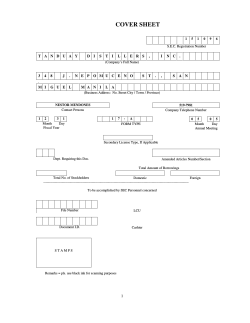

Document 258231