O T Q 2014 Q

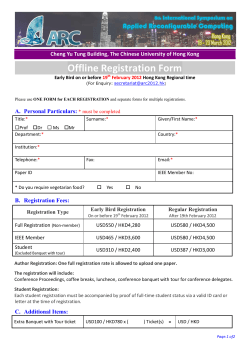

21515 Hawthorne Blvd. Suite 1200 Torrance, CA 90503 Telephone 310.543.4559 www.epwealth.com THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. - Sir John Templeton Things That Go Bump In The Night O ften when meeting with clients, we try to gain a better understanding of what they worry about – what keeps them up at night. Lately the geopolitical events have been at the top of most investors’ fears. ISIS and the Middle East, Ukraine and Russia, and now even Hong Kong are the concerns we typically hear first. The interesting thing about the geopolitical risks is that U.S. markets have remained relatively unscathed from geopolitical concerns. Certainly as the world seems unsettled, one of the safest places to invest continues to be the U.S. In many ways, domestic markets have been the beneficiary of global tensions. Since Saddam Hussein was removed from power, and his statue was dragged through the streets of Baghdad like the tin cans tied to the back of a newlywed’s car, the seeds of unrest, which had been held at bay by the stranglehold of Mr. Hussein, have been allowed to blossom. The newest iteration is a group of barbaric lawless rebels who seek to create an Islamic state in the territory they control in Northern Iraq and Eastern Syria. Similar events occurred in Iran when staunch religious leaders took the nation by force from another unscrupulous dictator. At that time the Iranians took Americans hostage, but now, in a world of instant social media, what better way to get attention and create panic than behead innocent journalists to prove that the militant religious state should be feared. America’s first response was to wait and see whether any action was needed. Since the enemy of my enemy is my friend, it is difficult to determine who is worse: the brutal Syrian President Bashar al -Assad, or the barbaric ISIS? Watching two evil empires try to destroy each other might be interesting, but it is far from humane. If America is to stand for anything, humanity is not a bad place to start. America has decided to join forces with yesterday’s enemy, and help Iraq and Syria defeat ISIS, even as that means joining forces with Assad. America does not want to put boots back on the ground in Iraq, so we, along with other nations, have launched airstrikes to destroy both ISIS’ military targets and their ability to finance their offensives. U.S. OPEC Oil Imports Billions of Barrels Per Year - 1993 to Present Source: U.S. Energy Information Administration 2.25 2.00 1.75 1.50 1.25 1.00 0.75 0.50 U.S. OPEC oil imports have declined by about 40% over the last decade, driven by increased domestic oil production. One would think that this military action would cause the price of oil to spike as fears of a warinduced supply disruption would put a significant premium in the oil market. Quite the opposite has happened. After peaking near $104 in June, the price of a barrel of oil has declined, and currently sits just below $90, a decline of more than 13%. Brent crude, the price of oil in European trading, has fallen even farther, from $113 to $95, down nearly 19%. This seems like THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK the first time in modern history that military action in the Middle East has caused oil prices to drop. The world just does not seem to work the way it used to. One of the reasons why oil prices have fallen is because global growth is so anemic. Europe continues to teeter on the brink of recession. Brazil is squarely in the midst of recession. China’s growth continues to disappoint, and expectations of 6-7% growth now seem excessive. Japan’s economy is in a tax-induced recession, and the only economy doing fairly well is the United States’. So while bombs are falling, the demand for oil remains weak, and fears of supply disruptions have been replaced with fears of continuing weak economic growth. S&P 500 Price April 2007 to Present Source: Bloomberg Data Systems 2,200 2,000 1,800 1,600 1,400 1,200 1,000 800 It is interesting to note that the U.S. has become 600 much less dependent on OPEC oil. From the peak in 400 2004 when America imported 2.09 billion barrels of oil, we are currently on pace to import less than 1.25 Stock prices have moved up in a fairly orderly fashion billion barrels this year, a decline of 40% over the following the severe decline that accompanied the Great past decade. America simply needs less OPEC oil, Recession. and that may also be a contributing factor to why oil prices are declining. The U.S. has replaced OPECsourced oil with oil produced domestically, including an astonishing increase in production driven by new technologies (yes dear reader, fracking). North American energy independence is not just talk, and Canada, Mexico, and the U.S. could cease needing foreign-sourced oil by the end of this decade. What will that do to our willingness to spend money defending the Straits of Hormuz, or supporting despicable despots in oil-rich Middle-Eastern states? As a portfolio