filipino 16,199,950 Common Securities, Inc. Various (record) Class B G/F, Makati Stock Exchange Stockholders Ayala Ave., Makati City Client Common Class B Common Class B Common Class B Common Class B The Hongkong and Shanghai Banking Corp. Suite 2002/2004, The Peak, 107 Alfaro St., Salcedo Village, Makati City Belson Securities Inc. 4th Floor Belson House 271 EDSA, Mandaluyong City Premiun Securities Inc. Unit 1415, Tower & Exchange Plaza, Ayala Avenue, Paseo de Roxas, Makati City Tower Securities Inc. 1802-C Tektite I Exchange, Ortigas Centre, Pasig City Percent 20.48% Various Stockholders Client Filipino 8,464,910 (record) 10.70% Various Stockholders Client Various Stockholders Client Filipino 6,327,264 (record) 8.00% Filipino 6,319,083 7.99% Filipino 4,022,641 5.08% Various Stockholders Client The shares registered under the name of the stock brokers are owned by various client, buyers and individuals. PCD Nominee Corporation, now known as Philippine Depository & Trust Corporation (PDTC) is the registered owner of the shares in the books of the Company’s transfer agent. The participants of PCD are the beneficial owners of and have been nominated as proxy to vote such shares. PCD holds the shares in their behalf or in behalf of their clients. The above mentioned brokers are participants of PCD with more than 5% of the company’s outstanding capital stock (part of the 90.53% of the PCD Nominee Corporation ownership). In order to vote the brokers are required by existing rules & regulation to comply with the necessary proxy form duly signed by the true and beneficial owner of the said shares. 7 Security Ownership of Directors and Management as of September 30, 2012 Title/Class Name of Beneficial Owner Position Common Delfin S. Castro Jr. Common Jose Francisco Miranda Common Common Antonio Victorino Gregorio III Alejandro Yu Common David Chua Director Common Reyno Dizon Director Common Leonardo Cua Director Common Mark Matthew Joven Common Philip Ella Juico Common Francis V. Gustilo Chairman/ President Vice President / Director Treasurer / Director Director Independent Director Independent Director Corporate Secretary Amount Citizenshi and Nature p of Beneficial Ownership 10,000 Filipino (direct) 10,000 Filipino (direct) 10,000 (direct) 100 (direct) 10,000 (direct) 1 (direct) 10,000 (direct) 5,000 (direct) 1 (direct) 95 (direct) Percent of All Class 0.01281% 0.01281% Filipino 0.01281% Filipino 0.00013% Filipino 0.01281% Filipino Filipino 0.0000013 % 0.01281% Filipino 0.006405% Filipino 0.0000013 % 0.00012% Filipino The aggregate numbers of shares owned of record by all or key officers and directors as a group as of September 30, 2012 is 55,197 shares or approximately 0.07% of the Company’s outstanding capital stock. Voting Trust Holders of 5% or More The Company has no knowledge of any person holding more than five percent (5%) of the Company’s shares of common stock under a voting trust or similar agreement. Change in Control As disclosed to the Securities Exchange Commission and to the Investing Public via the disclosure facilities of the Philippine Stock Exchange, the composition of the Board of Directors of DCSMI has significantly changed beginning the last quarter of 2011. The former controlling shareholders of DCSMI who belong to the Dizon family have substantially sold their holdings in the open market. After that, they nominated Mr. Delfin S. Castro, Jr. and his group to manage the Company. No particular person or entity now holds more than ten (10%) of the outstanding shares of the Company. With this ownership divestment by the Dizon family and their loss of interest to run the affairs of the Company, they have nominated the group of Mr. Delfin S. Castro, Jr. to manage DCSMI. 8 Item 5. Directors and Executive Officers a. Information Required of Directors and Executive Officers i. The following table sets forth certain information as to Directors and Executive Officers of the Company as of September 30, 2012: Name Delfin S. Castro, Jr. Jose Francisco Miranda Antonio Victoriano Gregorio III Alejandro Yu David Chua Reyno D. Dizon Leonardo Cua Mark Matthew Y.C. Joven Philip Ella Juico Francis V. Gustilo Venus L. Gregorio Bernard L. Fong Position Chairman/ President Vice President/ Director Treasurer/Director Director Director Director Director Independent Director Independent Director Corporate Secretary Assistant Corporate Secretary Vice President for Business Development Citizens hip Filipino Filipino Filipino Filipino Filipino Filipino Filipino Filipino Filipino Filipino Filipino Ag e 46 34 40 52 57 57 27 64 63 43 35 1. DELFIN S. CASTRO, JR. Concurrently Chairman and President. He holds a Master’s Degree in Business Administration and a Bachelor of Science in Business Management from the University of the Philippines. He is also currently the Director, Treasurer and Compliance Officer of Geograce Resources Philippines, Inc. He is the Corporate Secretary of Sunplaza Development Corporation. From June 2000 to April 2001, he was the Global Portfolio Manager for Private Equities at United Resources Asset Management, Inc. He was formerly the Engagement Director of Palo Alto Consultant Asia, Inc. and a Senior Assistant Vice President at Asiatrust Bank. 2. JOSE FRANCISCO MIRANDA. Vice President – Operations and Director. He holds a degree in Bachelor of Science in Geodetic Engineering from the University of the Philippines and continuing Master Degree of Business Administration from De La Salle University. He is currently the President and Director of Geograce Resources Philippines, Inc. and Vice President of Lodestar Investment Holdings Corporation. From 2003 – 2007, he was a Professional Instructor IV at the La Salle College Antipolo on Elementary Statistics and Business Statistics. He held various positions in Koldstor Centre Philippines, Inc. from 2002 to 2007 and was formerly the Group Head of Sales of the Lopez Group of Companies. 