EC501 Econometric Methods and Applications 4. Large Sample Methods Marcus Chambers

1/24

EC501 Econometric Methods and Applications

4. Large Sample Methods

Marcus Chambers

Department of Economics

University of Essex

31 October 2013

EC501 Econometric Methods and Applications

4. Large Sample Methods

2/24

Outline

1

Review

2

Large sample concepts

3

The method of maximum likelihood

4

Large sample hypothesis tests

Reference: Greene, chapter 14 and Appendix D.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Review

3/24

CLRM: y = Xβ + .

The OLS estimator, b = (X 0 X)−1 X 0 y, is BLUE.

Hypothesis tests: t- and F-statistics.

Exact t- and F-distributions rely on assumption of normality.

We shall attempt to see what happens when we relax the

assumption of normality in due course.

To do this we shall use large sample (asymptotic) methods.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

4/24

If we wish to relax some of the assumptions of the CLRM

then exact finite sample results are typically not available.

For example, if we relax the normality assumption,

t-statistics no longer have t-distributions, F-statistics no

longer have F-distributions etc.

Hence the critical values from these distributions are not

correct, and incorrect inferences may be drawn from the

tests.

We therefore use large sample methods to find out the

properties of estimators and test statistics as n → ∞.

For large enough n we treat the asymptotic results as

holding approximately.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

5/24

Consider a sequence of numbers indexed by n e.g.

1

1 1 1

−n

,

,

,..., n,... .

{xn = e } =

e e2 e3

e

We can define the limit of this sequence as n → ∞:

lim xn = lim e−n = 0.

n→∞

n→∞

The sequence {xn } is said to converge to zero.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

6/24

What happens if the elements are random variables?

The sequence of random variables {xn } is said to

converge in probability to a constant c if

lim Pr (|xn − c| > ) = 0 for some > 0.

n→∞

This is written

p

xn → c or plim xn = c.

In words: there exists a positive number such that, as n

gets larger and larger, the probability that the distance

between xn and c is larger than , converges to zero.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

7/24

If plim b = β then b is a consistent estimator of β.

Consistency is a large sample version of unbiasedness.

A useful property of the plim operator is:

Slutsky’s Theorem

Slutsky’s Theorem: If g(·) is a continuous function and

plim xn = c, then

plim g(xn ) = g(plim xn ) = g(c)

(see D-12 on p.1113 of Greene).

This is not a property shared by the expectations operator

– in general, E[g(x)] 6= g[E(x)] for a random variable x.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

8/24

Another useful result is:

Chebychev’s Lemma

If xn is a random sequence such that

lim E(xn ) = c and

n→∞

lim var(xn ) = 0,

n→∞

then plim xn = c (see D-1 on p.1107 of Greene).

This enables us to establish consistency by examining the

limiting properties of the expectation and variance.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

9/24

Convergence to a constant θ is illustrated above by the

variance of the distribution becoming smaller as n

increases.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

10/24

We are also interested in the distribution of random

variables.

Suppose Fn (·), the distribution function of xn , converges to

a distribution function F(·) as n → ∞.

Then F(·) is the limiting distribution of xn , and if x is a

random variable having distribution function F(·), then xn is

said to converge in distribution to x.

For example, if x ∼ N(0, σ 2 ) and xn converges in

distribution to x, then we write

d

d

xn → x ∼ N(0, σ 2 ) or xn → N(0, σ 2 ).

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample concepts

11/24

A useful result concerning convergence in distribution is:

Cramer’s Theorem

If An is a matrix sequence such that plim An = A, and bn is a

d

vector sequence such that bn → b ∼ N(0, Q), then

d

An bn → Ab ∼ N(0, AQA0 ).

This is useful in studying the limiting distribution of the OLS

estimator.

EC501 Econometric Methods and Applications

4. Large Sample Methods

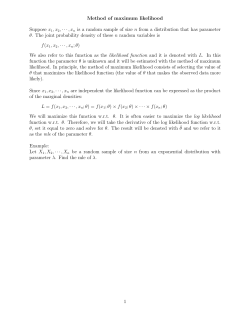

The method of maximum likelihood

12/24

Consider the classical model

yi = xi0 β + i , i = 1, . . . , n; xi nonrandom; i ∼ NID(0, σ 2 ).

(1)

NB: ‘NID(0, σ 2 )’ means ‘normally and independently

distributed with mean zero and variance σ 2 ’.

The normality assumption means the pdf for i is

1

2i

f (i ) = √ exp − 2 , −∞ < i < ∞.

2σ

σ 2π

The independence of the i means the joint pdf for the

n × 1 vector is:

n

Pn 2 n

Y

1

√

f () =

f (i ) =

exp − i=12 i .

2σ

σ 2π

i=1

EC501 Econometric Methods and Applications

4. Large Sample Methods

(2)

(3)

The method of maximum likelihood

13/24

Because y = Xβ + and

obtain the joint pdf for y:

f (y) =

1

2πσ 2

n/2

P

2i = 0 = (y − Xβ)0 (y − Xβ) we

(y − Xβ)0 (y − Xβ)

exp −

2σ 2

.

(4)

This is a function of y for given β and σ 2 .

But in econometrics we need to estimate β and σ 2 for

given y.

The method of maximum likelihood takes the probability

density in (4) and chooses the values of β and σ 2 which

are most likely to have given the observed y.

EC501 Econometric Methods and Applications

4. Large Sample Methods

The method of maximum likelihood

14/24

When regarded as a function of β and σ 2 for given y the

function in (4) is called the likelihood function L(β, σ 2 ; y):

(y − Xβ)0 (y − Xβ)

2

2 −n/2

L(β, σ ; y) = 2πσ

exp −

(5)

2σ 2

We need to maximise (5) with respect to β and σ 2 .

