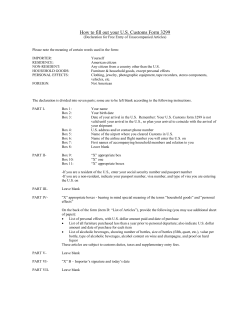

Document 295447