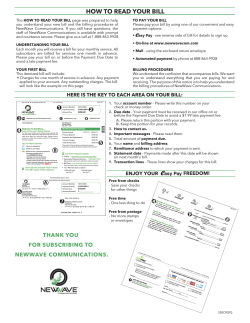

PRINT WARNING – Printed copies of this document or part... should not be relied upon as a current reference document.