3. ATTY. ANTONIO VICTORIANO GREGORIO III. Currently the Treasurer and Director. He graduated with a Juris Doctor from the Ateneo de Manila University Second Honor in 1998 and passed the bar examination in 1999. He also has a Bachelor of Science Major in Management Engineering and a Bachelor of Arts, Major in Economics-Honors, both from the Ateneo de Manila University, Magna Cum Laude. He was a valedictorian of his high school class in Ateneo. Atty. Gregorio is a Partner at Gregorio Law Offices and sits as director and officer of various public and private companies, including AGP Industrial, Inc. (Chairman and President), NiHAO Mineral Resources International, Inc. (President and Director), Lodestar Investment Holdings 9 Corporation (Corporate Secretary and Treasurer), Abacus Consolidated Resources and Holdings, Inc., Pride Development Bank Corporation, Tajima Yakiniku, Inc., Tanba Yakiniku, Inc., Big Herald Link International Corporation, among other companies. 4. BERNARD L. FONG. Vice President for Business Development. Mr. Fong graduated with a Bachelor of Science degree in Electrical Engineering from Rensselaer Polytechnic Institute in Troy, NY and received a Master of Business Administration degree from the MIT Sloan School of Management (Massachusetts Institute of Technology) in Cambridge, MA. Previously, he was the General Manager of Multi-Forms Corporation and a Business Analyst of General Motors Strategic Initiatives in Detroit, MI. 5. FRANCIS V. GUSTILO. He has been the Corporate Secretary for the past twelve (12) years. A practising lawyer and a Chemical Engineer, he is the Executive Director of Tindig Porac Development Foundation, Inc.; Past President Rotary Club of Paranaque East, President for RY2001-2002 under Rotary District 3830, Chairman, Mary Help of Christians Pabahay Foundation, Inc., Director, Kalahi Realty Inc., Director, Waste to Energy (Phils.) Holdings Inc., Independent Director-Rural Electrification Financing Corporation. 6. VENUS L. GREGORIO. She is the Assistant Corporate Secretary. Atty. Gregorio graduated with a Juris Doctor from the Ateneo de Manila University in 1998 and passed the bar examinations in 1999. She has a Bachelor of Arts degree major in Political Science from the University of the Philippines. Atty. Gregorio is a Partner at Gregorio Law Offices and sits as director and officer of various companies. 7. 8. DAVID CHUA. He graduated from St. Mary’s College of California with a Bachelors of Science in Financial Services Management Honors Program and received his Master of Business Administration form J.L. Kelogg School of Management (Northwestern University) and the Hong Kong University of Science and Technology (HKUST) Graduate School of Management. Mr. Chua is President of both Cathay Pacific Steel Corporation (CAPASCO) and Asia Pacific Capital Equities and Securities Corporation. He currently serves as a director on the board of the Philippines Stock Exchange, Philippine Savings Bank, NiHAO Mineral Resources International, Inc. and Crown Equities, Inc. He is also a trustee of the University of the East Ramon Magsaysay Medical Center. Mr. Chua is a director of the Trade Committee of t Federation of Filipino-Chinese Chambers of Commerce and Industry as well as Chairman of the 2008 National Employer’s Conference of the Employers Confederation of the Philippines (ECOP). He also serves as a director of Galleria Corporate Center Condominium Corporation and as director and Treasurer of the Heavenly Garden Memorial Park Development Corporation. Mr. Chua currently serves as President of the Kellogg/Northwestern University Alumni Association of the Philippines as well as the President of the Steelmakers Association and director of the Hardware Foundation of the Philippines. He is also a member of the Makati Business Club, Financial Executives Institute of the Philippines (FINEX), ECOP, Rotary Club of Makati West and the Young Presidents Organization. He was previously a director for First Metro Investment Corporation, The Philippine Banking Corporation, PBC Capital and Investments Corporation and Philippine Internet Service Organization. LEONARDO CUA. He graduated from the University of the Philippines, Diliman, with a degree in Bachelor of Science in Biology. He is a Doctor of Medicine from 10 the University of the East Ramon Magsaysay Memorial Medical Center (UERMMMC). He completed his post graduate internship from the Manila Doctor’s Hospital (1980-1981) and residency training, specializing in anesthesia at UERMMMC. He is a member of the Philippine Medical Association, Philippine Society of Anesthesiologist and Rotary Club of Chinatown-Manila Chapter. He is currently a visiting Anesthesia Consultant at UERMMMC and Medical Center Manila, and has been the Vice President for Operations of BCHT Enterprises from 1990 up to present. 9. ALEJANDRO YU. He received his Bachelor of Science Degree in Industrial Engineering, minor in Mechanical Engineering, from De La Salle University. He is currently a director of the Philippine Stock Exchange, Inc. (PSE) and the Securities Clearing Corporation of the Philippines (SCCP). He is likewise the President and CEO of R.S. Lim & Company, Inc. since 1990, its Trading Manager in 1982 and Vice President in 1987. He is also the President of Marden Enterprises since 1990. Mr. Yu has been a Governor of the PSE from 1994 to 1996. He was Chairman of both the FTAC and Sports Committees in the same period, as well as member of both Committees from 1994-2006, and the Computer Committee from 1994-1996. 