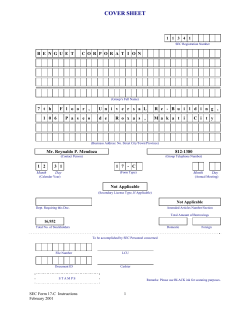

COVER SHEET M A G N U M I N C .

COVER SHEET 6 2 3 2 3 M A G N UM HO L D I NG S , I NC . (Company's Full Name) 1 7 G E N E R A L S A N MA L V A R A N T O N I O , S T ., P A S I G B A R A N G A Y C I T Y (Business Address : No. Street City / Town / Province) ARSENIO C. CABRERA, JR. (6 3 2) 8 1 3 7 1 1 1 Contact Person 1 2 Month 3 Company Telephone Number SEC 17-A 1 Day Month FORM TYPE Fiscal Year Day Annual Meeting Secondary License Type, If Applicable Amended Articles Number/Section Dept. Requiring this Doc. Total Amount of Borrowings 4 7 7 Domestic Total No. of Stocholders To be accomplished by SEC Personnel concerned File Number LCU Document I.D. Cashier Foreign SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATIONS CODE AND SECTION 141 OF CORPORATION CODE OF THE PHILIPPINES 1. For the calendar year ended December 31, 2006 2. SEC Identification Number 62323 3. BIR Tax Identification No. 050-000-889-223 4. Exact name of issuer as specified in its charter 5. MAGNUM HOLDINGS, INC. Philippines 6. Province, Country or other jurisdiction of incorporation or organization 7. No. 17 Malvar St., Brgy. San Antonio, Pasig City Address of principal office (SEC Use Only) Industry Classification Code: Postal Code 8. (632)-848-29-15 Issuer's telephone number, including area code 9. NOT APPLICABLE Former name, former address, and former fiscal year, if changed since last report. 10. Securities registered pursuant to Sections 8 and 12 of the SRC, or Sec. 4 and 8 of the RSA Title of Each Class Common Stock Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding 85,040,000 shares 11. Are any or all of these securities listed on Stock Exchange. Yes [ X ] No [ ] If yes, state the name of such stock exchange and the classes of securities listed therein Philippine Stock Exchange Common stock 12. Check whether the registrant: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports); Yes [ X ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. Yes [ X ] No [ ] 13. Aggregate market value of the voting shares held by non-affiliates: P 386,630,159 as at 3.30.07 DOCUMENTS INCORPORATED BY REFERENCE A portion of the Company’s 2006 Annual Report to Stockholders is hereto attached, incorporated by reference into Part II, Item 6 and item 7 of this report. 1 PART I - BUSINESS AND GENERAL INFORMATION Item 1. Business Description of Business MAGNUM HOLDINGS, INC. was incorporated in the Philippines and registered with the Securities and Exchange Commission on July 9, 1975. The Company’s primary purpose is to acquire by purchase, exchange, assignment, gift or otherwise and to hold, own and use for investment or otherwise, and to sell, assign, transfer, exchange, lease, let, develop, mortgage, pledge, traffic, deal in, and with, and otherwise operate, manage, enjoy and dispose of any and all properties of every kind and description and wherever situated, as and to the extent permitted by law, including, but not limited to, buildings, tenements, warehouses, factories, edifices and structures and other improvements and bonds, debentures, promissory notes, shares of capital stock or other securities or obligations, created, negotiated or issued by any corporation, association, or other entity, foreign or domestic and while the owner, holder or possessor hereof, to exercise all the rights, powers and privileges of ownership or any other interest therein, including the right to receive, collect and dispose of , any and all rentals, dividends, interest and income, derived there from, and the right to vote on any proprietary or other interest, on any shares of capital stock, and upon any bonds, debentures, or other securities, debentures, or other securities having voting power, so owned or held: and provided that it shall not engage in the business of an open-end or closed-end investment company as defined in the Investment Company Act (RA 2629) Sale and Purchase Agreement with Sagarmatha, Inc. On March 23, 2000 the major stockholders, Magnum (Guemsey) LTD and Magnum Enterprises SDB VHD entered into a conditional sale and purchase agreement with Sagarmatha, Inc. selling all its interest on the Company to the latter. The said conditional sale and purchase agreement was consummated on July 11, 2000 through a cross sale of 60,600,000 shares of the Company. In compliance with the Revised Securities act Sagarmatha, Inc. conducted a tender offer for the 24,440,000 common shares of the company not covered by the negotiated sale. The tender offer was conducted for the period June 06 to July 04, 2000. In 2002 to 2003, Sagarmatha sold 31,200,000 shares (of which 25,950,000 were purchased by Elizabeth Louise Armstrong) the sale reduced the ownership interest of Sagarmatha, Inc. to 34.45%. Development After Acquisition by Sagarmatha, Inc. The unfavorable economic condition since August 2000 did not warrant an aggressive stance towards investing and trading in the stock exchange. This business situation gives the company no choice but to be very cautious from investing and trading because of the unpredictable profitability. The temporary discontinuance of the company’s operation did not warrant the acquisition of assets nor the hiring of personnel. The personnel requirement is accommodated by its shareholder Sagarmatha, Inc. The seconded number of employees of MHI was two (2) in 2004, two (2) in 2005 and two (2) in 2006. The market research conducted by the company showed that the economic situation will not be stable for a continuing profitable business operation. For this reason, the Company will still refrain from investing at least in the next six (6) months. 