Bronze Sponsors Gold Sponsor

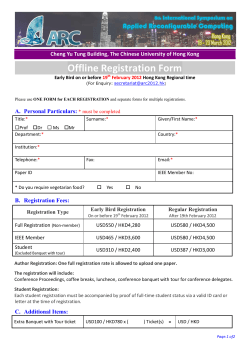

Gold Sponsor Bronze Sponsors PROVISIONAL PROGRAMME Paving the Way for a General Insurance Future Wednesday 8 October 2014 8:30am – 9:00am Registration 9:00am – 9:10am Opening Address Queenie Hui, Vice President of Actuarial Society of Hong Kong 9:10am – 9:55am Is Climate Change Increasing Typhoon, Flood and Drought Risks in Asia? Dr Graham Cook, Peak Re 9:55am – 10:40am Direct to Consumers – Challenges in the Asian Market Adrian Cheung, Direct Asia 10:40am – 11:00am Morning Tea 11:00am – 11:45am Keeping Pace with Rating Agency and Regulatory Changes Sifang Zhang, Aon Benfield 11:45am – 12:30pm RBC – Easy as 1,2,3… A Whistlestop Review of Capital and Capital Models David Menezes, Deloitte Actuarial & Insurance Solutions 12: 30pm – 1:30pm Lunch 1:30pm – 2:15pm Reaching Full Potential – From Managing Your Data to Managing Your Career Jenny Lyon, SKL 2:15pm – 2:50pm Predictive Modelling – GLMs and Price Elasticity David Dou, KPMG Advisory (China) 2:50pm – 3:25pm Understanding Customer Behaviour Using Analytics Frankie Chan, Ageas 3:25pm – 3:45pm Afternoon Tea 3:45pm – 4:20pm Why Frequent Flyer Programs (and other businesses) Need Actuaries? Ada Tong, Asia Miles 4:20pm – 5:05pm Panel Discussion – Paving the Way for a General Insurance Future Phillip Lui, Zurich Insurance Jenny Lyon, SKL Ada Tong, Asia Miles Facilitator: Colin Priest, Ageas 5:05pm – 5:15pm Closing Remarks Franz Josef Hahn, CEO of Peak Re 5:15pm – 6:15pm Networking & Drinks End of Program SPEAKER PROFILES Frankie Chan Head of General Insurance and Customer Analytics, Asia – Ageas Frankie is an Australian actuary with over 10 years of experience across General Insurance and Retail Banking. Frankie has a passion in applying analytics and modelling techniques in solving business problems, with a focus on value add. Frankie spent the first 7 years of his career in General Insurance, specializing on pricing and capital modelling in both corporate and consulting roles. Prior to joining Ageas, Frankie was the only actuary in the pricing analytics function of a major retail bank in Australia, where his job involved setting customer level interest rates for deposit and lending products. Ageas brought him back to Asia in 2013 in a regional role based in Hong Kong, where he provides advisory, mentoring and support to Ageas’ joint venture partners in Asia. Since joining Ageas he has been involved in a range of interesting projects including pricing, risk modelling and marketing analytics. Adrian Cheung Head, Group Actuary – Direct Asia Adrian has worked in the insurance industry for more than 10 years, and has been responsible for the actuarial functions at various international and local insurers and more recently, for the risk management of Direct Asia. Adrian joined Direct Asia in September 2011 where he has held various positions. In 2013, he was temporarily in charge of the Underwriting and Claims functions. Since the beginning of 2014, he has been responsible for the development and implementation of enterprise risk management framework and Internal Capital Adequacy Assessment Framework (ORSA). Prior to joining Direct Asia, Adrian was in charge of the actuarial function for AXA Greater China and AXA Corporate Solution. Adrian also previously worked for Suncorp and Trowbridge Deloitte. Graham R Cook, PhD Director, Research and Development – Peak Reinsurance Company Dr. Graham Cook hails from Melbourne, Australia, and received his Ph.D. in Engineering from John Hopkins University in 1987. After several years working as a Research Structural Engineer at the National Institute of Standards and Technology (NIST), he took a position at Applied Insurance Research (AIR) in Boston, MA. During his 8 years at AIR as Principal Engineer and Director of Wind Modeling and Research, he developed and validated natural hazard simulation models, performed damage surveys of all US landfalling hurricanes, and researched the effects of global climate change on hurricane intensity and severity. He then spent 3 years working as a Principal Modeler at Risk Management Solutions (RMS). Since 2001, he has consulted to several US and international insurance and reinsurance firms. He has developed capital allocation and dynamic pricing models, worldwide natural catastrophe and terrorism models, and enterprise risk management systems. David Dou Senior Manager, Actuarial Services – KPMG Advisory (China) David is a Senior Manager in Actuarial Advisory Services in KPMG China. He has over 12 years of insurance, risk management, and consulting experience. Before joining KPMG China, he held various positions in consulting and insurance companies. He is experienced in predictive model, pricing and product design, credit risk modeling, dynamic pricing, risk selection, marketing analytics, as well as fraud detection. Phillip Lui APAC CoE Chief Pricing Actuary – Greater China, GI Asia Pacific – Zurich Insurance Phillip Lui, FIAA, is Chief Pricing Actuary – Greater China for Zurich Insurance where he is responsible for developing and implementing robust pricing processes across personal and commercial portfolios. This includes using data analytics to draw insights for portfolio management and propositions. Prior to joining Zurich, Phillip worked as a consulting actuary in Hong Kong and Australia advising clients across Asia Pacific region on actuarial reserving, mergers & acquisition and regulatory topics. Phillip has held Certifying Actuary roles for insurers and reinsurers in Hong Kong, Singapore and Malaysia. SPEAKER PROFILES Jenny Lyon Director, SKL; Chair of Leadership and Career Development Committee for the Actuaries Institute Jenny is an actuary, experienced small business owner and director. She is currently a director of SKL, a specialist actuarial recruitment consultant which she helped to establish. Previously as Managing Director and part owner of Qed Actuarial she had over 20 years’ experience advising and recruiting actuaries across Australia, NZ and Asia. She has a strong interest in how individuals take responsibility for and enhance their career development, as well as the importance of diversity in the workplace. She is a member of the Council of the Actuaries Institute, chairs their Leadership and Career Development Committee and is a member of their Public Policy Committee. She also holds a couple of non-executive director roles. David Menezes Associate Director, Deloitte Actuarial & Insurance Solutions David is an Associate Director in Deloitte Actuarial & Insurance Solutions and is responsible for leading the firm's Hong Kong and Singapore non-life practices. David joined Deloitte in 2014 and has 14 years' experience spread between industry and consultancy. Prior to joining the firm he was the Head of Capital at a Lloyd’s of London managing agent. David has built capital models to accommodate Solvency II requirements in Europe; has experience in reserving specialty, commercial and personal lines; and has developed front-line reinsurance pricing tools. Colin Priest Regional Director, General Insurance, Asia – Ageas Colin is an Australian actuary with more than 25 years of experience in general insurance, including 5 years in Asia. Even though Colin’s actuarial work has included practically all lines of business and all types of actuarial roles, Colin has also enjoyed his experience in non-actuarial roles such as CEO of a high-tech start-up company, relationship management, portfolio management, marketing, customer analytics and artificial intelligence for video security systems. If you ask him, he will tell you an amusing story involving his project work for a pharmaceutical company… Colin currently works in a regional role for Ageas. While he is based in Hong Kong, his work tends to take him to other Asian countries. Nevertheless he enjoys his time in Hong Kong, especially the food and hiking in the mountains. Ada Tong Modelling & Insights Manager, Asia Miles Ada Tong is currently working in Hong Kong as Modelling & Insights Manager at Asia Miles. Asia Miles is a subsidiary of Cathay Pacific, and is Asia’s leading travel rewards program. Ada is passionate about using data and analytics to help businesses make better business decisions. In her current role, she analyses customer behaviour to help Asia Miles create a better customer experience for its members. Before moving to Hong Kong early last year, she worked at Quantium and PricewaterhouseCoopers, doing analytics and actuarial consulting for clients across a variety of industries. Sifang Zhang Director, Head of Rating Agency Advisory Service, APAC – Aon Benfield Analytics In his career to date, Sifang has worked in various industries including public accounting, telecommunications, insurance, and banking. He has worked in positions including financial reporting, cost modeling, corporate treasury, economic analysis, management accounting, and human resource management. During his seven years at Aon, Sifang helped a number of (re)insurers in Asia Pacific with financial strength rating application and/or maintenance. He helped clients optimize reinsurance management, capital management, and enterprise risk management from the rating agency and/or regulatory perspective. Sifang is currently responsible for Aon Benfield’s Rating Agency Advisory and Enterprise Risk Management practice in the Asia Pacific region. Assisted by the global rating advisory service team and the local analytics team, he helps clients in this region to obtain desired initial rating, to maintain existing rating, to seek upgrade and/or avoid downgrade. He also helps clients assess and improve enterprise risk management practice, and provides advice on insurance regulatory issues. Dear colleagues, With the increase in general insurance activity in the region and the growing popularity of data analytics, the Actuarial Society of Hong Kong (ASHK) would like to invite you to the inaugural General Insurance and Data Analytics Seminar in Hong Kong. Our theme this year is “Paving the Way for a General Insurance Future”. This seminar covers a variety of topics, with distinguished speakers from various companies to address the theme. We aim to generate discussions on how to stay ahead of the analytics game, keep abreast of regulatory changes, and hope that participants see how actuaries can be a crucial part of the general insurance industry's evolution. I am confident this one day seminar will foster increased knowledge sharing and interaction between members of our community and to promote the value of actuaries in this new and exciting world. Please join us in this first-ever ASHK general insurance seminar held in Hong Kong. We look forward to seeing you. Queenie Hui Vice President, Actuarial Society of Hong Kong Book by 5 September 2014 for Early-bird Discount Name : Company Name : Contact Person : Tel : Fax : Email : Registration Fee (Deadline for Registration : 24 September 2014) Cheque made payable to “The Actuarial Society of Hong Kong” should be sent to us by mail at 2202 Tower Two, Lippo Centre, 89 Queensway, Hong Kong on or before 24 September 2014. Please note cancellations made after 24 September 2014 or no shows will be charged at full rate. Early Bird (On or before 5 September 2014) Normal Rate (After 5 September 2014) ASHK Member HKD 1,400 HKFI Member HKD 1,400 Non Member HKD 1,700 ASHK Member HKD 1,600 HKFI Member HKD 1,600 Non Member HKD 1,900 Cancellation Policy Cancellations must be made by contacting [email protected] in writing. Cancellation before 24 September 2014 will be subject to a HK$ 400 administrative charge. No refunds will be made for cancellations after 24 September 2014. The Society reserves the right to cancel the seminar if conditions warrant. Please return your completed form with your payment to: The Actuarial Society of Hong Kong ‐ 2202 Tower Two, Lippo Centre, 89 Queensway, Hong Kong FAX : (852) 2147 2497 EMAIL : [email protected] Venue : Hotel ICON - 17 Science Museum Road, Tsim Sha Tsui East, Kowloon, Hong Kong

© Copyright 2026