manager, it is often healthy to be cynical – as Warren Buffett suggested “be fearful when others are greedy, and be greedy when others are fearful.” The increased military action in the Middle East appears to have two positive outcomes. First, as mentioned above, the price of oil is declining, which suggests that inflationary pressures will continue to be suppressed. Second, all those tomahawk missiles being fired at ISIS targets need to be replaced. War is typically good for the economy, and let’s be honest and recognize that every bomb, bullet and drone used during this action will need to be replaced. That will be supportive of continued economic expansion in America. Ukraine’s Economy Is The Size Of Iowa’s T Announced Mergers & Acquisitions Billions of Dollars - 2003 to Present Source: Bloomberg Data Systems $400 $350 $300 $250 $200 $150 $100 $50 $0 Merger & Acquisition activity has picked up dramatically over the past several months, reflecting higher corporate confidence in current and future business activity. hose of us who grew up with the Cold War still see Mother Russia as one of history’s greatest boogiemen. Their belligerent takeover of the Crimean peninsula last quarter ignited talk of a new Cold War. While not much has changed in Ukraine, it does seem as though the news from western Russia has become less bellicose. It is important to Page 2 THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK remember that the size of the Ukrainian economy is about the same size as that of Iowa. In a worst-case situation where Russia did militarize to annex the entirety of Ukraine, there would be little impact on global corporate profits. Completed IPOs Russia is the eighth largest economy in the world, somewhat bigger than Texas, but smaller than Billions of Dollars - 2004 to Present Source: Renaissance Capital IPO Center California. It is interesting to note that the financial $70 markets have sent a punishing message to Mr. Putin. The Russian stock market is down about 7% $60 this year, while the Rubble has declined by more $50 than 20% against the US dollar. Perhaps the $40 economic sanctions are working, or at the very least $30 the markets are showing that geopolitical hostilities $20 come with a price. Russia is discussing placing capital controls to prevent additional capital from $10 escaping the country after nearly $75 billion of $0 assets flowed out of the country during the first half of the year. One of Russia’s largest exports is oil, so they are further harmed by the recent decline in oil Initial Public Offering (IPO) activity has also increased dramatically, particularly over the past few years. While prices. While there is a certain schadenfreude in IPO activity suggests higher confidence, it may also upset seeing their economy stumble, unfortunately Russia the supply-demand balance of the stock market. does an enormous amount of trading with continental Europe, and the weakness in Russia is spreading, and adding to Europe’s difficulties. We do not expect further military action, but we realize that there is certainly the potential for a surprise that would not be welcomed by the market. High Yield Spread to Treasuries Merrill Lynch Master HY Index vs. US Treasury 7-10 Year Source: Merrill Lynch & Bloomberg Data Systems 20.0 7‐10 Yr UST HY Spread 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 High Yield spreads remain quite low by historic measures, although they have increased over the past few months (as seen in the far right side of the chart). One Country Two Systems No Longer T he unrest happening in Hong Kong at the end of September may actually be more alarming than some of the other highly visible geopolitical events happening in the world. In 1997 when the British Empire returned Hong Kong to China, the understanding was that Hong Kong would be allowed to maintain its democracy, even as it was reunited with mainland China. The free election scheduled to take place in 2017 was to permit the citizens of Hong Kong to select the Chief Executive of Hong Kong. While that election is still scheduled as planned, mainland China now wants to approve or veto the candidates running for election. The people understandably feel cheated, and have been peacefully protesting during a Chinese national celebration. The greater fear for Chinese leaders is that the unrest spreads to mainland China. The Chinese media is prohibited from carrying images of the protests in Hong Kong. However, the longer the protest lasts, the greater the likelihood that China will see protests of its own. How will the Chinese respond? Will tanks roll again? Will a lone student be able to stop the tanks in Tiananmen Square? Will the world’s second largest economy become victim to political unrest? Page 3 THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK Hong Kong used to be a significant part of Chinese GDP, but its importance has waned over the past 17 years. However, the financial markets in Hong Kong are vitally important to the Chinese economy. Over the past two