2 Item 2. Properties The Company does not own any property (such as real estate, plant and equipment, mines, patent, etc). There is no planned acquisition of properties in the next twelve (12) months. The Company has rented an office space in Barangay San Antonio, Pasig City. The lease rate is pegged at P5,000 per month. However, on the last month of the year, the Company has transferred and occupied a small portion of an office owned by a stockholder. Item 3. Legal Proceedings For the past six (6) years, the issuer has not come into possession of any information on any material pending legal proceedings of the following nature, which any of its directors and executive officers is a party to or of which any of their property is subject. 1. Any Bankruptcy Petition 2. Conviction by Final Judgment 3. Being subject to any order, judgment or decree 4. Violation of a Securities or Commodities Law or Regulation Item 4. Submission of Matters to a Vote of Security Holders The current Directors and officers were appointed during the Board of Director’s Meeting held on 21 February 2007, which was reported under SEC Form 17-C submitted on the same date. PART II - OPERATIONAL AND FINANCIAL INFORMATION (A) Market for Registrant's Common Equity and Related Stockholder Matters Market Information The principal market for the shares of stock of MHI is the Philippine Stock Exchange. Closing Market price as at 30 March 2007 is pegged at P 9.40. The high and low sales prices of each quarter within the last two years are as follows: Year 2006 First Quarter Second Quarter Third Quarter Fourth Quarter High Low P0.88 0.88 2.20 3.90 P 0.88 0.88 1.50 3.70 P2.00 1.00 1.00 1.00 P1.90 1.00 1.00 1.00 Source : Technistock Year 2005 First Quarter Second Quarter Third Quarter Fourth Quarter 3 (2) Holders The number of shareholders of record as of December 31, 2006 was 477. Common shares outstanding as of December 31, 2006 were 85,040,000. Top 20 stockholders as of December 31, 2006: 1. 2. 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Name PCD Nominee Corp. (Filipino) Elizabeth Louise Armstrong Jimmy Soo PCD Nominee Corp. (Non-Filipino) Delia Dulay Daniel Ongchoco Narciso Dungog Erwein John Catoto Melchor Rodriguez Hermelita Salom Nicanor Jorge Leonardo Perez Chee Sum Yeong Crispin Go Rowena Aloc Victoria Chavez Arsenio Exconde Yolanda Gao Angelina Jesus Ma. Diahn Daphne Jaucian No of Shares Held % of Total 46,360,830 54.52 25,950,000 30.52 3,000,000 3.53 2,995,000 3.52 1,350,000 1.59 336,667 0.40 200,000 0.24 140,000 0.16 110,000 0.13 100,000 0.12 80,000 0.09 50,000 0.06 30,000 0.04 21,000 0.02 20,000 0.02 20,000 0.02 20,000 0.02 20,000 0.02 20,000 0.02 20,000 0.02 Top 20 stockholders as of February 28, 2007: 1. 2. 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Name PCD Nominee Corp. (Filipino) Elizabeth Louise Armstrong Jimmy Soo PCD Nominee Corp. (Non-Filipino) Narciso Dungog Erwin Catoto Melchor Rodriguez Leonardo Perez Chee Sum Yeong Crispin Go Rowena Aloc Victoria Chavez Arsenio Exconde Yolanda Gao Ma. Diahn Daphne Jaucian Angelina Jesus David Kho N F Papanicolan Eloisa Tantoco Erlinda Abacan No of Shares Held % of Total 48,150,497 56.62% 25,950,000 30.52% 3,000,000 3.53% 2,995,000 3.52% 210,000 0.25% 140,000 0.16% 110,000 0.13% 50,000 0.06% 30,000 0.04% 21,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 20,000 0.02% 10,000 0.01% 4 ( 3) Dividends There were no dividends declared in the previous and current years. (4) Recent Sales of Unregistered Securities For the period 2003 to 2006, the company has no sale of any unregistered securities. PART III – FINANCIAL INFORMATION (A) Management's Discussion and Analysis or Plan of Operation. On 21 February 2007, the Board of Director approved the following: 1. 2. 3. 4. 5. Change the corporate name to ”NiHAO Mineral Resources International, Inc.” and amend Article 1 of the Articles of Incorporated and the By Laws. The “Ni” in the proposed corporate name is the chemical symbol of nickel; The conversion of the primary purpose to include the exploration, development, operation of mineral properties and the mining of metallic and non-metallic minerals including but not limited to nickel, gold, copper and the like; To increase the capital stock from P100million to P700 million and stock rights offering to comply with the requirements of SEC for the minimum amount of capital to be subscribed and paid up by the MHI stockholders. The Board likewise authorized Management to formulate the terms and conditions for the stock rights offering; Waiver of stock rights; Conversion of stockholders advances of HDI Securities, Inc. and Jerry C. Angping in the aggregate amount of P 4,699,465.00 into equity and issuance of 4,669,465 shares from the unissued portion of MHI’s authorized capital stock. For 2007, the principal stockholders are to provide the necessary funds to cover the various scheduled activities of the Company. Financial Condition – 2006 and prior years In order to sustain the “necessary” expenses that has to be incurred by a going concern that has temporarily suspended its commercial operation, a bilateral agreement so approve in the Board Resolution, was reach between the Company and Sagarmatha, Inc. one of its shareholders, such that the latter will temporarily advance the payment of the suspended operation expenses pending resumption of the company’s operation. Starting 2006 these advances are interest bearing. In November 30, 2006, the Company was able to settle the outstanding advances from Sagarmatha, Inc. Funds were provided by the principal stockholders and will be considered as deposit on future subscription. As of December 31,2006 and 2005 Total assets increased by 22% or P0.010 million from P 0.044 million in 2005 to P0.054 million in 2006. The increase is due to additional advances made by the stockholder. Total expenses for the year increased by 17% or P0.132million due to interest charges on advances and fines and penalties imposed due to non-submission of reports to government agencies. 