14 20 Sample

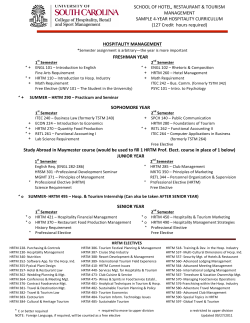

Albury Tourism Monitor 2014 Sample Page Foreword The Albury 2030 Community Strategic Plan highlights the community’s recognition of the value and benefits tourism brings to the city’s economy and lifestyle offer. As a result, AlburyCity has been an active advocate and partner to the tourism industry for many years. In the past twelve months Council, in consultation with industry, key stakeholders and the broader community, developed and adopted the 2014 - 2017 Destination Management Plan for Albury. This Plan defines our tourism vision, identifies priorities and the actions required to further increase its contribution to the local and regional economy and the lifestyle offer of the City. Primary objectives of this plan continue to include increasing visitor numbers, length of stay and spend. Destination Management is an ongoing process by which tourism, industry, government and community leaders plan for the future and manage a destination. The 2014 Albury Tourism Monitor provides a range of domestic and international tourism data in relation to visitation during Albury in 2013, and details of visitALBURYWODONGA destination marketing activity undertaken during the year. Future destination marketing activity will benefit from reflection on this document with its overview of industry trends and visitor analysis. Our tourism success is a reflection of the input of key stakeholders and dedicated staff, and the support of the community. Their efforts, and committment to collaboration to ensure the continued growth and development of tourism in our region, is to be commended. Cr. Kevin Mack Mayor, AlburyCity June 2014 Albury Tourism Monitor Albury Tourism Monitor Contents Year in Review Executive Summary Tourism Climate Tourism Regions Tourism Management Highlights Results Visitor Statistics Albury 2013 Financial Impact Conclusion 2 3 4 6 7 11 13 16 17 Appendices Appendix 1 - Domestic Overnight Visitors: Graphs Appendix 2 - Domestic Visitor Nights: Graphs Appendix 3 - Domestic Daytrip Visitors: Graphs Appendix 4 - International Overnight Visitors: Graphs Appendix 5 - Economic Impact & Occupancy: Graphs Appendix 6 - Data Interpretation Disclaimer The information contained in the 2014 Albury Tourism Monitor has been prepared with all due care for the benefit of the user. AlburyCity Council, its officers, employees, and agents do not warrant or make representations in relation to the information’s accuracy. The information is made available on the understanding that AlburyCity Council shall have no liability for any loss whatsoever that may arise as a result of use of the Information by the reader or any third parties who receive the Information directly or indirectly. It is the user’s responsibility to make investigations, decisions and enquiries of their own about the information. AlburyCity Council owns copyright of this report. Reproduction is not permitted without prior written consent from AlburyCity Council. 2 Albury Tourism Monitor Year in Review Regions 66.6% page ON 73 MMODATI ● ACCO LISTINGS ts albury 42 page e apartmen 33 abod Tourist park 42 EATING OUT 54 all Seasons Inn NMENT & r ENTERTAI 34 albury 42 58 ry Burvale Moto l n Hotel albu 35 albury re 42 1 albio 54 ment Cent Central Mote ry rtain albu ente Inn r 36 43 2 albury 54 Classic Moto er Wine Room ges 37 albury 43 Cotta m 3 Bord 55 Drea Borellas 38 albury e 43 4 Café 58 Manor Hous ry Café th albu s Brea 39 ge 43 5 Hog’ Hotel 55 Motor Villa ss Woolshed l 40 albury 44 Mote rt nt 6 Kinro 55 Rege e Reso Bar Tapas Bar ge Tapas 41 albury Lake Hum 45 urant and 7 Loun 55 ons albury Resta s Seas all attan l 42 45 8 Q Manh park Mote 56 australia Motor Inn n’s Hotel 43 australia mie 45 Sode Mera Inn 9 56 Western ry Hovell Tree albury 44 Best 45 10 SS&a ern plus albu 57 w West elbo ed 45 Best 46 & Breakfast albury 11 The Bend 58 dale Bed mercial Club 46 Briar Com 46 The 12 n Motel georgian ar 47 Clifto 46 page & Suites ry 13 Zedb Inn albu l fort rt Mote 48 Com 46 & SEE 58 ial golf Reso GS TO DO Commerc Shop 49 ry ● THIN hts & galle 59 rnview Heig art gallery dation 50 easte 47 ens 14 albury 59 accommo gard nic ique n Bota Bout datio 47 15 albury 59 ry accommo seum LibraryMu enjoy albu Inn ry r 51 albu 47 t Moto 16 60 tain Cour Racing Club 52 Foun ge 47 Cotta 17 albury 59 re lder Cent re Swim 53 Frauenfe 48 strian Cent Motel 18 albury 62 en Court onga eque Wod gard ry ry 54 48 l rt albu 19 albu 62 e Inn Mote ial golf Reso n 55 Hum 48 mmodatio 20 Commerc Wood Fired Oven 52 acco n anda datio ity 56 Jacar accommo 48 21 Commun 52 ls ts ara Serviced Labe tmen Nang try apar 57 49 iced 22 Coun es 62 Villa Serv t Homewar 58 palm 49 Olive on rs 23 Di Billie l 63 opte ity Hote t air Helic 59 Qual ers 49 Siesta 24 Fores 63 y Bushwalk ity Resort Valle Qual ay 60 50 25 Murr 64 playspace t albury es Creek 61 Ques 49 26 Oddi ry 64 es albu Canoe Hire 62 Rydg r Inn 50 27 Smartair guy at Murray River 52 r Inn arms Moto on Moto e Seat try 63 50 le 28 The Cano 64 r Hume Coun tmas Beet Sundowne l 64 72 Hote ry 29 The Chris 64 albu rra Trail 65 The New – Central albury 51 30 Wagi 65 e ands Dolc Wetl 66 Villa 31 Wonga Motor Inn albury Winsor park Laser Tag 67 Zone 32 LEGEND ALbURy MAp ● 13.6% Taxi Rank Lookout ts Cemetery Area Off Leash p Point Caravan Dum Public Toile Playground Parking Boat Ramp e Golf Cours on Railway Stati Post Australia Hospital on Police Stati Airport by AlburyCity Produced au sign.com. Design mzde m.au otzebra.co Copy apric nLink Printing Desig Bus Stop ATM hone Public Telep ss Internet Acce Wi-Fi on Petrol Stati n Centre Informatio d in this ation supplie ed within is the inform l contain does our to ensure the materia AlburyCity every endeav ty is given that t ation only. are subjec ity has made and inform te, no warran m all s shown which While AlburyC general use and comple Call 1300 9) 00 252 87 alBURY (13 Disclaimeris suitable, accurate material is intended forwal of details or serviceagents expressly disclai of such and on. The or withdra publication servants consequences ity. any change error or omissi , employees, material, and any t of AlburyC sibility for free from ity, its officers e on such written consen any respon not accept without notice. AlburyCion made in relianc uced without the ion or admiss not be reprod to alterat any act done, images may liability for on. Information or act or omissi Serviced in excess of 19,000 visitor groups at the Albury Visitor Information Centre Tourism injected a total of $564.44M into the local economy, an increase of 7.5% from the previous year 90,000 Official Visitor Guides distributed Day trip visitation has increased by 66.6% Domestic overnight visitors have increased by 13.6% 35.4% 32.7% International overnight visitors are up by 35.4% 134 tourism businesses participated in the inaugural joint Tourism and Visitor Information Centre Partner Program. The joint initiative stimulated the 32% growth in Tourism Partners. 