years, Chinese companies have raised $43 billion in initial public offerings in the Hong Kong market versus just $25 billion on mainland exchanges. Hong Kong accounts for two-thirds of direct foreign investment into China last year, up from 30% in 2005. Hong Kong is also the home to the world’s largest “dim -sum” bond market, that is yuan-denominated bonds issued to foreign investors. Hong Kong remains the Cumulative Mutual Fund Flows - Equities Millions of Dollars - 2007 to Present financial capital of China, and any government Source: Investment Company Institute (www.ici.org) crackdown runs the risk of disrupting capital flows, $200,000 and potentially slowing the world’s second largest $100,000 economy. Toppy Or Tired C lients often fret about how well the stock market has done since the market found its footing following the end of the Great Recession, and in particular over the past two years. As Sir John Templeton indicated in the quote at the beginning of this letter, bull markets die of euphoria. They don’t die of old age. Clients fretting about how well the market has done is certainly not an indication of euphoria. In fact, from a contrarian perspective, clients’ disbelief suggest that the market can go much farther than it already has. $0 ‐$100,000 ‐$200,000 ‐$300,000 ‐$400,000 ‐$500,000 After a large exodus, money returned to equity mutual funds in 2013, but recently funds have actually been exiting equity mutual funds. Typical recessions are caused when the Federal Reserve believes that too many excesses are building up in the economy. The Fed raises interest rates in the hopes of squeezing some of those excesses out of the system. The Fed has been curtailing its purchases of bonds (called quantitative easing, or QE3 since this is the third such program that the Fed has embarked on since the bottom of the Great Recession), and that can be thought of as monetary tightening. The Fed is even trying to telegraph that interest rate increases may Real 2-Year US Treasury Interest Rates begin sooner than many investors believe. 1977 to Present Source: Bloomberg Data Systems 10.0 The Fed is on target to end its purchases of bonds at th its next meeting on October 29 . Most market 8.0 participants believe the first interest rate increases will begin around the middle of next year, although 6.0 the Fed is suggesting that interest rates could be 4.0 increased earlier in the year, perhaps as early as March. The stock market often accepts the first few 2.0 interest rate increases as a sign that the economy is 0.0 doing well, and the market often continues to advance even after the Fed begins raising interest ‐2.0 rates. At some point the market’s psychology changes, and further interest rate increases are a ‐4.0 sign that the Fed has slowed the economy so much Real interest rates show the actual interest rate earned net of inflation. Real 2-year interest rates remain quite low, that it may cause a recession, and the stock market but have increased over the past few months. will begin to stumble. Bull markets can die from exposure to unfriendly monetary policy. It is unlikely that the Fed will be able to cause a recession in 2015, and it may not happen before the next Page 4 THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK presidential election in 2016. That would indicate the next recession might not occur before 2017, or perhaps later. While we are on the subject of elections, it seems that very few of the electorate really care that the complete House of Representatives and 36 senators are due to be elected on November 4th. The lack of concern regarding the outcome of an election slightly more than 30 days from now reinforces that our nation will get the government we deserve. It is highly unlikely that we will be represented by people who actually accomplish anything when we don’t really care who represents us. Gerrymandered districts imply that most Representatives will run virtually unopposed, allowing the fanatical fringe of both parties to be elected, even as they have no hope of leading or governing. When we want to reform the tax code, change our laughable immigration policies, rescue social security and Medicare, reform entitlement spending and reduce deficits, then we will have to elect leaders and governors – people who can compromise and legislate. That is their job after all. Until we demand a change, we will continue to have elected representatives that should be strapping children into carnival rides, not serving the people. The senate will probably fall under Republican control, but nothing will change. Our 60-vote majority system suggests that moving six senators from blue chairs to red means nothing, and that is precisely what will get accomplished over the next two years. The financial markets have, in all likelihood, already anticipated this result. The U.S. stock market has gone up with very little volatility, and very few corrections. We did have a 5% correction in January-February of this year, but the last 10% correction was actually in the spring of 2012, nearly 2 ½ years ago. Isn’t the market due for a correction?? The answer is of course the market is due for a healthy correction, but that does not necessarily mean we will get one. As prices correct, buyers have continued to enter the stock market, preventing the market from falling further. There have, however, S&P 500 Capitalization vs. GDP been some recent signs that the market is a bit tired, 1990 to Present Source: Bloomberg Data Systems and may even be somewhat toppy. 