Document 368535

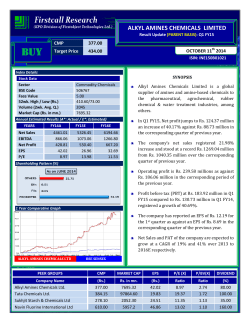

BAJAJ CORP LIMITED Result Update (PARENT BASIS): Q2 FY15 BUY CMP 287.65 Target Price 316.00 OCTOBER 22nd 2014 ISIN: INE933K01021 Index Details SYNOPSIS Stock Data Sector BSE Code Face Value 52wk. High / Low (Rs.) Volume (2wk. Avg. Q.) Market Cap (Rs. in mn.) Bajaj Corp Limited is one of India’s leading FMCG Company with major brands in ‘Bajaj Almond Drop hair oil’ is the 2nd largest brand in the overall hair oils segment and it is a market leader with over 60% market share of LHO market. FMCG 533229 1.00 298.90/198.00 19000 42428.38 In Q2 FY15, Revenue rose by 18.69% y-o-y to Rs. 1880.09 mn from Rs. 1584.01 mn, when compared with the prior year period Annual Estimated Results (A*: Actual / E*: Estimated) YEARS FY14A 6717.26 2267.80 1504.44 10.20 28.20 Net Sales EBITDA Net Profit EPS P/E FY15E 7926.37 2578.65 1634.80 11.08 25.95 FY16E During the 2nd quarter of FY15, Operating profit grew by 13.96% to Rs. 603.94 mn from Rs. 529.94 mn in the corresponding quarter ending of previous year. 8837.90 2830.83 1823.02 12.36 23.27 In Q2 FY15, Net profit grew by 3.94% y-o-y of Rs.374.35 mn compared to Rs. 360.16 mn in Q2 FY15. Shareholding Pattern (%) The Company has recommended an Interim Dividend at the rate of 1150% i.e., Rs. 11.50/- per share on face value of Rs. 1.00/- each for the financial year 2014-15. BCL has over the years created a strong distribution network across 2.74 mn retail outlets serviced by 7092 distributors and 15122 wholesalers. 1 Year Comparative Graph During H1 FY15, Bajaj Almond Drops Hair Oil got 39.8 % of its sales from Rural India with Volume Growth in Rural India – 5.0% and Market share in Rural India – 63.1%. The total cash balance with the company as on 30th Sept, 2014 is Rs. 3646.30 mn. BAJAJ CORP LIMITED Net Sales and Net Profit of the company are expected to grow at a CAGR of 13% and 3% over 2013 to 2016E respectively. BSE SENSEX PEER GROUPS CMP MARKET CAP EPS P/E (X) P/BV(X) DIVIDEND Company Name (Rs.) Rs. in mn. (Rs.) Ratio Ratio (%) 287.65 205.70 300.80 926.90 42428.38 361283.50 193977.80 315556.60 10.20 3.90 9.05 16.99 28.20 52.74 33.24 54.56 8.13 18.98 9.83 10.43 650.00 175.00 400.00 0.00 Bajaj Corp Ltd. Dabur India Ltd Marico Ltd Godrej Consumer Products Ltd Analysis & Recommendation – ‘BUY’ For 2nd Quarter of FY15, Revenue rose by 18.69% to Rs. 1880.09 mn from Rs. 1584.01 mn, when compared with the prior year period. During Q2 FY15, Operating profit grew by 13.96% to Rs. 603.94 mn from Rs. 529.94 mn in the corresponding quarter ending of previous year. In Q2 FY15, Net profit grew by 3.94% y-o-y of Rs.374.35 mn compared to Rs. 360.16 mn in Q2 FY15. The main impact of reduce in net profit is due to exceptional items, the company has acquired NOMARKS brand on August 22, 2013 and has also entered into a non compete agreement with the seller for a period of 3 years. The acquisition cost of Brand & Non Compete will be amortized over the estimated useful life of 3 years. The total cash balance with the company as on 30th Sept, 2014 is Rs. 3646.30 mn. This has been invested in Bank Fixed Deposits Rs. 1425.00 mn, Certificate of Deposits of Banks Rs. 1194.80 mn , PSU Bonds Rs. 836.50 mn and Liquid MFs Rs. 190.00 mn. Company is a Debt free company. Over the years, BCL has over the years created a strong distribution network across 2.74 mn retail outlets serviced by 7092 distributors and 15122 wholesalers which can be optimally utilized by introducing new products. Bajaj Corp with its sound financials, strong brands and high cash reserves will outperform the market in the long run. Over FY2013-16E, we expect the company to post a CAGR of 13% and 3% in its Net sales and Net profit respectively. Thus we recommend ‘BUY’ for ‘Bajaj Corp Ltd’ with a target price of Rs. 316.00 medium to long term investment. QUARTERLY HIGHLIGHTS (PARENT BASIS) Results updates- Q2 FY15, Rs. in