CURRENT ISSUES IN U.S. ACCOUNTING FOR INCOME TAXES (ASC 740) ACCOUNTING FOR

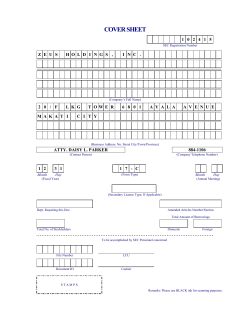

CURRENT ISSUES IN U.S. ACCOUNTING FOR INCOME TAXES (ASC 740) ACCOUNTING FOR INCOME TAXES (ASC 740) FACULTY: December 15 & 16, 2014 • Bloomberg LP • New York, NY James Hemelt Bloomberg BNA Arlington, VA A two-day advanced technical update with live group instruction on key tax accounting issues facing tax practitioners in compiling and reviewing income tax provisions under ASC 740 for the current year. Benefits of Attending: • Understand effective tax rate forecasting and interim reporting • List financial disclosure issues involving derivatives and financial products • Discuss tax accounting issues affecting intangibles, including goodwill, and impact on the income tax provision • And more! All paid attendees will receive the Bloomberg BNA Portfolio: #5000-4th Accounting for Income Taxes FASB ASC 740 (a $400 value) *One Portfolio per paid attendee. Quantities are limited. Earn Up to 15 CPE/CLE Credits >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> U.S. INTERNATIONAL TAX REPORTING & COMPLIANCE December 15 & 16, 2014 • Bloomberg LP • New York, NY Join us for a two-day session on the practical U.S. tax issues in documenting and reporting the tax and accounting results of foreign entities and operations. Benefits of Attending: • Understand how the expense apportionment rules under Reg. Sec. 1.861-8 affect foreign tax credit benefits • Find out how the latest tax law changes affect your company’s international tax reporting responsibilities • Find out how companies obtain foreign tax data from affiliates overseas for preparing Forms 5471 • Discover how to report the results of check-the-box and other foreign disregarded entities on Form 8858 • And more! All paid attendees will receive the Bloomberg BNA Portfolio: Reporting Requirements Under the Code for International Transactions #947 (a $400 value) *One Portfolio per paid attendee. Quantities are limited. Earn Up to 16 CPE/CLE Credits These unique courses are offered exclusively by Bloomberg BNA ::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::: For more information, call 800.372.1033 or visit www.bna.com/taxseminars ::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::: Peter Crocco WTAS Washington, DC Ellen MacNeil WTAS Washington, DC Ron Maiorano KPMG Toronto Dennis Minich WTAS LLC Chicago REPORTING & COMPLIANCE FACULTY: Kyle Bibb K. Bibb LLC Dallas, TX Eytan Burstein McGladrey New York, NY Victor Gatti KPMG New York, NY James Hemelt Bloomberg BNA Arlington, VA Marcellin Mbwa-Mboma Ernst & Young LLP New York, NY Mitchell Siegel McGladrey New York, NY CURRENT ISSUES IN U.S. ACCOUNTING FOR INCOME TAXES (ASC 740) December 15 & 16, 2014 • Bloomberg LP • New York, NY www.bna.com/taxseminars >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> DAY ONE 8:00 AM Registration and Continental Breakfast 8:45 AM Welcome and Overview 9:00 AM Hot Issues in U.S. Accounting for Income Taxes •Managing your tax positions-certain and uncertain •Effective tax rate forecasting and interim reporting •Accounting for Uncertain Tax Positions-review of applicable rules and recent developments •Identifying your effective tax rate drivers •Reconciling the statutory and effective tax rate for U.S. multinationals 10:30 AM Break for Refreshments 10:45 AM Accounting for International Operations – Part I •Inside/outside basis issues in consolidating affiliated group results – treatment of variable interest or check-the-box entities •Maintaining U.S. GAAP records for foreign subsidiaries, branches and partnerships – consolidation v. equity method •Translation of foreign currency statements under ASC 830 (FAS 52) – description of other comprehensive income (OCI) •Treatment of permanently reinvested CFC earnings – application of ASC 740-30-05 (APB 23) •Comparison with the IFRS accounting rules 12:15 PM Luncheon 1:00 PM Organizational and Transactional Tax Accounting Issues Facing U.S. Multinational Companies •Common effective tax rate drivers •Valuation allowances and losses without benefit •ASC740 -30-05 (APB 23) considerations when criteria are not met •ASC740-10 (FIN48): considerations for MNCs 2:15 PM Break for Refreshments 2:30 PM Tax and Disclosure of