UIC Lunch & Learn Kara Tess Principal/Sr. Account Executive TRUSTED Dental Advisors

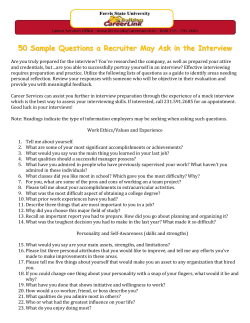

UIC Lunch & Learn Kara Tess Principal/Sr. Account Executive Your TRUSTED Dental Advisors Agenda The Resume The Interview Process After The Interview The Job: What You Need To Know Dental Stats Final Thoughts / Questions The Resume The Resume A solid resume should contain the following: Contact Information o Name o Address o Phone / E-mail Overview / Objective o 2-3 sentences max o State your objective; what you are seeking in a job The Resume A solid resume should contain the following (cont.): Professional Experience o Start with your most recent position o Include : • Place of Employment • Job Title • Job Functions (3-5 bullets) • Employment Dates Volunteer Experience Other Experience The Resume A solid resume should contain the following (cont.): Continuing Education Courses Completed Research & Professional Affiliations Research & Professional Publications Professional Societies Education, Activities & Honors The Resume Common Resume Questions: What is the difference between a resume and a CV? How many pages should my resume be? What if I don’t have very much relevant experience? o Sell yourself and ALL of your experience • Work Experience • Extracurricular / Athletics • Community Involvement / Philanthropy Top 10 Things to Leave OFF Your Resume 1. Photo 2. Age 3. Ethnic background 4. Marital status 5. Number of children 6. Political and/or religious affiliation 7. Hobbies 8. In-depth descriptions of previous jobs 9. References 10. Work history beyond 10 years The Interview Process The Interview Remember ….. Sell yourself! • This process is as much for you as it is for them Top 10 Interview Must-Do’s 1.Listen & maintain eye contact 2. Smile when you talk 3. Dress for success 4. Have a firm handshake 5. Introduce yourself 6. Maintain posture – be attentive, sit up straight 7. Be prepared with questions 8. Bring a portfolio with paper to write on and extra copies of your resume 9. Be prepared with how you can benefit the company 10. Be prepared to discuss previous job duties and professional/social successes Top 10 Most Common Interview Questions 1. Tell me about yourself. 2. What have your achievements been to-date? 3. Are you happy with your career to-date? 4. What is the most difficult situation you have had to face and how did you tackle it? 5. What do you like about your present job? 6. What do you dislike about your present job? 7. What are your strengths? 8. What is your greatest weakness? 9. Why do you want to leave your current employer (if applicable)? 10. Why have you applied for this particular job? Top 10 Ways to Ruin An Interview 1. Be late 2. Chew gum 3. Lie about anything 4. Swear and cuss 5. Be too quiet or too talkative 6. Show indifferent body language 7. Answer your cell phone 8. Ask about perks and vacation 9. Don’t know about the company 10. Criticize current/previous company and/or boss Are You Prepared For the Interview? ➡QUESTIONS CONCERNING YOU • What unique skills will I gain? • Is there a mentorship program? • What type of involvement will I have in decisions being made within the practice? • What benefits do you offer? • How are your doctors compensated? Will lab fees be covered? • Are the patients I diagnose and care for mine to treat? • Will those patients become my patients of record? • Are there any partnership or buy-out opportunities? • Are the doctors on call? If so, how often? ➡QUESTIONS CONCERNING THE PRACTICE • What is the collection rate? • What is the number of active patients? • How many new patients does the practice get per month? • How are new patients channeled? • How many operatories will I have? • How many assistants will I have? • How far out are new patients booked? • How many patients do the doctors see per day? • What is the practice philosophy? • How are your fees established? • What are your age demographics? • Is there a payment plan for patients? • How long does it take to collect your payments? After The Interview: Things To Consider Ensure the practice fits your practice goals, standards and philosophies. After a job offer is made, but prior to accepting the offer, ask to review a sample of patient records. o This helps you to determine whether or not you agree with the treatment philosophies and also demonstrates your attention to detail and professionalism. Understand the production requirements you will need to perform at. Know what segments of the practice you will treat. Make sure the physical office space can accommodate another dentist. Identify what you’ll need in order to succeed and whether or not it will be provided. o Training schedule o Integration / On-boarding plan o Mentor o Sufficient staff / Patient base The Job: What You Need To Know Dental Practice Models Solo Practice o Sole Ownership Partnership o Dual Ownership Group Practice o Multiple locations, generally not all practitioners have ownership Military o Guaranteed salary/benefits/tuition reimbursement FQHC o Tuition reimbursement provided Indian Health Service (IHS) o Direct Hire via Tribe o Hired through federal government (would be a commissioned officer) o Guaranteed salary/ benefits/tuition reimbursement State of __________ (Corrections) o Guaranteed salary/benefits/tuition reimbursement Compensation Methods Base Compensation: A set wage for a