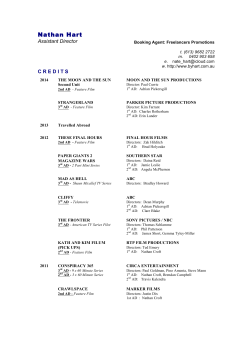

2014 For personal use only PEGASUS METALS