Document 411086

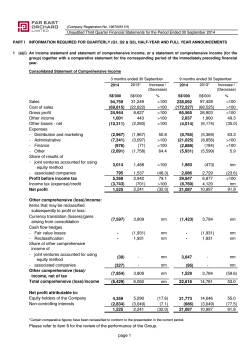

C&G ENVIRONMENTAL PROTECTION HOLDINGS LIMITED Third Quarter Results and Dividend Announcement for the Period Ended 30 September 2014 The Board of Directors are pleased to announce the consolidated results of the Group for the three months ended 30 September 2014. The figures presented below have not been audited. PART I - INFORMATION REQUIRED FOR ANNOUNCEMENTS OF QUARTERLY (Q1, Q2 & Q3), HALF-YEAR AND FULL YEAR RESULTS 1(a)(i) An income statement and statement of comprehensive income, or a statement of comprehensive income, for the group, together with a comparative statement for the corresponding period of the immediately preceding financial year. three months ended 30 September nine months ended 30 September % % 2014 2013 Increase / 2014 2013 Increase / HK$'000 HK$'000 (Decrease) HK$'000 HK$'000 (Decrease) Revenue Cost of sales 176,482 (125,021) 163,700 (116,774) 7.81 7.06 587,820 (388,112) 417,374 (263,711) 40.84 47.17 Gross profit 51,461 46,926 9.66 199,708 153,663 29.96 Other income Administrative expenses Other operating income/(expense) 7,714 (27,587) 15,785 (19,811) (51.13) 39.25 25,341 (70,575) 29,179 (60,057) (13.15) 17.51 1,007 (3,912) 125.74 3,506 (3,912) 189.62 Profit from operations 32,595 38,988 (16.40) 157,980 118,873 32.90 (37,116) (31,337) 18.44 (110,147) (91,417) 20.49 (Loss)/profit before tax (4,521) 7,651 (159.09) 47,833 27,456 74.22 Income tax expense (1,003) (3,282) (69.44) (19,668) (4,749) 314.15 (Loss)/profit for the year attributable to the owners of the Company (5,524) 4,369 (226.44) 28,165 22,707 24.04 4,000 11,044 (63.78) (9,645) 45,585 (121.16) (1,524) 15,413 (109.89) 18,520 68,292 (72.88) Finance costs Other comprehensive income, net of tax: Items that may be reclassified to profit or Exchange difference on translating foreign Total comprehensive income for the year attributable to the owners 1 1 (a)(ii) Explanatory Notes: Other income comprises: The Group Three months ended 30 September 2014 HK$’000 Interest income Exchange gain (Loss)/gain on disposal of fixed assets Government grants Refund of value-added tax Fair value gain on financial liabilities at fair value through profit or loss Reimbursement income from a contractor Sundry income 2013 HK$’000 26 520 6,973 - Nine months ended 30 September 2014 HK$’000 551 4 (1) 645 6,605 110 2013 HK$’000 240 3,106 21,767 - 810 39 25 2,051 18,057 215 - 7,482 - 7,482 195 7,714 389 15,785 228 25,341 500 29,179 (Loss)/profit before tax is arrived at after charging/(crediting): The Group Three months ended 30 September 2014 HK$’000 Depreciation and amortisation Interest on bank loans Interest on finance lease Reversal of impairment loss of value-added tax receivables 34,120 37,098 18 (1,007) 2 2013 HK$’000 33,488 31,326 11 - Nine months ended 30 September 2014 HK$’000 102,751 110,090 57 (3,506) 2013 HK$’000 99,172 91,393 24 - 1(b)(i) A statement of financial position (for the issuer and group), together with a comparative statement as at the end of the immediately preceding financial year. The Group 30.9.2014 31.12.2013 HK$'000 HK$'000 Non-current assets Fixed assets Intangible assets Long term prepayment Investment in subsidiaries Investment in a joint venture The Company 30.9.2014 31.12.2013 HK$'000 HK$'000 8,592 4,129,794 11,015 71 4,149,472 10,113 4,041,219 71 4,051,403 10,191 158,068 7,743 140,901 193,650 237,335 107,336 - 418,665 483,842 2 - 16,752 53,548 44,722 895,596 21,726 44,044 54,930 990,521 49 906,203 9,316 195 1,023,101 906,203 134 906,337 5,045,068 5,041,924 1,609,512 1,481,733 97,302 1,664,192 97,302 1,645,026 97,302 1,364,874 97,302 1,372,657 1,761,494 1,742,328 1,462,176 1,469,959 1,980,389 976 25,003 116,173 2,122,541 1,984,086 1,136 24,257 97,059 2,106,538 71,637 71,637 - 39,177 42,434 - - 45,836 53,001 - - 419,578 317,075 1,091 269 336,350 1,657 1,161,033 345,159 317,075 1,097 257 432,369 1,666 1,193,058 2,263 73,436 75,699 2,255 9,519 11,774 Total liabilities 3,283,574 3,299,596 147,336 11,774 TOTAL EQUITY AND 5,045,068 5,041,924 1,609,512 1,481,733 Current assets Inventories Trade receivables Gross amounts due from customers for contract work Other deposits and other receivables Trade deposits and prepayments Due from a subsidiary Pledged bank deposits Bank and cash balances TOTAL ASSETS Capital and reserves Share capital Reserves Equity attributable to owners of the Company Non-current liabilities Interest-bearing borrowings Finance lease payables Deferred income Deferred tax liabilities Current liabilities Trade payables Gross amounts due to customers for contract work Accruals and other payables Advance payment received Due to a subsidiary Deferred income Finance lease payables Interest-bearing borrowings Current tax liabilities 3 11,015 575,396 586,411 - 575,396 575,396 - 1(b)(ii) In relation to the aggregate amount of the group's borrowings and debt securities, specify the following as at the end of the current financial period reported on with comparative figures as at the end of the immediately preceding financial year. Amount repayable in one year or less, or on demand As at 30 September 2014 As at 31 December 2013 Secured (HK$’000) Unsecured (HK$’000) Secured (HK$’000) Unsecured (HK$000) 336,350 Nil 432,369 Nil Amount repayable after one year As at 30 September 2014 As at 31 December 2013 Secured (HK$’000) Unsecured (HK$’000) Secured (HK$’000) Unsecured (HK$’000) 1,980,389 Nil 1,984,086 Nil Details of any collateral At 30 September 2014, the banking facilities of the Group were secured by the following: The pledge of the Group’s intangible assets of approximately HK$4,129,794,000. 4 1(c)(i) A statement of cash flows (for the group), together with a comparative statement for the corresponding period of the immediately preceding financial year. Group three months ended 30 September 2014 2013 HK$'000 HK$'000 Group nine months ended 30 September 2014 2013 HK$'000 HK$'000 CASH FLOW FROM OPERATING ACTIVIES (Loss)/profit before tax Adjustments for: Depreciation and amortisation Interest expenses Profit from construction services Amortisation of deferred income Interest income Gain on financial liability at fair value through profit or loss Written off of construction in progress and fixed assets Reversal of impairment loss of value-added tax receivables Net loss/(gain) on disposal of fixed asset Share based payment expenses (4,521) 7,651 47,833 27,456 34,120 37,116 (2,628) (272) (26) (1,007) 204 33,488 31,337 (267) (551) (110) 3,912 1 247 102,751 110,147 (7,135) (818) (240) (3,506) 646 99,172 91,417 (414) (794) (810) (215) 3,912 (25) 380 Operating profit before working capital changes Increase in long term prepayment Decrease/(increase) in inventories Decrease/(Increase) in trade receivables Decrease/(increase) in other deposits and other receivables (Increase)/decrease in trade deposits and prepayments Increase/(decrease) in trade payables Increase/(decrease) in accruals and other payables Increase in deferred income 62,986 (11,015) 208 11,335 14,632 (159) 4,898 5,268 1,702 75,708 907 (15,122) 7,532 (12,014) 1,831 (22,814) 1,041 249,678 (11,015) (2,448) (17,167) 68,683 4,974 (3,257) (10,450) 1,702 220,079 (2,437) 5,354 (4,329) (20,150) 7,850 (15,718) 6,819 Cash generated from operations Interest paid 89,855 (45,836) 37,069 (45,553) 44,019 (8,484) 152,871 76,642 CASH FLOWS FROM INVESTING ACTIVITIES Payment for construction work for BOT projects Investment in a joint venture Proceeds from disposal of fixed assets Purchase of fixed assets Interest received (136,479) (470) 26 31,224 (71) 50 (322) 551 (244,782) 7 (1,146) 240 (78,081) (71) 100 (1,663) 810 Net cash (used in)/generated from investing activities (136,923) 31,432 (245,681) (78,905) Net cash generated from/(used in) operating activities CASH FLOWS FROM FINANCING ACTIVITIES Decrease in amount due to contractors Advance from/(repayment to) ultimate holding company and a related company (Increase)/decrease in pledged bank deposits Repayment of finance lease payables Repayment of interest-bearing borrowings Drawdown of Interest-bearing borrowings - (24,892) 91,390 (66,695) (9,350) 31,469 (66) (37) (117,551) (117,141) 122,449 505,430 280,700 197,468 (127,829) (120,826) 134,271 (67,294) (56,515) (9,504) (33) (194) (85) (423,165) (310,306) 322,592 745,630 Net cash generated from financing activities 86,872 328,134 24,000 311,397 NET (DECREASE)/INCREASE IN CASH AND CASH EQUIVALENTS (6,032) 351,082 (68,810) 309,134 25,397 (19,534) 58,602 33,670 54,930 9,993 Effect on foreign exchange rate changes CASH AND CASH EQUIVALENTS AT BEGINNING OF THE FINANCIAL PERIOD CASH AND CASH EQUIVALENTS AT END OF THE FINANCIAL PERIOD ANALYSIS OF THE BALANCES OF CASH AND CASH Bank and cash balances 5 25,357 21,249 44,722 352,797 44,722 352,797 44,722 352,797 44,722 352,797 1(d)(i) A statement (for the issuer and group) showing