140% 120% 100% Here is our take on some of the signs that suggest to us that the market may be more receptive to a healthy correction than it has been so far: 80% Pick-Up In Merger & Acquisition (M&A) Activity. It is undeniable that there has been a significant pick40% up in announced M&A activity. Some of this activity has been driven by the desire for companies to seek 20% out a lower corporate tax rate (called tax inversions), 0% but many of these deals reflect the fact that assets can be bought less expensively than they can be replaced. With slow global growth, mergers that can The value of the S&P 500 compared with the size of the reduce overhead and improve growth prospects can U.S. economy is about as expensive as it has been since 2001. This ignores the 40% of profits generated overseas. add to corporate profitability. An increase in M&A also reflects improved corporate confidence, and these increases typically begin mid-cycle, and continue to later phases of an economic recovery. 60% Erosion in the Number of Stocks Making New Highs. The S&P 500 made a new all-time high on September 18th, and the Dow made a new record high the following day. The small-cap stocks (the Russell 2000) actually peaked in March, and made a similar high again in July. Since that time the small cap stocks have actually fallen by 8.5% as of September 30th. The number of stocks listed on the New York Stock Exchange that are above their 60-day moving average (suggesting short-term positive momentum) is only 23%, and the percentage of NYSE stocks above their 200-day moving average (suggesting longer-term positive momentum) is only 36%. The number of stocks making new highs is declining, even as the stock market made new highs roughly two weeks ago. As fewer and fewer stocks are participating in the rally, this low rate of participation Page 5 THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK may suggest that the market is vulnerable to a correction. After all, it may only take a few more stocks to move lower for the indices to catch up with what is happening to many individual securities. Increased IPO Activity. It takes good markets to accept new stocks for trading. Confidence must be high, and capital must be available for new companies to take capital away from existing companies. IPO (initial public offerings) activity, like increased M&A activity, rarely happens early in the economic cycle, and more frequently occurs mid-to-late cycle. This past month we witnessed the largest new company to ever join the New York Stock Exchange. More than $25 billion was invested in the Chinese internet powerhouse Alibaba (a Chinese Wholesale Amazon.com for lack of a better description), giving the company a valuation rivaled by Chevron or Verizon. There is a dark side to increased IPO activity, and that is historically a dramatic increase in new IPOs upsets the existing supply-demand balance. Where, for example, did the $25 billion come from to invest in Alibaba? The answer, of course, is that other shares had to be sold to make room for the new entity in an investors’ portfolio. The price of many of those company’s shares declined, even as the successful IPOs made it look like the market would continue to run higher. Credit Spreads Moving in the Wrong Direction. Credit spreads measure the amount that investors S&P 500 Price & Shiller CAPE Ratio demand to incur the risk associated with investing 1985 to Present Source: Bloomberg Data Systems, Yale University, Robert Shiller in a particular company. The riskier the company, 2,500 50 the higher the credit spread investors require to SPX (Left) CAPE (Right) CAPE Avg (Right) invest. High yield bonds are bonds that are issued 2,000 40 by lower quality borrowers. Many are excellent credit risks, but because of the nature of their 1,500 30 businesses they have more debt on their balance sheet than the average company. Investors in 1,000 20 search of higher yields in a very low interest rate 500 10 environment have bid the prices of high yield bonds up to high levels. High yield bonds typically suffer 0 0 greater credit losses when the economy sours, but while the economy is robust, few companies get into trouble, and losses and credit spreads remain low. The stock market looks expensive using the CAPE index. Credit spreads widened from June through However, that assumes that the 46% profit decline that September, suggesting that the investors were occurred in 2008 will occur every decade. demanding a higher reward to invest in these bonds than they had a few short months