10. PHILIP E. JUICO. He was elected as one of the Independent Directors during the annual stockholders’ meeting on August 31, 2010. He was the of the De La Salle University Graduate School of Business (DLSU GSB) from 2002 to 2008, holding the Corazon C. Aquino Chair for Business Management. He was a full time Professor at the Asian Institute of Management from 1990 to 1995. He was Secretary of the Dept. of Agrarian Reform (DAR) from 1987 to 1989. He also practiced his profession as Educator in various prestigious universities and colleges. Aside from being an Educator, he is also a Consultant of various companies and organizations and served in the Boards of some of the largest conglomerates in the Philippines such as San Miguel Corp., Meralco, Land Bank, DBP and Development Academy of the Philippines. He is an Entrepreneur, a Journalist, a Sportsman and an active Socio-Civic Leader. 11. MARK MATHEW Y.C. JOVEN. He was elected one of the Independent Directors of the Company during the August 31, 2011. A graduate of De la Salle University with a degree of Bachelor of Science in Accountancy and is currently taking up Masteral Degree in Business Administration at the Ateneo Graduate School of Business. He acquired his license as a Certified Public Accountant (CPA) in November 2007. He is a member of PICPA since 2007. He became an Associate of SyCip, Gorres, Velayo & Co. CPAs (SGV & Co.) from November 2007-2009. He also became a Lecturer in Government Service Insurance System (GSIS) from January – March 2010. He is presently employed as a Lecturer in De la Salle University Manila since May 2009 and a General Manager of Victory System-Plus Inc. since November 2009. 12. REYNO D. DIZON. He has been appointed as the company’s Vice President. Before joining DCSMI, he served as Vice President for Administration and Finance of Vendiz Pharmaceuticals, Inc. Mr. Dizon is also the previous President of Celestino-Maria Dizon Foundation, Inc. He was the Materials Management Manager of Dizon Copper Operation in San Marcelino, Zambales of Benguet Corporation. 11 (b) Significant Employees The Company maintains a skeletal force of technical and administrative personnel. For the current year 2012, owing to the relatively small number of employees, the Company does not know yet if any employee is expected to make significant contribution to the business, and thus has no significant employees to name and report. (c) Family Relations Atty. Antonio Victoriano F. Gregorio III and Atty. Venus L. Gregorio are spouses. Other than the relationship disclosed above, the company is not aware of any other family relationships up to the fourth civil degree, either by consanguinity or affinity, among the directors and officers of the Company. (d) Certain Relationships and Related Transactions The Company has no related transactions to report owing to the lack of business operations for the last 2 fiscal years. We are not part of any conglomerate or any group of companies, so we cannot show any relationship between parent company and subsidiaries. (As prescribed under SRC Rule 68C). (e) Nominees The Nomination Committee created by the Board under its Corporate Governance Manual nominated the following for re-election to the Board of Directors at the forthcoming Annual Stockholder’ Meeting: 1. 2. 3. 4. 5. 6. 7. (f) Delfin S. Castro, Jr. Jose Francisco Miranda Antonio Victoriano Gregorio III Alejandro Yu David Chua Reyno D. Dizon Leonardo Cua Independent Directors Mrs. Marilou de Jesus nominated to the Board for inclusion in the list of candidates for Independent Directors the following stockholders: 1. Mark Matthew Y.C. Joven 2. Philip Ella Juico 12 Item 6. Compensation of Directors and Executive Officers The following summarizes the compensation packages of the Directors and Executive Officers of the Registrant during the last two (3) years. Name and Principal Position 2010 Gregorio C. Dizon, Chairman Lourdes D. Dizon, President Frederick D. Matsuda, Treasurer 2011 Gregorio C. Dizon, Chairman Lourdes D. Dizon, President Frederick D. Matsuda, Treasurer 2012 Delfin S. Castro Jr., Chairman/President. Jose Francisco Miranda, Vice President Operations Antonio Victoriano Gregorio III, Treasurer Francis V. Gustilo, Corporate Secretary Venus L. Gregorio, Assistant Corporate Secretary Bernard Fong, Vice President Business Development All above named officers As a group YEAR SALARY BONUS OTHER ANNUAL COMPENSATION 2012 2011 2010 520,000* 342,339 304,652 - - All other directors and Officer as a group unnamed 2012 2011 2010 800,000* 1,408,210 1,312,940 - - Total Directors per diem 2012 2011 2010 - - 240,000* 80,000 90,000 *Estimate January to September 2012 There are no other arrangements, including consulting contracts, pursuant to which any director of the Company was compensated, or is to be compensated, directly or indirectly, for any service provided as a director. No action is to be taken with regard to any bonus, profit sharing, pension, retirement plan or the granting or extension of any option or warrant to directors and executive officers. The Company has no officers categorized as highly paid executives. 13 Annual Report to Stockholders The Financial Statements and Consolidated Statement of Income and Retained Earnings of the Company as of December 31, 2011 and the Interim Financial Statements as of September 30, 2012 will be mailed together with this proxy statement. The Corporate Secretary holding office at 6th Flr, Sunplaza Centre, Shaw Blvd cor., Princeton St., Bgy.Wack-Wack, Greenhills East, Mandaluyong City shall provide without charge, upon written request by the shareholder, a copy of the registrant’s annual report on SEC Form 17A and SEC Form 17Q. ITEM 7. Independent Public Accountant a. The accounting firm Sycip, Gorres, Velayo & Co. (SGV & Co.), Ayala Ave., Makati City has been the Company’s Independent Public Accountant for the past year and has been selected to serve as such for the current year. A representative of that firm will be present at the Annual Meeting with an opportunity to make a statement, if they so desire, and to respond to appropriate questions. The Company’s auditors