5 As of December 31, 2005 and 2004 Total assets decreased by 8% or P0.004 million from P0.048 million in 2004 to P0.044 million in 2005. The net decrease is due to the decrease in cash in bank of P0.006 million and the increase in advances of P0.002 million. The decrease in cash in bank of P0.006 million is accounted for as follows: Funds provided by: Advances from Sagarmatha, Inc. Funds used for: Net loss from operations Advances for official business Payment of accounts payable & accrual Decrease in Cash in Bank 791,600 788,694 2,247 6,953 797,894 ( 6,294) As of December 31, 2004 and 2003 Total assets decreased by 52% or by P0.051 million from P0.100 million in 2003 to P0.048 million in 2004. The net decrease is due to the decrease in cash in bank of P0.089 million and increase in advances of P0.038 million. The decrease in cash in bank of P0.089 million is accounted for as follows: Fund provided by: Increase in accounts payable & accrued expenses Advances from Sagarmatha, Inc. Total Funds used for: Operating losses Advances for official business Total Net decrease in cash in bank 11.633 628,028 639,661 691,286 37,753 729,039 89,378 Results Of Operation The operations of the Company has been suspended since August 2000. The suspension is for the purpose of minimizing the losses occasioned by unfavorable business conditions. Henceforth, the losses sustained by the Company purely represents suspended operations cost and expenses of a going concern. For the years ended December 31, 2006 and 2005 The net loss during the year amounted to P 0.921 million or equivalent to P 0.011 loss per share. The net loss during the year increased by P0.132 million or by 17% and the net loss per share increased by P.002 per share or by 22% compared to the immediately preceding year. 6 The increase in cost and expenses by P 0.132 million is accounted for as follows: Increase (Decrease) Amount % Professional Fees Meetings & Conferences Transportation Interest Expense Rent Fines and Penalties Taxes & licenses Communication Miscellaneous 3,960 ( 349) 43,026 72,979 (5,000) 42,300 ( 5,456) (32,697) 13,250 Net increase in cost and expenses 132,013 1.74% - 0.23% 85.81% 100.00% - 8.33% 100.00% -100.00% -100.00% 47.90% For the years ended December 31, 2005 and 2004 The net loss during the year amounted to P 0.79 million or equivalent to P 0.009 loss per share. The net loss during the year increased by P0.097 million or by 14% and the net loss per share increased by P.001 per share or by 11% compared to the immediately preceding year. The increase in cost and expenses by P 0.120 million is accounted for as follows: Increase (Decrease) Amount % Professional Fees Meetings & Conferences Transportation Annual listing maintenance fee Utilities Communication Taxes & licenses Supplies Miscellaneous 10,000 31,722 (35,155) 110,000 (50,916) 19,935 9,118 (14,172) 16,676 Net increase in cost and expenses 97,208 1.45% 4.59% -5.09% 15.91% - 7.37% 2.88% 1.32% - 2.05% 2.41% The increase in cost and expenses is primarily due to uncontrollable cost and expenses. The Company is continuously controlling its expenses in order to reduce the losses occasioned by the temporary suspension of operations. As soon as the business conditions become profitably attractive, the company plans to make investments and actively trade at the stock exchange. 7 Key Performance Factors: For the Years Ended December 31 2006 2005 Debt to Equity Ratio Current Ratio Loss per share (1.0112) (1.0114) 0.2159 0.0455 P 0.011 P0.009 Debt to Equity Ratio: This ratio is determined by dividing the total liabilities into the total stockholders equity. The ratio measures the leverage on borrowed capital. Current Ratio: The ratio is computed by dividing the current assets into the current liabilities. The ratio measures the company’s ability to pay maturing obligations. Financial Statements Audit report enclosed Changes in and Disagreements with Accountants on Accounting and Financial Disclosures None PART IV - CONTROL AND COMPENSATION INFORMATION (A) (1) Directors and Executive Officers of the Registrant The following persons are the directors and officers who have been nominated to serve as directors and officers until the next annual meeting of stockholders or until their successors, if any, are elected. Office Director, Chairman of the Board Director, President Corporate Secretary Treasurer & Compliance Officer Independent Director Director Director Director Name Khrisnamurti Africano Delfin S. Castro, Jr. Arsenio Cabrera, Jr. Citizenship Filipino Filipino Filipino Age 70 41 46 Simmon C. Dee Felix Ang Brandon Chia Tzu Chern Eugenio R. Esguerra Edison D. Go Filipino Filipino Singaporean Filipino Filipino 52 47 29 48 50 KHRISNAMURTI A. AFRICANO, Chairman of the Board, Filipino Atty. Africano, 70 years old, holds a Master of Laws from the Harvard Law School and a Bachelor of Laws degree Magna Cum Laude at the Far Eastern University. He was elected as Chairman of the Board on 21 February 2007. He is currently the Legal Consultant of Angping & Associates Securities, Inc. 8 DELFIN S. CASTRO, Jr. Director/President, Filipino Mr. Castro, 40 years old, holds a Masters in Business Administration and a Bachelor of Science Degree in Business Administration from the University of the Philippines. He was elected as President on 21 February 2007. He was formerly the Global Portfolio Manager for Private Equities of a fund management company - United Resources Asset Management, Inc. He was also a Senior Assistant