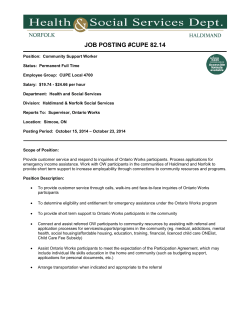

W