million SEP-14 SEP-13 % Change Net Sales 1880.09 1584.01 18.69 PAT 374.35 360.16 3.94 EPS 2.54 2.44 3.94 603.94 529.94 13.96 EBITDA The company’s Revenue for the 2nd quarter of FY15 rose by 18.69% to Rs. 1880.09 mn from Rs. 1584.01 mn, when compared with the prior year period. Net profit Jumps to Rs. 374.35 mn from Rs. 360.16 mn in the corresponding quarter ending of previous year, an increase of 3.94% y-o-y. Profit before interest, depreciation and tax grew by 13.96% y-o-y and stood at Rs. 603.94 mn as against Rs. 529.94 mn in the corresponding period of the previous year. Reported earnings per share of the company stood at Rs. 2.54 a share during the quarter, registering 3.94% increase over previous year period. Break up of Expenditure: Break up of Expenditure (Rs. in mn) Q2 FY15 Q2 FY14 Cost of Material Consumed 604.26 561.16 Purchase of Stock-in-trade 160.32 112.32 Employee Benefit Expenses 94.63 86.68 Depreciation & Amortization. 12.51 9.68 Advertisement 123.83 125.97 Other Expenditure 416.69 317.08 Latest Updates • During the quarter average price of LLP increased to Rs 84.27/Kg from Rs 75.33/Kg in corresponding quarter of previous year. • The company aims for a market share of 65% from other hair oil segments by the year 2015-16. • During the quarter Prices of Refined Oil decreased to Rs 69.99/Kg from Rs 70.85/Kg in corresponding quarter of previous year. • The total cash balance with the company as on 30th Sept, 2014 is Rs. 3646.30 mn. This has been invested in Bank Fixed Deposits Rs. 1425.00 mn, Certificate of Deposits of Banks Rs. 1194.80 mn , PSU Bonds Rs. 836.50 mn and Liquid MFs Rs. 190.00 mn. Company is a Debt free company. • BCL has over the years created a strong distribution network across 2.74 mn retail outlets serviced by 7092 distributors and 15122 wholesalers which can be optimally utilized by introducing new products. • During H1 FY15, Bajaj Almond Drops Hair Oil got 39.8 % of its sales from Rural India with Volume Growth in Rural India – 5.0% and Market share in Rural India – 63.1%. COMPANY PROFILE Bajaj Corp Ltd is one of India’s leading FMCG Company with major brands in Hair care category. With brands, such as Bajaj Almond Drops, Bajaj Brahmi Amla, Bajaj Amla Sheekakai, and Bajaj Kailash Parbat that have been in the market for eight decades and it is part of one of the oldest business houses of the country. Bajaj Corp Limited is part of Bajaj Group which has business interests in varied industries including sugar, consumer goods, power generation & infrastructure development. The companies brand Bajaj Almond Drop Hair Oil is the third largest brand in the overall hair oil. BCL has over the years created a strong distribution network across 2.71 mn retail outlets serviced by 6964 direct distributors and 15122 wholesalers which can be optimally utilized by introducing new products. The company acquired in September 2011 (Uptown Properties) owns a piece of land and building in Worli, Mumbai. Uptown Properties was previously owned by the C.K. Raheja Group (i.e. Mr. Chandu Raheja). The corporate Headquarters of Bajaj Corp Ltd will be constructed on this land. The Construction is expected to be completed by mid 2015. Bajaj Corp Limited acquires NOMARKS brand: The acquisition of the NOMARKS brand by Bajaj Corp is a strategic move as its presence in the personal care market and gives an entry in to the skin care category. It widens the Company’s position in the personal care sector as Bajaj Almond Drop Hair Oil is already the third largest brand in the overall hair oil category and in addition NOMARKS brand gives an opportunity to play in an additional Rs 8500 crore Personal Care space besides the Rs 5222 crore non coconut hair oil market. The profitability of the company depends directly on the revenue generation of this premium brand. NOMARKS has a small export sale, through which enhance several times in the next couple of years