Derivatives and Hedging Activities •Accounting for hedges and derivative products – update on ASC 815 (FAS 133) •Comparison of ASC 815 to tax rules related to hedging and derivatives •Common M-1 adjustments related to hedging and derivative activities •Financial disclosure issues involving derivatives and financial products – comparison with the IFRS accounting guidelines Times/topics/speakers subject to change ©2014 The Bureau of National Affairs, Inc. All rights reserved These unique courses are offered exclusively by Bloomberg BNA ::::::::::::::::::::::::::::::::: For more information, call 800.372.1033 or visit www.bna.com/taxseminars ::::::::::::::::::::::::::::::::: 4:00 PM Special Tax Accounting Issues in Reporting the Results of Mergers, Acquisitions and Dispositions – ASC 805 and ASC 350 •Tax accounting issues affecting intangibles, including goodwill, and impact on the income tax provision •Consequences of making a basis step-up election under Sec. 338 – interrelationship with purchase accounting •Counter-intuitive effective tax rate impact on accounting statements •Understanding IFRS convergence issues 5:30 PM Meeting Adjourns for the Day DAY TWO 8:00 AM Continental Breakfast 8:45 AM The Growing Role of Valuation in Financial Statements •Fair value measurement •Business combinations •Goodwill and other intangibles •Hedging •Impairment •Debt/equity determinations 10:15 AM Break for Refreshments 10:30 AM Reducing the U.S. Tax Rate on Domestic Production Activities •Projecting rate benefits from domestic production activities – computing the Sec. 199 deduction in 2014 and 2015 •Determining income attributable to production activities and QPAI amounts eligible for the deduction •Avoiding the taxable income and W-2 wage limitations •Preparing workpaper support for the Sec. 199 deduction – complying with footnote disclosure – IRS audit update 12:15 PM Luncheon 1:15 PM Compensation Issues •Review of deduction provisions affecting stock options and other incentive pay in merger and acquisitions •Latest developments in compensation tax issues •Special issues involving mergers and acquisitions •Funding non-qualified deferred compensation plans •Interrelationship with accounting rules under IFRS 3:15 PM Meeting Ends U.S. INTERNATIONAL TAX REPORTING & COMPLIANCE December 15 & 16, 2014 • Bloomberg LP • New York, NY www.bna.com/taxseminars >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> DAY ONE 8:00 AM Registration and Continental Breakfast 8:45 AM Welcome and Overview 9:00 AM Reporting the Results of Foreign Operations • Obtaining the accounting data from overseas for preparing and filing U.S. tax returns – identifying foreign source income • Who are U.S. persons required to file a return with the IRS? • Computing earnings and profits for CFCs and disregarded entities – Schs. C, H and J, Form 5471, Form 8858 • Understanding the functional currency concept of QBUs and joint ventures – translation of P&L and B/S items and taxes 10:30 AM Break for Refreshments 10:45 AM U.S. Tax Issues in Structuring Foreign Entities • Special issues in structuring foreign operations for individual S corporation or LLC shareholders in a foreign entity • Selecting a foreign corporate or pass-through entity – when a foreign entity can elect to be taxed as a conduit – per se corporations • Understanding the latest U.S. tax consequences of making a check-the-box (CTB) election on Form 8832 • Recapture of overall foreign and domestic losses and dual consolidated loss issues 12:15 PM Luncheon 1:30 PM Computing Direct and Indirect Foreign Tax Credit Benefits • Claiming direct foreign tax credit benefits – maintaining pools of foreign taxes available for credit • Tracking and translating Earnings & Profits on for foreign dividend and gross-up calculations • Applying the foreign tax credit limitation formula for passive or general basket income and taxes • Computation of the Sec. 78 gross-up for deemed paid taxes – interrelationship with the Subpart F FPHCI rules • FTC recharacterization and resourcing rules – treatment of overall foreign and domestic losses and splitter transactions 3:15 PM Break for Refreshments 3:30 PM Expense Apportionment • How expense apportionment affects foreign tax credit benefits • Understanding key definitions for class