did not perform any substantial non-audit services for the company. b. Changes in and Disagreements with Accountants on Accounting and Financial Disclosures There has been no event where SGV & Co. and the Company had any disagreement with regard to any matter relating to accounting principles or practices, financial statement disclosure or accounting procedure. C. ISSUANCE AND EXCHANGE OF SECURITIES Item 8. Modification or Exchange of Securities No action will be taken with respect to the modification of any class of securities of the Registrant, or the issuance or authorization for issuance of one class of securities in exchange for outstanding securities of another class. Item 9 . Financial and Other Information 1. Stockholders entitled to notice and to vote will be furnished the following information and documents: The Audited Financial Statements of the Company for the fiscal year 2011 and the Interim Financial Statement as of September 30, 2012 and the Management’s Discussion and Analysis Results of Operation and Financial Condition are attached to this Information Statement and incorporated herein by reference as part of the Financial Report of Management. 2. Management Discussion and Analysis and Plan of Operation The continued regional economic slump in the year 2009 did not prevent our company in pursuing other businesses. 14 Port Dizon, the Company’s port facilities located in Subic, Zambales, may still be used as loading facility for ore and aggregates should the Company resume mining operations. It cannot be denied, however that the biggest setback suffered by the company was the closure of Urban Bank in April 2000 where the company has substantial investments. On April 25, 2000, UBI declared bank holiday and was subsequently placed under receivership. A rehabilitation plan of UBI was drawn up, but on February 08, 2001, the prospective acquiring bank suspended its plan to acquire UBI, pending resolution of all legal issues involving UBI. On May 2001, Export Industry Bank (EIB) had shown a greater interest in rehabilitating Urban Bank. EIB has forged a working partnership with the National Association of UBI and UII Depositors and Creditors Group (NAUD) and has actively pursued its rehabilitation proposal. EIB had been designated by the Philippine Deposit Insurance Corporation (PDIC) to take full control and management of Urban Bank Inc. (UBI) and Urbancorp Investment, Inc. (UII) and was opened to the public on September 3, 2001. A MOA entered among the major stockholders of UBI/UII, including the Company (major stockholders) and the EIB provides for the original shares of stock held by the Major stockholders to be placed in an escrow account to be managed by an escrow agent under an escrow arrangement for a period of six (6) years from the opening of the merged bank. In order for the Major stockholders to recover their original investment in the old UBI/UII, the merged bank has created an Assets Pool, Non-Performing Assets Pool and Real Properties Pool. Cash collections or sales proceeds from the sale of assets in the NonPerforming Assets and Real Properties Pool, after satisfying the additional interest recoveries of depositors and creditors of UBI and UII up to a certain amount, will be distributed according to sharing arrangements outlined in the MOA. As of December 31, 2007, it is not possible at this time to determine the amount that the Company can ultimately recover pending the actual realization of the values of the assets in the Assets Pool over the six (6) years period. Aside from the investment of the Corporation in the capital stock of UBI and UII, the company had money market placement in the bank’s premium time deposits of more than P60 million. On opening of operations of UBI by EIB, as per approval of the Board of Trustees, 10% of the outstanding balance of the placement was converted to common shares amounting to P6.1 million and an initial amount of P500 thousand was received in 2001. Under the terms and conditions of the repayment plan, the balance shall be payable within the next 3 years. The first payment of 30% was received in September 2002, the next 30% was collected in September 2003 and the full payment of the balance was collected in August 2004. No losses were incurred in the transactions and even realized interest earnings although at lower rate. As in the prior years, the company’s current ratio as of the end of the current year still indicated a sound financial position. Its total current assets amounted to P1.975 million whereas its total current liabilities amounted to P3.814 million thereby giving a positive current ratio of 0.51:1 or 51%. Likewise, its overall liquidity ratio is also indicative of the company’s strong financial condition when it generated a positive 844% or 8.44:1 ratio which was derived by getting the quotient of P32.195 million Total Assets and P 3.814 million Total Liabilities. As of the end of the current year, stockholders’ equity ratio was 0.8815:1which has been computed by dividing total stockholders’ equity of P28.381 million over total assets of P32.195 million. Since the company operated at a loss, its basic/diluted loss per share was P0.06 computed using the weighted average number of shares during the year of 15 78,006,687. Return on equity ratio has been -0.16, which was computed by getting the quotient of Net Loss of P4.594 million and Total Stockholders’ Equity of P28.381 million. As against last year’s net loss, the company showed an unfavorable variance of 15% or P0.613 million because its net loss during the current year increased to P 4.60 million from previous year’s P 4 million. Revenue for the year was P 5.192 million an increased by P 1.919 million compared with last year’s P 3.273 million. Further, the company expenses this year of P 8.124 million increased by P1 million compared to last year