MARKET INSIGHTS 28 October 2014 F. Yap Securities, Inc.

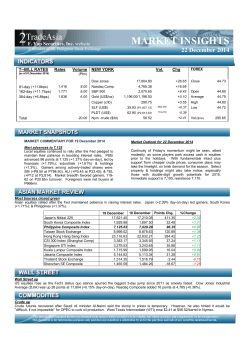

MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange 28 October 2014 I T--BILL RATES Rates (as of 07 October 2014) Volume NEW YORK Vol. 1.144 1.676 8.00 6.00 Nasdaq Comp. S&P 500 1.870 6.00 Gold (US$/oz) 16,817.94 +12.53 Close 44.80 4,485.93 1,961.63 +2.22 -2.95 Open 44.72 1,229.50/1,230.00 -1.80 Average 44.76 306.35 -0.55 High 44.80 Low 44.72 Copper (c/lb) SLF (US$) PLDT (US$) Total FOREX (Pbn) Dow Jones 91-day (-10.0bps) 182-day (+2.6bps) 364-day (+6.0bps) Chg 20.00 Nym. crude ($/bl) 34.65 (P1,552.32) 239,845 -0.21 70.80 (P3,171.84) 70,420 -0.66 81.00 -0.26 Vol.($mn) 259.70 P P MARKET COMMENTARY FOR 27 October 2014 Market Outlook for 28 October 2014 PSEi flat @7,103 Local equities closed flat following the local monetary board's decision to have benchmark rates unchanged. PSEi stood at 7,103 (unchanged day-on-day), with sectors in the red save for financials (+0.04%) & holdings (+0.25%). Losers among actively-traded shares included TEL (-P14 at P,3,212); ALI (-P0.05 at P32.75) & GTCAP (-P15 at P1,024). Winners-losers reached 53-120, on P5.6bn turnover. Net foreign selling was P294mn. Sideways session might prevail, as bargain shoppers check on momentum improvement prior to taking aggressive positions. Most are likely to take their cue from the US Fed’s interest rate decision, aside from economic data from regional peers. Some might weigh corporate prospects in 2015, as 9M earnings are announced. Immediate support is 7,070-7,080, resistance 7,120. Bourses mixed Asian stocks were mixed, with Shanghai (-0.92% day-on-day) & Hong Kong (-0.48%) leading declines, as the planned link failed to materialize. China (Shenzhen +0.44%) is also being buffeted by signs of economic slowdown, after the economy grew 7.3% in 3Q. Japan led gainers as none of Europe's largest banks were found lacking in the European Central Bank (ECB) study of their financial health. Jakarta Composite Index CSI 300 Index (Shanghai Comp) Hong Kong Hang Seng Index Taiwan Stock Exchange Singapore STI Index Philippine Composite Index South Korea Composite Index Shenzhen SE Composite Kuala Lumpur Composite Index Thailand Stock Exchange Japan's Nikkei 225 27-Oct 5,034.62 2,368.83 23,143.23 8,627.78 3,218.75 7,103.54 1,931.97 1,302.39 1,821.64 1,547.63 15,388.72 26-Oct Points Chg. 5,081.82 -47.20 2,390.71 -21.88 23,255.62 -112.39 8,646.01 -18.23 3,221.62 -2.87 7,103.55 -0.01 1,925.69 6.28 1,296.64 5.75 1,811.21 10.43 1,538.37 9.26 15,291.64 97.08 %Change -0.93 -0.92 -0.48 -0.21 -0.09 0.00 +0.33 +0.44 +0.58 +0.60 +0.63 US equities slightly up ahead of Fed meeting US equities finished slightly up, as gains were capped by declines among energy producers, after oil dipped below $80/barrel. In Europe, ECB settled $2.2bn of covered-bond purchases, as it started its effort to revive the economy. Fed policy makers are meeting 28-29 October, when they are expected to end monthly asset purchases. Dow Jones Industrial Average (DJIA) was up 12 points at 16,817 (+0.07% day-on-day), Nasdaq Composite inched 2 notches up at 4,485 (+0.05%). The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. F. Yap Securities, Inc. website A member of the Philippine Stock Exchange MARKET INSIGHTS 28 October 2014 Crude slipped Crude futures traded lower, as banks reduced price forecasts given the increasing scale & sustainability of US shale oil production. Also, OPEC’s biggest members are discounting supplies to defend their share, instead of cutting production to boost prices. West Texas Intermediate (WTI) for December delivery traded $0.26 lower at $81/barrel in Nymex. Central bank says euro banks’ stress test stabilized markets Central bank (BSP) chief Tetangco said the European Central Bank's (ECB) issuance of a clean bill of health to majority of Eurozone banks should help stabilize financial markets. BSP also noted that sentiment remained positive. Oil players slash prices Pilipinas Shell & Phoenix Petroleum (PNX) will reduce pump prices for gas by P0.35/liter, diesel at P0.20/liter. The rollback will take effect 28 October. Tighter rules for multi-class UITFs Central bank (BSP) tightened rules in opening multi-class investment trust funds (UITF), specifically in submitting key data, distribution of investment units & evidence of participation. Multi-class UITFs are those with more than one class of units that can be differentiated based on the level of trust fees, minimum holding period, among others. Proposals in place for Islamic banks' no interest rate policy on loans Central bank (BSP) is drafting rules that would allow Islamic banks to function without the use of interest rates. The rules might be inserted in the Bangsamoro Basic Law, or filing a more comprehensive bill for deliberations at the House & Senate. Islamic banks comply with their Shariah law that prohibits charging interest on loans. Instead, Islamic banks rely on risk-sharing, which means borrowers might take banks as partners when taking out loans. ASIA's capital restructuring still pending with SEC, to change name to NextGen AsiaTrust (ASIA) recapped to the Exchange that its board, during a special meeting last 27 March 2013, approved: (1) the issuance of new shares of not more than 10% of outstanding capital & investment in new ventures; (2) change in corporate name to Next Genesis Holding, & reduction in par value to P0.064/share. As of 24 October 