PRS Prime Re Solutions News 2/2011

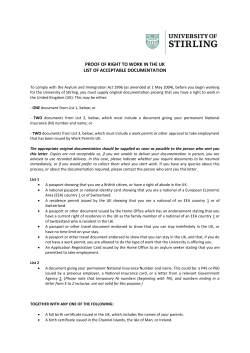

PRS Prime Re Solutions News 2/2011 Editorial by Berndt M. Räder, Chief Executive Officer Dear Reader, In the previous edition of PRS Prime Re Solutions News we introduced you to the full range of services we offer, and we would now like to give you a better idea of their direct applications. This second edition of PRS Prime Re Solutions News will familiarise you with one of the services which has made our name with many of our clients: supporting the launch of (re)insurers in Switzerland, either moving here from abroad or as a start-up. PRS really is a one-stop shop here, offering all the services you’ll need for a successful (re)insurance launch. PRS Prime Re Solutions has been growing consistently, extending both its client base and its portfolio of products, and in light of this we have decided to overhaul our website, www.prs-zug.ch. We can now provide a wider range of information and hope to give you a better idea of our consultancy and choice of services. We’d be happy if you would let us know what you think of our new homepage. As ever, we hope you find the newsletter an interesting and informative read and we look forward to your feedback. Yours sincerely, Berndt M. Räder Chief Executive Officer, PRS Prime Re Solutions AG PRS Prime Re Solutions supports brokers as well as primary and reinsurers relocating to Switzerland and Liechtenstein. Providing support for (re)insurers who are relocating or establishing either a branch or a fully licensed subsidiary in Switzerland is one of PRS Prime Re Solutions’ main activities, and our company has guided a considerable number of relocations since its foundation in 2000. Berndt Räder, CEO of PRS Prime Re Solutions, who has special responsibility for this field, explains the causes of the latest wave of reinsurance start-ups in Switzerland and sets out the things to bear in mind during relocation. What has brought about the recent spike in relocations of (re)insurers to Switzerland? PRS Prime Re Solutions AG +41 (41) 725 32 10 The majority of the (re)insurers that have recently settled in Switzerland have come from Bermuda or the Lloyd’s market and are looking to break into continental Europe – a market that is attractive and profitable as long as you adhere to its rules. In addition, upcoming capital requirements under Solvency II have forced (re)insurers to diversify, both geographically and in terms of their insurance lines. Lindenstrasse 2 +41 (41) 725 32 15 CH-6340 Zug/Baar 1/4 www.prs-zug.com There are external factors, too: Insurers in Bermuda are disconcerted as they don’t know how the tax situation there is going to develop and pressure from the United States is becoming increasingly intense. The financial crisis has also taught us the value of establishing a politically and economically stable operating base. What advantages does Switzerland offer (re)insurers? Switzerland is a historic location for (re)insurers that has grown organically and can look back on 150 years of experience in the trade. Unlike some of the newer, synthetic – or even virtual – (re)insurance locations offering poor infrastructure and scant resources, Switzerland boasts a high concentration of expertise, specialised universities and reliable, experienced and respected insurance regulators. There is also an impressive service infrastructure here supplying independent auditors, actuaries, lawyers and so on, which only increases the attractiveness of Switzerland as an insurance location. The country is also politically and economically stable – Switzerland embodies continuity. Boom and bust is not an issue. This is important, as anyone hoping to pursue a strategy in a modern world of overcapacity, narrow margins and low prices needs a reliable backdrop and planning security. Success will be incremental. What requirements should be met by a (re)insurer hoping to locate to Switzerland? Continental European insurers are not opportunistic and expect their reinsurers to stick with them through the troughs of the insurance cycle. High-value, profitable business will thus come along only over time. Thus the crucial factor in any decision to settle in Switzerland is a realistic, long-term perspective. New arrivals should not have forgotten to bring their patience and must be willing to think and act in a continental European way, taking on appropriate underwriters and looking to forge partnerships rather than seeking quick fixes driven by the pressure of quarterly reporting. Will the current trend continue? What are the limits to growth? A lot of firms have now settled in Switzerland, so there are limits to how many more can be accommodated. There is currently considerable overcapacity on the (re)insurance market, including Switzerland. Consolidation is on the cards. (Re)insurers in this country are following widely varying market strategies, however, with many concentrating on narrowly defined niches