SBI Life Lifelong Pensions Plan Life You have trusted

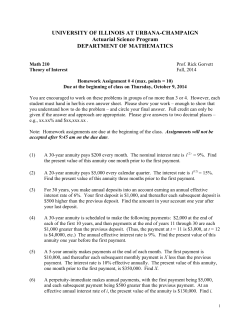

SBI Life Lifelong Pensions Plan You have trusted SBI for banking Now TRUST SBI Life for your retirement benefits Why Pensions scheme? Before: 60 yrs Working Time 67 yrs Retirement 71 yrs Now: V.R.S. Working Time Retirement Tomorrow? Working Time 80/85 yrs ? Retirement Lifelong Pensions the best tool to provide financial security for retirement age How does it work? ACCUMULATION PERIOD Flexible contribution mode of payment (minimum Rs. 3,000 p.a.) Vesting Age 50 to 70 ANNUITY PERIOD 4 main options 13 different choices How does it work during the accumulation period? Personal Pension Account 4% p.a. till March 2010 Plus Vested Bonus Annuity options available at the vesting age (50 upto 70) PURCHASE OF ANNUITY 4 MAIN OPTIONS 1 Life time annuity Guaranteed pension for the entire Life 2 3 Increasing Life time annuity Joint Life time annuity (say @1 / 2 / 3% p.a.) (husband / wife) Protection against inflation Life time annuity for Survivor 50% or 100% of last annuity 4 Annuity for Life with guaranteed period of 5 / 10 / 15 years Option 1 & 2 available with refund of balance purchase price Lifelong Pensions Plan: Product features Lifelong Pensions 2 options Option 1 Option 2 Pure Pension Pension with Life cover Simplified Proposal Form Lifelong Pensions Plan: 2 options Option 1 Pure Pension Option 2 Pension cum Life Cover Min. / Max. Age at entry 18 / 65 18 / 60 Min. / Max Term 2 years / 52 years 5 years / 52 years Min. / Max age to start receiving pension Min. / Max contribution Anytime between 50 to 70 years (choice of annuity option, 6 months before vesting Age) Single contribution: Rs. 10,000 (x 500) / No Limit Regular contribution: Rs. 3,000 (x 500) p.a. / No Limit (Min. per contribution Rs. 500) Contribution Mode Single /Y / HY / Q / M (3 months in advance by cheque. Standing Instruction / Credit Card thereafter) Min. / Max. S.A. for Life Cover Not Available Max. Cover Age for Life Cover Not Available Rs. 25,000 / Rs. 3lakh (Max. Rs. 1 lakh for 46 & above) 65 years Lifelong Pensions 2 options Option1: Pure Pension product: • No medical questionnaire, • No financial underwriting, • Pure accumulation vehicle: Automatic acceptance Option 2: Pension cum Life Cover: • Simple medical questionnaire • If life cover is not accepted, automatic enrolment under option 1. • Term of the Life Cover is equal to vesting age / 65 years old whichever is earlier. • If Life cover is extended due to postponement of vesting age, new medical questionnaire and new premium amount Hassle free process to join: Simplified proposal form In case of unpaid contribution P.P.A. will be used to maintain the Life Cover Life Cover Personal Pension Account Premium for Life Cover will be deductible from the PPA Once a year The Policyholder has the option to write us to end the Life Cover, How does it work? ACCUMULATION PERIOD Flexible contribution mode of payment (minimum Rs. 3,000 p.a.) Vesting Age 50 to 70 ANNUITY PERIOD 4 main options 13 different choices Investment Period: Do not speculate with your pension ? ? Unit Linked product No uncertainty Lifelong Pensions: Non Unit Linked product To get the best of compounding effect without any risk Accumulation period easy to understand Contribution(s) Net of premium for Life Cover if any Personal Pension Account Accumulation period ends at vesting date /death whichever is earlier How does it work during the accumulation period? Personal Pension Account 4% p.a. Till March 2010 Extra Additional Contribution Min. Rs. 500 When you wish Single contribution Regular contribution Plus Vested Bonus An example 30 years later Rs. 10,000 p.a for 30 years P.P.A.