either (i) all changes in equity or (ii) changes in equity other than those arising from capitalisation issues and distributions to shareholders, together with a comparative statement for the corresponding period of the immediately preceding financial year. Attributable to owners of the Company Share Foreign based currency Share Share Contributed Statutory payment translation Retained capital premium surplus reserve reserve reserve earnings Total HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 97,302 786,115 39,768 1,071 209,568 526,839 1,762,814 Group For the three months ended 30 September 2014 At 1 July 2014 Share-based payment Total comprehensive income for the financial period At 30 September 2014 102,151 - - - - 204 - - - - - - - 4,000 (5,524) 204 (1,524) 97,302 786,115 102,151 39,768 1,275 213,568 521,315 1,761,494 97,302 786,115 102,151 204,730 534,264 1,764,463 For the three months ended 30 September 2013 At 1 July 2013 Share-based payment Total comprehensive income for the financial period At 30 September 2013 39,768 133 - - - - 247 - - - - - - - 247 11,044 4,369 15,413 97,302 786,115 102,151 39,768 380 215,774 538,633 1,780,123 97,302 786,115 102,151 223,213 493,150 1,742,328 For the nine months ended 30 September 2014 At 1 January 2014 Share based payment Total comprehensive income for the financial period At 30 September 2014 39,768 629 - - - - 646 - - - - - 1,275 - 97,302 786,115 102,151 39,768 97,302 786,115 102,151 39,768 - - 646 (9,645) 28,165 18,520 213,568 521,315 1,761,494 170,189 515,926 1,711,451 For the nine months ended 30 September 2013 At 1 January 2013 Share-based payment Total comprehensive income for the financial period At 30 September 2013 - - - - 380 - - - - - 97,302 786,115 102,151 6 39,768 380 - - 380 45,585 22,707 68,292 215,774 538,633 1,780,123 Attributable to owners of the Company Share Foreign based currency Share Share Contributed payment translation Retained capital premium surplus reserve reserve earnings Total HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 HK$'000 97,302 786,115 1,071 125,755 352,383 1,464,777 Company For the three months ended 30 September 2014 At 1 July 2014 Share-based payment Total comprehensive income for the financial period At 30 September 2014 102,151 - - - 204 - - - - - - - (2,805) 204 (2,805) 97,302 786,115 102,151 1,275 125,755 349,578 1,462,176 97,302 786,115 102,151 133 125,755 362,190 1,473,646 For the three months ended 30 September 2013 At 1 July 2013 Share-based payment Total comprehensive income for the financial period At 30 September 2013 - - - 247 - - - - - - - (1,589) 247 (1,589) 97,302 786,115 102,151 380 125,755 360,601 1,472,304 97,302 786,115 102,151 629 125,755 358,007 1,469,959 For the nine months ended 30 September 2014 At 1 January 2014 Share-based payment Total comprehensive income for the financial period At 30 September 2014 - - - 646 - - - - - - - (8,429) 97,302 786,115 102,151 97,302 786,115 102,151 646 (8,429) 1,275 125,755 349,578 1,462,176 - 125,755 364,572 1,475,895 For the nine months ended 30 September 2013 At 1 January 2013 Share-based payment Total comprehensive income for the financial period At 30 September 2013 - - - 380 - - - - - - - (3,971) 97,302 786,115 102,151 7 380 125,755 360,601 380 (3,971) 1,472,304 1(d)(ii) Details of any changes in the company's share capital arising from rights issue, bonus issue, share buy-backs, exercise of share options or warrants, conversion of other issues of equity securities, issue of shares for cash or as consideration for acquisition or for any other purpose since the end of the previous period reported on. State also the number of shares that may be issued on conversion of all the outstanding convertibles, as well as the number of shares held as treasury shares, if any, against the total number of issued shares excluding treasury shares of the issuer, as at the end of the current financial period reported on and as at the end of the corresponding period of the immediately preceding financial year. Par value HK$ Issued and fully paid-up ordinary shares and balances as at 30 September 2013 and 30 September 2014 0.10 Number of shares 973,023,354 Issued and paid-up share capital HK$ 97,302,335 Note: There were no changes in the Company’s share capital since the end of the previous period reported on. (i) Employee Share Option Plan As at 30 September 2014, the number of outstanding share options was 2,778,000 (30 September 2013: 2,585,000). (ii) Performance Share Plan (“PSP”) As at 30 September 2014, the number of shares outstanding under the Company’s PSP was 1,665,800 (30 September 2013: 1,550,000). (iii) Restricted Share Plan (“RSP”) As at 30 September 2014, the number of shares outstanding under the Company’s RSP was 1,111,200 (30 September 2013: 1,034,000). 