ago. It is hard to differentiate between a dramatic increase in the risk of these bonds, or the fact that prices had simply moved too far, and a healthy correction was needed. The fact remains that credit spreads moved in the wrong direction. Typically credit spreads can widen for many quarters, or even years before a recession begins. The fact that credit spreads widened during this past quarter is a sign of concern that bears watching. While the four indicators listed above are typically found closer to the top, there are several more indicators that are not flashing caution. Here is our take on the indicators that are not suggesting the market is as vulnerable: Heavy Inflows into Equity Mutual Funds. Actually quite the opposite has happened over this past quarter. While equity mutual fund flows have been quite substantial since the end of 2012, nearly $10 billion of investor flows actually left the equity market over the past quarter. Usually a top in the equity market is a time of euphoria, and flows into equity investments are high, even as the market begins to roll over. The lack of significant flows into equity is conspicuously missing from those events that have typically indicated that stock markets are close to a top. Blow-off Top. Stock markets often have a last push higher that typically looks almost parabolic in shape. While the market did reach a new high two weeks ago, the gains have been orderly, and have not been Page 6 THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK indicative of an exhaustive top. Shift Toward Defensive Leadership. As the market teeters at the top, the leadership of the market begins to change, and the more defensive names actually start to outperform, while the more cyclical names begin to struggle. During the past quarter the best performing sectors were healthcare and technology, while the worst performing were energy and utilities. This indicator seems to be neutral – neither suggesting S&P 500 Price & Price-Earnings Ratios 1985 to Present fear nor complacency. It is certainly not suggestive Source: Bloomberg Data Systems of a long-term top. 2,500 36 SPX (Left) 2,000 PE (Right) PE Avg (Right) PE Forecast (Right) 32 28 24 1,500 1,000 20 16 12 500 8 4 0 0 The current PE ratio is roughly in line with the averages over the past 30 years. Looking toward estimated earnings, the market is at an undemanding valuation. Weakening Upward Earnings Revisions. Earnings revisions and forward-looking estimates often peak long before the stock market peaks. As analysts review individual companies and begin to lower their expectations, those declines show up in cumulative forward-looking earnings numbers. It is often the case that these numbers turn negative prior to the start of a recession. Forward earnings estimates for the S&P 500 have stopped increasing over the past two months, and have actually declined modestly. These declines seem more like noise, (a decline of 5/100 of 1%), and are not suggestive of the type of decline in earnings that have previously foretold a weakening stock market. Rising Real Interest Rates. As the Fed tightens monetary policy, interest rates move higher, while inflation tends to move lower. This causes real interest rates (that is interest rates adjusted for the rate of inflation) to move higher. High real interest rates are a sign the Fed is serious about slowing the economy and causing a recession, and high real interest rates can be an ingredient in a stock market top. Real Fed Funds rates are modestly higher than they were at the beginning of this year, but are somewhat lower than they were over the past several months. Real two-year interest rates are modestly higher than they were at the start of this year, but are again lower than they were over the previous few months. Real 10-year interest rates are much lower than they were at the start of this year, but are slightly above where they were over the past few months. While the direction of real interest rates is inconclusive, it is certainly not suggestive of the kind of moves typically seen near past stock market tops. Excessive Valuations. Last, but perhaps most important are valuations. Valuations are often excessive at stock market peaks, but most measures of valuation are hardly suggestive of past excesses. It is certainly true that stock market valuations are not as attractive as they were two years ago, but there are only a few measures of valuation that are flashing caution. Let’s first review those measures that are in fact giving us some concern: Warren Buffet’s favorite valuation measure compares the value of the stock market with the size of the economy. By this measure the stock market is as expensive as it has been at any time since the middle of 2001. The global companies in the S&P 500 generate approximately 40% of their corporate earnings overseas. It seems odd that we would be comparing the value of global companies with the domestic economy, and perhaps this indicator added more value when foreign sales were less important to the