3 Executive Summary Albury’s social, cultural and economic vigour is substantially enhanced by the local tourism industry. The tourism marketplace is increasingly competitive as regional destinations endeavour to capture a greater market share. Despite the challenges, Albury has demonstrated its capacity and value as a destination by continuing to increase day and overnight visitation and domestic visitor spend. AlburyCity acknowledges the contribution of tourism to the city, the flow-on benefits of being a recognised tourism destination and the potential for further growth. As a result, it has remained proactive in supporting and promoting the tourism industry as part of its plan to maintain the sustainable growth and development of the city and its economy. Achievements over the past year include: • Continued operation and growth of the Level 1 accredited Visitor Information Centre • Collaboration with the City of Wodonga to prepare, release and deliver the 2013 Albury Wodonga Tourism and Visitor Information Centre Partner Program • Facilitation and hosting of a number of national sporting and cultural events • Distribution of a range of hard copy and online visitor information material • Strengthened ties with key national, state and regional industry groups and stakeholders • Ongoing marketing and promotional activities at a local, regional, state and national level • Utilisation of social media channels as an opportunity to promote Albury and its attractions • Representation on, or member of, major business, events and tourism bodies: Murray Regional Tourism Board, Business Events Victoria, Accredited Visitor Information Centre, Australian Regional Tourism Network, Sydney Melbourne Touring, Victoria Tourism Industry Council, Murray Regional Managers Forum and Visitor Information Centre Networking Groups (High Country and Murray). The 2014 Albury Tourism Monitor analyses data provided by Tourism Research Australia (TRA) to determine the number and type of visitors to Albury in the period mentioned and benchmarks Albury’s performance in comparison to other destinations across regional NSW and Victoria. It also outlines total visitation to visitALBURYWODONGA.com, social media outlets and the Albury Visitor Information Centre. Finally, the report highlights the key tourism related activities undertaken by the Economic Development & Tourism Team from 1 January 2013 - 31 December 2013. Albury Tourism Monitor 4 Tourism Climate Australia’s tourism industry is a highly dispersed sector, which has allowed it to fair well against the volatile economic environment of recent years. Natural disasters and global economic instability have placed pressure on the industry resulting in falling visitor numbers from traditional markets (United Kingdom, United States and Japan). The transformation of the global economy, particularly the growth of wealth across north-east and south-east Asia, has presented Australia with the opportunity for growth in inbound tourism from countries in these regions (China, South Korea, Singapore, Malaysia). These markets are being actively targeted by Tourism Australia. Assisted by the recent rise in domestic day trippers (figures not seen since the late nineties), the Australian tourism industry contributed over $42 billion to Australia’s GDP during 2013 (growth of 3.7%), and employed over 543,600 Australians directly (growth of 2.1%). The strength of tourism is expected to continue to rise with Tourism Research Australia forecasting increases in international visitors and domestic travel during the next two years. Australia Domestic:In 2013 Australian residents made 75.8 million overnight trips in Australia, spending 282.7 million nights away from home. Overnight trips increased by 2% compared to 2012, while visitor nights remained consistent. Day trips:There were 164.3 million day trips taken in Australia by Australian residents during 2013, 6% lower than the number of day trips taken during 2012. Items of highest expenditure for day trip travellers included petrol, eating out and shopping. International:During 2013, there were 5.9 million overseas visitors to Australia (aged over 15yrs); an increase of 3.5% from 2012. A total of 216.7 million visitor nights were spent in Australia, an increase of 5% compared with the previous year. Albury Tourism Monitor 5 Tourism Climate (cont) New South Wales Domestic: There were 25.7 million overnight trips taken in NSW by Australian residents during 2013; this represents a 33.9% share of the total visitor trips nationwide. These overnight visitors spent 85.5 million nights in the state during 2013. The most popular reasons for a visiting NSW were holiday and leisure, visiting friends and relatives followed by business. Day trips:There were 52 million day trips taken in NSW by Australian residents during 2013, a 5.3% decrease compared to 2012 (consistent with national trend). NSW received 31.6% of the nation’s total daytrip visitors during 2013. International:During 2013, there were almost 3 million international visitors to NSW, a 5.7% increase compared to 2012. Visitors spent 72.8 million nights in NSW; this represents a 6.7% increase from visitor nights spent in NSW during 2012. Murray Region Domestic:In 2013 there were 993,000 overnight trips taken to the Murray Region by Australian residents, representing a 13.6% increase compared to 2012. These visitors spent 2.5 million nights in the Murray Region during 2013, up by 1.6% in comparison to the previous year. The most popular reasons for visiting the region were holiday and leisure, followed by visiting friends and relatives. Day trips:There were 1.5 million day trips taken in the Murray Region by Australian residents during 2013, a 52.6% increase compared to 2012. The most popular activities undertaken by day trip visitors included eating out, shopping for pleasure and visiting friends and relatives. International:During 2013, there were 21,200 international visitors to the Murray Region, a 17.6% increase compared to the previous year. Albury Tourism Monitor 6 Albury Tourism Monitor Tourism Regions Albury is a member of the Murray tourism region. This region is represented by Murray Region Tourism and includes the Albury, Balranald, Berrigan, Campaspe, Corowa, Deniliquin, Gannawarra, Greater Hume, Greater Shepparton, Mildura, Moira, Murray, Swan Hill, Wentworth (including Lake Mungo National Park), Wodonga and Wakool Local Government Areas. 