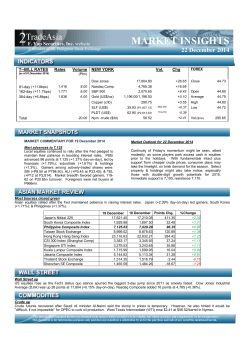

MARKET INSIGHTS - 2TradeAsia.com

MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange 26 January 2015 I T--BILL RATES Rates (as of 05 January 2015) Volume NEW YORK Vol. 1.416 1.771 rejected rejected Nasdaq Comp. S&P 500 1.836 rejected Gold (US$/oz) 17,672.60 -141.38 Close 44.18 4,757.88 2,051.82 +7.48 -11.33 Open 44.23 1,290.80/1,291.30 -10.20 Average 44.16 253.75 -6.30 High 44.23 Low 44.12 Copper (c/lb) SLF (US$) PLDT (US$) Total FOREX (Pbn) Dow Jones 91-day (unch) 182-day (unch) 364-day (unch) Chg -- Nym. crude ($/bl) 31.72 (P1,401.39) 554,195 -0.05 67.53 (P2,983.48) 69,437 -0.14 45.22 -0.77 Vol.($mn) 924.00 P P MARKET COMMENTARY FOR 23 January 2015 Market Outlook for 26 January 2015 PSEi up @7,548 Buying activity resumed, as players rode with Wall Street’s overnight ascent (DJIA +259, Nasdaq Comp. +82 points) following ECB’s $69bn/month asset purchase plan. The PSEi zoomed 132 points up at 7,548 (+1.79% day-on-day) led by property (+2.1%), holdings (+2%) & industrials (+1.84%). JGS (+P1.30 at P63.40); MBT (+P2.95 at P92.95); & ALI (+P0.55 at P35.40) were among that rose. Gainers-losers reached 105-67, on P7bn turnover. Net foreign buying was P883mn. Having pierced 7,500 on positive momentum, the market may continue to trend higher to test 7,600. The euphoria over ECB’s stimulus plan will be balanced with results from Greece’s snap elections, & whether or not the latter would opt to stay in the euro zone. It might be timely to revisit select second-tiers that typically play catch-up versus large-caps, especially those with sequel corporate announcements. Immediate support is 7,500, resistance 7,600. Asian equities up on ECB stimulus Asian equities closed in the green after the European Central Bank (ECB) pledged $69bn in monthly asset purchases through September 2016. Philippines (+1.79% day-on-day) led gainers, followed by Singapore (+1.21%) & Hong Kong (+1.2%). Philippine Composite Index Singapore STI Index Hong Kong Hang Seng Index Taiwan Stock Exchange Jakarta Composite Index Japans' Nikkei 225 Thailand Stock Exchange Kuala Lumpur Composite Index South Korea Composite Index CSI 300 Index (Shanghai Comp) Shenzhen SE Composite 23 January 7,548.93 3,411.07 24,815.85 9,470.94 5,309.19 17,511.75 1,576.43 1,799.48 1,936.09 3,571.73 1,514.30 22 January Points Chg. 7,416.31 +132.62 3,370.29 +40.78 24,522.63 +293.22 9,369.51 +101.43 5,253.18 +56.01 17,329.02 +182.73 1,560.34 +16.09 1,781.75 +17.73 1,920.82 +15.27 3,567.61 +4.12 1,530.28 -15.98 %Change +1.79 +1.21 +1.20 +1.08 +1.07 +1.05 +1.03 +1.00 +0.79 +0.12 -1.04 US equities mixed Weaker-than-expected earnings from listed firms in the US weighed on sentiment, pulling Dow Jones Industrial Average (DJIA) lower. Declines were minimized however, after ECB member Benoit Coure said policy makers are prepared to extend asset purchases beyond September 2016 if inflation outlook warrants it. Dow Jones Industrial Average (DJIA) fell 141 points at 17,672.60 (-0.8% day-on-day), Nasdaq Composite was up 7 notches at 4,757.88 (+0.16%). The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. F. Yap Securities, Inc. website MARKET INSIGHTS A member of the Philippine Stock Exchange 26 January 2015 Crude weaker Crude oil resumed its bear pattern, on traders' expectation Saudi Arabia will not signal any changes in its strategy on oil prices. Salman Bin Abdulaziz Al Saud will succeed King Abdullah, and that the former is seen to maintain his predecessor's policies. Crude for March delivery weakened $0.72 at $45.59/barrel in Nymex. Stable policies for now, central bank assured Central bank (BSP) chief Tetangco said there is no strong need to change monetary policy settings, even with the euro zone's latest stimulus package. Tetangco believes the quantitative easing (QE) from Europe should boost confidence in the euro zone over the nearterm. However, it must be seconded by structural reforms & adjustments in EU labor market. Visayas