2014, SEC has yet to approve the issuance of shares & reduction in authorized capital of the bank. No further details were provided. AC-Aboitiz Land group files motion against Optimal's appeal Team Orion, the group of Ayala's (AC) AC Infrastructure Holdings & Aboitiz Land, filed a motion to urge the Office of the President to resolve the Appeal filed by Optimal Infrastructure Development, either by accepting by judicial notice, the alleged bid of Optimal Infrastructure, or dismissing the appeal. Team Orion believes Optimal has already forfeited its right to appeal, for not following legal rules. SMPH denies link with BVI firm SM Prime (SMPH) said they're not related in any way to Preeminent Global Holdings Ltd. (PGHL), rumored to have been formed as a British Virgin Island (BVI) firm that was incorporated last July. Unnamed sources claimed PGHL bought the block of Fernando Ortigas clan's OCLP Holdings for the control of Greenhills, Tiendesitas & Kapitolyo project in Pasig. MEG launched P10bn Alabang West Megaworld (MEG) will spend P10bn over the next 5 years to develop its 15th township, Alabang West (AW). The project is 62ha. prime lot in Las Piñas & will be developed via MEG subsidiary, Global Estate Resorts (GERI). The Beverly Hills-themed township will include 1.3km commercial & retail row, inspired by Rodeo Drive. AW will also feature the exclusive Alabang West Village with 788 residential lots ranging from 250-800sqm. Residential lots will have an initial price of P48,000/sqm. MEG sees the lots to be fully sold in 6-12 months with 150-160 of lots already reserved. Turnover of AW is set for 2017, with commercial & retail component targeted at an earlier date. CLSA exercised greenshoe option for PLC shares of BEL Belle (BEL) executed a Greenshoe Agreement with CLSA & SEC has granted CLSA's request as stabilizing agent, to undertake price stabilization activities in relation to the 489.556mn common shares of Premium Leisure (PLC). CLSA will purchase 284.6512mn common shares of PLDT at P1.65/share, payment for which will be made 29 October. CEB launched Cebu-Narita flights Cebu Air (CEB) will mount direct flights to Narita in Tokyo, Japan from Cebu starting 26 March 2015 as part of its efforts to ferry more Japanese tourists into the country. CEB will fly 4x/week using its new Airbus A320. MER sees P17.8bn 2014 earnings Meralco (MER) sees P17.8bn in core net income for 2014, after posting P14.3bn in 9M net income. No other data was given. The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange 28 October 2014 ACR signed a $73.5mn loan accord; Saranggani Energy plant already 76% complete Alsons Consolidated (ACR) signed a $73.5mn Long-Term Loan, with a syndicate of domestic & foreign banks, arranged by UBS AG (Singapore). Proceeds will partially finance ACR’s power project in Mindanao & debt repayment. ACR is developing coal-fired power facilities in Mindanao, to provide stable source of base load power in the area. The facilities include 105MW San Ramon Power (SRP) & 210MW Sarangani Energy (SE). SE is one of the only 2 plants in Mindanao operating in 2015. The first 105MW of the plant is currently under construction & 76%-complete. The plant will be commissioned May 2015, & start operations October 2015. SE is seen to reach the full 210MW capacity by 4Q16 or within 1H17. LRI issues clarification on plans for excluded assets in merger with Holcim Lafarge Republic (LRI) notified the Exchange that they're exploring combining of all or part of their business with Holcim Philippines (HLCM), excluding LRI's Bulacan & Norzagaray cement facilities. To access wider potential buyers, LRI's board requested Lafarge S.A. to include the excluded assets in the information package that Lafarge S.A. would be distributing to potential purchasers. Reports came about India's Aditya Birla Group (ABG) allegedly submitted a bid for the Brazilian & Philippine assets of LRI & HLCM. LRI stressed, no official decision or proposal has been evaluated yet on the matter. CMT shareholders approve follow-on offering Southeast Asia Cement (CMT) clarified reports even if CMT shareholders approved the follow-on offer, details for the use of proceeds are being drawn up & have not been finalized yet. Earlier, Platinum Group (PGM) announced plans to conduct a P10bn follow-on float in April, after its backdoor in the Exchange via CMT. IMI confirms $20mn capex for 2015 Integrated Micro-Electronics (IMI) confirmed plans to allocate $20mn in capex for 2015. The move is in synch with the firm's business expansion to extend its global footprint. TUGS ventures into international towage & recruitment Harbor Star (TUGS) will hold a special meeting on 28 November to approve: (1) inclusion of international towage, commerce & navigation in the carriage of goods & passengers to its primary purpose, & international manning, recruitment, contracting & ship & crew management for all types of vessels; & (2) include in secondary purpose the operation of liner & feeder vessels & barges, among others. Dividend Declaration Company ATN Holdings (ATN) Interim results (in Pmn) Company BDO Unibank (BDO) Unionbank (UBP) Interim results (in Pmn) Company Meralco (MER) Cash Div. -- Stock Div. 100% 3Q14 5,700.0 5,005.3 9M14 14,308.0 Ex – Date TBA Record Date TBA 3Q13 4,042.5 7,338.5 9M13 13,644.0 Date Payable TBA % change +41.0 -31.8 % change +4.9 The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein.

© Copyright 2026