profitability of global corporations. Dr. Robert Shiller’s Cyclically Adjusted Price-Earnings (CAPE) ratio is currently as high as it was just before the market declined at the start of the Great Recession. The CAPE looks at corporate earnings over the past 10 years, and compares stock market valuations with those long-term earnings numbers. The problem with these numbers is that looking at the past 10 years includes the 46% earnings decline that occurred in 2008-09. Page 7 THIRD QUARTER 2014 QUARTERLY REVIEW & OUTLOOK If we are valuing the stock market using that severe earnings decline, it suggests that such a decline is a normal occurrence for investors, yet the last time corporate earnings fell by as much was 1932. Clearly normal periods of time do not include corporate earnings falling by nearly half, and any valuation tool that normalizes that decline is not a true indicator of the valuation of the stock market in ordinary times. Most other valuation metrics suggest that the stock market is fairly valued, not cheap, but certainly not overvalued. The PE ratio is roughly at its long-term average, but is below average when looking at what the S&P might earn next year. Stocks are cheap when compared with interest rates, and are also roughly fairly valued when compared with interest rates and inflation, even as they are not as cheap as they were a few years ago. Taking all valuation tools together, the market is probably fairly valued, not cheap, but certainly not as expensive as it might appear by some unique measures. Using all of the indicators we discussed above, we believe the equity market may be tired, and may be due for a healthy correction, but we do not see the ingredients in place to call a top to the stock market advance that began in March of 2009. Measures of valuation do not dramatically impact our goal of being long-term investors, and we do expect the stock market to move higher through the end of this year, and into the first quarters of 2015. Interest rates have continued to surprise us this year, moving lower even as the Fed is purchasing fewer bonds. Deflationary pressures abound, and the strong dollar is pushing commodity prices lower. Oil prices are falling, even with the geopolitical risks. It seems that inflationary pressures have been relegated to the back burner yet again, and demographic changes that lower consumption patterns are further contributing to weaker inflation. While we expect the stronger U.S. economy to push interest rates modestly higher over the remainder of this year and into the first part of next year, the weak economic growth in many other parts of the world are providing a counter-balance, and we expect interest rates to remain lower than we had previous thought. As always, it is important that we know of any changes in your financial situation. Please feel free to call us if you have questions or comments regarding your investment portfolio. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All information is derived from sources deemed to be reliable. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Content does not involve the rendering of personalized investment advice and should not be construed as a recommendation or solicitation to buy or sell a particular security. A professional advisor should be engaged before implementing any of the strategies discussed. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client's investment portfolio. There also can be no assurance that any investment or strategy will outperform any particular benchmark. EP Wealth Advisors Inc. is a registered investment advisor with the U.S. Securities and Exchange Commission (“SEC”). Registration with the SEC does not constitute an endorsement by the SEC, nor does it imply that EPWA has attained a certain level of skill or ability. This newsletter is limited to the dissemination of general information intended to inform current and prospective clients of current events affecting the market. The opinions expressed in this newsletter are not an exclusive determinant of how recommendations are made by EP Wealth Advisors Inc. in constructing actual client portfolios. Recommendations to actual clients’ portfolios may differ in accordance with their investment objectives, preferences, financial situation, account size, risk temperament, and diversification requirements. Tax information is general in nature and should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. Projections presented are based on assumptions that may never come to pass. No guarantee or warrantee is given that the projections presented will be met or sustained. Market events and other factors may influence the reliability of the potential outcomes. No current or prospective client should assume that the future performance of any specific investment or strategy, or product made reference to directly or indirectly, will be profitable or equal to past performance levels. 21515 Hawthorne Blvd. Suite 1200 Torrance, CA 90503 Telephone 310.543.4559 www.epwealth.com

© Copyright 2026