It is easiest to take logs:

n

n

S(β)

ln L = − ln 2π − ln σ 2 −

,

2

2

2σ 2

where S(β) = (y − Xβ)0 (y − Xβ) is the familiar sum of

squares function.

EC501 Econometric Methods and Applications

4. Large Sample Methods

(6)

The method of maximum likelihood

15/24

The first-order conditions for the maximisation are:

∂ ln L

∂β

= −

∂S(β) 1

∂S(βˆML )

· 2 =0 ⇒

= 0;

∂β

2σ

∂β

∂ ln L

∂σ 2

= −

n

S(β)

S(βˆML )

2

+

=

0

⇒

σ

ˆ

=

. (8)

ML

2σ 2

2σ 4

n

(7)

Clearly, from (7), βˆML = b, the OLS estimator:

βˆML = (X 0 X)−1 X 0 y,

2

σ

ˆML

=

(9)

(y − X βˆML )0 (y − X βˆML )

6= s2 .

n

EC501 Econometric Methods and Applications

4. Large Sample Methods

(10)

The method of maximum likelihood

16/24

Consider a general estimation problem where we want to

estimate an m × 1 parameter vector θ whose true value is

θ0 .

Let

g(θ) =

∂ ln L(θ)

(m × 1),

∂θ

H(θ) =

∂ 2 ln L(θ)

(m × m).

∂θ∂θ0

Note that the maximum likelihood estimator (MLE) θˆ

ˆ = 0.

satisfies g(θ)

EC501 Econometric Methods and Applications

4. Large Sample Methods

The method of maximum likelihood

17/24

The MLE θˆ has the following properties:

1

2

3

Consistency: plim θˆ = θ0 .

a

Asymptotic normality: θˆ ∼ N θ0 , I(θ0 )−1 , where

I(θ) = −E[H(θ)] is the information matrix.

Asymptotic efficiency: θˆ achieves the Cramer-Rao lower

bound for consistent estimators, meaning that

ˆ = I(θ0 )−1

var(θ)

˜ var(θ)

˜ ≥ I(θ0 )−1 ).

(in general, for an estimator θ,

Although we have concentrated on the CLRM, maximum

likelihood can be applied in a wide variety of problems,

provided we can write down the density function!

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample hypothesis tests

18/24

Sometimes we want to test hypotheses involving

nonlinear restrictions of the form

H0 : c(θ) = 0 against H1 : c(θ) 6= 0

(11)

where θ is an m × 1 vector of parameters and the function

c : Rm → RJ (J ≤ m) i.e. c(θ) is J × 1.

Linear restrictions are a special case: c(θ) = Rθ − q.

Let θˆ be the unrestricted MLE and θˆR be the restricted

MLE:

θˆ = arg max L(θ); θˆR = arg max L(θ) s.t. c(θ) = 0,

θ

θ

where L(θ) is the likelihood function.

There are three large sample tests based on L(θ):

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample hypothesis tests

19/24

ˆ

Wald Test: Based on unrestricted estimator θ:

h

i−1

d

ˆ 0 C(θ)I(

ˆ θ)

ˆ −1 C(θ)

ˆ0

ˆ →

W = c(θ)

c(θ)

χ2J

(12)

under H0 as n → ∞, where

C(θ) =

∂c(θ)

(J × m).

∂θ0

and I(θ) denotes the information matrix

2

∂ ln L(θ)

I(θ) = −E

(m × m).

∂θ∂θ0

Easy to use when restrictions are difficult to impose on the

model.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample hypothesis tests

20/24

Likelihood Ratio Test: Based on both θˆ and θˆR .

Let

λ=

L(θˆR )

.

ˆ

L(θ)

Then LR = −2 ln λ i.e.

h

i

d

ˆ − ln L(θˆR ) →

χ2J

LR = 2 ln L(θ)

under H0 as n → ∞.

It can be of interest to compare θˆ and θˆR .

EC501 Econometric Methods and Applications

4. Large Sample Methods

(13)

Large sample hypothesis tests

21/24

Lagrange Multiplier Test: Based on θˆR :

h

i−1

d

LM = g(θˆR )0 I(θˆR )

g(θˆR ) → χ2J

(14)

under H0 as n → ∞, where

g(θ) =

∂ ln L(θ)

.

∂θ

Easy to use when it is difficult to estimate the unrestricted

model.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample hypothesis tests

22/24

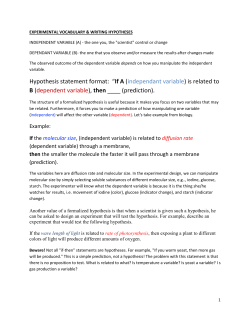

The three tests are depicted above.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Large sample hypothesis tests

23/24

Which test should be used, and when?

A key consideration is how easy it is to estimate under H0

and H1 .

The tests are, however, asymptotically equivalent under

the null hypothesis.

But note that different inferences can be drawn from testing

the same hypothesis with the different tests.

In the CLRM, for example, it can be shown that

LM ≤ LR ≤ W.

In such circumstances, if LM rejects H0 , then so will LR and

W, while if W does not reject H0 , then neither will LM or LR.

EC501 Econometric Methods and Applications

4. Large Sample Methods

Summary

24/24

Summary

large sample convergence concepts

maximum likelihood estimation

large sample hypothesis tests

Next week:

OLS in large samples

instrumental variables estimation

EC501 Econometric Methods and Applications

4. Large Sample Methods

© Copyright 2026