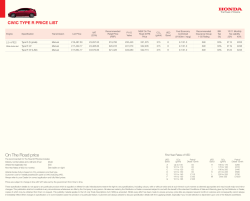

Little black book The fi eld manual to choosing