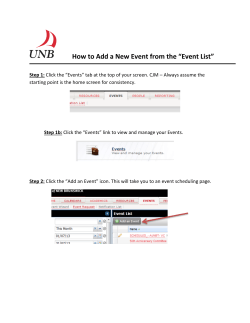

Sample Reserve Study Your City, Your State February 01, 2003