Budget 2015 Breakfast Briefing Rated 4/5 over last

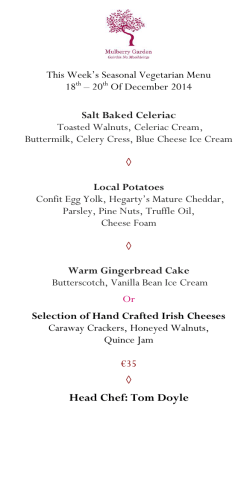

Budget 2015 Breakfast Briefing Budget 2015 deconstructed Rated 4/5 over last 3 years Speakers EVENT DETAILS Dublin Tim Lynch Tax Director Cork Mark Barrett Tax Partner with panellists including: Andrew Gallagher President, Irish Tax Institute Arthur Beesley Economics Editor, The Irish Times Martin Murphy Managing Director, HP Fergal O’Brien Head of Policy and Chief Economist, IBEC John Cuddigan Tax Partner with Guest Speaker Eoin Gunn Senior Relationship Manager, AIB Business Banking Arrive at your desk having heard the tax implications, as well as the commercial and economic reactions to Budget 2015 Dublin: Shelbourne Hotel, Dublin 2 Cork: Radisson Blu Hotel, Little Island, Cork Time: 07.45 – 09.00 Price: €45 Table of 10 Price: €400 Wed 15 Oct 2014 1 HOUR CPD Book online at www.taxinstitute.ie Email: [email protected] Tel: +353 1 663 1700 SPEAKER Biographies BOOKING FORM Budget 2015 Budget 2015 Breakfast Briefing Breakfast Briefings Budget 2015 deconstructed Expert analysis of Budget 2015’s tax technical developments and economic implications. I wish to reserve: places: Price: €45 Price: €400 I wish to reserve a table for 10: These essential briefings on 15 October 2014 will include technical updates by Tim Lynch of KPMG in Dublin and by Mark Barrett of Ronan Daly Jermyn, and Vice-President of the Irish Tax Institute; and John Cuddigan, Ronan Daly Jermyn, in Cork. Membership Ref. No(s).: / I wish to attend (please tick): Dublin The technical briefing in Dublin will be followed by a panel discussion. Tap into the knowledge and experience of our expert tax technical speakers: / Cork Surname: First Name: Surname: First Name: Surname: First Name: (if more than 3 attendees please attach details) Tim Lynch is a Director with KPMG and advises a wide range of Private Irish Businesses in various sectors on all tax matters affecting companies, partnerships and individuals. Tim’s clients include professional services firms, investment funds, insurance companies, Irish headquartered public companies, and Irish subsidiaries of non-Irish public companies. His client base has allowed him to gain extensive experience in advising on international tax structures, mergers and acquisitions and restructuring. Tim is involved with charitable and sporting bodies in considering tax issues affecting them. He is a Chartered Accountant (ACA) and an AITI Chartered Tax Adviser (CTA). Firm/Company: Address: Tel.: Email: I wish to pay by cheque made payable to “Irish Tax Institute” I wish to pay by credit/debit card Card Type: Mark Barrett is a Tax Partner with Ronan Daly Jermyn and an AITI Chartered Tax Adviser (CTA). Mark has worked in tax for over 20 years in both industry and practice and has advised Irish and multinational clients on a wide range of tax matters. He is Vice-President of the Irish Tax Institute and is one of the Institute’s representatives on Main TALC. He chairs the South West Region Branch Network for the Institute. MasterCard Visa Visa Debit AmEx Card Holder: Billing Address: (If different from above) Card No.: John Cuddigan is a Tax Partner with Ronan Daly Jermyn and an FITI Chartered Tax Adviser (CTA). He specialises in the provision of tax consultancy services to corporates and high net worth individuals. He has lectured extensively and presented seminars on various tax matters for the Irish Tax Institute and the Law Society of Ireland and is currently a member of the Taxation Committee of Law Society of Ireland. John is co-author of the Institute publication FINAK – Finance (No. 2) Act 2013 Explained. Expiry Date: Total Price: € Signature: Date: Please return this form to: Irish Tax Institute South Block, Longboat Quay Grand Canal Harbour, Dublin 2 Tel.: +353 1 663 1700 Email:[email protected] www.taxinstitute.ie Feedback from last year’s attendees Refund Policy: Full refund for written cancellations received up to five working days prior to the event, but no refund thereafter. An alternative attendee can be nominated at any time up to and including the day of the event. There is no credit allowed for non-attendance. “As good and informative as is always the case” Data Protection: Your personal information will be processed in accordance with the Data Protection Act 1988 and 2003. We will use your information to process your booking form. And where appropriate compiling a delegate list which will only be available at the conference in the delegate pack. If you do not wish your name and company name to be included in the delegate list please email [email protected]. We would like to retain your details on our database in order to keep you informed about future services from the Institute. If you do not wish do receive such communication please opt out by ticking this box “Good speakers and content” “Very well presented” Book online at www.taxinstitute.ie

© Copyright 2026