by leveraging export infrastructure in the GCC, SAARC and the ASEAN region. FINANCIAL HIGHLIGHT (PARENT BASIS) (A*- Actual, E* -Estimations & Rs. In Millions) Balance Sheet as at March31st, 2013 -2016E Bajaj Corp Ltd. I FY-13A FY-14A FY-15E FY-16E Share Capital 147.50 147.50 147.50 147.50 Reserves and Surplus 4690.56 5073.31 6062.61 6881.06 4838.06 5220.81 6210.11 7028.56 Long term borrowing 0.00 0.00 0.00 0.00 Deferred Tax Liability (net) 12.56 0.00 0.00 0.00 Sub Total Non Current Liabilities 12.56 0.00 0.00 0.00 Trade payables 493.02 405.16 364.64 335.47 Other Current liabilities 216.62 190.93 210.02 226.82 Sub Total Current Liabilities 709.64 596.09 574.67 562.30 Total Liabilities (A + B + C ) 5560.26 5816.90 6784.77 7590.85 444.02 476.15 497.58 512.50 Intangible assets 1.45 1125.71 1002.55 1072.73 Capital Work in Progress 12.98 7.01 5.05 3.43 a) Sub Total Fixed Assets 458.45 1608.87 1505.17 1588.66 b) Non Current Investments 522.52 538.86 549.64 555.13 c) Long Term loans and advances 265.43 262.05 269.91 275.31 1246.40 2409.78 2324.72 2419.11 Current Investment 1832.36 1568.35 2289.79 2720.72 Inventories 358.51 394.52 453.70 508.14 Trade receivables 99.71 83.71 98.78 113.59 1889.85 1289.91 1496.30 1651.00 Short-terms loans & advances 19.14 26.73 45.98 68.04 Other current assets 114.29 43.90 75.51 110.24 Total Current Assets 4313.86 3407.12 4460.05 5171.74 Total Assets (D+E) 5560.26 5816.90 6784.77 7590.85 SOURCES OF FUNDS Shareholder's Funds A) Sub Total Net worth Non Current Liabilities B) Current Liabilities C) II APPLICATION OF FUNDS D) Non-Current Assets Fixed Assets Tangible assets Total Non-Current Assets E) Current Assets Cash and Bank Balances Annual Profit & Loss Statement for the period of 2013 to 2016E Value(Rs.in.mn) FY13A FY14A FY15E FY16E Description Net Sales 12m 6067.19 12m 6717.26 12m 7926.37 12m 8837.90 Other Income 400.51 401.25 371.16 391.57 Total Income 6467.70 7118.51 8297.52 9229.47 Expenditure -4339.01 -4850.71 -5718.87 -6398.64 Operating Profit 2128.69 2267.80 2578.65 2830.83 -0.82 -58.84 -20.59 -23.68 Gross profit 2127.87 2208.96 2558.06 2807.15 Depreciation -32.84 -36.75 -43.48 -50.00 Exceptional Items 0.00 -285.96 0.00 -469.80 Profit Before Tax 2095.03 1886.25 2514.58 2287.35 Tax -421.21 -381.81 -504.17 -464.33 Net Profit 1673.82 1504.44 2010.41 1823.02 Equity capital 147.50 147.50 147.50 147.50 Reserves 4690.56 5073.31 6062.61 6881.06 Face value 1.00 1.00 1.00 1.00 EPS 11.35 10.20 13.63 12.36 Interest Quarterly Profit & Loss Statement for the period of 31st MAR, 2014 to 31st DEC, 2014E 31-Mar-14 30-Jun-14 30-Sep-14 31-Dec-14E 3m 3m 3m 3m 1845.13 1913.15 1880.09 1917.69 Other income 82.77 90.71 82.79 79.15 Total Income 1927.90 2003.86 1962.88 1996.84 Expenditure -1317.46 -1376.25 -1358.94 -1388.41 Operating profit 610.44 627.61 603.94 608.43 Interest -16.48 -0.17 -0.12 -0.08 Gross profit 593.96 627.44 603.82 608.35 Depreciation -9.63 -8.53 -12.51 -12.76 Exceptional Items -117.45 -117.45 -117.45 -117.45 Profit Before Tax 466.88 501.46 473.86 478.14 Tax -83.74 -105.31 -99.51 -96.58 Net Profit 383.14 396.15 374.35 381.56 Equity capital 147.50 147.50 147.50 147.50 Face value 1.00 1.00 1.00 1.00 EPS 2.60 2.69 2.54 2.59 Value(Rs.in.mn) Description Net sales Ratio Analysis Particulars Charts FY13A FY14A FY15E FY16E EPS (Rs.) 11.35 10.20 11.08 12.36 EBITDA Margin (%) 35.09 33.76 32.53 32.03 PBT Margin (%) 34.53 28.08 25.80 25.88 PAT Margin (%) 27.59 22.40 20.62 20.63 P/E Ratio (x) 25.35 28.20 25.95 23.27 ROE (%) 34.60 28.82 26.32 25.94 ROCE (%) 44.68 44.14 42.22 40.99 EV/EBITDA (x) 18.18 17.45 14.99 13.44 Book Value (Rs.) 32.80 35.40 42.10 47.65 P/BV 8.77 8.13 6.83 6.04 OUTLOOK AND CONCLUSION At the current market price of Rs. 287.65, the stock P/E ratio is at 25.95 x FY15E and 23.27 x FY16E respectively. Earning per share (EPS) of the company for the earnings for FY15E and FY16E is seen at Rs.11.08 and Rs.12.36 