Vice President of Asiatrust Bank, Inc. handling restructuring of loans and rehabilitation of companies, and was head of the bank’s acquired assets. His other past positions include as Senior Consultant in the Management Services Division of SGV & Co. handling mergers and acquisitions, and Engagement Director for Palo Alto Consultants Asia, Inc. ARSENIO C. CABRERA, Director/Corporate Secretary, Filipino Atty. Cabrera, 46 years old, a member of the Philippine Bar, holds a Bachelor of Laws (Second Honors) and a Bachelor of Science in Legal Management from the Ateneo de Manila University. Mr. Cabrera is a Senior Partner of Herrera Teehankee Faylona & Cabrera Law Offices. He was elected as a Director of the Company on 30 November 2006. He is currently the General Counsel of Systems Technology Institute, Inc., Corporate Secretary of GEOGRACE Resources Philippines, Inc., Adamson & Adamson, Inc., Global Clark Assets Corporation, Clark Field Medical Services, Inc., Mountain Ridge Executive Resorts & Corporate Center, Inc., AAPC Philippines, Inc., Calatagan Bay Realty, Inc., Canlubang Golf and Country Club, Inc., DLS-STI College of Health Professions, Inc., Foundation for Filipinos, Inc., Lorenzo Shipping Corporation, Northcroft Lim (Philippines) Inc., People’s Shrine Foundation, Inc. Renaissance Condominium Corporation, Rinaldi Structural (Philippines), Inc., Sonak Holdings, Inc., Trend Developers, Inc., Villa Development Corporation and WVC Development Corporation. SIMON C. DEE, Director, Filipino Mr. Dee, 52 years old, obtained his degree in Industrial Management Engineering from De La Salle University. He has been in the cargo transport business for almost 30 years. He is President of Transmodal Forwarders Corporation, Interisland Container Transport and Leasing Corporation, and Icon Reefer Corporation. He is also a director of Kabayan Realty, and Landbase Realty. He has also held marketing positions in First Base Industries Corporation , Sulpicio Lines ad Worldwide Electronics Corporation. FELIX R. ANG Mr. Ang, 47 years old, is President of CATS Motors, Inc., CATS Automobile Corporation, CATS Asian Cars, Inc. and Felton Properties. He is also a director of Bit Stream Entertainment, Inc., Best Forms, Inc., and Sound Stream Entertainment, Inc. BRADON CHIA TZU CHERN, Director, Filipino Mr. Chern, 29 years old, is a graduate of Bachelor of Laws at the National University of Singapore. He was elected as Director of the company on 21 February 2007. He is currently the Operations Manager (International) of HDI Group/Macroserve Pte. Ltd. 9 EUGENIO R. ESGUERRA, Director, Filipino Mr. Esguerra, 49, holds a Masters Degree of Applied Science in Mineral Exploration from the University of New South Wales in Australia and a Bachelor of Science in Geology from Mapua Institute of Technology. He was elected as Director on 21 February 2007. He is currently a Consulting Geologist at RT Minerals Corporation, Rizal Cement Corporation, Diamond Group Development Corp. and Ko’s Partners Mining Company, a Consulting Engineering Geologits at Robinson Homes and Shell Philippines. He was formerly a Consulting Geologist at Didipio Gold/Copper Project, Climax Mining, an Engineering Geologist at Katahira Engineers International, a Project Geologist at Nettitsu Mining Consultant, a Consulting Geologist at Palmer Resources in Canada, and Exploration Geologist at Stellar Metals also in Canada . He was also formerly a Geologits at Mines and Geosciences Bureau. EDISON GO, Director, Filipino Mr. Go, 50 attended De La Salle University, major in Business Management. He was elected as Director on 21 February 2007. He is currently the General Manager of Shine Manila Customs’ Brokerage, Proprietor of EDG Trucking and G.D. Edison Laboratories, President of Vertical Fertilizer Chemical Corporation and Grapeseeds of Wonder Corp., Managing Partner of Sofast Chemical Fertilizer Corporation and Director of Netpak Philippines, Inc. (2) Identify Significant Employee No person, who is not a director or an executive officer, is expected to make a significant contribution to the business of the Company. Neither is the business highly dependent on the services of certain key personnel. (c) Family Relationships No family relationships up to the fourth civil degree either by consanguinity or affinity exist among the directors, executive officers or persons nominated or chosen by the Company to become directors or executive officers. (d) Involvement in Certain Legal Proceedings To the knowledge and/or information of the Company, the above named directors and executive officers of the Company are not, presently or during the last five (5) years up to the present date, involved or have been involved in: (a) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer; (b) any conviction by final judgment, in a criminal proceeding, domestic or foreign, or being subject to a pending criminal proceeding, domestic or foreign, excluding traffic violations and other minor offenses; (c) being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, domestic or foreign, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities, commodities or banking activities; and (d) being found by a domestic or foreign court of competent jurisdiction (in a civil action), the Commission or comparable foreign body, or a domestic or foreign Exchange or other organized trading market or self regulatory organization, to have violated a securities or commodities law or regulation, and the judgment has not been reversed, suspended, or vacated. 