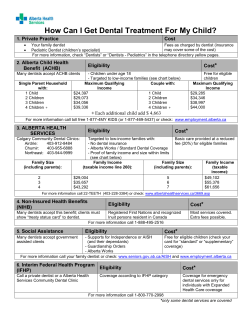

Dental Network Office Manual