EMR Explained Helen Scott Market Development Originator 1

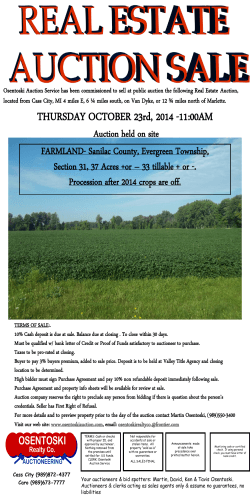

EMR Explained Helen Scott Market Development Originator 1 What is a Contract for Difference (CfD)? ▲ Ultimate intention is to promote investment in low carbon by reducing the cost of capital. ▲ Low carbon generators are paid a fixed price for the electricity they generate – reference price (linked to wholesale price) plus top up to a fixed strike price – but have to repay money if wholesale price rises above strike price. ▲ Covers all technologies covered by RO plus nuclear and CCS. ▲ Certain eligibility criteria must be met to participate in an allocation round. ▲ Established technologies (including onshore wind and solar) will move straight to competitive auction via sealed bids, competing against each other for budget. 2 What is a Contract for Difference (CfD)? ▲ Immature technologies (including offshore wind) will not go to auction, but be allocated administratively will replace the Renewables Obligation from 2017, the two will run concurrently between 2014 and 2017. ▲ Funded by suppliers (and hence customers) via a compulsory levy with exemptions for Energy Intensives (which are expected to start from 2016). ▲ Levy Control Framework (LCF) sets a cap on total low carbon costs at £7.6bn (2012 real prices) in 2020 (more than twice the current £3.3bn p.a.). CfD costs will start in April 2015 at c. £0.5/MWh and increase on a quarterly basis through to 2020 when they will be c. £8/MWh CfD costs will start in April 2015, ramping up over time from approx £0.5/MWh1 to approx £8/MWh1 by 2020. DECC have decided on a quarterly “fixed” unit cost (p/kWh) to pass costs on to suppliers, with a reconciliation at the end of each quarter. There will also be a fixed operational cost associated with the running of the LCCC. Sources: RWE Analysis, June 2014 4 CfD costs will start in April 2015 at c. £0.5/MWh and increase on a quarterly basis through to 2020 when they will be c. £8/MWh Suppliers also have to post collateral for a reserve fund and an insolvency fund. Energy Intensive users will have some level of exemption but this will not be in place from 2015 (and will not be applied retrospectively). There is a BIS/DECC consultation open now on eligibility for Energy Intensive exemptions. This will further increase costs for those that are not eligible. What is a Capacity Mechanism? An annual auction to secure reliable capacity for delivery four years later, with first auction held in December 2014 for delivery in 2018/19 Year ahead auction to “top up” any capacity shortfall and allow Demand Side Response (DSR participation) DECC have decided to procure 50.8GW in the 2014 capacity auction to ensure sufficient capacity to meet demand at peak in 2018 A further 2.5GW of DSR will be procured in the T-1 year ahead auction 6 What is a Capacity Mechanism? Plant receiving RO, CfD, FiT, RHI and long term STOR are excluded (including co-firing plant). Penalties for non-delivery of capacity (which will be capped at 200% monthly payment, 100% annual payment), but potential reward for over-delivery. Demand Side Response (DSR) to participate on equal terms after 2 staged transition Costs will be recovered from Suppliers according to their forecast market share of peak demand (4-7pm Winter weekdays). National Grid looking to introduce additional Balancing Services to deal with any capacity adequacy shortfalls in interim. Design of the Capacity Mechanism is finalised although accurate costs will not be known until the auction has been held in Dec 2014 ▲ The Capacity Mechanism provides an insurance premium against the lights going out as it will result in existing plant staying open and new plant being built. ▲ However, there is an associated cost which will be funded by consumers. ▲ As capacity is procured via an auction, it is very difficult to predict the costs accurately. ▲ With 50.8GW1 procured via the auction at a clearing price of £39/kW2, total cost to consumers is c.£2bn. ▲ If the auction were to clear at the auction cap (£75/kW), total cost to consumers is c.£4bn. ▲ However, we will have certainty of 95% of costs, 4 years ahead of delivery and total costs 1year ahead of delivery so there will be no surprises. 