1 Northern Rivers 2 North Coast 3 Lord Howe Island 4 Central Coast 5Sydney 6Illawarra 7 South Coast 8 New England North West 9 The Hunter 10 Blue Mountains 11 Capital Country 12 Snowy Mountains 13Outback 14 Central NSW 15Riverina 16 The Murray 17Gippsland 18 High Country 19Goldfields 20Grampians 21 Yarra Valley/Dandenong Ranges 22Melbourne 23 Daylesford/Macedon Ranges 24 Great Ocean Road 25 Phillip Island 26 Mornington Peninsula 1 8 13 2 14 4 10 5 15 6 11 16 12 20 19 18 23 22 17 21 24 26 25 3 9 7 7 Tourism Management Highlights Key tourism activities for the period 1 January 2013 - 31 December 2013 include: • In collaboration, AlburyCity and the City of Wodonga presented their inaugural joint Tourism and Visitor Information Centre Partner Program prospectus. Positively received amongst local and regional tourism businesses, 134 partners participated in the 2013-2014 program. • Production and launch of the fourth Albury Wodonga Official Visitor Guide (OVG). Similar to 2012, the 2013 Guide was endorsed by Tourism Victoria, Destination NSW and Murray Region Tourism and subsequently featured the ‘Jigsaw’ branded front cover. • AlburyCity in collaboration with Destination NSW (DNSW) and Tourism Research Australia (TRA) conducted research on visitors to the city. The research provided a visitor profile and insights into the satisfaction levels of visitors, as part of the TRA Destination Visitor Survey (DVS) program to gain a better understanding of visitors to the region, including their motivation for visiting and satisfaction. • An online Business Event & Conference Guide was launched in February, complemented by hard copy motivational collateral in order to drive enquiries through visitALBURYWODONGA.com. • In consultation with industry and key stakeholders, AlburyCity reviewed the 2010-2013 Tourism and Destination Marketing Strategy and developed the 2014-2017 Destination Management Plan for Albury (adopted by council March 2014). Albury Tourism Monitor 8 Albury Tourism Monitor Tourism Management Highlights (cont) 2013 was a busy year for the city with the Events Team providing assistance and facilitation of services, as well as hosting a huge calendar of events, including: • Margaret Court Cup (Tennis) • Carols by Candlelight • International Schools Tennis Cup • Ovens & Murray Football & Netball Grand Final • Australian Country Junior Basketball Cup • Albury Wodonga International Horse Trials • Nail Can Hill Run • Country Week Tennis • Italian Connection Tour • National U/15 Volleyball Championships • Music in the Gardens Series • Border Stargaze • Lake Hume Open Water Bridge Swim • Swan Classic (Netball) • Albury Wodonga Football Association Grand Final (Soccer) • WNBL - Canberra Capitals vs. Sydney Uni Flames • Albury Wodonga Eisteddfod • Great Murray River Basketball Jamboree • Chryslers on the Murray • National Veteran’s Badminton Championships • Albury Gold Cup Carnival • National Model Aero Championships • The Beatles Festival • Twin Cities Basketball Classic • Albury Wodonga Gift (Athletics) 9 Tourism Management Highlights (cont) Advertising, promotion and online activity to key markets included: • In conjunction with Murray Region Tourism, AlburyCity hosted “Huey’s Kitchen”; filming several Albury Wodonga segments featuring local attractions and markets. • Sydney Melbourne Touring Product Manual - nine 1/3-page ads for key tourism products in Albury. • Five-page feature article in the Regional Stopover section of REX’s “OUTthere” magazine, promoting tourism in Albury. • Numerous Albury events promoted via Aurora’s NSW Visitor Information Centre (VIC) newsletter, which is distributed to more than 100 VICs across NSW. • Half page ad in “North East Tourist News” promoting Albury Wodonga and Lake Hume during the spring and summer season targeting leisure and visiting friends and relatives travellers. • Feature article in CIM (Australia’s leading business events magazine) on recent developments and events in Albury Wodonga. • Three articles published in “The Weekly Times” promoting the Flying Fruit Fly Circus, Albury’s CBD Historic Building Walking Tour app and Albury’s Community Wood Fired Oven. • Conducted an interview on 2GB’s Sunday morning travel show highlighting Albury Wodonga’s attractions, accommodation, and food and wine options. • “Regional Victoria Planners Guide 2014-15” - full page ad promoting Albury’s business event market. • Feature article in the Herald Sun’s “Escape Magazine” featuring the Bonegilla Migrant Experience Heritage Park. • Full-page ad in “Trade Travel” promoting Albury Wodonga to the coach group and seniors markets. • Five-page spread in the “ Destinations for the Discerning Traveller” magazine, promoting Albury as a destination of choice for the leisure market. • Full-page article in the “Pharmacy Guild of Australia” (Guild Bulletin) promoting Albury as a destination of choice. • Continued the Google AdWords campaign to increase visitation to visitALBURYWODONGA.com. • Management of presence on websites including - visitALBURYWODONGA.com, www.visitvictoria.com, www.visitnsw.com, www.sydneymelbournetouring.com.au, www.visitthemurray.com.au (including app). • Ongoing growth of the @VisitAW Twitter account (70.5% increase in followers). Albury Tourism Monitor 10 Tourism Management Highlights (cont) Tradeshows, conference and business event activities included: • Canberra Times Home, Leisure, Travel, Caravan, 4WD & Camping Show and Sydney Caravan, Camping, RV & Holiday Supershow. • Australian Regional Tourism Network Conference in Margaret River • Associations Forum National Conference. • I n conjunction with Murray Region Tourism and Mildura Business Events, hosted a dinner with 25 qualified business event buyers in Melbourne. • Asia Incentive Marketing Expo in Melbourne. • Pitched Albury as