respectively. Net Sales and Net Profit of the company are expected to grow at a CAGR of 13% and 3% over 2013 to 2016E respectively. On the basis of EV/EBITDA, the stock trades at 14.99 x for FY15E and 13.44 x for FY16E. Price to Book Value of the stock is expected to be at 6.83 x and 6.04 x respectively for FY15E and FY16E. We recommend ‘BUY’ in this particular scrip with a target price of Rs.316.00 for Medium to Long term investment. Industry Overview The overall fast moving consumer goods (FMCG) market is expected to increase at a compound annual growth rate (CAGR) of 14.7 per cent to US$ 110.4 billion during 2012–2020, with the rural FMCG market expected to increase at a CAGR of 17.7 per cent to US$ 100 billion during 2011–2025. Rising incomes and growing youth population have been key growth drivers for the sector. Brand consciousness has also aided demand. It is estimated that First Time Modern Trade Shoppers (FTMTS) spend will reach US$ 1 billion by 2015. The Government of India's policies and regulatory frameworks such as relaxation of license rules and approval of 51 per cent foreign direct investment (FDI) in multi-brand and 100 per cent in single-brand retail are some of the major growth drivers in this sector. The government has also amended the Sugarcane Control Order, 1966, and replaced the Statutory Minimum Price (SMP) of sugarcane with Fair and Remunerative Price (FRP) and the State Advised Price (SAP). There is a lot of scope for growth in the FMCG sector from rural markets with consumption expected to grow in these areas as penetration of brands increases. Also, with rising per capita income, which is projected to expand at a CAGR of 7.4 per cent over the period 2013-19, the FMCG sector is anticipated to witness some major growth. The industry has witnessed healthy foreign direct investment (FDI) inflow, as the sector accounted for 3 per cent of the country’s total FDI inflow in the period April 2000 to October 2013. Organised retail share is expected to double to 14–18 per cent of the overall retail market by 2015. The FMCG market is set to treble US$ 33.4 billion in 2015. Penetration level as well as per capita consumption in most product categories like jams, toothpaste, skin care, hair wash etc in India is low indicating the untapped market potential. The Indian FMCG industry represents nearly 2.5% of the country’s GDP. The industry has tripled in size in past 10 years and has grown at ~17%CAGR in the last 5 years driven by rising income levels, increasing urbanization, strong rural demand and favourable demographic trends. The sector accounted for 1.9% of the nation’s total FDI inflows in April 2000- September 2012. Cumulative FDI inflows into India from April 2000 to April 2013 in the food processing sector stood at Rs. 9,000.3 crore, accounting for 0.96% of overall FDI inflows while the soaps, cosmetics and toiletries, accounting for 0.32% of overall FDI at Rs. 3,115.5 crore. Food products and personal care together make up two-third of the sector’s revenues. Rural India accounts for more than 700 mn consumers or 70% of the Indian population and accounts for 50% of the total FMCG market. With changing lifestyle and increasing consumer demand, the Indian FMCG market is expected to cross $80 bn by 2026 in towns with population of up to 10 lakh. India's labor cost is amongst the lowest in the world, after China & Indonesia, giving it a competitive advantage over other countries. Household care The fabric wash market size is estimated to be ~USD 1 billion, household cleaners to be USD 239 million, with the production of synthetic detergents at 2.6 million tonnes. The demand for detergents has been growing at an annual growth rate of 10 to 11% during the past five years Personal Care (HPC) The personal care products (PCP) market in India is estimated to be worth ~USD 4 bn p.a. Personal hygiene products (including bath and shower