* = P.P.A Rs. 781,130 Total contributions paid: Rs. 300,000 Assuming 6% per annum The compounding effect Accumulation period: The compounding effect • Long period of time for accumulation period makes savings effort less cumbersome. • Short period of time for accumulation period makes savings effort more difficult Your prospect is never too young to think about a good pension builder TIME DURATION IS A FAVOURABLE FACTOR P.P.A.: the Power of Compounding Term 10 years 20 years 30 years 40 years 50 years Single Contribution Rs. 10,000 16,650 29,830 53,410 95,660 171,310 Single Contribution Rs. 20,000 33,300 59,660 106,820 191,320 342,620 Yearly Contribution Rs. 5,000 64,635 (50,000) 181,420 (1,00,000) 3,90,565 (1,50,000) 7,65,110 (2,00,000) 14,35,860 (2,50,000) Yearly Contribution Rs. 10,000 1,29,270 (1,00,000) 3,62,840 (2,00,000) 7,81,130 (3,00,000) 15,30,220 (4,00,000) 28,71,720 (5,00,000) Assumptions 6% p.a Cost of delaying is high At vesting Age (50 to 70) The amount of P.P.A. helps you to retire gracefully. You will have to opt for annuity option How does it work? ACCUMULATION PERIOD Flexible contribution mode of payment (minimum Rs. 3,000 p.a.) Vesting Age 50 to 70 ANNUITY PERIOD 4 main options 13 different choices 6 months before vesting age,choose the most convenient annuity option Your Personal Pension Account Upto 33% of the P.P.A. as a lump sum TAX-FREE Balance PPA is used to purchase annuity option (free choice of annuity provider) Annuity options available at the vesting age (50 upto 70) PURCHASE OF ANNUITY 4 MAIN OPTIONS 1 Life time annuity Guaranteed pension for the entire Life 2 3 Increasing Life time annuity Joint Life time annuity (say @1 / 2 / 3% p.a.) (husband / wife) Protection against inflation Life time annuity for Survivor 50% or 100% of last annuity 4 Annuity for Life with guaranteed period of 5 / 10 / 15 years Option 1 & 2 available with refund of balance purchase price Life time annuity Vesting age 50 to 70: Life time annuity PEACE OF MIND FOR THE YEARS TO COME Available with option refund of Balance Purchase Price Increasing Life time annuity Vesting age 50 to 70: Increasing Life time annuity Every year, your pension increases of, say 1/2/3 % p.a. Available with option refund of balance purchase price Refund of Balance Purchase Price to your nominee Amount of P.P.A. Used to buy annuity (-) Cumulative annuity Amount already paid A WIN- WIN option! = Balance of Annuity Purchase Price Joint Life time annuity At vesting age: Life time annuity for you and Life time annuity for the survivor (50 /100%) The best option to protect you as well as your spouse Annuity for life with 5/10/15 years guaranteed period Vesting age 50 to 70Y: guaranteed period 15 Yrs + life time annuity 50/70 15th 15 guaranteed period after 15 years, life annuity 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Payable to the policyholder / nominee A Life time pension with guaranteed source of income for the first 5/10/15 years for the family Which annuity option is the best? All options have been calculated with the same monetary value So… The Option chosen by the policyholder is always the best !!! Some examples of annuity option for a P.P.A of Rs. 10 lakhs Vesting Age 60 years 65 years Life Annuity Rs. 75,360 Rs. 85,010 (Rs. 71,360) (Rs. 79,400) Rs. 63,750 Rs. 73,380 (Rs. 60,600) (Rs. 69,390) Life annuity with 10 years guaranteed period Rs. 73,090 Rs. 80,790 Life annuity with 15 years guaranteed period Rs. 70,410 Rs. 75,740 Joint Life Annuity with 50% reversion Rs. 68,680 Rs. 76,090 Joint Life Annuity with 100% reversion Rs. 63,090 Rs. 68,860 (with refund Balance Purchase Price) Increasing Life Annuity @ 2% (with refund