a preferred destination for a variety of major conferences in 2013, 2014 and 2015. Industry development activities included: • Hosted a number of tourism industry workshops to improve industry knowledge and product packaging. • Provided various familiarisations of key tourism assets in Albury Wodonga to local and state tourism personnel. •P resented to numerous groups with topics including product development, the Tourism Partner Program and an overview of tourism in Albury. •A ttended monthly Albury Wodonga Motel Association meetings and quarterly Boutique Accommodation, North East Victoria VIC group, Murray VIC managers and Murray Region Tourism Managers meetings. Albury Tourism Monitor 11 Albury Tourism Monitor Results Key tourism results for the period 1 January 2013 - 31 December 2013 include: • visitALBURYWODONGA.com received over 53,000 unique visitors during the year. Visitation to the website was most active during January, with an additional peak during April (largely attributed to ANZAC Day). Users of visitALBURYWODONGA.com were most 2013 Website VisitaGon interested in pages relating to What’s On, Accommodation, Things to Do and See, Food and Wine and Hot Deals. visitALBURYWODONGA.com • The Google AdWords campaign continued during 2013 in order to build traffic to visitALBURYWODONGA.com. As a result, the campaign attracted 35.3% of total visitation. 10,000 2013 Website Visitation visitALBURYWODONGA.com 9,000 Unique Visitors 8,000 Total Visitors 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 12 Results (cont) • The Visitor Information Centre has built a strong and reliable Twitter account over the past 12 months. Tweets efficiently promote local events, partner and tourism products as well as dispersing local information when relevant (such as fire warnings). As of 1 January 2013, the @VisitAW account had 509 followers, which grew to 868 by 31 December 2013, an annual growth of 70.5%. • During 2013 the Albury Visitor Information Centre (AVIC) serviced approximately 19,050 walk-in visitor groups, 2,700 telephone and email visitor enquiries, and over 720 industry enquiries. These enquiries reflect the number of service units i.e. individuals or groups provided with one-on-one customer service. • Feedback from Tourism Partners, visitors and other tourism operators has been excellent, with numerous letters of appreciation received. • For the period 1 January 2013 to 31 December 2013, over $42,000 in direct accommodation bookings were made with Tourism Partners (ie. where an accommodation provider is phoned and a booking made on behalf of a visitor). During the past calendar year, direct bookings decreased by 26.3%. The decrease in bookings may be a reflection of the increasing trend of travellers to access information and make bookings via smart phones and tablets while travelling rather than seeking assistance from the VIC. Note: AlburyCity does not charge a commission for bookings. Also it is important to note that this value does not reflect when a visitor opts to arrange their own booking, in which case AVIC staff generally make two or three property recommendations that they believe will meet the visitor’s needs, expectations and budget. Albury Tourism Monitor 13 Visitor Statistics Albury Domestic Overnight Visitors Domestic overnight visitors form the backbone of Albury’s tourism industry. During 2013, over 47% of visitors came to see friends and relatives, while holiday travellers accounted for 25% of visitors. 475,000 domestic overnight visitors came to Albury in 2013, staying for 1,078,000 nights. Of these visitors: • 120,000 were in Albury for holiday and leisure purposes and stayed an average 2.53 nights. • 223,000 were visiting friends and relatives and stayed an average 2.28 nights. • 68,000 were in Albury for business and stayed an average 2.11 nights. • 64,000 were in Albury for other reasons and stayed an average 1.84 nights. While the number of domestic overnight visitors to Albury has increased by 13.64%, visitor nights have decreased from 1,142,000 nights during 2012 to 1,078,000 during 2013. Albury’s domestic overnight visitors spent an average of $157.00 per night during 2013 resulting in an estimated total spend in excess of $209 million. When compared to 2012’s visitor impact of $145 million ($127.00 per night) the economic contribution to the city has grown substantially. Domestic Daytrip Visitors Domestic day-trippers include anybody who travelled a distance of at least 50 kilometres from their home to visit Albury, this may include visitors from Beechworth, Wagga, Corowa and other nearby destinations. Of the estimated 1,118,000 day trip visitors who travelled to Albury over the last twelve months: • 450,000 came for holiday and leisure purposes. • 184,000 visited friends and relatives. • 188,000 were in the city on business. • 296,000 visited for other reasons. Albury experienced a dramatic increase (66.6%) in the number of day trip visitors when compared to 2012. During 2013, day trip visitors to Albury spent an estimated $218.3 million in the city - an average of $173.00 per visitor. This is a considerable increase to visitor spend when considering day trip visitors spent an estimated $86.6 million during 2012 (an average of $129.00 per visitor). Albury Tourism Monitor 14 Visitor Statistics Albury (cont) International Overnight Visitors 15,591 international overnight visitors spent a total of 181,404 nights in Albury in 2013. Of the 15,591 international overnight visitors: • 7,383 visited for holiday and leisure. • 4,500 came to the city to visit friends and family. • 2,465 were on business. • 1,243 came for other reasons (including education and employment). Interestingly, the number of international visitors to Albury grew by 35% when compared to the previous year, however the number of nights international visitors spent in Albury has dropped by 5.5%. While international visitors only account for 3.28% of total visitors to Albury, this market does present opportunity for growth. Albury Tourism Monitor 15 Visitor Statistics Wodonga Domestic Overnight Visitors 88,000 domestic overnight visitors came to Wodonga in 2013, staying for 257,000* nights. Of these visitors: • 25,000* were in Wodonga for holiday and leisure purposes and stayed an average 1.92 nights. • 55,000 were visiting friends and relatives and stayed an average 3.4 nights. • 7,000* visitors were in Wodonga on