10 (B) Executive Compensation SUMMARY COMPENSATION TABLE Name and Principal Position Year 2007 (est) Salary Annual Compensation Bonus Other 2,210,000 ======== ======== 0 ======== 0 ======== 0 ======== 0 ======== Delfin Castro, Jr., President Claudine del Rosario, Vice President Gina Pasion, Controller Arlene Mendoza, Legal Officer Bertrand Yao, Executive Assistant No executive compensation • 2004-2006 Compensation of Directors and Chairman The Directors and the Chairman of MHI are not receiving any compensation directly or indirectly for any services provided. • Employment Contracts and Termination of Employment and Change-in-control Arrangement There are no special arrangements as to the employment contract of any executive officer such that said officer will be compensated upon his resignation, retirement or other termination from the Company or its subsidiaries, or as may result from a change-incontrol except as provided by law. 11 (C) Security Ownership of Certain Beneficial Owners and Management as of December 31, 2005 Name and address of record owner Type of Class and relationship with owner Common PCD Nominee Corp Name of Beneficial Owner and relationship with Record owner Citizenship Percent Filipino 46,360,830 54.52% Filipino 18,539,130 21.80% R & L Investments 675 Lee St. Mandaluyong City Filipino 6,222,500 7.32% Angping & Associates 20/F The Peak, 107 LP Liveste St. Salcedo Village, Makati City Filipno 5,121,385 6.02% MDR Securities, Inc. Unit 1806, 8F Medical Plaza Ortigas Bldg, Pasig City Filipino 4,894,330 5.76% Singaporean 25,950,000 30.52% G/F, Makati Stock Exchange Bldg. Ayala Avenue , Makati City Name of PCD participant owning more than 5% HDI Securites, Inc. 11F Ayala Tower I, Ayala Avenue, Makati City Common No. of Shares Held Elizabeth Louise Kim Armstrong Jannov Plaza, 2295 Pasong Tamo Ext. Makati City Note 1 PCD Nominee Corporation is a wholly owned subsidiary of Philippine Central Depository, Inc. (PCD) and is the registered owner of the shares in the book of the Company’s transfer agent. The participants of the PCD are the beneficial owner of such shares. PCD holds the shares on behalf of their clients. ( 2 ) Security Ownership of Management Type of Class Name of Beneficial Owner Common shares Khrisnamurti A. Africano Delfin S. Castro, Jr Felix Ang Eugene Esguerra Simmon Dee Brandon Chia Tzu Chem Edison Go Arsenio Cabrera , Jr. All Directors and executive officers as a group (D) Amount & nature of beneficial ownership R R R R R R R R 0 0 1,000 0 1,000 0 1,000 0 3,000 Citizenship Filipino Filipino Filipino Filipino Filipino Filipino Filipino Filipino Percent of class 0.0000% 0.0000% 0.0012% 0.0000% 0.0012% 0.0000% 0.0012% 0.0000% 0.0035% Certain Relationships and Related Transactions No family relationships up to the fourth civil degree either by consanguinity or affinity exist among the directors, executive officers or persons nominated or chosen by the Company to become directors or executive officers. 12 PART V – CORPORATE GOVERNANCE (a) Due to the fact that there has been no commercial operations of the Company and its subsidiaries and considering that the Company currently has only one (1) employee, there has been no specific mechanism/evaluation system formulated by the Board to measure compliance with the Manual. (b) The Company elects at least one (1) independent Director. The Company also ensures that all the nominees to the Board possess none of the disqualifications prescribed by the Manual on Corporate Governance. The Company has an Audit Committee which is tasked to review the Audited Financial Statements. (c) In view of the restraints discussed in item (a) above, MHI cannot be fully compliant with the provisions of the Manual. (d) As soon as the Company has regular commercial operations, it shall strengthen the system already in place to ensure full compliance with the Manual. PART VII - EXHIBITS AND SCHEDULES (A) Exhibits and Reports on SEC Form 17-C (a) Exhibits - See accompanying index to Exhibits ( Page 15 ) • The other exhibits, as indicated in the Index to Exhibits are either not applicable to the Company or require no answer. (b) Reports on SEC Form 17-C Date of Report - 06 December 2006 Item Reported Item 9 – Resignation of directors/Election of Directors and Officer The Board of Directors accepted the resignations of Messrs. Toribio U. Reyes III, Jose Abad Santos III and Edmundo T. Gocudo as Directors. The Board elected Messrs. Francis H. Suarez, Simon C. Dee and Edison D. Go as new directors of MHI to serve as such for the ensuing year and until the election and disqualification of their successors. The Board likewise accepted the resignations of Mr. Toribio U. Reyes, III as Chairman and Treasurer, Ms. Leonor Cabarus as President and Atty. Perfecto Mirador as Corporate Secretary. The Board elected Mr. Francis H. Suarez Jr. as Chairman and Treasurer, Mr. Simmon C. Dee as President and Compliance Officer and Atty. Arsenio C. Cabrera, Jr. as Corporate Secretary/ Corporate Information Officer. Date of Report - 19 December 2006 Item Reported Item 4 – Resignation of directors/ The company received a letter dated 15 December 2006 from Mr. Benson J. Te indicating his irrevocable resignation as Independent Director. The resignation of Mr. Te was not due to any disagreement with MHI on any matter relating to the Company’s operations. 