of income, statutory and residual groupings and gross income apportionment • Application of expense apportionment to interest and research expense – treatment of stewardship, state tax and charitable deductions • Learn how the expense apportionment rules limit foreign tax credit benefits for book and tax purposes 5:00 PM Conference Adjourns for the Day Times/topics/speakers subject to change ©2014 The Bureau of National Affairs, Inc. All rights reserved These unique courses are offered exclusively by Bloomberg BNA ::::::::::::::::::::::::::::::::: For more information, call 800.372.1033 or visit www.bna.com/taxseminars ::::::::::::::::::::::::::::::::: DAY TWO 7:30 AM Continental Breakfast 8:00 AM Corporate International Tax Compliance • Preparation of Form 5471 – best practices for reviewing the data • Preparation of Schedule M, Form 5471 for reporting intercompany transactions • Review of key U.S. international reporting forms – Form 926, 1118, 8858 and 8621 9:15 AM Understanding the Subpart F Provisions • Defining CFC ownership for Subpart F purposes • Determining Subpart F income amounts and analyzing how Subpart F accelerates the U.S. tax on foreign earnings • Application of the Sec. 954(c)(6) look-through rules • Computing the Subpart F inclusion and deemed paid credit • Defining Sec. 956 earnings invested in U.S. property • Planning for distributions of Previously-Taxed Income (PTI) • Avoiding the Passive Foreign Investment Company (PFIC) rules 10:45 AM Break for Refreshments 11:00 AM Understanding the Rules for Computing Foreign Exchange Gain (Loss) • Foreign currency translation v. transaction gain (loss) – determining the functional currency for foreign entities under Sec. 985 • Determining the character and source of Sec. 988 transactions • Transactions involving branches and foreign disregarded entities under Sec. 987 – filing Form 8858 • Translation rules for foreign taxes and earnings and profits under Sec. 986 12:15 PM Luncheon 1:15 PM Computing the Gain from the Sale of CFC Shares Under Sec. 1248 • How the U.S. taxes gain from the sale of shares in a CFC • Determining gain (loss) on the liquidation of a CFC under Secs. 331 and 332 • U.S. tax consequences of making a Sec. 338 election on the sale of a CFC • Understanding how Sec. 964(e) applies to dispositions of shares in lower-tier CFCs 2:30 PM Break for Refreshments 2:45 PM Transfers of Stock and Assets to a Foreign Corporation • How to qualify an outbound transfer of assets to a foreign subsidiary or joint venture as tax-free under Sec. 367(a) • Special rules for transfers of intangibles under Sec. 367(d) • Organizing a foreign corporation or holding company – completing a Gain Recognition Agreement (Form 8838) • Special issues involving non-taxable mergers and reorganizations under Sec. 367(b) 4:45 PM Conference Ends Five Easy Ways to Register: E-Mail: [email protected] Telephone: 800.372.1033 Web: www.bna.com/taxseminars Facsimile: 800.253.0332 Mail: Bloomberg BNA’s Customer Contact Center 3 Bethesda Metro Center, Suite 250 Bethesda, MD 20814-5377 USA >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> HARDSHIP POLICY Bloomberg BNA offers a hardship policy for CPAs and other tax and accounting professionals who wish to attend our live conference and seminars. Individuals must earn less than $50,000 annually in order to qualify. For individuals who are unemployed or earning less than $35,000 per year, a full discount off the price of registration for the program will be awarded. Individuals earning between $35,000 and $50,000 per year will receive a 50% discount off the price of the program. If an individual wishes to submit a case for hardship, he or she must contact Bloomberg BNA directly at [email protected]. Please include the following information with your request: complete contact information, program for which a hardship reduction is being requested, requested amount for hardship reduction, and reason for applying for hardship. Please note that requests will not be considered until 30 days from the program date and that individuals may only apply for a hardship reduction once within a 12-month period. Bloomberg BNA reserves the right to make a final determination on a case-by-case basis. Our decision for granting a hardship is final