P 7.122 million due to payment of employees who resigned from the company in Oct 2011. As compared to year 2009’s net loss of P7.744 million, the company’s net loss during the year likewise showed a positive variance of 40% or P3.144 million. Revenue for 2011 of P 5.192 million comprised mainly of miscellaneous income arising from sale of Tektite Condominium, Interest earnings and rentals P 4.730 million, P 0.137 million and P 0.188 million respectively. These amounts represent 91.1 %, 2.64% and 3.62% of the total revenues respectively. Interest income during the current year is P 0.137 million comprised 3.62% of the company’s total revenues. This account, which pertains to interest earnings of various time deposits and other bank deposits, increased by 1.5% or P0.003 million from last year’s P 0.135 million. Rental income generated from the condominium unit held for lease of P 0.188 million compared to last year’s P 0.753 million because of the effectivity of the sales of Tektite Condominium in the first quarter 2011. Rental income represented 2.64% of the corporation’s total revenues during the current year and 23% of 2010 total revenue. Basic / diluted loss per share during the current year of P0.06 reflected an unfavorable variance of 20% because of a P.01 per share decrease from last year’s loss per share of P 0.05. The Company’s P8.124 million expenses during the current year pertained to mine site and administrative expenses. A P1 million or 14.06% increase in this account has been generated as a result of the separation pay of regular employees of the company from last year’s P7.122 million to this year’s P8.124 million. Total assets as of the current year is P32.176 million declined by P9.77 million or 22.57% from last year’s P41.553 million. This has been brought about by the net effect of the decrease in the company’s non current assets and the decrease in current assets. The company’s total current assets of P 1.976 million as of December 31, 2011 accounted for 6.1% of the corporation’s total assets. As against last year’s figures of P 9.414 million, it gave a unfavourable variance of P 7.438 million or 79% due to net effect of the decrease in cash and cash equivalents and receivables totalling to P 2.155million and the decrease in prepayments of P 1.084 million and the sale of Tektite Towers amounting to P 4.198 million has contributed greatly in the decrease of total current assets. As in the previous years, there were more cash outflows than cash inflows; hence, there was a 61% decrease in cash and cash equivalents account. Receivables also declined by 68% after some accounts had been collected during the year. Prepayments decreased by 65% compared to 2010 balance of P 1.667 million due to the application of the input taxes to output VAT. Cash and cash equivalents accounted for 68.90% of the company’s total current assets. This account of P1.363 million decreased by P2.091 million or 61% as against previous year’s balance of P3.454 million. This has been due to the fact that since the company had not much revenue to pay for its current operating expenses, there had been 16 various withdrawals from the company’s time deposit accounts thereby causing a significant decrease in the cash and cash equivalent account during the year. Receivables which comprises 1.5% of the corporation’s total current assets amounted to P 0.03 million. As compared to year 2010 figures of P 0.94 million, this account decreased significantly due to collection of some receivable accounts. As mentioned above, Prepayments and other current assets which comprised 30% of the total current assets decreased from last year’s P1.667 million to P 0.583 million, thereby giving a variance of 65% or P1.084 million due primarily to the recognition of input VAT. Total noncurrent assets as of the end of the current year which accounted for 94% of the total assets of the company amounted to P30.219 million. As against prior year’s P32.139 million, the company had a P 1.921million or 6% decreased. Property and equipment which comprised only 0.04% of the total noncurrent assets during the current year increase from last year’s P.0036 million to P 0.014 million. The 306% or P 0.011 million increased is brought about by the provision for purchase of computer accessories as furniture and fixtures. Investment properties, which account for 99.32% of the company’s total noncurrent assets amounted to P30.013 million as of the current year which is the same as last year amount for investment properties. Available for sale financial assets account pertains to the fair value of the investments in debt and equity securities and mutual funds. This year’s ending balance of P0.192 million accounted for 0.64% of the company’s total noncurrent assets. As compared against balance of P 2.123 million, this account gave a negative variance of 91% or a P 1.931 decrease due to some adjustment in value of the said investment. Total liabilities as of the end of the current year amounted to P3.814 million. As compared to balances in 2010 in the amount of P 7.582 million, total liabilities showed a 49.7% decrease equivalent to P3.768 million brought about by decrease in accounts payables from P3,384 million in 2010 to P 0.229 million in 2011 and 100% decrease in accrued retirement benefits. Current liabilities amounting to P3.814 million comprised 100% of the company’s total liabilities as of end of the current year. There had been a 45.29% decrease equivalent to P 3.156 million from P 6.969 million balances as of year 2010 to current year due to decrease in accounts payable and accrued expenses. Accounts payable and accrued expenses, which amounted to P 0.229 million in the current year, and which comprised 6% of the total current liabilities, decreased by P 3.155 million or 93% as against last year’s P 3.384 million due to full settlement of account due to creditors. Dividends payable is P3.584 million during the year, which accounted for 94% of the company’s total current liabilities during the current year. There was a movement to this account from 2010 of P 395.00 from one the stockholders who got her cash dividend. Noncurrent liabilities, which pertained to accrued retirement benefits ending a zero balance for the current period. This account showed 100% decrease from last year’s P0.613 million balance due to a retirement benefit of one of the an employee who separated from the company. There were adjustments in the retirement benefits. 