business and stayed an average 2.85 nights. • 1,000* visited for other reasons and stayed an average 1 night. Domestic Daytrip Visitors Domestic day-trippers includes anyone who travelled a distance of at least 50 kilometres from their home to visit Wodonga; this may include visitors from Bright, Myrtleford, Wangaratta, and other nearby destinations. Of the estimated 145,000 day trip visitors who travelled to Wodonga over the last twelve months: • 58,000 came for holiday and leisure purposes. • 48,000* visitors visited friends and relatives. • 3,000* were in the city on business. • 35,000* visited for other reasons. International Overnight Visitors 4,301* international overnight visitors spent a total of 45,703* nights in Wodonga in 2013. Of the 4,301* international overnight visitors: • 1,316* visited for holiday and leisure. • 2,653* came to the city to visit friends and family. • 259* were on business. • 73* came for other reasons (including education and employment). Due to the small sample size, * values contained within the abovementioned have a confidence interval greater than 50% and are deemed to be unreliable by TRA. Albury Tourism Monitor 16 Albury Tourism Monitor Financial Impact The financial impact of tourism activity in Albury Wodonga was examined using spending and visitor data from TRA and the Tourism Module of REMPLAN’s Regional Economic Modelling Software. The key financial findings are: Visitor Type Domestic Overnight Domestic Daytrip International Overnight Direct Tourism Impact Indirect Tourism Impact Total ECONOMIC IMPACT OF TOURISM IN ALBURY WODONGA Visitor Numbers/Nights Average Daily Spend $ (Dec 2013) 1,334,000 (nights) $157^1 1,262,000 (visitors) $173^1 227,107 (nights) $92 1^2 As determined using REMPLAN. ABS and TSA data. Visitor Impact $209.4M $218.3M $20.9M $310.4M $254.04M $564.44M The $310.4 million direct tourism impact calculated above was further analysed using REMPLAN Economic Modelling Software and Australian Bureau of Statistics (ABS) Tourism Satellite Account (TSA) data to determine that the indirect tourism impact is $254.04 million. Albury Wodonga’s Gross Regional Product (GRP) as at December 2013 was $5.04 billion. This financial analysis and REMPLAN’s Regional Economic Modelling Software were also used to calculate the employment impact of tourism in Albury and Wodonga. It is estimated that 1,991* direct jobs were supported by the tourism industry. A further 959* people were indirectly employed as a result of industry activity, bringing the overall number of owners and employees to 2,950*. When taking into account the population multiplier (partners and children) of 2.7 persons per business owner or employee, a total of 7,965 people were supported by tourism. ^1 ‘Travel to the Murray region – Albury Wodonga’ (YE December 2013) report, Tourism Research Australia ^2 ‘Travel to NSW’ (YE December 2013) report, Tourism Research Australia * These positions are not full time equivalent (FTE) 17 Conclusion Tourism plays an important role in the social, cultural and economic vibrancy of Albury. As demonstrated in the Tourism Contribution graphs (Appendix 5), the effect of tourism is not limited to the Accommodation, Cafes & Restaurants and Retail sectors; the indirect financial and employment benefits filter through to all but a few industries. Since undertaking responsibility for tourism, AlburyCity has worked energetically to increase the industry’s contribution to the sustainable growth and development of Albury and the region. Substantial work has also been undertaken to further develop analysis tools required for effective marketing and promotion, strengthening ties with key national, state and regional industry groups and stakeholders, actively driving growth in the business, sports and recreation events market and providing high quality visitor information services and experiences. Collaboration with the City of Wodonga to present the inaugural joint Tourism and Visitor Information Centre Partner Program prospectus, and subsequently, the Albury Wodonga Official Visitor Guide, provides a clear example of how AlburyCity has listened to, and worked with local industry, key stakeholders and the general public to increase visitation, length of stay and spend to the region through clear messaging of a single entity. The support of local and regional businesses, reflected in the growth of participation in the Tourism and Visitor Information Centre Partner Program, is an indication that we are heading in the right direction. The key findings from the 2014 Albury Tourism Monitor, most notably the 13.6% increase in the number of overnight visitors, are also a positive sign that Albury’s reputation as one of Australia’s leading regional destinations is continuing to build. Consequently, AlburyCity continues to take a leadership role in tourism, working with industry to increase its contribution in sustainable growth and development and implementing the recently endorsed 2014 - 2017 Destination Management Plan for Albury. Tracey Squire Director Economic Development & Tourism AlburyCity Albury Tourism Monitor Appendix 1 Domestic Overnight Visitors: Graphs Definitions Domestic Overnight Visitors (DOV) An Australian resident who has travelled at least 40km from their home for a period of less than 12 months. Graphs Domestic Overnight Visitors • By Purpose Albury - All Purpose • Average (2000-2013): Top 25 Regional NSW & VIC - All Purposes • AAR%C (2000-2013): Top 25 Regional NSW & VIC - All Purposes • Average (2000-2013): Albury & Surrounds - All Purposes • By Origin (2013) Albury - All Purposes • By Season Albury - All Purposes • By Age Profile Albury - All Purposes • By Accommodation Type Albury - All Purposes • By Transport Type Albury - All Purposes • By Travel Party Albury - All Purposes • By Top Activities Albury - All Purposes • By No. Stopovers Albury - All Purposes Note: * Values contained within the abovementioned graphs have a confidence interval greater than 50% and are deemed to be unreliable. Albury Tourism Monitor Albury Tourism Monitor Domestic Overnight Visitors by Purpose Albury - All Purposes Domestic Overnight Visitors by Purpose Albury - All Purposes Key Highlight: 475,000 people visited Albury in 2013: 223,000 were visiting friends and relatives while a 120,000 were visiting for holiday and leisure. 