6 - 11 October 2014 Bangalore & New Delhi

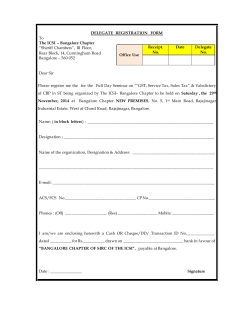

6 - 11 October 2014 Bangalore & New Delhi India has carried out a slow but steady programme of economic openness since the early 1990s, which is set to accelerate with the new Modi government and its recently unveiled programme for further rapid reforms aimed at creating jobs and boosting foreign investment. After a growth of 4.8% in 2013, the World Bank forecasts that India will grow by over 6% in the next 2 years and 7% in 2016. India has opportunities in all sectors as it expands and develops. It is a price sensitive market, but there’s a natural fit between the UK and Indian economies. UK companies offer goods, technology, services, and expertise in the areas that India has identified as critical for rapid economic development including: finance, infrastructure, energy efficiency, vocational skills, education and healthcare. Beyond Mumbai - lucrative opportunities in Bangalore & New Delhi: Although NE companies unfamiliar with India might regard Mumbai as the obvious major commercial centre to first visit; they should not ignore other regional capitals, where the opportunities are considerable and the competition from international companies weaker. Bangalore is India’s third most populous city and is widely referred to as the Silicon Valley of India because of the number of software and IT companies operating in the city. Half of India’s life science companies are also there, and tremendous opportunities lie in the state’s health sector, for trading and co-development in drug discovery and delivery. The Bangalore business model is no longer about low-cost outsourcing. Most British corporates who come to the state are involved in exciting JVs or collaboration using high-end skills and world-class levels of technical expertise. Maximising your time, resources and business opportunities: We have designed a programme visit which aims to maximise your time in India with a two city-centre itinerary including B2B meetings with potential Indian buyers/agents; visits to UK companies based in India (learning from those who’ve done it); participation at the British Business Group Convention and briefings, workshops and seminars about doing business in India. The focus of our New Delhi schedule will be three key business events: Global SME Summit; FICCI* Convention and the GB-India Business Convention. There will be ample opportunities to network, meeting new potential customers as well as have time to organise your own business meetings in both cities. * Federation of Indian Chambers of Commerce & Industry. We are collaborating with UK High Commission in New Delhi and Bangalore; UK India Business Council (who have business hubs in Bangalore and New Delhi) and the British Business Group in India. Benefits of Access India Market Visits Access India sponsored Market Visits are designed to provide NE companies with greater market support access; minimise risk and are excellent value for money. They are an efficient and effective method for companies visiting overseas markets. They can greatly facilitate the targeting of opportunities backed by pre-visit subsidised market research; provide easier routes into market including soft landings for JVs and partnership opportunities. Features include Financial contribution of £1,000 for eligible North East Companies Itinerary schedule to maximise visit opportunities with flexibility & options Options to visit cities/regions beyond the traditional centres where major opportunities may be higher than the traditional centres, which are often already saturated. Security of visiting as part of an official UK group Bespoke in-depth research available Opportunity for peer to peer support & intelligence sharing between companies Useful websites: UK Indian British Council www.ukibc.com Federation of India Chamber of Commerce & Industry www.ficci.com Who should participate? Those who have already identified that their products or services have a good potential in India and are in the initial stages of researching more market opportunities; refining product/service suitability; and/or wish to meet already identified or new potential partners. British Business Group www.britainindiaconvention.com Estimated travel package costs Proposed Programme Itinerary (TBC Tuesday 7th: Bangalore: B2B Meetings, Networking events, company visits. “How to do Business in India Briefing” Wednesday 8th: New Delhi: B2B Meetings, Tour of UKIBC offices, Thursday 9th New Delhi: Global SME Summit (free entry) Friday 10th: New Delhi: FICCI Convention & Welcome Evening Reception at UK High Commission Residence Saturday 11th: New Delh: GB-India Business Convention International flights: Internal Flights: Accommodation: Visas: Total: £608 £87 £700 £176 £1571.00 BBG Convention Fee: £175 before end July thereafter £225 To Register: Please email [email protected] Market Opportunities in India Advanced engineering: India’s 2011 National Manufacturing Policy aims to increase the sector’s contribution to GDP from 16 % to 25% by 2022 and create an additional 100 million jobs. There are opportunities for: supply of raw materials and equipment technological collaboration research and development (R&D) licensed manufacturing joint ventures technical and vocational education In the aerospace sector, the Indian government’s manufacturer HAL is currently working on at least 6 new aircraft development programmes. These involve capital expenditure of about £10 to £15 billion. The rapid growth in airlines, airports and aircraft has led to an increased need for advanced ecosystems involving building and maintaining