17 Stockholders Equity as of the end of the current year amounted to P28.363 million. As of end of the previous year, it had a balance of P33.971 million. The 16.57% decrease which is equivalent to P 5.608 million as against 2010 figures represents the P 4.613million in net loss during the current year and some adjustments in net changes in fair values of available investment. KEY PERFORMANCE INDICATORS: 1.1 CURRENT RATIO – Measures ability to meet currently maturing obligations from existing current assets: CURRENT ASSETS: CURRENT LIAB. P 1,975,671 P 3,813,598 = 0.52 : 1 Current assets for the year are not sufficient to cover all current obligations. In this case the company needs to infuse fresh funds to meet its obligations. For this reason, there are plans to sell all the remaining unsubscribed shares and the treasury shares to raise working capital. 2.1 DEBT TO EQUITY RATIO – Measures the relative amount of resources provided by shareholders and creditors. It indicates an extent of leverage used and creditor protection in case of insolvency. TOTAL LIABILITIES: STOCKHOLDERS EQUITY P 3,813,598 P 28,381,401 = 0.13 : 1 The creditors are protected in case of insolvency. 3.1 RETURN ON STOCKHOLDERS EQUITY RATIO – Measures rate of earnings on resources provided by shareholders. NET LOSS STOCKHOLDERS EQUITY P 4,594,391 P 28,381,401 = 16.1% The ratio indicates that the company should generate positive income so as to have satisfactory return on investments. 4.1 EARNINGS PER SHARES (EPS) – Measures the amount of earnings attributable to each share of common stock. NET LOSS P 4,594,391 NO. OF SHARES OUTSTANDING 78,006,687 = 0.06 For the current year and continuing loss, the shares were further diluted. 5.1 EQUITY RATIO – Measures total investment provided by stockholders. STOCKHOLDERS EQUITY TOTAL ASSETS P28,381,401 32,194,999 = 0.8815 : 1 The total investment provided by the stockholders indicates a good sign. 5.2 CREDITORS’ EQUITY TO TOTAL ASSETS – Measures the amount of resources provided by creditors. 18 TOTAL LIABILTIES TOTAL ASSETS P 3,813,598 32,194,999 = 0.1184 :1 The company being solvent and liquid is evident by the above ratio. A reconciliation of Retained Earnings available for dividend declaration is not applicable in our company, because we don’t have any. (As prescribed in SRC Rule 68-C). There are no known trends, demands, commitments, events, or uncertainties that will have material impact on the company’s liquidity as of this date. As discussed in the preceding paragraphs, despite the company’s net losses for the past years, the financial condition of the company is still very sound such that it has the full ability to pay its operating expenses and other obligations without having to resort to borrowing funds from outside creditors. This is evidenced by the company’s current ratio of 52% and over-all liquidity ratio of 844%. It has no outstanding loan or any indebtedness that have not been paid within the stated trade terms. Also, there are no seasonal events that will have a material effect on the financial condition or result of operation of the company. Comparative amounts of consolidated revenues, expenses, assets, liabilities and stockholders’ equity for the last 3 years are as follows: Total Revenues (million) Operating Expenses Total Assets Total Liabilities Stockholders’Equity 2011 P 5.192 8.124 32.19 3.81 28.38 2010 P 3.27 7.124 41.55 7.58 33.97 P 2009 1.22 8.88 44.10 6.00 38.10 As disclosed to the Securities Exchange Commission and to the Investing Public via the disclosure facilities of the Philippine Stock Exchange, the composition of the Board of Directors of DCSMI has significantly changed beginning the last quarter of 2011. With the ownership divestment by the Dizon family and their loss of interest to run the affairs of the Company, they have nominated a new group to manage DCSMI. With a new management in place, the Board of Directors is paving the way for renewed business activities for DCSMI. Thus, the following corporate actions have been approved by the stockholders on May 2012 during the Special Stockholder’s Meeting for purposes of laying the groundwork for new business undertakings that the Company may engage in. - Change of the Company name. - Change of address to SUN PLAZA Centre, Shaw Blvd., Barangay Wack-wack, Mandaluyong City. - Denial of Shareholders’ Pre Emptive Rights. Increase in the authorized capital stock of the Company from One Hundred One Million Two Hundred Fifty Thousand Pesos (P101,250,000.00) divided into One Hundred One Million Two Hundred Fifty Thousand (101,250,000.00) shares at a par value of one Peso (P1.00) per share TO UP to One Billion Pesos 19 (P1,000,000,000.00) divided into One billion (1,000,000,000) shares at One Peso (P1.00) per share without stockholders’ pre-emptive right which capital increases will be undertaken in tranches in such amounts as may be determined by the Board of Directors. - Amendment of By Laws to provide for the creation, functions and powers of the Compensation, Nomination and Audit Committees in compliance with the rules on Corporate Governance. - Approval of the issuance of shares of stock from the proposed capital increase via pre-emptive Stock Rights Offering (SRO) on a 1:1 proportion