Balance Purchase Price) Annuity rates are not guaranteed at the entry time, Rate will be fixed at vesting age only What about death benefits? In case of death during the accumulation period Option 1: Pure Pension Option 2: Pension cum Life Cover Nominee will receive in one Lump Sum the amount of the Personal Pension Account Nominee will receive in one Lump Sum the amount of the Personal Pension Account + Basic Sum Assured for the Life Cover In case of death during the annuity period 1. Life time annuity No death benefit 2. Life time Annuity with refund of balance purchase price Refund of balance purchase price to the nominee if any 3. Increasing Life time annuity @ 1 / 2 / 3 % p.a. No death benefit 4. Increasing Life time annuity @ 1 / 2 / 3% p.a. with refund of balance purchase price Refund of balance purchase price to the nominee if any 5. Joint Life time annuity with 50% / 100% reversion to the spouse 6. Annuity for Life with 5 / 10 / 15 years guaranteed period If spouse survives, he/she will receive 50% / 100% of the annuity for Life time If death occurs during guaranteed period, the remaining guaranteed period annuity will be paid to the nominee as per the original schedule What about tax advantage? Pension = Section 80 CCC A maximum of Rs. 10,000 p.a. paid as a contribution on a pension plan is fully deductible from the taxable income Should be increased upto Rs. 20,000 next Fiscal Year 80CCC Taxe advantage for everybody Gross Total Income Rs. 0 - 1.5 lac Rs. 1.5 – 5 lac Above Rs. 5 lac Tax rebate u/s 88 As a percentage of the premium paid upto Rs. 70,000 20% 20% 15% Tax exemption U/S 80CCC Upto Rs. 10,000 Rs. 10,000 Tax exemption Irrespective of Gross Total Income Is there any rebate? Rebates will be added to the PPA Mode of payment: • • • • Yearly: 2% of Contribution Half-Yearly: 1% of Contribution Quarterly: no rebate Monthly: Extra charge 5% Contribution amount: • From Rs. 1 lakh up to Rs.199,500: 1% of Contribution • From Rs. 2 lakhs up to Rs. 499,500: 2% of Contribution • Rs. 5 lakhs and above: 3% of Contribution Life cover premium • Women: 5% discount regular mode / 1% for Single mode Rebates are cumulative Surrender Value Flexible / Single contribution Policy Year Regular contribution Duration till vesting age Less than 6 years Duration till vesting age 6 years and above 1 NIL NIL NIL 2 80% of PPA NIL NIL 3 80% of PPA 80% of PPA NIL 4th year and onwards 85% of PPA -do- 85% of PPA Some illustrations Illustration that will tell you your Yearly Pension Amount and the total amount accumulated in your PPA if you contribute Rs. 10,000 annually Age at retirement 60 years 65 years Age at entry Retirement/PPA Amount* (Rs.) Yearly Pension Amount ** (Rs.) Retirement/PPA Amount* (Rs.) Yearly Pension Amount ** (Rs.) 30 790,370 59,562 1,114,460 94,740 35 548,190 41,312 790,370 67,189 40 367,220 27,738 548,190 46,602 45 221,990 16,729 367,220 31,217 Note: * Retirement/Personal Pension Account amount available at retirement illustrated are based on assumptions. This is worked out at the rate of 6% per annum (with a bonus of 2% over and above the base rate of 4%. The base rate of 4% is guaranteed for the first 7 years as of now).The actual rate for each year will be based on Company’s performance. Please request for a sales illustration for a complete projection ** Yearly Pension Amount payable to the policyholder are indicative and are not guaranteed. It is assumed the entire Retirement Amount is used to purchase Life Time Annuity. This option entitles you to receive this amount every year as long as you survive. An illustration that tells you what your Annual Contribution should be to get a Retirement Amount of Rs. 1 lakh Age at retirement 