700 592 600 538 500 552 535 485 475 471 438 No. Visitors (000's) 432 400 390 392 2009 2010 418 418 2011 2012 342 300 200 100 0 2000 2001 2002 Holiday or leisure 2003 2004 2005 2006 2007 Visiting friends and relatives 2008 Business Other Total 2013 Albury Tourism Monitor Domestic Overnight Visitors (Average Domestic Overnight Visitors (Average 2000 - 2013) Top 25 Regional NSW & 2000-2013) VIC - All Purposes Top 25 Regional NSW & Vic - All Purposes 1200 Key Highlight: Albury is the 16th most visited destination in regional NSW and Victoria. Albury’s position remains unchanged from last year. 1000 No. Visitors (000's) 800 600 400 200 0 Shoalhaven Region Eurobodalla Ballarat Albury Clarence Valley Coffs Harbour Surf Coast Blue Mountains Mildura Snowy River Bass Coast East Gippsland Bega Valley Dubbo Wagga Wagga Port Macquarie-Hastings Bendigo Region Campaspe Tweed Region Alpine Port Stephens Region Great Lakes Byron Bay Tamworth Region Wingecarribee Albury Tourism Monitor Domestic Overnight Visitors (AAR% Change 2000 - 2013) Top 25(AAR%C Regional NSW & VIC - All Purposes Domestic Overnight Visitors 2000-2013) Top 25 Regional NSW & Vic - All Purposes Key Highlight: 9 of the top 25 destinations recorded a growth in total visitor numbers between 2000 and 2013. During this period, Albury experienced a 1.23% decrease. 4.00% 3.00% Annual Average % Change 2.00% 1.00% 0.00% -1.00% -2.00% -3.00% Tweed Region Colac-Otway Great Lakes Surf Coast South Gippsland Wagga Wagga Blue Mountains Port Macquarie-Hastings Tamworth Region Shoalhaven Region Bendigo Region Bass Coast East Gippsland Clarence Valley Bega Valley Bathurst Region Ballarat Eurobodalla Albury Byron Bay Campaspe Alpine Snowy River Port Stephens Region Warrnambool Albury Tourism Monitor Domestic Overnight Visitors (Average Overnight 2000 - 2013) Albury & Surrounds - All Purposes Domestic Visitors (Average 2000-2013) Albury & Surrounds - All Purposes 600 Key Highlight: On average, Campaspe (484,000 visitors) and Albury (465,000 visitors) remain the two most popular destinations in the region. 500 No. Visitors (000's) 400 300 200 100 0 Albury Wagga 1 Wagga Alpine Greater Shepparton Moira Wangaratta Indigo Wodonga Corowa Benalla Berrigan* Mount Buller Resort* Deniliquin Strathbogie Murray* Greater Hume* Towong Mount Hotham Resort* Falls Creek Resort* Campaspe Domestic Overnight Visitors by Origin (2013) Albury - All Purposes Albury Tourism Monitor Domestic Overnight Visitors by Origin (2013) Albury - All Purposes Key Highlight: Regional NSW and Regional VIC were the source of 60% of domestic visitors to Albury during 2013. 11% 17% 24% 36% 12% Melbourne Other - Victoria Sydney Other - NSW Other - States Albury Tourism Monitor Domestic Overnight Visitors by Season Albury - All Purposes Domestic Overnight Visitors by Season Albury - All Purposes Key Highlight: 2013 saw visitors increasing their travel during autumn, spring and summer with travel during winter dropping. 200 180 160 No. Visitors (000's) 140 120 100 80 60 40 20 0 2000 2001 2002 2003 2004 Summer 2005 2006 Autumn 2007 Winter 2008 2009 Spring 2010 2011 2012 2013 Albury Tourism Monitor Domestic Overnight Visitors by Age Profile Albury - All Purposes Domestic Overnight Visitors by Age Profile Albury - All Purposes 300 Key Highlight: 2013 saw an increase in visitors aged between 15-24, 45-64, 65+ years travelling to Albury, while the number of visitors aged between 25-44 years declined slightly. 250 No. Visitors (000's) 200 150 100 50 0 2000 2001 2002 2003 2004 15 - 24 2005 2006 25 - 44 2007 45-64 2008 2009 65+ 2010 2011 2012 2013 Albury Tourism Monitor Domestic Overnight Visitors by Accommodation Albury - All Purposes Domestic Overnight Visitors by Accommodation Type Albury - All Purposes Key Highlight: Consistent with past years, roughly 50% of Albury’s visitors during 2013 choose to stay in paid accommodation. 350 300 No. Visitors (000's) 250 200 150 100 50 0 2000 2001 2002 2003 2004 2005 Hotel, resort, motel or motor Inn 2006 2007 2008 2009 2010 Friends or relatives property 2011 2012 2013 Other Albury Tourism Monitor Domestic Overnight Visitors by Transport Type Albury - All Purposes Domestic Overnight Visitors by Transport Type Albury - All Purposes Key Highlight: The preferred method of transport for visitors to Albury is private or company vehicle (85%). 600 500 No. Visitors (000's) 400 300 200 100 0 2000 2001 2002 2003 2004 2005 2006 Private or company vehicle 2007 2008 2009 2010 2011 Other transport 2012 2013 Albury Tourism Monitor Domestic Overnight Visitors by Travel Party Albury - AllVisitors Purposesby Travel Party Domestic Overnight Albury - All Purposes 300 Key Highlight: Those travelling alone, as adult couples or with family and friends increased over the past year. 250 No. Visitors (000's) 200 150 100 50 0 2000 2001 2002 2003 Travelling alone 2004 2005 2006 Adult couple 2007 2008 2009 2010 2011 Family and friend groups 2012 2013 Other* Albury Tourism Monitor Domestic Overnight Visitors by Top Activities Albury - All Purposes Domestic Overnight Visitors by Top Activities Albury - All Purposes Key Highlight: Eating out continues to be the most popular activity amongst Albury’s domestic visitors followed by visiting friends and family. 350 300 No. Visitors (000's) 250 200 150 100 50 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 Eat out at restaurants Visit friends and relatives General sightseeing Go shopping 2009 2010 2011 2012 Pubs clubs discos etc 2013 Albury Tourism Monitor Domestic Overnight Visitors by No. Stopovers Albury - All Purposes Domestic Overnight Visitors by No. Stopovers Albury - All Purposes Key Highlight: Albury’s location between Melbourne and Sydney could account for the 72% of visitors who stopped in Albury as part of a longer trip. 450 400 350 No. Visitors (000's) 300 250 200 150 100 50 0 2000 2001 2002 2003 2004 2005 Destination was only stopover 2006 2007 2008 2009 2010 2011 2012 Trip included multiple stopovers 2013 Appendix 2 Domestic Visitor Nights: Graphs Definitions Domestic Visitor Nights (DVN) The number of nights spent by a domestic visitor in a Local Government Area. Graphs Domestic Visitor Nights • By Purpose Albury - All Purposes • Average (2000-2013): Top 25 Regional NSW & VIC - All Purposes • AAR%C (2000-2013): Top 25 Regional NSW & VIC - All Purposes • Average (2000-2013): Albury & Surrounds - All Purposes Note: * Values contained within the abovementioned graphs have a confidence interval greater than 50% and are deemed to be unreliable. Albury Tourism Monitor Albury Tourism Monitor Domestic Visitor Nights by Purpose Albury - All Purposes Domestic Visitor Nights by Purpose Albury - All Purposes 1600 1400 1,285 1,290 1,344 1,368 1,289 1,191 1200 No. Visitors Nights (000's) Key Highlight: Albury’s domestic visitor nights dropped during 2013. Visitors staying in Albury while visiting friends and family spent more nights in the city compared to business and holiday and leisure travellers. 