13 MAGNUM HOLDINGS, INC. INDEX TO FINANCIAL STATEMENTS AND SUPPLEMENTARY SCHEDULES FORM 17-A Financial Statements Statement of Management's Responsibility For Financial Statements Report of Independent Public Accountants Balance Sheets as of December 31 , 2006 and 2005 Statements of Expenses for the years ended December 31, 2006 and 2005 Statements of Changes in Capital Deficiency for the years ended December 31, 2006 and 2005 Statements of Cash Flow for the years ended December 31, 2006 and 2005 Notes to Financial Statement Supplementary Schedules Report of Independent Public Accountants on Supplementary Schedules A. Marketable Securities - ( Current Marketable Equity Securities and Short - term Cash Investments ) B. Amounts Receivable from Directors, Officers, Employees, Related Parties and Principal Stockholders ( Other than Affiliates ) C. Non-Current Marketable Equity Securities, Other Long-term Investments, and Other Investments D. Indebtedness to Unconsolidated Subsidiaries and Affiliates E. Property, Plant and Equitment F. Accumulated Depreciation G. Deferred charges - Other Assets H. Long-Term Debt I. Indebtedness to Affiliates and related parties (Long-term Loans from Related Companies) J. Guarantees of securities of other Issuers K. Capital Stock 16 17-18 19 20 21 22 23-27 28 NA NA NA NA NA NA NA 29 NA 30 15 MAGNUM HOLDINGS, INC. BALANCE SHEETS December 31 2006 Notes ASSETS Current Cash Non-current Advances to officers and employees 2 2005 P 14,000 P 4,327 P 40,000 54,000 P 40,000 44,327 P 64,841 P 95,046 2, 4, 9 LIABILITIES AND CAPITAL DEFICIENCY LIABILITIES Current Accounts payable and accrued expenses Non-current Advances from shareholders CAPITAL DEFICIENCY The notes on pages 7 to 11 are an integral part of these financial statements. 2, 5 2, 4 4,806,098 4,870,939 (4,816,939) P 54,000 3,845,512 3,940,558 (3,896,231) P 44,327 MAGNUM HOLDINGS, INC. STATEMENTS OF EXPENSES Years Ended December 31 2006 2005 Notes EXPENSES Professional fees Listing fees Meetings and conferences Transportation Interest expense Rent Fines and penalties Taxes and licenses Communication Others NET LOSS BASIC LOSS PER SHARE P 2,7 The notes on pages 7 to 11 are an integral part of these financial statements. P 231,960 220,000 152,280 93,166 72,979 55,000 42,300 12,112 40,911 920,708 P P 228,000 220,000 152,629 50,140 60,000 17,568 32,697 27,661 788,695 P 0.011 P 0.009 MAGNUM HOLDINGS, INC. STATEMENTS OF CHANGES IN CAPITAL DEFICIENCY Notes SHARE CAPITAL Par value, P1 per share Authorized share-100,000,000 P 100,000,000 Issued and outstanding - 85,040,000 shares Additional paid-in capital DEFICIENCY Balance, beginning of year Net loss Balance, end of year 6 6 Years Ended December 31 2006 2005 P 85,040,000 190,000 85,230,000 P 85,040,000 190,000 85,230,000 89,126,231 920,708 90,046,939 88,337,537 788,694 89,126,231 P (4,816,939) P (3,896,231) The notes on 7 to 11 are an integral part of these financial statements. MERCADO CALDERON JARAVATA & CO. 5 MAGNUM HOLDINGS, INC. STATEMENTS OF CASH FLOWS Years Ended December 31 2006 2005 Notes CASH FLOWS FROM OPERATING ACTIVITIES Net loss Changes in operating asset and liabilities: Increase in other current asset Decrease in accounts payable and accrued expenses Net cash used in operating activities P CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from advances from shareholders NET INCREASE (DECREASE) IN CASH CASH, BEGINNING OF YEAR 2 CASH, END OF YEAR 2 P 920,708 P 788,695 30,205 950,913 2,247 6,953 797,895 960,586 791,600 9,673 (6,295) 4,327 10,622 14,000 P 4,327 The notes on pages 7 to 11 are an integral part of these financial statements. MERCADO CALDERON JARAVATA & CO. 6 MAGNUM HOLDINGS CORPORATION NOTES TO FINANCIAL STATEMENTS 1. Corporate information Magnum Holdings, Inc. was incorporated in the Philippines and registered with the Securities and Exchange Commission on July 9, 1975 under SEC Reg. No 62323. The Company’s primary purpose is to acquire by purchase, exchange, assignment, gift or otherwise, and to hold, own and used for investment or otherwise, and to sell, assign, operate or dispose any and all properties of every kind and description as to the extent permitted by law. The registered office address of the Company is No. 17 Gen. Malvar Street, Brgy. San Antonio, Pasig City. The Company’s personnel requirement is being accommodated by its shareholder, Sagarmatha, Inc. since the Company is not actively trading. These financial statements have been approved and authorized for issuance by the Company’s Board of Directors on March 17, 2006 2. Summary of significant accounting policies The principal accounting policies applied in the preparation of the financial statements are set out below. These policies have been consistently applied to all the years presented, unless otherwise stated. Basis of presentation The Company’s financial statements have been prepared in accordance with Philippine Financial Reporting Standards (PFRS). The term PFRS includes all PFRS, Philippine Accounting Standards (PAS) and interpretation, which have been approved by the Accounting Standards Council (now called Financial Reporting Standards Council or FRSC). The policies set out below have been consistently applied to both years presented. The preparation of financial statements in conformity with PFRS requires the use of certain critical accounting estimates. It also requires management to exercise judgment in the process of applying the Company’s accounting policies. Actual results may ultimately differ from these estimates. New standards, amendments and interpretations effective 2006 and onwards The following standards, amendments, and interpretations which are mandatory for accounting periods beginning on or after January 1, 2006, unless otherwise stated, are not adopted and not relevant to the Company’s operations. Philippine Accounting Standards • • • • PAS 19 PAS 39 PAS 39 PAS 39 Employee Benefits – Actuarial Gains and Losses, Group Plans and Disclosures Cash Flow Hedge Accounting of Forecast of Intragroup Transactions The Fair Value Option Financial Guarantee Contracts Philippine Financial Reporting Standards • PFRS 4 Financial Guarantee Contracts • PFRS 6 Exploration for and Evaluation of Mineral Resources MERCADO CALDERON JARAVATA & CO. 7 MAGNUM HOLDINGS, INC. Notes