and submission does not constitute acceptance. CANCELLATION POLICY If you are unable to attend this event, you may: transfer your registration to another person from your company for the same event; or transfer your registration to a substitute event listed on our web site. In either instance, there will be no charge or penalty for substitution. To request a transfer, contact [email protected] with the new attendee or substitute event information more than 5 business days prior to the conference start date. On the first day of the event, absent attendees will be considered “no shows” and will not be eligible for a refund, transfer, or substitute event. Cancellations must be made in writing to [email protected] more than 5 business days before the event and will be assessed a $350 conference setup fee. Cancellations will not be accepted if notice is received fewer than 5 business days before the event. For more information regarding administrative policies, complaints and cancellations, please contact us at 800.372.1033, or e-mail [email protected]. CPE/CLE CREDITS AVAILABLE Bloomberg BNA is registered with the National Association of the State Boards of Accountancy as a sponsor of continuing professional education on the National Registry of CPE sponsors. State Boards of Accountancy have final authority on the acceptance of individual courses. Complaints regarding registered sponsors may be addressed to NASBA, 150 Fourth Avenue North, Suite 700, Nashville, TN 37219-2417. Bloomberg BNA will apply for continuing legal education credits in any state or jurisdiction where available. For more information, please contact Bloomberg BNA customer service at 800.372.1033 and ask to speak to the CLE Accreditations Coordinator, or email us at [email protected]. CONFERENCE LOCATIONS Bloomberg LP – Tel.: 212.318.2000 731 Lexington Avenue, New York, NY 10022 Hotel accommodations are at your own discretion. We suggest the following: Renaissance New York Hotel – Tel: 866.240.8604 130 East 57th Street, New York, NY Fitzpatrick Hotel Group – Tel: 800.367.7701 687 Lexington Avenue, New York, NY DoubleTree by Hilton Hotel Metropolitan – Tel: 212.752.7000 569 Lexington Avenue, New York, NY Fee Includes Continental breakfasts, lunches, refreshment breaks, Bloomberg BNA Portfolio and course materials in electronic format. Contact Bloomberg BNA about discounts for three or more registrants from the same company >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> REGISTER EARLY & SAVE! Name Title Organization Current Issues in Accounting for Income Taxes $1295 Early Registration (up to 1 month prior to course) $1495 Registration (within 1 month of course) U.S. International Tax Reporting & Compliance $1195 Early Registration (up to 1 month prior to course) $1395 Registration (within 1 month of course) Method of Payment All credit cards converted to and billed in U.S. dollars (USD). Check enclosed payable to Bloomberg BNA Credit card payment: MasterCard Visa AmEx Discover All credit cards will be processed at current U.S. conversion rates Address City State Zip Card No. TelephoneFax V-code Card exp. /Billing Zip E-mail Signature Card Expiration Date CURRENT ISSUES IN U.S. ACCOUNTING FOR INCOME TAXES (ASC 740) December 15 & 16, 2014 • Bloomberg LP • New York, NY WHY YOU SHOULD ATTEND Corporate tax practitioners are always advised to stay current with the latest ASC as well as tax law changes. Such changes and developments often impact not only the calculation of the income tax provision but also the disclosure required in the tax footnote in the annual as well as the interim financial statements. Many tax practitioners are aware that the tax provision constitutes a significant item in the financial statements. In particular, the recognition of deferred tax assets is an issue affecting all tax practitioners, particularly in light of the increased scrutiny from auditors and regulators regarding the sufficiency of the valuation allowance. Further the ASC 740 issues stemming from business combination transactions are often complex and present challenges in properly reporting and disclosure of the issues. This course provides an excellent opportunity to discuss the most current trends and issues in ASC 740. BloombergBNA is pleased to announce its