8 Design of the Capacity Mechanism is finalised although accurate costs will not be known until the auction has been held in Dec 2014 ▲ Costs to be allocated to suppliers according to market share of Winter peak, defined as 4-7pm Winter weekdays between November and February (Triad periods). ▲ It is very difficult to switch off for all of these periods, so only onsite generation will allow customers to avoid all the charges, but there could be significant cost advantages of avoiding the charges, meaning investment is worthwhile. ▲ However, onsite generation may participate in the Capacity Mechanism via Demand Side Response. ▲ Opportunity to participate via Demand Side Response (likely a role for aggregators or small scale DSR). EMR is expected to be implemented from Q4 2014 CM Regulations came into force Pre-qualification starts Jul 14 CfD Regulations came into force Final Auction Guidelines Oct 14 Allocation budget confirmed First CM Auction takes place Jan 15 CfD Auction takes place Confirmation of first CfD unit rate CM Operational Cost recovery starts Apr 15 CfD Cost recovery starts CfD Allocation Round opens In August 2014 the EMR secondary legislation was passed into law & State Aid approval was granted, marking the “go-live” of EMR. Jul 15 Revenue Generation & Cost Mitigation Vish Sharma Head of npower Structured Products 11 Cost impact of EMR CfD CAPACITY MECHANISM EMR £8-£10/MWh £3-£7/MWh £11-£17/MWh by 2020 by 2018/19 12 by 2020 Revenue generation: Participate DSR IN CAPACITY MECHANISM Demand Side Response (DSR) providers will be able to participate in the Capacity Market on equal terms with traditional forms of generation DSR will need to meet testing requirements and post bid bonds if have no evidence of providing capacity in other balancing services For DSR providers that are reducing their consumption to meet their capacity agreement, this will measured using a Baselining approach to determine whether they delivered their obligation Their baselines and delivery will be adjusted for participating in balancing services but not for Triad avoidance Pre-qualification began on 4th August for the first CM auction for capacity in 2018 For those that don’t participate in the main auction this year there will be transitional arrangements specifically for DSR capacity in 2016 & 2017 with reduced bid bonds & 2 products (time banded product and load following product) designed to introduce new participants to DSR market 13 Revenue generation: Participate DSBR EDR In June National Grid launched the Demand Side Balancing Reserve (DSBR) It will begin with a pilot this Winter to tender for a maximum 330MW of capacity Participants will be paid a utilisation fee (they can bid in fee they wish to receive from a range of nominal rates between £250/MWh to £12,500/MWh) with no penalties for not responding Participants can also opt to receive a set up fee of £10,000/MW (for demand reduction that can be sustained for 2 hrs) to support with any upfront costs The cheapest utilisation fees will be dispatched first and participants opting not to receive the set up fee will be prioritised Applications to take part in the Winter 14 closed on Monday 21st July 2014 The results of this tender will be published shortly 14 A pilot is being launched this year, expected to last 2 years and will provide financial support to participants who install new efficiency measures that will deliver capacity savings over the winter peak period (Nov-Feb weekdays 4-8pm). Examples of efficiency measures that would be eligible for support include installing efficient motors, air conditioning & lighting. Good opportunity to revisit projects that didn’t seem economically viable before this support was available The final EDR pilot rules and guidance were published in July Expressions of Interest are open now and applications close 31st October 2014 Cost mitigation: avoid & smarter usage COST ILLUSTRATION OF A “TYPICAL” WINTER 2018/19 PEAK HOUR ENERGY EFFICIENCY & LOAD MANAGEMENT Value of 17:00-18:00 in Winter 2018/19 Avoid/Reduce Consumption: £/MWh The CfD charge is based on overall consumption, not consumption at a time specific, therefore the only way to reduce this cost is to use less! 400 350 300 These additional costs (CfD & CM) make energy efficiency business cases more attractive and reduce financial payback times. 250 200 150 Others FiT BSUoS CfD Dloss CM costs are time specific however, so load management at winter peaks (NovFeb, Mon-Fri, 4pm-7pm) can reduce this cost (if HH metered). 100 RO 50 DUoS CM 0 15 Energy How can my business mitigate the cost impact of EMR? CONSUME LESS SMARTER CONSUMPTION PARTICIPATION COST CERTAINTY WORK IN PARTNERSHIP WITH YOUR ENERGY SUPPLIER 16

© Copyright 2026