1(d)(iii) To show the total number of issued shares excluding treasury shares as at the end of the current financial period and as at the end of the immediately preceding year. Par value HK$ Issued and fully paid-up ordinary shares and balance as at 1 January and 30 September 2014 0.10 Number of shares 973,023,354 1(d)(iv) A statement showing all sales, transfers, disposal, cancellation and/or use of treasury shares as at the end of the current financial period reported on. Not applicable. 2. Whether the figures have been audited or reviewed, and in accordance with which auditing standard or practice. The figures have not been audited nor reviewed by the Company’s auditors. 3. Where the figures have been audited or reviewed, the auditors' report (including any qualifications or emphasis of a matter). Not applicable. 8 4. Whether the same accounting policies and methods of computation as in the issuer's most recently audited annual financial statements have been applied. The Group has applied the same accounting policies and methods of computation adopted in the preparation of financial statements for the year ended 31 December 2013. 5. If there are any changes in the accounting policies and methods of computation, including any required by an accounting standard, what has changed, as well as the reasons for, and the effect of, the change. Not applicable. 6. Earnings per ordinary share of the group for the current financial period reported on and the corresponding period of the immediately preceding financial year, after deducting any provision for preference dividends. (a) Based on the weighted average number of ordinary shares on issue; and (b) On a fully diluted basis (detailing any adjustments made to the earnings). Three months ended 30 September 2014 HK$ cents Earnings per share (1) - Basic (2) - Diluted Three months ended 30 September 2013 HK$ cents (0.57) N/A 0.45 N/A Nine months ended 30 September 2014 HK$ cents 2.89 N/A Nine months ended 30 September 2013 HK$ cents 2.33 N/A Explanatory notes: 1. Basic earnings per share (“EPS”) is calculated based on the profit attributable to shareholders for the period ended 30 September 2014 and 2013 and the weighted average number of shares 973,023,354 (2013:973,023,354). 2. No diluted earnings per share is presented as the Company did not have any diluted potential ordinary shares during the period ended 30 September 2014 and 2013. 7. Net asset value (for the issuer and group) per ordinary share based on the total number of issued shares excluding treasury shares of the issuer at the end of the:— (a) current financial period reported on; and (b) immediately preceding financial year. Net asset value (HK$’000) Number of issued shares Net asset value per share (HK$ cents) The Group 30.9.2014 The Group 31.12.2013 The Company 30.9.2014 1,761,494 973,023,354 1,742,328 973,023,354 1,462,176 973,023,354 1,469,959 973,023,354 181.03 179.06 150.27 151.07 The Company 31.12.2013 8. A review of the performance of the group, to the extent necessary for a reasonable understanding of the group's business. It must include a discussion of the following:— (a) any significant factors that affected the turnover, costs, and earnings of the group for the current financial period reported on, including (where applicable) seasonal or cyclical factors; and (b) any material factors that affected the cash flow, working capital, assets or liabilities of the group during the current financial period reported on. 9 Review of Operating Results of the Group Revenue Electricity generation and construction The revenue comprised of (i) construction income, (ii) electricity tariff and waste handling fee (i.e. revenue from WTE operation services) and (iii) equipment sales. The revenue mix is shown in the table below: Three months Three months ended 30 ended 30 September 2014 September 2013 HK$'000 Revenue from operation services Revenue from construction services Total HK$'000 Increase / (decrease) % 118,857 109,045 9.0 57,625 54,655 5.4 176,482 163,700 7.8 In Q3 2013, there