to Financial Statements – December 31, 2006 Philippine Interpretation • IFRIC 4 • IFRIC 5 • IFRIC 7 • IFRIC 8 • IFRIC 9 • IFRIC 10 Determining whether an Arrangement Contains a Lease Rights to Interests arising from Decommissioning, Restoration and Environmental Rehabilitation Funds Applying the Restatement Approach under PAS 29 Financial Reporting in Hyperinflationary Economies Scope of PFRS 2 Reassessment of Embedded Derivatives Interim Financial Reporting and Impairment (effective on or after November 1, 2006) Related party and related party transactions Related party relationships exist when one party has the ability to control, directly or indirectly through one or more intermediaries, the other party or exercise significant influence over the other party in making financial and operating decisions. Such relationships also exist between and/or among entities, which are under common control with the reporting enterprise and its key management personnel, directors, or its shareholders. In considering each possible related party relationship, attention is directed to the substance of the relationship, and not merely the legal form. Transactions between related parties are accounted for at arm’s length prices or on terms similar to those offered to non-related entities in an economically comparable market. Functional and presentation currency Items include in the financial statements of the Company are measured using the currency of the primary economic environment in which the entity operates (the Philippine peso). The financial statements are presented in Philippine peso, which is the Company’s functional and presentation currency. Financial risk management The Company’s activities expose it to a variety of financial risks: credit risk and liquidity risk. The Company’s overall risk management program seeks to minimize potential adverse effects on the financial performance of the Company. The policies for managing specific risks are summarized below: Liquidity risk In the management of liquidity, the Company monitors and maintains a level of cash deemed adequate by the management to finance the Company’s operations and mitigate the effects of fluctuation in cash flows. Credit risk The Company’s establishes credit limits at the level of the individual borrower and corporate relationship. Financial assets and liabilities The carrying amounts of the financial assets (receivables and other non-current assets) and financial liabilities (payables and accrued expenses) recorded in the financial statements represents their respective net fair values. Cash Cash includes money and any other negotiable instruments that are payable in money and acceptable by the bank for deposit and immediate credit. Cash is valued at face value. Accounts payable and accrued expenses Accounts payable and accrued expenses are recognized in the period in which the related money are received or when a legally enforceable claim against the Company is established. MERCADO CALDERON JARAVATA & CO. 8 MAGNUM HOLDINGS, INC. Notes to Financial Statements – December 31, 2006 Expense recognition Expenses are recognized when incurred. Basic loss per share Basic loss per share is determined by dividing net loss by the total number of shares of stocks issued and outstanding during the year. Income taxes Income tax payable on profits, based on the applicable tax laws, is recognized as an expense in the period in which profit arise. 3. Going concern uncertainties The accompanying financial statements have been prepared on the assumption that the Company will continue as a going concern. However, the following factors, among others, indicate that the Company may not be able to continue as a going concern: • The Company incurred losses of P920,708; P788,695 and P691,286 and capital deficiency of P4,816,939, P3,896,231 and P3,107,537 for the years ended December 31, 2006, 2005 and 2004 respectively, as shown in its financial statements. • The losses were attributed primarily to the poor trading conditions caused by financial instability affecting the region as well as representing the cost of maintaining and safeguarding the Company’s assets and resources. As of balance sheet date, there is no sign of a favorable market condition. The Company is dependent on the continuing support of its major stockholders, Sagarmatha, Inc. The Company has taken the cautious stance in 2006 and 2005 due to political uncertainties. Depending on how political events will finally unfold, the Company will trade securities to full trading operation immediately upon generating the funds that would be derived from the issuance of the remaining 14,960,000 unissued shares. The above statements do not include any adjustments that might result from the outcome of the above uncertainties. 4. Related entities and related party transactions Below shows the confirmed balances of related party transactions: Related party Sagarmatha, Inc. Officers and employees Amount owed by related parties 2005 2006 Amount owed to related party 2005 2006 P 4,806,098 P 40,000 P 3,845,512 P 40,000 There was no movement in the amount owed by the officers and employees. The amount owed to stockholder represents non-interest bearing advances from Samargatha, Inc. which the latter temporarily advance for the necessary expenses of the Company’s suspended operational expenditure pending resumption of commercial operation. A bilateral agreement so approved in the Board Resolution, was reach between the Company and Sagarmatha, Inc. one of its shareholders, such that the latter will temporarily advance the payment of the suspended operation expenses pending resumption of the company’s operation. These advances are non-interest bearing. Sagarmatha, Inc. also provided the Company with a sort of petty cash fund deposited in the Company’s current account in the amount of about P100,000. The fund is replenished upon request of the Company. MERCADO CALDERON JARAVATA & CO. 9 MAGNUM HOLDINGS, INC. Notes to Financial Statements – December 31, 2006 5. Accounts payable and accrued expenses This account consists of accounts payable and accrued professional fees of P12,112 and P52,729 respectively. 