Interest Rate Swap Product Disclosure Statement

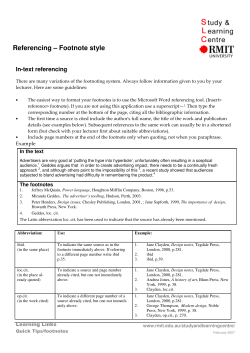

Interest Rate Swap Product Disclosure Statement A Product Disclosure Statement is an informative document. The purpose of a Product Disclosure Statement is to provide you with enough information to allow you to make an informed decision about a product’s suitability for your needs. A Product Disclosure Statement is also a tool for comparing the features of other products you may be considering. If you have any questions about this product, please contact us on any of the numbers listed at the end of this Product Disclosure Statement. Important Information This Product Disclosure Statement is issued by CIT Capital Markets – Risk Management th Products Desk (“CIT”) and is current as of January 18 , 2008. The information contained herein is subject to change. CIT will provide updated information by issuing a replacement Product Disclosure Statement. The information contained in this document is general in nature. It has been prepared without taking into account your objectives, financial situation or needs. Because of this, you should, before acting on this information, consider its appropriateness to your objectives, financial situations and needs. By providing this Product Disclosure Statement, CIT does not intend to provide financial advice or any financial recommendations. You should read and consider this Product Disclosure Statement in its entirety and seek independent expert advice before making a decision about whether or not this product is suitable for you. The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT. Interest Rate Swap Counterparty CIT Lending Services Corporation (CIT, we or us.) Purpose What is a Swap? An Interest Rate Swap (Swap) is an interest rate management tool for customers who have financing arrangements that are subject to changing interest rates, for example, a LIBOR based facility. A Swap is not a lending facility. It is an interest rate management tool that can be used in conjunction with any variable rate lending facility, including a facility with another lender. Your underlying lending facility will continue to be governed by the terms and conditions set out in your facility agreement. It is also important to remember that a Swap only affects the base interest rate applicable to your underlying lending facility. It has no effect on any acceptance or other fees and margins payable under that facility. You remain obligated to pay those fees and margins no matter what happens with the Swap. For that reason, this document does not consider or take into account any fees and margins payable in respect of your underlying lending facility. Suitability Do I have sufficient knowledge about this product? A Swap may be suitable if you have a good understanding of interest rate markets and would like to manage your interest rate exposure. If you are not confident about your understanding of these items, we suggest you seek independent advice before making a decision about this product. Description All Swaps involve a variable and a fixed rate A Swap is an agreement between you and CIT where one party agrees to pay the other (in cash) the difference between a fixed interest rate (Swap Rate) and a series of variable interest rates over an agreed period of time. The fixed interest rate is established at the beginning of the transaction, while the variable rate is a Reference Rate determined on period Reset Dates. The variable Reference Rates used for most swaps are LIBOR or PRIME (see the market reference rate section for more information.) The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT …and a Payer and a Receiver A Swap is based on an agreed notional amount (the Principal). It usually involves the exchange of a fixed for a floating rate (fixed for floating). In every fixed for floating Swap transaction, one person wants to pay a fixed interest rate (the Payer) and the other wants to receive that fixed payment (the Receiver). The motivation of the Payer in a fixed for floating Swap is to transform an underlying variable interest rate into a fixed rate obligation, and vice-versa for the Receiver. How does it work? At each reset date: if the Reference Rate is greater than the Swap Rate, then the Payer will receive a cash payment from the Receiver based on the difference between the Reference Rate and the Swap Rate if the Reference Rate and the Swap Rate are the same, there is no exchange of payments if the Reference Rate is less than the Swap Rate, then the Receiver will receive a cash payment from the Payer based on the difference between the Swap Rate and the Reference Rate. The following diagram summarizes the variable and fixed rate payment obligations of a Payer and Receiver in a fixed for floating Swap. It assumes that the Reference Rate is LIBOR. LIBOR + SPREAD Customer Fixed Loan payment LIBOR The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT Periodic settlement Settlement occurs on every Reset Date and the relevant amount is paid at the end of the interest rate period (in arrears). If you are making a payment, you must do so according to CIT’s instructions. CIT will make all payments to a bank account selected by you. There is no exchange of principal – only exchange of interest Neither party commits to the exchange of Principal amounts. The notional Principal remains