aeroplanes. The Indian automotive sector: is worth over US$ 60 billion manufactures 21 million vehicles a year exported over 9.3 billion US$ worth of components in 2013 and is forecast to grow over 30 billion US$ by 2020. UK industry can offer expertise in vehicle development, testing and validation programmes, as well as supply chain opportunities. In the engineering sector opportunities include the supply of: equipment to the mining, metallurgical and other process industries machine tools, robotics, automation and process control products services such as training and consulting Infrastructure: The scale and range of potential opportunities in India is vast. India plans massive investment in infrastructure to meet the demand of its ambitious GDP growth target. Projects include: the building of large number of metros modernisation of airports increasing ports capacity setting up new water and sewage treatment plants Education and vocational skills: Education is a focus area for the Indian government and a $20 billion market opportunity. The government aims to: create 40 million new university places 11,000 new secondary schools increase Gross Enrolment Ratio (GER) to 30% by 2020 Current resources are unable to meet the planned reforms. Priorities include: digital learning raising the quality of teaching and learning Opportunities include: setting up an offshore campus partnering with Indian institutions to offer joint delivery of courses; curriculum development and joint research in Science, Technology, Engineering and Mathematics (STEM), humanities, arts and social sciences Skills development is the core of India’s employment strategy set out in the 2012 to 2017 Twelfth Plan. This aims to develop the skills of 500 million people by 2022 and includes a need to train 79,000 trainers. There are opportunities in: train the trainer programmes curriculum and content development accreditation and certification services employer engagement and placement strategies infrastructure planning and development policy development and technical assistance establishment of National Occupational Standards (NOS) Energy: India is the world’s fifth largest energy market and fourth largest energy consumer. It accounts for 4.4% of global energy consumption. It has set an ambitious generation capacity addition target of 118.5 gigawatt (GW). The Asian Development Bank forecasts that $2.3 trillion investment is needed to close the power deficit in the energy sector. Opportunities exist in all sectors across energy including: coal based thermal power oil and gas nuclear renewable energy The Ultra Mega Power Projects (UMPP) initiative has been launched by the Ministry of Power (MoP) in association with Central Electricity Authority (CEA) and Power Finance Corporation (PFC). This aims to develop coal based power generation. Each UMPP has a capacity of about 4000 megawatt (MW) representing an investment opportunity of about £2.46 billion per UMPP. India has 20 nuclear reactors with an installed capacity of 4780 MW. Kudankulam 1 in Tamil Nadu came on stream in 2013 adding 1000 MW. The Nuclear Power Corporation of India Limited (NPCIL) has an ambitious programme to add 4 Indigenous Pressurized Heavy-Water Reactors (PHWR) of 700 MW each by 2016 to 2017. India’s oil and gas sector contributes over 15% to GDP. 46 blocks were offered under the 10th round of New Exploration Licensing Policy (NELP X), on 12 January 2014 by the Ministry of Petroleum and Natural Gas (MoPNG). NELP X, will offer blocks covering an area of about 166,053 square kilometres in 13 sedimentary basins for competitive bidding including: 17 onshore 15 shallow water 14 deep-water water India has also set up a cross country green corridor for renewable energy with an investment of INR 420 billion (£5 billion) over a 5 year period. The investment is aimed at transmitting 40 GW of renewable energy capacity by 2030. Life sciences: The Indian biotechnology sector is anticipated to grow to £60 billion by 2025. The pharmaceutical sector is estimated to grow to £27 billion by 2020 and is dominated by generic drugs. Growth is projected due to pharmaceutical outsourcing and investments by multinational companies. Opportunities in the sector include: co-development contract research in drug discovery and development Therapeutic growth areas for R&D collaborations are: oncology diabetes regenerative medicine vaccines There is a growing demand for: regulatory stability licensing partners for innovative research contract manufacturing following global norms Licensing arrangements through R&D investments in the biopharma sector generates significant income. Recommended Travel Package International Airfares: BA1327 BA119 9W7008 BA256 BA1334 4th October 4th October 8th October 13th October 13th October Newcastle – Heathrow Heathrow – Bangalore Bangalore – New Delhi New Delhi – Heathrow Heathrow – Newcastle 1055-1210 1410- 0425* 0950-1230 1025-1450 1635-1745 Fares starting at £608 and are subject to availability and the time of booking Hotel Accommodation: Bangalore – Waiting UKIBC to recommend New Delhi Taj Palace Hotel 2, Sardar Patel Marg Palika Vihar Diplometic Enclave Chanakyapuri New Delhi 110021, India Corporate Rate starting at 8000 /9000 INR including taxes and breakfast (Companies must be registered onto Great Britain India Business Convention to obtain the above rates) Visa: Costs aprox £176.00 depending on services We recommend using CTMS Travel contact details: Agent: Irina Ligay Phone: +44 (0)20 7400 9481 Fax: +44(0)20 7117 4526 Email: [email protected] BBG Group Rate convention Fee: £175.00 before end July thereafter £225.00

© Copyright 2026