were six plants in operation with a total capacity of 5,100 tonnes, namely Jinjiang, Huangshi, Huian, Anxi, Fuqing and Jianyang. In Q3 2014, with the expansion of phase 2 for the Anxi plant, these six plants are currently operating with a total capacity of 5,400 tonnes. Revenue from operation services comprised of power generation and waste handling fees of HK$117.8 million and equipment sales of HK$1.1 million. Revenue from operation services increased by 9.0% to HK$118.9 million for Q3 2014. During the review quarter, the Group processed approximately 455,000 tonnes of waste and generated 113,996,000 kWh of on-grid electricity which were sold, an increase of 5.9% and 9.4% respectively compared with Q3 2013. The average utilisation rate for waste handling remained stable at 91.5% in Q3 2014 compared to Q3 2013, and the average utilisation rate for electricity generation increased from 65.9% in Q3 2013 to 72.1% in Q3 2014. The increase in revenue from operation services was mainly attributable to an upward adjustment of waste handling fee for the Huian plant since October 2013 and contributions from the improved operational efficiency in both waste processing and electricity generation at the plants. Construction services revenue is recognised according to the percentage of completion for construction of Waste-to-Energy (“WTE”) plants. During the period under review, the revenue from construction services were mainly generated from the Thailand and Huian Phase 2 projects. The higher construction revenue for the Thailand and Huian Phase 2 projects recognised in Q3 2014 was in line with the progress of the construction work. Gross profit A breakdown of the gross profit by sector is as follows: Three months Three months ended 30 ended 30 September September 2013 2014 HK$'000 HK$'000 Increase / (decrease) % Gross profit Operation services Construction services Total 48,833 46,926 4.1 2,628 - N.M 51,461 46,926 9.7 Gross profit margin Operation services Construction services Total 10 41.1% 43.0% 4.6% 0.0% 29.2% 28.7% Gross profit margin from operation services decreased from 43.0% in Q3 2013 to 41.1% in Q3 2014. For details, please refer to the explanation in the paragraph below under Net loss. Other income Other income decreased mainly because there was no reimbursement income from a contractor for the use of facilities in Q3 2014 compared to HK$7.5 million which was recognised in other income in Q3 2013. Administrative expenses Administrative expenses which include payroll expenses, legal and professional expenses, travelling and business development-related expenses amounted to HK$27.6 million for Q3 2014. The balance increased by HK$7.8 million mainly due to higher legal and professional fee arising from securing the term loan facility with China Development Bank Corporation for the Bangkok WTE Project, recognition of the under-provision of China building taxes from prior years and increased in travelling expenses. Other operating income/(expense) Other operating income/(expense) amounted to HK$1.0 million due to the reversal of impairment loss of value added tax receivables upon the receipt of the value added tax invoices from a contractor. In Q3 2013, other operating expense represented construction in progress and fixed assets of HK$3.9million which were written off due to the Nanping project which was in the process of deregistration. Finance costs Finance costs increased from HK$31.3 million to HK$37.1 million for the three months ended 30 September 2014. This was mainly due to an increase in the bank loan interest paid for the new bank loans for the Jinjiang, Huian and Anxi projects. Income tax expense Income tax expense comprises deferred tax expense. The decrease was mainly due to a decrease in deferred tax expense arising from temporary differences between the international and PRC GAAP. Three months ended 30 September 2014 HK$’000 Income tax expense Deferred tax expense Temporary differences on assets recognised under IFRIC 12 Tax loss Temporary differences between the international and PRC GAAP Total Three months ended 30 September 2013 HK$’000 Changes - - (4,745) (433) 995.8% 14,244 (8,496) (973) 4,688 (1,563.9%) (281.2%) 1,003 3,282 (69.4%) EBITDA EBITDA on recurring items is shown in the table below. Construction profit is excluded in the below analysis as the amount is recognised according to the percentage of completion of the construction work of the plants. This amount fluctuates every quarter. 