1,142 1,087 1,004 1000 1,078 1,027 940 912 800 728 600 400 200 0 2000 2001 2002 Holiday or leisure 2003 2004 2005 2006 2007 Visiting friends and relatives 2008 2009 Business 2010 2011 Other 2012 2013 Total Albury Tourism Monitor Domestic Visitor Nights (Average 2000 - 2013) TopNights 25 Regional NSW & VIC - All Purposes Domestic Visitor (Average 2000-2013) Top 25 Regional NSW & Vic - All Purposes Key Highlight: Albury holds its position as being the 24th most stayed destination based upon domestic visitor nights in regional NSW and regional Victoria. 4,000 3,500 No. Visitors Nights (000's) 3,000 2,500 2,000 1,500 1,000 500 0 Shoalhaven Region Port Stephens Region Byron Bay Mildura Tamworth Mornington Peninsula Bega Valley Surf Coast Bendigo Region Kempsey 1Coffs Harbour Bass Coast Tweed Region Campaspe Ballarat Eurobodalla Great Lakes Snowy River Alpine Albury Port Macquarie-Hastings East Gippsland Clarence Valley Blue Mountains Dubbo Albury Tourism Monitor Domestic Visitor Nights (AAR%C 2000 - 2013) Top 25 Regional NSW & VIC 2000-2013) - All Purposes Domestic Visitor Nights (AAR%C Top 25 Regional NSW & Vic - All Purposes Key Highlight: Albury recorded the 4th largest average increase in domestic visitor nights in regional NSW and regional Victorian destinations during the past 13 years. 5.00% 4.00% Annual Average % Change 3.00% 2.00% 1.00% 0.00% -1.00% -2.00% -3.00% -4.00% Campaspe Great Lakes Wagga Wagga Port Macquarie-Hastings Eurobodalla Bass Coast Blue Mountains Clarence Valley Ballina Dubbo Tweed Region Ballarat Tamworth Snowy River Port Stephens Region Albury Mornington Peninsula Surf Coast East Gippsland Great Tarree Bendigo Region Alpine Shoalhaven Region South Gippsland Coffs Harbour Albury Tourism Monitor Domestic Visitor Nights (Average 2000 - 2013) Albury & Surrounds - All Purposes 1,400 Key Highlight: Albury is the 3rd most popular destination in the region in terms of domestic visitor nights. Albury’s position remains unchanged from last year. 1,200 No. Visitors Nights (000's) 1,000 800 600 400 200 0 1Albury Campaspe Alpine Wagga Wagga Moira Greater Shepparton Mount Buller Resort* Corowa Wangaratta Indigo Wodonga Berrigan* Deniliquin Murray* Falls Creek Resort* Mount Hotham Resort* Benalla Strathbogie Towong Greater Hume* Appendix 3 Domestic Daytrip Visitors: Graphs Definitions Domestic Daytrip Visitors (DDV) An Australian resident who travels more than 50km, is away for more than four hours, but does not stay overnight. Routine commuting to school or work is excluded. Graphs Domestic Daytrip Visitors • By Purpose: Albury - All Purposes • By Activity: Albury - All Purposes Note: * Values contained within the abovementioned graphs have a confidence interval greater than 50% and are deemed to be unreliable. Albury Tourism Monitor Albury Tourism Monitor Domestic Daytrip Visitors by Purpose Albury - All Purposes Domestic Daytrip Visitors by Purpose AlburyDomestic - All Purposes Key Highlight: day trip visitation to Albury was dominated by those travelling for holiday and leisure. 1200 1118 1000 No. Visitors (000's) 800 600 581 512 713 713 2011 2011 671 568 506 495 464 416 480 509 430 401 400 200 0 2000 2001 2002 Holiday or leisure 2003 2004 2005 2006 2007 Visiting friends and relatives 2008 2009 Business 2010 Other 2012 Total 2013 Albury Tourism Monitor Domestic Daytrip Visitors by Top Activities Albury - All Purposes Domestic Daytrip Visitors by Top Activities Albury - All Purposes Key Highlight: During 2013, eating out and shopping were the most popular activities undertaken by day trip visitors to Albury. 600 500 No. Visitors (000's) 400 300 200 100 0 2000 2001 2002 2003 Eat out at restaurants 2004 2005 2006 2007 Go shopping (pleasure) 2008 2009 2010 2011 Visit friends and relatives 2012 2013 Appendix 4 International Overnight Visitors: Graphs Definitions International Overnight Visitor (IOV) A person who has travelled to Australia from another country for a period of less than 12 months. Graphs International Overnight Visitors • By Purpose: Albury - All Purposes • Average 2000-2013: Top 25 Regional NSW & VIC - All Purposes • Contribution to Total Visitation - Albury Note: * Values contained within the abovementioned graphs have a confidence interval greater than 50% and are deemed to be unreliable. Albury Tourism Monitor Albury Tourism Monitor International Overnight Visitors by Purpose Albury - All Purposes International Overnight Visitors by Purpose Albury - All Purposes Key Highlight: International visitors to Albury increased by 30.06% during 2013. 25000 20,336 20000 17,604 17,405 16,617 16,350 16,594 15,029 15,157 14,265 No. Visitors 15000 15,591 15,104 11,129 11,580 11,517 10000 5000 0 2000 2001 2002 Holiday/ pleasure 2003 2004 2005 2006 Visiting friends and relatives* 2007 2008 2009 Business* 2010 2011 Other* 2012 Total 2013 Albury Tourism Monitor International Overnight Visitors (Average 2000 - 2013) Top 25 Regional NSW & VIC - All Purposes International Overnight Visitors (Average 2000-2013) Top 25 Regional NSW & Vic - All Purposes Key Highlight: The trend of coastal visitation by International visitors is consistent throughout the past 13 years. 17 of the top 25 most popular destinations for international visitors are located on the coast. 180,000 160,000 140,000 No. Visitors 120,000 100,000 80,000 60,000 40,000 20,000 0 Byron Bay East Gippsland Corangamite Moyne Ballina Coffs Harbour Surf Coast Eurobodalla Walcha* Mildura 1 Blue Mountains Bass Coast Bega Valley Tweed Region South Gippsland Port Macquarie-Hastings Port Stephens Region Ballarat North Grampians Great Lakes* Colac Otway Warrnambool Shoalhaven Region Albury Bendigo Region Albury Tourism Monitor International Overnight Visitors (Average 2000 - 2013) Contribution to Total Visitation - Albury International Overnight Visitors Contribution to Total Visitation - Albury 4.50% 4.24% 4.00% 3.50% Key Highlight: The percentage contribution of international visitors to Albury was 3.28% in 2013, an increase compared to 2012. 