constant throughout the life of the Swap (unless an amortization or accretion schedule is built into the Swap). Reset (or rollover) Dates Reset Dates (or rollover dates) divide the term of your underlying exposure into equal intervals (usually quarterly or monthly) called Calculation Periods. Cost of product Cost of product There are no fees or other direct costs associated with a Swap. The price of the Swap is simply the fixed rate of interest applicable to the Swap. When setting the fixed rate of interest, CIT takes into account a variety of factors, including: the amount of the Principal, the term of the Swap, the Reference Rate and the reset or payment frequency inter-bank market rates prevailing at the time, and market volatility CIT derives a financial benefit from entering into a Swap. CIT obtains that benefit by incorporating margins into the rates it sets for Swaps. By that we mean that the agreed upon rates for a Swap will be different to the base market interest rates prevailing at the time. In effect, you pay for the Swap by accepting the fixed interest rate quoted by CIT. Advantages/benefits Advantage/benefits Disadvantages/risks A Swap is flexible. It allows you to tailor the Principal, payment frequency and maturity to suit your financing arrangement. A Swap allows you to manage interest rate risk without affecting the financing arrangement. There is no upfront premium. Disadvantages/risks You effectively “lock in” a fixed interest rate. This means you The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT Early termination cannot participate in favorable interest rate movements. Early termination may incur a breakage cost subject to market movements (see Early termination section). We generally have performance obligations under all the financial products into which we enter. Customers depend on us to perform our obligations. Our ability to do so is linked to our financial well-being. This type of risk is commonly referred to as credit or counterparty risk. As we are an A rated credit, the risk of us failing to perform is very low. Can I terminate a Swap before maturity? You may ask us to terminate a Swap at any time up to the maturity date. CIT will provide you with a quote for canceling the Swap. What will the value of a Swap be upon early termination? Our quote will incorporate the same variables (amount of the Principal, term of the Swap, Reference Rate, and reset or payment frequency) used when pricing the original Swap. These will be adjusted for prevailing market rates over the remaining term of the Swap. We will also need to consider the cost of reversing or offsetting your original transaction. When doing this, CIT takes into account the current market rates that apply to any such offsetting transactions. What happens if I accept? If you accept the termination quote, the Swap will be cancelled. You should appreciate that you may lose money as a result of early termination. Credit approval Credit approval Before entering into a Swap, CIT will assess your financial position to determine whether or not your situation satisfies our normal credit requirements. CIT will advise you of the outcome of its review as soon as possible. If your application is successful, you will need to enter into the appropriate agreements as defined by the International Swaps and Derivatives Association’s (ISDA) documentation. Documentation Documentation You will be required to sign a standard master agreement. The ISDA Master Agreement is multicurrency, cross border agreement that comprehensively covers all of the terms and conditions of one or more derivative transactions. This is the industry standard documentation. The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT The ISDA Schedule to the Master Agreement covers all of the specifics between you and CIT. Both this document and the Master are drafted by CIT, or its counsel. Each of the above documents governs the dealing relationship between you and CIT and set out the terms and conditions that apply to all transactions that we enter into with you. In particular, they document the situations where those transactions can be terminated and the way the amount payable following termination is calculated. We will provide you with your own copy of each of these documents and we strongly recommend that you fully consider their terms prior to entering into any transaction. You should obtain independent advice if you do not understand any aspect of the documents. Confirmation Shortly after entering into a Swap, CIT will send you a confirmation that outlines the economic terms of the transaction. This confirmation will need to be signed by you and returned to CIT. It is extremely important that you check the confirmation to make sure that it accurately reflects the terms of the transaction. In the case of a discrepancy, you will need to raise the matter with your CIT contact as a matter of urgency. The market Reference Rate The market Reference Rate The Reference Rate provides a benchmark interest rate. The market Reference Rates that are commonly used are USD LIBOR or its foreign counterparts. Where the variable interest rate applicable to the underlying financing agreement is not referable to LIBOR, the Reference Rate used for the Swap will be different. The Reference Rate will correspond to the variable rate applying to the underlying financing