11 Three months Three months Increase / ended 30 ended 30 (decrease) September 2014 September 2013 HK$'000 HK$'000 % 64,088 76,387 (16.1) EBITDA (exclude construction profit) For details, please refer to the explanation in the paragraph below under Net loss. Net loss The Group recorded a net loss of HK$5.5million for Q3 2014 compared to a net earnings of HK$4.3million for Q3 2013. During the quarter under review, legal and professional fee increased by HK$2.5 million for securing and preparing the documentation of the loan facility from China Development Bank Corporation, additional provision of HK$1.7million was made for the under provision of China Building tax, reimbursement income from contractor dropped by HK$7.5million and non-recurring expenses of HK$8million (approximately RMB6.35million) was incurred as a result of an industrial accident in C&G Environmental Protection (Anxi) Company Limited (hereinafter “Anxi Plant"), a wholly-owned subsidiary of the Group. Subsequent to the accident, the Group has launched a review and introduced improvements to the safety measures and practices for all the subsidiaries. Anxi plant having obtained the necessary approvals from relevant departments for resumption of operation, has since resumed normal operations. In the meanwhile, the Group had submitted the claims to the insurance companies to recover the non-recurring expenses. As at the date of this report, HK$1.2million (approximately RMB0.96million) has been recovered. The final amount of the claims that can be recovered from the insurance companies is still under assessment and will be credited to the Income Statement according to IAS 37 when it is virtually certain. Financial Position of the Group ASSETS Intangible assets Intangible assets represent the service concession rights for WTE BOT projects in PRC. The intangible assets were stated at amortised cost with the initial measurement at the fair value, which was assessed by an independent valuer with reference to the replacement cost and the percentage of completion of the construction of work for each project. The increase of HK$88.6 million in intangible assets was due to the movement below: HK$’000 4,041,219 211,348 (100,103) (22,670) 4,129,794 Net book value as at 1 January 2014 Add: Addition during the period Less: Amortisation for the period Exchange loss Net book value as at 30 September 2014 Trade receivables The trade receivable balance of HK$158.1 million comprised receivables from waste services of HK$25.3 million, electricity tariff of HK$132.3 million and equipment sales of HK$0.5 million. Trade receivables increased by HK$17.2 million mainly due to the overall increase in operational revenue. Long term prepayment Long term prepayment of HK$11.0 million represented the unamortised portion of the export credit insurance for the equipment for our Bangkok Nong Khaem Municipal Solid Waste Incineration Power Plant in Q3 2014 as required by the lender, China Development Bank Corporation. The balance will be amortised over the tenure of the loan (i.e. 9 years). 12 Gross amounts due (to)/from customers for contract work Gross amounts due (to)/from customers for contract work represented the amount prepaid or payable to the contractors and suppliers, calculated based on the percentage of completion of construction work. The decrease in gross amounts due from customers for contract work was mainly due to the utilisation of prepaid amount for the construction cost for the Huian phase 2 and Thailand projects. The decrease in gross amounts due to customers for contract work was mainly due to settlement to contractors for the Langfang project. Other deposits and other receivables Other receivables Deposits Due from a joint venture Value-added tax receivables Amount due from a related company 30.9.2014 HK$’000 16,300 32,064 5 28,025 31.12.2013 HK$’000 54,666 44,774 5 42,334 342,271 418,665 342,063 483,842 Changes (70.2%) (28.4%) (33.8%) 0.1% (13.5%) Other deposits and other receivables mainly represented tender deposit paid for the BOT contracts, value-added tax receivables, prepaid expenses paid to contractors and amount due from a related company. The balance of other deposits and other receivables decreased by HK$65.2 million was mainly because utilisation of the prepaid expenses paid to the contractor, amounting to HK$44.4 million and the