products, deodorants etc.), hair care, skin care, colour cosmetics and fragrances are the key segments of the personal care market. Food & Beverages Food processing industry is one of the largest industries in India, ranking fifth in terms of production, growth, consumption, and export. The total value of Indian food processing industry is expected to touch USD 194 billion by 2015 from a value of USD 121 billion in 2012, according to Indian Council of Agricultural Research (ICAR). Conclusion While the rural market certainly offers a big attraction to marketers, it would be naïve to think that any company can enter the market without facing any problems and walk away with a sizable share. Distribution is the most important variable in the marketing plans of most consumer goods manufacturers, because managing such a massive sales and distribution network is in itself a huge task. This sector will continue to see growth as it depends on an ever-increasing internal market for consumption, and demand for these goods remains more or less constant, irrespective of recession or inflation. Hence this sector will grow, though it may not be a smooth growth path, due to the present world-wide economic slowdown, rising inflation and fall of the rupee. This sector will see good growth in the long run and hiring will continue to remain robust. As people are demonstrating an increasing interest in online shopping, future prospects pose a tremendous growth opportunity for retail and FMCG players alike. The market size of the Indian FMCG sector is expected to reach US$ 135 billion by 2020 from US$ 44.9 billion in 2013. It is also the fourth largest sector in the Indian economy and has grown at an annual average of about 11 per cent over the last decade. Food products, the leading market segment with 43 per cent of the overall market revenue together with personal care at 22 per cent make up two-thirds of the sector's revenue. Disclaimer: This document prepared by our research analysts does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. The information contained herein is from publicly available data or other sources believed to be reliable but do not represent that it is accurate or complete and it should not be relied on as such. Firstcall India Equity Advisors Pvt. Ltd. or any of it’s affiliates shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. This document is provide for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Firstcall India Equity Research: Email – [email protected] C.V.S.L.Kameswari Pharma U. Janaki Rao Capital Goods B. Anil Kumar Auto, IT & FMCG M. Vinayak Rao Diversified C. Bhagya Lakshmi Diversified B.Vasanthi Diversified G. Amarender Diversified Firstcall India also provides Firstcall India Equity Advisors Pvt.Ltd focuses on, IPO’s, QIP’s, F.P.O’s,Takeover Offers, Offer for Sale and Buy Back Offerings. Corporate Finance Offerings include Foreign Currency Loan Syndications, Placement of Equity / Debt with multilateral organizations, Short Term Funds Management Debt & Equity, Working Capital Limits, Equity & Debt Syndications and Structured Deals. Corporate Advisory Offerings include Mergers & Acquisitions(domestic and cross-border), divestitures, spin-offs, valuation of business, corporate restructuring-Capital and Debt, Turnkey Corporate Revival – Planning & Execution, Project Financing, Venture capital, Private Equity and Financial Joint Ventures Firstcall India also provides Financial Advisory services with respect to raising of capital through FCCBs, GDRs, ADRs and listing of the same on International Stock Exchanges namely AIMs, Luxembourg, Singapore Stock Exchanges and other international stock exchanges. For Further Details Contact: 3rd Floor,Sankalp,The Bureau,Dr.R.C.Marg,Chembur,Mumbai 400 071 Tel. : 022-2527 2510/2527 6077/25276089 Telefax : 022-25276089 E-mail: [email protected] www.firstcallindiaequity.com

© Copyright 2026