i.e., one (1) share held by qualified stockholders entitles said stockholders to subscribe to one (1) share under the SRO at the SRO price of Five Pesos (P 5.00) including a delegation the Board of Directors to set and determine other terms and conditions of the SRO and to appoint / select the underwriter(s), the financial consultant(s), legal team to effect the SRO. - Disposition of the Company’s treasury shares with authorization to the President to negotiate terms and conditions thereof subject to compliance with applicable laws and regulations. - Creation of two (2) subsidiaries with authority to engage in the business of mining development 3. During the Company’s two (2) most recent fiscal years or any subsequent interim periods, the Company had no material disagreements with its external auditor, SGV & Co., on accounting and financial disclosures. Representatives of SGV & Co. are expected to be present at the Special Meeting and will have opportunity to make a statement, if they desire to do so, and are expected to be available to respond to appropriate questions. D. OTHER MATTERS Item 10. Action with Respect to Reports The following reports will be submitted for approval by the Stockholders: 1. Election of new Board members and 2 Independent Directors as follows: Delfin S. Castro Jr., Francisco Miranda, Antonio Victoriano Gregorio III, David Chua, Alejandro Yu, Leonardo B. Cua. Mark Matthew Joven, Dr. Philip Juico and Reyno D. Dizon. 2. Appointment of Sycip, Gorris, Velayo & Co. (SGV) as external Auditor of the Corporation for the year 2012. 3. September 17, 2012 Meeting- Results of the Meeting of the Board: The Board approved to accept the Memorandum of Agreement between Capital Gold Pty. Ltd and Welcome Stranger Mining Ltd and authorizes the Chairman Mr. Delfin Castro Jr. and Eng’r Jose Francisco E. Miranda to sign for and in behalf of the company and 20 4. The members of the Audit Committee to be tasked to comply with SEC Memorandum Circular 4 to prepare the Audit Committee Charter including the self assessment of its performance. These are intended to aid the Company to comply with the principles of Good Corporate Governance. Item 11. Amendment of Charter, By-Laws or Other Documents On August 14, 2012 the Securities and Exchange Commission approved the Company’s Articles of Incorporation (Amending Articles III and VII thereof) as follows: a) The place where the principal office of the corporation is located at a new address to 6th Floor, Sun Plaza Centre, Shaw Blvd., Barangay Wack-wack, Mandaluyong City, Philippines. b) The pre-emptive right of stockholders to subscribe to all issues or disposition of shares of any class, proportion to their respective shareholdings, is hereby denied. Also, August 14, 2012 the Securities and Exchange Commission approved the Company’s Amended By-Laws on Articles IX on the creation of Board Committees (Nomination Committee, Compensation and Remuneration Committee and Audit Committee) and its functions, to aid the Company in complying with the principles of Good Corporate Governance. Item 12. Other Proposed Actions There are no other proposed actions other than those discussed in the preceding sections. Item 13. a. Voting Procedures Vote required: Article I, Sections 3, 4 and 5 of the Amended By-Laws of the Company provides: “Section 3 Quorum – A quorum at any meeting of the stockholders shall consist of a majority of the voting stock of the Corporation, and a majority of such quorum shall decide any question at the meeting, save and except in these matters where the Corporation Law, as amended, require affirmative vote of a greater proportion. “Section 4. proxy – Stockholders may vote at meetings either in person or by proxy duly given in writing to the Secretary for inspection and record prior to the opening of said meeting. “Section 5. Vote – Voting upon all question sat all meetings of the stockholders shall be by shares of stock and not per capita.” The vote of stockholders representing at least two-thirds (2/3) of the issued and outstanding capital stock entitled to vote is required on certain matters affecting changes / amendments in the Company’s Charter and By-laws. b. Method of Voting: Straight Voting 21 In all items for approval, each share of stock entitles its registered owner to one vote. c. Method by which votes will be counted Art. II, Sec. 5 states that “voting upon all questions at all meetings of the stockholders shall be by shares of stock and not per capita.” The counting of votes cast will be done by the Office of the Corporate Secretary with the assistance of the External Auditors or the Stock Transfer Agent. Item 14. Matters Market for Registrant’s Common Equity and Related Stockholder Market Information The Company’s common equity is principally traded at the Philippine Stock Exchange (PSE). The high and low quarterly sales prices for the last three (3) years and for the third quarter of the year 2012 are indicated in the table below. Period -2009 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter High 1.80 5.30 4.65 4.60 Low 1.44 1.52 2.80 3.55 Period-2010 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter High 4.45 4.30 4.50 6.10 Low 3.40 3.85 3.60 3.91 Period-2011 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter High 5.00 6.05 14.40 11.98 Low 4.00 4.34 5.65 6.96 Period-2012 1st Quarter 2nd Quarter 3rd Quarter High 49.50 61.80 37.00 Low 11.40 29.50 17.56 Market price as of the latest practicable date September 28, 2012 was Php 23.40 per share. There was no trading from September 29 to 30, 2012. 