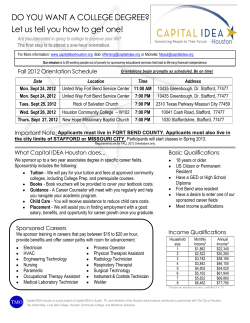

IMPORTANT!