and others pursuing broadly diversified approaches. What relocation services does PRS offer its clients? PRS has been providing services for (re)insurers looking to relocate to Switzerland for more than ten years, so we have plenty of experience under our belt. We offer a modular approach: The client can choose guidance from us right from the formulation of an initial strategy to final licensing, or alternatively, select individual services as and when required. PRS Prime Re Solutions AG +41 (41) 725 32 10 Lindenstrasse 2 +41 (41) 725 32 15 CH-6340 Zug/Baar 2/4 www.prs-zug.com What are the most important steps in the relocation process? When settling in Switzerland, a viable business plan and strategic thinking are essential. Companies need to ask themselves: What sort of business do we want to conduct and in which lines and markets; how great is our appetite for risk, and how much capital should we allocate to specific risks? We then subject the business plan to the Swiss Solvency Test (SST), which reveals how much capital is required for the subsidiary according to the business plan. Once the feasibility study is complete, the next step is to register the (re)insurer with FINMA, the Swiss Financial Market Supervisory Authority, who will check the solidity and sustainability of the business plan. As we know FINMA well and have maintained close links with them for years, we are able to simulate the various assessment steps with our clients, which not only increases the chances of successful registration but also speeds up the whole process considerably. Besides these fundamental steps there are a host of organisational details by which the success of a relocation can stand or fall. These include entry in the commercial register, convening a board of directors and an executive board, obtaining legal advice and gearing up the operational side of a company launch. PRS advises companies on selecting and developing a site, office premises, and IT and telecommunications infrastructure. We help the client gain a clear understanding of local expectations regarding compensation and social benefits, assist in sourcing personnel and, if necessary, supply interim management until the organisation is up and running. We can install or host the IT architecture, manage the payroll or provide risk management or actuarial support. In short, our entire portfolio is at the client’s disposal. Four or five months usually elapse between the formulation of a viable business plan and registration; the better the preparation, the more quickly and smoothly this process will run. What are the most important considerations for a realistic calculation of costs? Actual relocation costs are comparatively reasonable: the registration fee with FINMA is about CHF 30,000, entry in the commercial register is an additional CHF 10,000 or so, and then there is prorata stamp duty payable on the capital. If the company is capitalised at CHF 50 million, the stamp duty will be CHF 50,000. How difficult is it to find staff? Compared to other locations, it has never been problematic for a new company to find good staff in Switzerland. The local market is growing and there are plenty of foreign experts willing to come to Switzerland as the job market is inviting and the quality of life high. If the firm also has an established brand and can attract highprofile names as management, it isn’t difficult to put a good team together. PRS Prime Re Solutions AG +41 (41) 725 32 10 Lindenstrasse 2 +41 (41) 725 32 15 CH-6340 Zug/Baar 3/4 www.prs-zug.com Is FINMA helpful and has it proved a reliable partner over the long term? FINMA is one of the most experienced and reliable regulatory authorities in the world, but good preparation is crucial for successful registration and subsequent supervision. We thus strongly recommend that foreign companies take advice, as this dramatically increases their chances of success. Do relocations usually live up to expectations? What are the typical mistakes made, and how can they be avoided? Most relocations live up to expectations as the only firms looking to settle and acquire a license here are ones that know the market and can put together a solid business plan. Mistakes are nonetheless made, and these are mostly due to overestimation of personal abilities. Anyone who thinks they can do it all themselves will soon fall foul of local conventions, whether in the technicalities of the (re)insurance business, in their dealings with FINMA or as they try to put together a team. Useful links: PRS Prime Re Solutions AG +41 (41) 725 32 10 Swiss Insurance Association: www.svv.ch Swiss Financial Market Supervisory Authority: www.finma.ch Website with useful information about Switzerland from the Swiss Ministry of Foreign Affairs (EDA): www.swissworld.org Business and Economic Development Division of the Canton of Zurich: www.location.zh.ch Lindenstrasse 2 +41 (41) 725 32 15 CH-6340 Zug/Baar 4/4 www.prs-zug.com

© Copyright 2026