60 years 65 years Age at entry Annual Contribution* (Rs.) Annual Contribution* (Rs.) 30 35 40 45 1,265 1,824 2,723 4,310 897 1,265 1,824 2,723 Note: * Annual Contribution amount illustrated are based on assumptions. This is worked out at the rate of 6% per annum (with a bonus of 2% over and above the base rate of 4%. The base rate of 4% is guaranteed for the first 7 years as of now).The actual rate for each year will be based on Company’s performance. Please request for a sales illustration for a complete projection. Minimum Annual Contribution Amount should be not less than Rs. 3,000. Lifelong Pensions The competitors Competitors to Lifelong Pensions Unit Linked Non Unit Linked HDFC: Personal Pension Plan ICICI: Forever Life LIC: New Jeevan Suraksha OM KOTAK: Kotak Retirement Plan TATA AIG: Nirvana AVIVA: Pension Plus AMP Sanmar: Bhagya Shree And NOW SBI Life: Lifelong Pensions ICICI: Life Time Pension ICICI: Life Link Pension AVIVA: Pension Plus AMP Sanmar: Bhagya Shree Lifelong Pensions / Personal Pension Plan (HDFC) Lifelong Pensions (SP) Lifelong Pensions (RP) Personal Pension (SP) Personal Pension (RP) Min/Max Age at entry 18 / 65 18 / 65 35 / 60 18 / 60 Min/Max Vesting Age 50 / 70 50 /70 50 / 70 50 / 70 Min/Max term 2 / 52 2 / 52 5 / 35 10 / 35 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) Min. SA Rs. 25,000 Y: Rs. 1,800 Guaranteed returns 4% for the first seven year 4% for the first seven year No No Death benefit PPA PPA Contribution refunded @ 8% p.a. Contribution refunded @ 8% p.a. Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 No No Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1: 0 Y2++: 50% SP + VB Y1/2/3: 0 Y4++: 50% P – 1st YP Free choice of annuity provider Yes Yes Yes Yes Y1/2/3: 0 Y4++: 85% PPA Lifelong Pensions / Forever Life(ICICI) Lifelong Pensions (SP) Lifelong Pensions (RP) Personnal Pension (RP) Min/Max Age at entry 18 / 65 18 / 65 18 / 60 Min/Max Vesting Age 50 / 70 50 /70 50 / 70 Min/Max term 2 / 52 2 / 52 5 / 30 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) Min. SA: Rs. 50,000 Guaranteed returns 4% for the first seven year 4% for the first seven year SA @ 3.5% p.a. for the first 4 years Death benefit PPA PPA SA + VB Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 No Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA Y1/2/3: 0 Y4++: 35% PP – 1st YP Free choice of annuity provider Yes Yes Yes Lifelong Pensions / New Jeevan Suraksha (LIC) Lifelong Pensions (SP) Lifelong Pensions (RP) New Jeevan Suraksha Min/Max Age at entry 18 / 65 18 / 65 18 / 65 Min/Max Vesting Age 50 / 70 50 /70 50 / 79 Min/Max term 2 / 52 2 / 52 2/ 35 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) SP: Rs. 10,000 RP: Rs. 2,500 Guaranteed returns 4% for the first seven year 4% for the first seven year No. Only in case of death Death benefit PPA PPA Contribution Paid @ 5% p.a. Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 NO Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA SP: Y1/2: 0 Y3++: 90%P RP: Y1/2:0, Y3++: 90%P1st YP + VB Free choice of annuity provider Yes Yes NO Lifelong Pensions / Kotak Retirement Plan Lifelong Pensions (SP) Lifelong Pensions (RP) Kotak Retirement Plan (RP) Min/Max Age at entry 18 / 65 18 / 65 18 / 60 Min/Max Vesting Age 50 / 70 50 /70 45 / 65 Min/Max term 2 / 52 2 / 52 5 / 30 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) Y / HY / Q YP: Rs. 4,000 Guaranteed returns 4% for the first seven year 4% for the first seven year No Death benefit PPA PPA SA – P due + PPA Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 Max 25% SA p.a. Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA No surender value Free choice of annuity provider Yes Yes Yes Lifelong Pensions / Nirvana (TATA AIG) Lifelong Pensions (SP) Lifelong Pensions (RP) NIRVANA (RP) Min/Max Age at entry 18 / 65 18 / 65 18 / 65 Min/Max Vesting Age 50 / 70 50 /70 50 / 65 Min/Max term 2 / 52 2 / 52 10 / 42 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) Y/HY/Q/M Min SA: Rs. 50,000 Guaranteed returns 4% for the first seven year 4% for the first seven year After 10 Years: G.A.=10% of SA (1 time) Death benefit PPA PPA SA + G.A. (if any) + VB (from Y5 onwards) Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 NO Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA Y1/2/3: 0 Y4++: 30%P – 1st YP+VB Free choice of annuity provider Yes Yes Yes Lifelong Pensions / Pension Plus (AVIVA) Lifelong Pensions (SP) Lifelong Pensions (RP) Pension plus (RP) Min/Max Age at entry 18 / 65 18 / 65 18 / 65 Min/Max Vesting Age 50 / 70 50 /70 50 / 70 Min/Max term 2 / 52 2 / 52 5 / 52 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) Y / HY / Q / M YP: Rs. 6,000 Guaranteed returns 4% for the first seven year 4% for the first seven year YP: 6,000 – 7,499: 103%P YP: 7,500 – 9,999: 104%P YP 1 lac & above: 105%P (1 time) Death benefit PPA PPA PPA Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 Yes Min. Rs. 1,000 Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA ? Yes Yes Yes Free choice of annuity provider Lifelong Pensions / BHAGYA SHREE (AMP Sanmar) Lifelong Pensions (SP) Lifelong Pensions (RP) BHAGYA SHREE (SP) BHAGYA SHREE (RP) Min/Max Age at entry 18 / 65 18 / 65 18 / 65 18 / 65 Min/Max Vesting Age 50 / 70 50 /70 45 / 70 45 / 70 Min/Max term 2 / 52 2 / 52 5 / 52 5 / 52 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) Min. SA Rs. 1,00,000 Y: Rs. 2,500 Guaranteed returns 4% for the first seven year 4% for the first seven year No No Death benefit PPA PPA PPA PPA Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 Yes Min. Rs. 2,500 Yes Min. Rs. 2,500 Surender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA Y1/2/3/ 0 Y4: 90% PPA Y5: 95% PPA Y6++: 100% PPA Y1/2/3/ 0 Y4: 90% PPA Y5: 95% PPA Y6++: 100% PPA Free choice of annuity provider Yes Yes Yes Yes Lifelong Pensions / Life Time/Life Link (ICICI) Lifelong Pensions (SP) Lifelong Pensions (RP) Life Link (SP) Life Time (RP) Min/Max Age at entry 18 / 65 18 / 65 18 / 62 18 / 60 Min/Max Vesting Age 50 / 70 50 /70 50 / 70 50 / 70 Min/Max term 2 / 52 2 / 52 3 / 52 10 / 52 Min/Max contribution Rs. 10,000 Rs. 3,000 p.a. (Min. Rs. 500) SA: Rs. 40,000 Y/HY/Q/M YP: Rs. 10,000 M: Rs. 833 Guaranteed returns 4% for the first seven year 4% for the first seven year No No Death benefit PPA PPA 100% / 105% P paid + PPA PPA+ SA if any Extra additional contribution Yes Min. Rs. 500 Yes Min. Rs. 500 No No Surrender Value Y1: 0 Y2-3: 80% PPA Y4: 85% PPA Policy Term more than 6Y: Y1/2/3: 0 Y4++: 85% PPA Y1: 0 Y2++: unit value Y1/2/3: 0 Y4++: unit value Free choice of annuity provider Yes Yes Yes Yes How to sell Lifelong Pensions? According to their age group, why should they buy Lifelong Pensions Scheme? 18 to 30 yrs: • Accumulating money at a lower price 31 to 40 yrs: • Looking for Tax benefit, Section 80 CCC 41 to 50 yrs: • Start building Pension 51 to 60 yrs: • Act now, otherwise… 60 to 70 yrs: • Financial independance post retirement Lifelong Pensions USP’s Save Tax u/s 80 CCC irrespective of the tax bracket. Guaranteed returns 4% till March 2010. Flexibility in premium contribution, in mode of payment, in retirement age, in annuity options and annuity provider. Making the right choice for long commitment is now easy… Never too young to start building pension and…. Never too late to benefit from lifetime income…. LIFELONG PENSIONS HELPS YOU TO MAINTAIN YOUR EXISTING LIFESTYLE

© Copyright 2026