6. Issued capital The Company’s authorized capital stock is P100,000,000 divided into 100,000,000 shares with a par value of P1 per share. Total subscribed and paid-up capital stock is P85,040,000 as of December 31, 2006. There are 477 stockholders of the Company as of December 31, 2006. Below are the percentages of total shares outstanding held by each stockholder: Stockholders Corporate Individual Individual 7. Filipino Filipino Foreign Total shares Percent 45,893,830 10,169,170 28,977,000 85,040,000 53.97% 11.96% 34.07% 100.00% Basic loss per share Computation of loss per share is shown below. 2005 2006 Net loss for the year Total outstanding shares Basic loss per share 8. P 920,708 85,040,000 P 0.011 P 788,694 85,040,000 P 0.009 Key management assumptions Short range financial plan The Company is working on the documentation of the stock rights to be issued from the unissued shares in the amount of P14,960,000. The proceeds from the issuance of stock rights shall be used for the following: • • To eliminate the deficit P4,816,939 as of December 31, 2006. The cash inflow to be generated by the stockrights shall be used to finance the outstanding advances from Samargatha, Inc. in the amount of P4,806,098 and the balance will be available for working capital. The Company does not expect stable improvement in business condition at least in the next six months. 9. Significant accounting judgments and estimates Estimates The key assumptions concerning the future and other sources of estimation uncertainty at the balance sheet date that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year are discussed below. Estimated allowance for probable losses on receivables The Company evaluates the possibility of losses that may arise out of the non-collection of receivables based on a certain percentage of the outstanding balance of receivable and on an evaluation of the current MERCADO CALDERON JARAVATA & CO. 10 MAGNUM HOLDINGS, INC. Notes to Financial Statements – December 31, 2006 status of the account. However, as of December 31, 2006, no allowance for probable losses was provided for, as the accounts were deemed fully collectible. Asset impairment Impairment on assets occurs whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The factors that the company considers important which could trigger an impairment review include the following: • significant underperformance relative to the expected historical or projected future operating results; • significant changes in the manner of use of the acquired assets or the strategy for overall business; and • significant negative industry or economic trends. An impairment loss is recognized whenever the carrying amount of an asset exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell. The fair value less costs to sell is the amount obtainable from the sale of an asset in an arm’s length transaction while value in use is the present value of estimated future cash flows expected to arise from the continuing use of an asset and from its disposal at the end of its useful life. Recoverable amounts are estimated for individual assets or, if it is not possible, for the cash-generating unit to which the asset belongs. In determining the present value of estimated future cash flows expected to be generated from the continued use of the assets, the Company is required to make estimates and assumptions that can materially affect the financial statements. The Company has no property and equipment to be tested for impairment as of December 31, 2006 and 2005. 10. Additional disclosure requirements by SRC Rule 68 Under the following disclosure requirements by the SRC Rule 68, the company has neither an existing plan nor transaction involving the following: ● ● ● ● ● ● ● Preferred shares Pension and retirement plans Profit sharing and other similar plans Capital stock optioned, sold or offered for sale to directors, officers and key employees Warrants or rights outstanding Defaults Key management personnel compensation 11. Other matters Where necessary, comparative figures have been adjusted to conform to changes in presentation in the current year. MERCADO CALDERON JARAVATA & CO. 11 MAGNUM HOLDINGS, INC. Schedule A MARKETABLE SECURITIES ( Current Marketable Equity Securities and Other Short-Term Cash Investments) As of December 31, 2006 Name of issuing entity and association of each issue (1) NONE Number of shares of principal amount of bonds and notes Amount shown in the balance sheet*(2) NONE NONE Value based on market quotation at balance sheet date (3) Income received and accrued NONE MAGNUM HOLDINGS, INC. Schedule I Indebtedness to Affiliates and Related Parties (Long-term Loans from Related Companies) As of December 31, 2006 Name of Affiliate (1) Balance at beginning of period Balance at end of period (2) NONE NONE NONE MAGNUM HOLDINGS, INC. Schedule K SHARE CAPITAL As of December 31, 2006 Title of issue (2) Number of shares authorized Number of shares issued and outstanding at shown under related balance sheet caption Common 100,000,000 85,040,000 Number of shares shares reserved for options, warrants, conversion & other rights 14,960,000 Number of shares held by affiliates -3 Directors, Officers and Employees 3,000 Others 85,037,000

© Copyright 2026