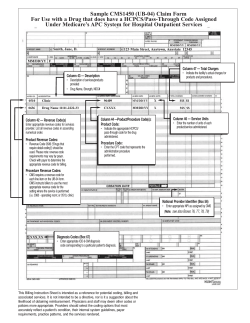

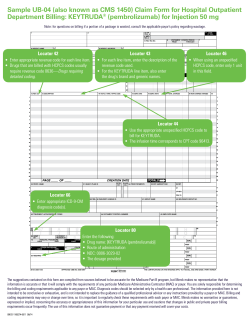

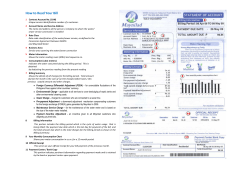

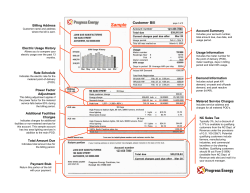

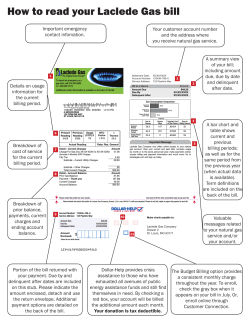

5. Billing and Payment