arrangement. Example Example The example below is indicative only and uses rates and figures that we have selected to demonstrate how the product works. In order to assess the merits of any particular Swap, you would need to use the actual rates and figures quoted to you at the time. (Note that the calculations below include rounding of decimal places.) The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT Scenario You are a borrower with a 3 year US Dollar ($) 10,000,000 variable rate LIBOR based facility, which rolls over on a quarterly basis at the prevailing 3 month LIBOR rate. In the current economic environment interest rates look as though they will be rising and your borrowing costs may exceed 5.00%. You would like to lock in your borrowing costs at the current Swap rate of 5.00%. To hedge against the risk of interest rates rising, you elect to enter into a 3 year Swap with CIT to pay a fixed interest rate of 5.00% (the Swap Rate) on a Notional Principal of $10,000,000 quarterly Reset Dates and 3 month LIBOR as the Reference Rate. For the purposes of this example, assume that there are 90 days in the quarter. If 3 month LIBOR is above 5.00% Assume that 3 month LIBOR is 6.00%. The variable base rate that would apply under your LIBOR based facility would then be 6.00%. However, as you have entered into a Swap with CIT with a Swap rate of 5.00%, CIT will compensate you for the difference between LIBOR and the Swap Rate. Therefore, you receive an amount based on the difference of 1.00%. This amount offsets the increased base amount payable under your underlying facility, which has risen by 1.00%. This effectively means you have “locked in” your base interest rate at 5.00%. This process is repeated on each quarterly Reset Date. CIT uses the following formula to determine the amount payable where the financing arrangement is a LIBOR based facility. Floating Amount: Floating Amount = Notional Principal x Reference Rate(%) x Actual/360 Fixed Amount: Fixed Amount = Notional Principal x Fixed Swap Rate(%) x Actual/360 Where Actual means the actual number of days in the Calculation Period. The difference between the Floating and Fixed Amounts (depending on whether it is positive or negative number) will be paid either by you or by CIT. Below is a simple way to calculate the amount payable. Using the figures in the example, this is calculated as follows: The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT Amount payable at Reference Rate: Fixed Amount = $10,000,000 x 5.00% x 90/360 = $125,000.00 Amount received at Swap Rate:: Floating Amount = $10,000,000 x 6.00% x 90/360 = $150,000.00 The payment CIT makes to you is the difference between the above amounts, that is: $150,000.00 - $125,000.00 $ 25,000.00 If 3 month LIBOR is below 5.00% If 3 month LIBOR is below 5.00% (for example, 4.50%) then the variable base interest rate that would apply under your underlying facility would be 4.50%. However, as you have entered into a Swap with CIT at a Swap Rate of 5.00% you will need to compensate CIT for the difference between the 3 month LIBOR rate and the Swap Rate. This will result in a cost to you because you have agreed to forego favorable interest rate movements and have “locked in” your interest rate at 5.00% (the Swap Rate). Based on the above, the amount payable in this example would be as follows: Amount payable at Reference Rate: Fixed Amount = $10,000,000 x 5.00% x 90/360 = $125,000.00 Amount received at Swap Rate:: Floating Amount = $10,000,000 x 4.50% x 90/360 = $112,500.00 The payment made by you to CIT is the difference between the above amounts, that is: $112,500.00 - $125,000.00 ($ 12,500.00) What if 3 month LIBOR is the same as the Swap Rate? If 3 month LIBOR remains at 5.00%, no amount is payable under the Swap for the period. Your base interest rate would remain at 5.00%. The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT The chart below illustrates the aforementioned calculations: Market Interest Rate CIT pays you if Reference Rate > Swap Rate Cost of Funds Swap Interest Rate You pay CIT if Reference Rate < Swap Rate Underlying Interest Rate at Reset Date LIBOR Taxation Taxation Taxation law is complex and its application will depend on your circumstances. When determining whether or not this product is suitable, consider the impact it will have on your taxation position and seek professional advice on the tax implications it may have for you. Factors that may influence our advice CIT Contact Details Factors that may influence our advice This document has been designed to help you choose the right product for your needs. When you ask for a recommendation, please be assured that our professionals will always explain your choices and suggest a suitable product. Peter Phelan Managing Director (212) 771-9623 [email protected] Jim Beattie Analyst (212) 771-1779 [email protected] The information contained herein has been compiled from a variety of sources believed to be reliable. We do not guarantee such information or make any representation as to its accuracy. This publication is intended to provide general information regarding capital markets and financing matters and is not intended nor should it be construed, to provide legal, accounting or financial advice. Securities and Investment Banking Services are offered through CIT Capital Securities LLC, an affiliate of CIT

© Copyright 2026