lines restored by NGCP National Grid Corp. (NGCP) has restored all transmission & sub-transmission lines & substations in Visayas last 21 January, for those earlier affected by typhoon Amang. NGCP holds the 25-year concession to operate the power transmission network & is made up of Monte Oro Grid (group of Henry Sy, Jr.), Calaca High Power (c/o Robert Coyiuto, Jr.) & State Grid Corp. of China as technical partner. NEDA set to approve 9 projects National Economic & Development Authority (NEDA) board could approve 7 public-private partnership (PPP) projects & 2 others, which were recently approved by NEDA’s investment coordination committee in the 1st half of January. The projects are: Public-Private Partnership Projects Project Name Makati-Pasay-Taguig Mass Transit System Loop North-South Railway Project Cavite Laguna Expressway (CALAx) rebidding Swiss Challenge mode of implementation of 8km North Luzon Expressway (NLEx)-South Luzon Expressway (SLEx) Connector Road Motor Vehicle Inspection (MVIS) Project Civil Registry System (CRS)-Information Technology (IT) Project Phase II Tarlac-Pangasinan-La Union Expressway (TPLEx) Expansion Outside PPP Project Name LRT Line 2 West Extension Bureau of Fire Protection Capability Building Program Phase II Cost (Pbn) 378.33 179.22 35.42 18 13.33 1.16 To be determined Cost (Pbn) 13.89 Not stated TEL ups 2015 capex PLDT's (TEL) 2015 capex will most likely be more than the P34.5bn allocated in 2014, with bulk going to cellular sites. Previously, Fitch said profitability among local telcos would be depressed this year, as they invest in expanding data businesses. TEL said fixed-line broadband subscribers reached 1mn as of 2014, driven by the firm’s extensive facility rollout & efforts to provide multimedia content. MWIDE gets P2.5bn integrated transport hub project The Transportation bureau (DoTC) formally announced last Friday the award of the P2.5bn contract to build, transfer & operate (BTO) an integrated transport hub in southern Metro Manila to Megawide (MWIDE) & partner, WM Project Management, Inc. or MWM. MWM meanwhile, was given until 12 February to complete post-award requirements. The group will be given 8 months to start construction, and 18 months more, or until end April 2017 to start operations. PAL to defer delivery of new aircrafts Philippine Airlines (PAL) is negotiating with French aircraft manufacturer, Airbus, to reset & prolong delivery for 38 Airbus-321, up to 2024. The purchase is part of PAL’s refleeting plan, originally slated for completion in 2020. Airbus ‘agreed in principle’ & will not impose any penalty or interest on staggered delivery. 2 aircrafts are seen to be delivered March, another 2 in April & one in June. NOW ups capital, plans rights offer Shareholders of Now Corp. (NOW) ratified the increase in their authorized capital from P1.32bn to P2.1bn, & conversion of advances made by Velarde, Inc. worth 200mn. NOW shareholders also approved a rights offer for the subscribed by Velarde, Inc. PBB in talks with foreign banks Phil. Business Bank (PBB) chair Alredo Yao said the bank is in talks with a lot of foreign lenders, one of which wants a controlling stake in the firm. He said "The most I can do is for us to be at par." Yao & Zest-O Corporation control 62.43% of PBB, while director Francis T. Lee owns 7.08%. Public ownership stands at 29.30%. The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein. MARKET INSIGHTS F. Yap Securities, Inc. website A member of the Philippine Stock Exchange Dividend Declaration Company Phil. Savings Bank (PSB) 26 January 2015 Cash Div. P0.75 Stock Div. - Ex – Date TBA Record Date TBA Date Payable TBA The Information contained herein was obtained from sources which we believe to be reliable, but whose accuracy and completeness we do not guarantee. This document is for information purposes only and does not constitute a solicitation by us for the purchase and sale of any securities mentioned herein.

© Copyright 2026