FORM N-Q SECURITIES AND EXCHANGE COMMISSION

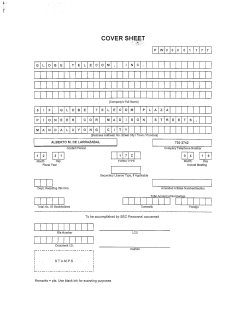

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2014-10-20 | Period of Report: 2014-09-30 SEC Accession No. 0001330833-14-000023 (HTML Version on secdatabase.com) FILER Small Cap Value Fund, Inc. CIK:1330833| IRS No.: 000000000 | State of Incorp.:TX | Fiscal Year End: 1231 Type: N-Q | Act: 40 | File No.: 811-21782 | Film No.: 141163405 Mailing Address 8150 N. CENTRAL EXPRESSWAY SUITE 101 DALLAS TX 75206 Copyright © 2014 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Business Address 8150 N. CENTRAL EXPRESSWAY SUITE 101 DALLAS TX 75206 214-360-7410 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act File Number 811-21782 Exact Name of registrant as Specified in charter Small Cap Value Fund, Inc. Address of principal executive office 8150 N. Central Expwy Suite #M1120 Dallas, Texas 75206 Name and address of agent for service Laura S. Adams 8150 N. Central Expwy Suite #M1120 Dallas, Texas 75206 Registrants telephone number, inc. area code 214-360-7418 Date of fiscal year end: 12/31 Date of reporting period: 9/30/2014 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. Schedule of Investments SMALL CAP VALUE FUND, INC. SCHEDULE OF INVESTMENTS (Unaudited) SEPTEMBER 30, 2014 DESCRIPTION ----------- SHARES ------ FAIR VALUE ------------ COMMON STOCKS ? 88.39% Freight Transportation Arrangement-4.96% Brink?s Co. 43,074 Gold/Siver Ore-2.80% Coeur Mining Inc. 1,035,499 117,955 Crude Petroleum and Natural Gas-13.35% Stone Energy Corp. (a) Swift Energy Co. (a) Vaalco Energy Inc. (a) Fabricated Rubber Products-8.44% Cooper Tire & Rubber 15,179 72,945 189,283 585,057 476,013 700,272 1,608,906 -------2,785,191 61,403 Retail-7.84% EZ Corp. (a) 1,762,266 165,120 Air Transportation, Scheduled-8.83% Hawaiian Holdings Inc. (a) Skywest Inc. 1,636,339 86,690 87,015 1,165,980 Gold Ore Mining-4.78% IAMGOLD (a) 676,977 -------1,842,957 361,387 Apparel and Accessory Stores-14.34% Tilly?s Inc. (a) Express Inc. (a) Equipment Rental and Leasing-4.61% Marlin Business Services Corp 997,428 129,870 129,120 976,623 2,015,563 -------2,992,186 52,493 961,672 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document - Continued ? SMALL CAP VALUE FUND, INC. SCHEDULE OF INVESTMENTS, continued SEPTEMBER 30, 2014 DESCRIPTION ----------- SHARES ------ FAIR VALUE ----------- Colleges, Universities & Prof Schools-2.32% ITT Educational Services (a) 112,641 483,230 Misc. Shopping Goods Stores-3.64% Big 5 Sporting Goods (a) 81,000 758,970 Oil & Gas Field Exploration Services-3.80% Dawson Geophysical 43,638 793,339 314,097 691,013 81,500 1,120,625 -------- Drilling Oil & Gas Wells-3.31% Hercules Offshore (a) Business Services-5.37% Liquidity Services (a) Total common stocks (cost $21,315,790) Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document $ 18,445,772 - Continued ? SMALL CAP VALUE FUND, INC. SCHEDULE OF INVESTMENTS, continued SEPTEMBER 30, 2014 SHORT-TERM INVESTMENTS ? 11.68% Schwab Money Market Fund-current interest at 0.00% SHARES ------ Total short-term investments (cost $ 2,437,533) 2,437,533 $ 2,437,533 -------2,437,533 -------- Total investment securities ? 100.07% (cost $23,753,323) Other assets less liabilities ? (0.07)% Net assets ? 100.00% FAIR VALUE --------- 20,883,305 (14,453) -------- $ 20,868,852 ============ (a) Presently non-income producing The Fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, Fair Value Measurements (FAS 157). In accordance with FAS 157, fair value is defined as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. FAS 157 also establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund's own assumptions about the assumptions that market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below. Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Level 1 - quoted prices in active markets for identical investments. Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) Level 3 - significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments) The following table summarizes the valuation of the Fund's investments by the above fair value hierarchy levels as of September 30, 2014: Level ----Level 1 Level 2 Level 3 Total Investments in Securities ---------$20,883,315 0 0 ----------$20,883,315 =========== Other Financial Instruments * ----------$ 0 0 0 -----------$ 0 ============ * Other financial instruments are derivative instruments not reflected in the Portfolio of Investments, such as futures forwards and swap contracts, which are valued at the unrealized appreciation / depreciation on the instrument. Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document THIS IS AN UNAUDITED STATEMENT See accompanying notes to these financial statements. NOTES TO FINANCIAL STATEMENTS Investment Transactions ? Purchases and Sales of investment securities (excluding money market funds) for the nine months ended September 30, 2014 were $19,998,599 and $10,860,721, respectively. At the end of the period, net unrealized depreciation for Federal Income tax purposes aggregated ($2,870,018), of which $1,642,372 related to unrealized appreciation of securities and ($4,512,390) related to unrealized depreciation of securities. The cost of investments at September 30, 2014 for Federal Income tax purposes was $21,315,790, excluding short term investments. Item 2. Controls and Procedures a) Laura S. Adams is the President and Treasurer of the Fund and has concluded that the Registrant?s disclosure controls and procedures(as defined in Rule 30a-3(c) under the Investment Company Act of 1940 are effective as of a date within 90 days of the filing date of this report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Investment Company Act of 1940 and Rules 15d-15(b) under the Securities Exchange Act of 1934, as amended. b) There were no changes in the Registrant?s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940 that occurred during the Registrant?s last fiscal half-year that has materially affected, or is reasonably likely to material affect, the Registrant?s internal control over financial reporting. Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 3. Exhibits Separate certifications for each principal executive officer and principal financial officer of the registrant as required by Rule 30a2(a) under the Investment Company act of 1940 are filed herewith. SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Small Cap Value Fund, Inc. By /s/ Laura S. Adams ------------------------Laura S. Adams President Date: 10/20/2014 Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Small Cap Value Fund, Inc. By /s/ Laura S. Adams ------------------------Laura S. Adams Treasurer Date: 10/20/2014 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document CERTIFICATION I, Laura S. Adams, certify that: 1. I have reviewed this report on Form N-Q of Small Cap Value Fund, Inc. 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; 3. Based on my knowledge, the schedule of investments included in this report fairly present in all material respects the investments of the registrant as of the end of the fiscal quarter for which the report is filed; 4. I am responsible for establishing and maintaining disclosure controls and procedures(as defined in Rule 30a-2(c) under the Investment Company Act of 1940) and internal control over financial reporting(as defined in Rule 30a-3(d) under the Investment Company act of 1940) for the registrant and have: a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to me by others within those entities, particularly during the period which this report is being prepared; b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; c) Evaluated the effectiveness of the registrant's disclosure controls and procedures and resented in this report my conclusion about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing of this report, based on such evaluation; and d) Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most resent fiscal quarter that has materially Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document affected, or is reasonably likely to material affect, the registrant's internal control over financial reporting; and 5. I have disclosed to the registrant's auditors or persons performingthe equivalent functions: a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize, and report financial information; and b) Any fraud, whether or not material, that involves management orother employees who have a significant role in the registrant's internal control of financial reporting. Date: 10/20/14 By: /s/ Laura S. Adams -------------Laura S. Adams President Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document

© Copyright 2026