service based on hours worked per year. Base Compensation w/Incentive: A lower base salary; however, incentives are provided for reaching company established goals which may increase the overall compensation. Production Reimbursement: A salary based on a percentage of what the dentist produces. This percentage is then multiplied by the total production to come up with the dentists compensation. – Example: A dentist produces $360,000 worth of dentistry per year, and is paid based on 30% production; therefore, $360,000 x .30 = $108,000. Production Reimbursement Based on Collection: Similar to the Production Reimbursement from method, but instead of the percentage being multiplied by what the dentist actually produces, the percentage is now multiplied by what the dentist produces minus the money unable to be retrieved by the office (i.e. write-offs). – Example: A dentist produces $360,000 worth of dentistry per year, and is paid based on 30% of production, minus ‘write-offs.’ For this example, ‘write-offs’ are equivalent to 10% of total production; therefore, $360,000 x .90 x .30 = $97,200. Laboratory Fees On average, lab fees run 10% – 12% of monthly production. So, if you earn $100,000 per year, and produce $480,000 per year, then: 0% Lab Fee Covered: 50% Lab Fee Covered: 100% Lab Fee Covered: Average Monthly Cost: $1100 Average Annual Cost: $13,200 Annual Salary: $86,800 Average Monthly Cost: $550 Average Annual Cost: $6,600 Annual Salary: $93,400 Average Monthly Cost: $0 Average Annual Cost: $0 Annual Salary: $100,000 Laboratory Fees (cont.) Out of 2000 dentists surveyed, 33.9% said lab fees represent 8% 10% of their overhead. Over one-half (52.5%) claim lab fees represent 11% - 15% of their overhead. Another 13.6% report fees at 16% - 20% of their overhead. Contracts/Agreements A Solid Employment Contract/Agreement Should Contain The Following: Define terms of the employment agreement: compensation, classification status, job duties Confirm insurance benefits that will be offered: professional liability, workers compensation, property, loss of income, disability, etc. Other areas an associate may be reimbursed (i.e. CE). Define the termination policy: timing for notice of termination, disability, sale of practice. Consider a covenant not to compete. Have an anti-solicitation clause. Spot to solidify the agreement (signed and dated written contract). Employee vs. Independent Contractor Employee Independent Contractor Utilizes the office’s materials, tools and equipment. X X Follows instruction put forth by employer such as when/where to work, where to purchase supplies, what work is required and other procedures. X Abides by office policies, rules and safety regulations. X Produces according to the practice owner’s plans and requests. X Works in tandem with the practice owner, shares patients and philosophies. X Receives benefits including unemployment insurance and workers compensation. X Employer withholds income taxes, withholds and pays social security and Medicare taxes. X Paid per time in the office and possibly a production commission on top of salary. X Negotiate to work for a percentage of work performed. Job is usually bid. X X Dental Stats Average Doctor hours worked p/m: Average exams per Doctor hour: Gross Production per total exam: Total exams p/m: Gross Production p/h: Active Patients: Adj. Production: Sikka Software Corp. Jan 2013 to May 2013 trends. 139.8 0.434 $1,745 61.4 $761.60 2,045 86.05% The average income of a dentist is in the highest 8 percent of U.S. family income. The average gross billings per owner dentist in 2007 was $713,100 for a general practitioner and $1,049,320 for a specialist. The average net income for an independent private practitioner who owned all or part of his or her practice in 2007 was $205,960 for a general practitioner and $353,280 for a specialist. Amongst dentists that have practiced less than four years, about 42 percent own their own practice; within six years after graduation, this figure increases to 53 percent. In 2001, 67.0 percent were working in a solo practice; 21.0 percent with 1 other dentist; and 12.0 percent worked with 2+ dentists. In 2005, the numbers shifted to 63.1, 20.0 and 16.9 percent respectively. In 2009, 58.9%, 22.8% and 18.3%. Year Solo Partner Group 2001 67.0% 21.0% 12.0% 2005 63.1% 20.0% 16.9% 2009 58.9% 22.8% 18.3% Yearly % Change -3.9% 1.0% 4.9% Projecting the ADA Numbers Solo Practice Group Practice 2001 67.0% 12.0% 2005 63.1% 16.9% 2009 58.9% 18.3% *2013 54.9% 21.5% *2017 50.81% 24.6% Current snapshot of the male to female ratio 65 and Over 55 to 64 45 to 54 35 to 44 Under 35 Male 11.90% 23.70% 32.60% 20.80% 11% 100.00% Female 1.10% 4.90% 27.30% 39% 27.60% 99.90% U.S. Full time Male: 87.1%, Part-time 12.9% U.S. Full time Female: 76.5%, Part-time 23.5% General Dentists in the US Specialists in the US Speciality Oral Surgeon Endodontist Orthodontist Pedodontist Periodontist Prosthodontist Number 7,184 4,953 10,375 6,134 5,252 3,343 Year 1993 2000 2009 2010 Number 116,372 132,835 146,675 150,043 Male vs. Female Dentist in the US Year 1998 2006 2009 Male 140,000 140,000 144,775 Female 23,513 35,444 41,309 Total 163,513 175,444 186,084 Final Thoughts My Best Advice Get started early Be honest Be yourself Questions? Thank You Kara Tess 920.634.9788 / [email protected] Check out our website at www.EdgeAdvise.com

© Copyright 2026