22 The Company has a total of 79,087,499 outstanding Common B shares and total of 1,080,812 treasury shares. As of September 30, 2012, the Company has 2,143 stockholders on record. The top 20 stockholders as of September 30, 2012 are as follows: Name 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. No. of Shares Held PCD NOMINEE CORPORATION PCD NOMINEE CORPORATION FRANCISCO M. VARGAS LOURDES D. DIZON JESUS DEL FIERRO MAGSAYSAY FELICITO C. PAYUMO PILIPINAS BANK EMPLOYEE RET. PLAN ELOISA TANTUCO JECI LAPUZ ALFONSO LAO EDMUNDO MADARAZO ANTONIO JALANDONI MRIA ISABEL O. DE LA RIVA EDWIN LIM ABRAHAM ONG LEE MANUEL SY JAMES CU KEHIONG ELISA D. PAPA ANITA CHUA &/OR ELY CHUA ROBERTO GUEVARRA MARIE JOSINE N. DEE JOSEPH D. ONG 71,596,131 1,328,363 223,250 202,786 117,014 110,000 100,000 95,732 93,000 90,781 62,500 58,505 54,159 50,000 50,000 50,000 47,000 46,805 43,750 40,000 39,003 35,937 % of Total 90.53% 1.68% 0.28% 0.26% 0.15% 0.14% 0.13% 0.12% 0.12% 0.11% 0.08% 0.07% 0.07% 0.06% 0.06% 0.06% 0.06% 0.06% 0.06% 0.05% 0.05% 0.05% The number of stockholders on record of the previous years are December 30, 2009 – 2,341, as of December 31, 2010 – 2,308 and December 29, 2011 – 2,231. Item 15. Corporate Governance All the Directors were required to attend a seminar on Good Corporate Governance Principles that was sponsored by the Philippine Institute of Certified Public Accountants (PICPA). Also, the creation of the different Committees was acted upon during the organizational meeting of the Board. The Company continues to follow the Manual of Corporate Governance and will continue to review and adopt ways to improve on its compliance. The Company also submitted the Corporate Governance Score Card jointly prepared by the Institute of Corporate Directors in collaboration with the SEC, PSE and Ateneo School of Law being a publicly listed company. The Company has complied with Securities and Exchange Commission (SEC) Memorandum Circular No. 4, Series of 2012, entitled Guidelines for the Assessment of Performance of Audit Committees of Companies listed on the Exchange by submitting its 23 Audit Committee Charter and the results of assessment on the performance of the Committee. NOTE: The Company will provide without charge a copy of the Company’s Annual Report on SEC Form 17-A to its stockholders upon receipt of a written request addressed to Atty. Francis V. Gustilo, Corporate Secretary, at 6th Flr., Sunplaza Centre, Shaw Blvd cor. Princeton St., Bgy.Wack-Wack, Greenhills East, Mandaluyong City, Metro Manila. PART II. INFORMATION REQUIRED TO BE IN THE PROXY FORM Item 1. Identification This Proxy is solicited by the Board of Directors of the Company to be voted at the Annual Stockholders’ Meeting. The Information Statement and this Proxy shall be sent through the mail or courier services to stockholders of record as of November 16, 2012 starting 26 November, 2012. Duly executed Proxies may be returned by mail or by hand at the mailing address of the Company. Proxies must be received on or before December 7, 2012 at 2.00 p.m. The cost of solicitation will be borne by the Company and is estimated not to exceed P250, 000.00. In addition to solicitation of the Proxies by use of the mail, officers and employees of the Company may solicit Proxies personally or by telephone. No person has informed the Company in writing that he intends to oppose any action intended to be taken by the Company at the Annual Meeting. Item 2. Instructions All proxies must be accomplished in writing in the form hereto attached. Proxies must be duly signed by the stockholder and delivered or returned either by mail or by hand to the Company c / o the Corporate Secretary at the following address: DIZON COPPER-SILVER MINES, INC. 6th Flr, Sunplaza Centre, Shaw Blvd cor. Princeton St., Bgy.Wack-Wack, Greenhills East, Mandaluyong City, Metro Manila Attention: Mr. Delfin S. Castro, Jr. President Proxies must be received for validation not later than 7 December, 2012 at 2:00 p.m. Proxies sent by mail shall be considered only when actually received at the address stated above. Stockholders who mail their proxies have the burden of proof in establishing actual receipt of the proxies at the address above stated. At their discretion, the Proxies are authorized to vote upon such matters as are set forth in the Agenda and such other matters as may properly come before the meeting. 24 Management is hereby authorized to use this proxy for subsequent stockholders’ meetings within a period no longer than five (5) years from the date of this Proxy, unless the Proxy holder instructs otherwise. Item 3. Revocability of Proxy A stockholder returning a Proxy may revoke it any time prior to the voting at the Annual Stockholders’ Meeting. A Proxy returned by a stockholder at least four (4) days before the Annual Meeting, which is not subsequently revoked, will be voted in accordance with the marked instructions indicated thereon. A Proxy which revokes another Proxy shall not be allowed to vote unless it has passed the proxy validation process. The Proxy validation will be conducted by the Corporate Secretary and representatives from the stock transfer agent of the Company. All proxies submitted on or before the deadline will be checked and tallied. Proxy validation will be held at the Company’s principal office. Item 4. Persons making the Solicitation This Proxy is solicited by the Board of Directors of the Company. It is estimated that about P250, 000.00 will be spent for the preparation, printing, mailing and distribution of the proxy statements. Item 5. Interest of Certain Persons in Matters to be Acted Upon No director or executive officer, or associate of the foregoing persons, has any substantial interest in the matters to be acted upon by the stockholders at the Annual Meeting. This Proxy is solicited on behalf of the Board of Directors of Dizon Copper-Silver Mines Inc. Important: The Office of the Corporate Secretary of the Company must receive this Proxy not later than December 7, 2012 at 2:00 p.m. _______________________________________ Signature of Stockholder over Printed Name Dated this _____ day of _____________, 2012 25

© Copyright 2026