popular conference, Current Issues in US Accounting for Income Tax (ASC 740), which is designed to update attendees on the latest ASC 740, and related SEC) developments. In addition, emphasis is placed on current income tax issues impacting the income tax provision calculations. This two-day technical update provides in-depth coverage of key tax accounting issues, such as the accounting for compensation and stock based pay, business combinations, uncertain tax positions, and the financial and tax treatment of financial obligations and hedges. Let BloombergBNA assist you in developing and refining the skills needed to evaluate the tax provisions. Read through our course outline and reserve your place today at this special program. WHO SHOULD ATTEND This intermediate level course is designed for the corporate VP-Tax or accounting, as well as directors, managers and their staff, including controllers and financial executives responsible for assembling the tax provision and financial statement preparation. This two-day course is designed to upgrade your skills under ASC 740 and also will benefit financial analysts and investment bankers involved in evaluating financial statements. Prerequisites: completion of our Tax Accounting Primer course, or familiarity with the basic ASC 740 rules and an understanding of valuation allowances is necessary. This program is nontransitional which is appropriate for experienced attorneys. Earn Up to 15 CPE/CLE Credits >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> U.S. INTERNATIONAL TAX REPORTING & COMPLIANCE December 15 & 16, 2014 • Bloomberg LP • New York, NY WHY YOU SHOULD ATTEND In today’s global business environment, U.S. and foreign-based multinational companies are expanding overseas and increasing their cross-border business activities. The U.S. Internal Revenue Service (IRS) has implemented extensive tax reporting requirements for monitoring foreign activities of U.S. companies. As a result, tax departments at multinational companies must constantly review their global operations and filing responsibilities to stay in compliance with the U.S. tax laws. Bloomberg BNA is pleased to announce its Conference on U.S. International Tax Reporting & Compliance. This two-day entry level update session is designed to familiarize attendees with the latest IRS reporting requirements and review the latest forms and best practices for IRS international tax compliance. Let our faculty show you how to calculate the amount of a Subpart F dividend and the Sec. 78 gross-up for inclusion in U.S. income. Find out if your company is adequately documenting its intercompany transactions and expense apportionment methodologies. Review recent cross-border merger and reorganization activities with our experienced faculty and ascertain if the IRS disclosure requirements have been satisfied. Attendees should have a fundamental understanding of U.S. international tax or should have attended the Bloomberg BNA course on Introduction to U.S. International Tax or an equivalent course. WHO SHOULD ATTEND This basic level update session is designed for tax practitioners new to the international tax area or looking to update their knowledge of the latest U.S. international tax reporting and compliance requirements. Attendees include corporate tax managers, tax analysts, tax supervisors and controllers, as well as, tax accountants, attorneys and financial executives responsible for overseeing U.S. international tax compliance for their clients. This program with live group instruction is transitional which is appropriate for newly admitted attorneys. Earn Up to 16 CPE/CLE Credits CURRENT ISSUES IN U.S. ACCOUNTING FOR INCOME TAXES (ASC 740) December 15 & 16, 2014 • Bloomberg LP • New York, NY >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>> U.S. INTERNATIONAL TAX REPORTING & COMPLIANCE December 15 & 16, 2014 • Bloomberg LP • New York, NY These unique courses are offered exclusively by Bloomberg BNA ::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::: For more information, call 800.372.1033 or visit www.bna.com/taxseminars ::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::::: Bloomberg BNA’s Customer Contact Center 3 Bethesda Metro Center, Suite 250 Bethesda, MD 20814-5377

© Copyright 2026