3.70% 3.66% 3.50% 3.61% 3.60% 3.28% 3.13% No. Visitors 2.95% 2.94% 2.92% 3.00% 2.77% 2.76% 2.48% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 2000 2001 2002 2003 2004 2005 2006 2007 % International Visitors 2008 2009 2010 2011 2012 2013 Appendix 5 Economic Impact & Occupancy: Graphs Graphs Economy • Estimated Contribution of Tourism to Sector Turnover (As at December 2013): Albury Wodonga • Estimated Contribution of Tourism to Sector Employment (As at December 2013): Albury Wodonga • Quarterly Accommodation Occupancy Rates - Albury Albury Tourism Monitor Albury Tourism Monitor Estimated Contribution of Tourism to Sector Turnover (As at December 2013) Albury Wodonga Estimated Contribution of Tourism to Sector Turnover (As at December 2013) Albury $160.00 $140.00 $120.00 $Million $100.00 $80.00 $60.00 $40.00 $20.00 $0.00 Direct Tourism Contribution Indirect Tourism Contribution Accomm & Food Services Retail trade Manufacturin g Transport, Postal & Warehousing Arts & Recreation Services Education & Training Wholesale Trade Other $132.14 $45.46 $16.10 $36.69 $9.23 $17.09 $7.81 $45.88 $11.10 $18.29 $49.02 $14.88 $2.42 $6.29 $13.95 $138.10 Albury Tourism Monitor Estimated Contribution of Tourism to Sector Employment (As at December 2013) Albury Wodonga Estimated Contribution of Tourism to Sector Employment (As at December 2013) Albury 1,200 1,076 1,000 No. Jobs 800 600 431 400 247 178 200 96 85 22 138 131 58 54 15 55 36 71 37 70 0 Accomm & Dining Direct Tourism Contribution Indirect Tourism Contribution Retail trade Transport Administra Health Arts & Manufactu & Storage, Education tive & Care & Recreation Wholesale Social ring & Training Support Services Trade Services Assistance 16 30 Rental, Hiring & Real Estate Services 1 34 6 20 Informatio Finance & n Media & Insurance Telecomm Services unications 43 Other 1,076 431 22 131 54 138 36 37 16 1 6 43 96 178 85 58 15 55 71 70 30 34 20 247 Albury Tourism Monitor Quarterly Accommodation Occupancy Rates - Albury Quarterly Accommodation Occupancy Albury 80,000 70.0% 70,000 60.0% 60,000 50.0% No. Visitors 50,000 40.0% 40,000 30.0% 30,000 20.0% 20,000 10.0% 10,000 0.0% 0 % Room Nights Occupied Room Nights Occupied Appendix 6 Data Interpretation Data Sources The primary base data used in this analysis has been sourced from the National Visitor Survey and International Visitor Survey conducted by Tourism Research Australia. Further information was also sourced from the Department of Resources, Energy & Tourism, REMPLAN - Compelling Economics and the Australian Bureau of Statistics - Tourism Satellite Account. National Visitor Survey and the International Visitor Survey The National Visitor Survey (NVS) and the International Visitor Survey (IVS) are quarterly surveys conducted by TRA. TRA is the major source of information on the characteristics and travel patterns (demographics, travel behaviour, expenditure patterns etc.) of national and international visitors. Each year TRA surveys 40,000 international and 120,000 domestic tourists. The IVS is conducted by interviewing departing, short-term international travellers over the age of 15 years who have visited Australia, while the NVS consists of telephone interviews. Data denoting enquiries received by the Albury Visitor Information Centre (AVIC) is recorded daily by AVIC employees. Google Analytics provides monthly data on the website usage of visitALBURYWODONGA.com to determine unique visitation to the website. Albury Tourism Monitor Albury Tourism Monitor Appendix 6 Data Interpretation (cont) Data Segmentation In order to reflect regional tourism trends, the following metropolitan and urban NSW and Victorian Local Government Areas have been removed from the graphs contained in this report: Banyule Bayside Booroondara Brimbank Cardinia Casey Darebin Frankston Glen Eira Greater Dandenong Greater Geelong Hobsons Bay Hume Kingston Knox Manningham Ashfield Auburn Bankstown Baulkham Hills Blacktown Botany Bay Burwood Camden Campbelltown Canada Bay Canterbury Fairfield Gosford Hawkesbury Holroyd Hornsby Hunter’s Hill Hurstville Kogarah Ku-ring-gai Lane Cove Leichardt Liverpool Lake Macquarie Victoria Maribyrnong Maroondah Melbourne Melton Monash Moonee Valley Moreland Mornington Peninsula New South Wales Liverpool Plains Manly Marrickville Mosman Newcastle North Sydney Parramatta Penrith Pittwater Randwick Rockdale Ryde Nillumbik Port Phillip Stonnington Whitehorse Whittlesea Wyndham Yarra Yarra Ranges South Sydney Strathfield Sutherland Shire Sydney Warringah Waverley Willoughby Wollongong Woollahra Wyong Albury Tourism Monitor Appendix 6 Data Interpretation (cont) Data Reliability & Confidence Intervals The NVS and IVS are capable of producing individual estimates of various visitor statistics for a specific location, each of which are subject to sampling errors. There is a confidence interval associated with each estimate, which indicates the extent that this value may vary from the true value. Understanding these confidence intervals enables users to determine when a change between years is likely to be statistically significant or when it is more likely to be the result of random variability in the data. These confidence intervals represent the maximum and minimum point estimates within which 95% of all possible samples would fall. Readers of this report should consult and understand the tables below before drawing any conclusions based on the data. NVS – 95% Confidence Interval IVS – 95% Confidence Interval Appendix 6 Data Interpretation (cont) In these tables, estimates below the dotted line have confidence intervals of less than 50%. Such estimates are closer to the values that would be obtained if a census of the entire Australian population were conducted. In this report, any value with a confidence interval above 50% has been flagged with an asterisk, as this is the threshold above which TRA considers data unreliable. For Example The estimated number of overnight visitors to a particular state was 7,000,000. Looking at the Overnight Visitors column of the NVS table, this estimate has a 95% confidence interval width of 5.5%. That is, there is a 5.5% chance that if the entire population were included in the survey a figure within the range 7,000,000, plus or minus 5.5% (between 6,615,000 and 7,385,000) would have been obtained. Albury Tourism Monitor

© Copyright 2026