refund of tender deposit paid for the BOT contracts of HK$12.7 million. Trade deposits and prepayments The decrease in trade deposits and prepayments of HK$5.0 million was mainly due to the utilisation of the prepaid spare parts cost of HK$5.0 million. Pledged bank deposits The pledged bank deposits represented deposit of HK$25.3 million placed in the bank to facilitate the arrangement of performance guarantee to the Thailand government for the Bangkok WTE project, deposit of HK$18.9 million to secure the repayment of bills payable to the subcontractor and 12-month fixed deposit of US$1.2 million (equivalent to HK$9.3 million) pledged to secure the bank loan of the Bangkok WTE Project. The balance increased by HK$9.5 million mainly due to the HK$9.3 million fixed deposit as at 30 September 2014. Bank and cash balances Bank and cash balances decreased by HK$10.2 million as at 30 September 2014. For details of the cash movement, please refer to the Statement of Cash Flows and the explanation notes on page 15. LIABILITIES Trade payables Trade payables decreased by HK$3.3 million mainly because of decrease in spare parts used for operation and maintenance services. Accruals and other payables Bills payable Amounts due to contractors Due to the ultimate holding company Due to a related company Others 30.9.2014 HK$’000 38,589 97,474 232,736 1,163 49,616 419,578 13 31.12.2013 HK$’000 38,049 154,097 99,168 460 53,385 345,159 Changes 1.4% (36.7%) 134.7% 152.8% (7.1%) 21.6% Others comprised mainly of accrued salaries, other payables, bank interest payable, other tax payables, retirement benefit payable and value-added tax payable. Accruals and other payables increased by HK$74.4 million mainly due to the following reasons: (1) Settlement of construction payables of HK$61.0 million; and (2) Increase in amount due to the ultimate holding company of HK$133.6 million. Advance payment received The amount represented the brought forward balance of the advance payment of the cash consideration of RMB250 million (equivalent to HK$317.5 million) paid by Grandblue Environment Company Limited (“the Purchaser”) for the Proposed Sales according to the Framework Agreement entered into on 23 December 2013. Deferred income Non-current portion Current portion 30.9.2014 HK$’000 25,003 1,091 26,094 31.12.2013 HK$’000 24,257 1,097 25,354 Changes 3.1% (0.5%) 2.9% Deferred income represented the unrecognised part of government subsidies received by the project companies. These balances will be recognised over the remaining concession periods of the related projects upon commencement of operation. The balance increased by 2.9% mainly due to the receipt of government subsidy of HK$1.7 million for the Jianyang project in Q3 2014 which was partially net off with the amortisation of deferred income for the period. Finance lease payables Non-current portion Current portion 30.9.2014 HK$’000 269 976 1,245 31.12.2013 HK$’000 257 1,136 1,393 Changes 4.7% (14.1%) (10.6%) The finance lease payables represented the payable for the purchase of vehicles under hire purchase agreements. The balance decreased by 10.6% due to the repayment of the finance lease payables for the period. Interest-bearing borrowings Non-current portion Current portion 30.9.2014 HK$’000 1,980,389 336,350 2,316,739 31.12.2013 HK$’000 1,984,086 432,369 2,416,455 Changes (0.19%) (22.2%) (4.1%) The interest-bearing borrowings decreased by 4.1% as compared with prior year. The loan was borrowed as project loans to finance the construction of WTE plants. In Q3 2014, HK$322.6 million was drawn down and HK$423.2 million was repaid. The loans were secured by the intangible assets. As at 30 September 2014, the Group’s gearing ratio remained relatively stable at 65.1% compared to 65.4% as at 31 December 2013. Financial Position of the Company Long term prepayment Long term prepayment of HK$11.0 million represented the unamortised portion of the paid insurance fee in Q3 2014 for the term loan facility in the amount of US$24.0 million with China Development Bank Corporation for 9 years for the Bangkok WTE Project. 14 Gross amounts due from customers for contract work Gross amounts due from customers for contract work represented the amount prepaid to the contractors, calculated based on the percentage of completion of construction work. The increase in gross amounts due from customers for contract work was mainly due to the prepaid amount for the construction cost for the Thailand project. Trade deposits and prepayments Trade deposits and prepayments represented the current portion of the long term prepayment. For details, please refer to the explanation paragraph of the long term prepayment item. Pledged bank deposits The pledged bank deposits represented a 12-month fixed deposit of US$1.2 million (equivalent to HK$9.3 million) pledged to secure the bank loan of the Bangkok WTE Project which was drawdown in Q3 2014. Interest-bearing borrowings The interest-bearing borrowings represented non-current portion of the term loan facility in the amount of US$24.0 million with China Development Bank Corporation for 9 years for the Bangkok WTE Project. Statement of Cash Flows Net cash generated from operating activities The Group recorded a net cash inflow in operating activities for the period mainly because of the decrease in prepaid expenses paid to contractors and the settlement of trade receivables. Net cash used in investing activities Net cash used in investing activities in this quarter represented mainly the payment of construction costs for the BOT projects. Net cash generated from financing activities Net cash generated from financing activities in this quarter represented mainly net cash inflow from the drawdown of interest-bearing borrowings and advance from the ultimate holding company offset by the repayment of interest-bearing borrowings and increase in pledged bank deposits. 9. Where a forecast, or a prospect statement, has been previously disclosed to shareholders, any variance between it and the actual results. Not applicable. 15 10. A commentary at the date of the announcement of the significant trends and competitive conditions of the industry in which the group operates and any known factors or events that may affect the group in the next reporting period and the next 12 months. Further to the announcements made on 23 October 2013, 24 November 2013, 24 December 2013, 29 January 2014, 8 April 2014, 7 May 2014, 30 June 2014, 7 July 2014, 14 August 2014, 15 September, 22 October 2014, 29 October 2014 (the “Previous Announcements”) and its circular to shareholders dated 14 April 2014 (the “Circular”) in relation to the proposed sale of the Group’s WTE business and assets in the PRC to the Purchaser, the Listed Company Acquisition and Restructuring Review Committee of China Securities Regulatory Commission ( “CSRC”) has conditionally approved the Purchaser’s application for the issue and allotment of its shares to C&G (HK) as part consideration for acquisition of C&G (China). Further announcement will be made upon the receipt of the formal approval documents from CSRC by the Purchaser and will keep shareholders informed of further significant developments. The Company has successfully secured the term loan facility in the amount of US$24.0 million with China Development Bank Corporation on 18 August 2014 with a loan tenure of 9 years for financing the equipment cost for our Bangkok WTE project. As of the date of this report, US$15.5 million was drawdown. The Bangkok WTE project is currently under construction and is expected to be completed by the first half of 2015. The Company has incorporated a subsidiary in Shenzhen and it has commenced the equipment sales business since Q3 2014. In Q4 2014, it has further secured the second contract of approximately RMB0.8million. More contracts are expected to be secured or awarded in coming 12 months. 11. If a decision regarding dividend has been made:— (a) Whether an interim (final) ordinary dividend has been declared (recommended). None (b) (i) Amount per share and (ii) previous corresponding period. None (c) Whether the dividend is before tax, net of tax or tax exempt. If before tax or net of tax, state the tax rate and the country where the dividend is derived. (If the dividend is not taxable in the hands of shareholders, this must be stated). Not applicable. (d) The date the dividend is payable. Not applicable. (e) The date on which Registable Transfers received by the company (up to 5.00 pm) will be registered before entitlements to the dividend are determined. Not applicable. 12. If no dividend has been declared (recommended), a statement to that effect. No dividend has been declared. 13. If the Group has obtained a general mandate from shareholders for IPTs, the aggregate value of such transactions as required under Rule 920(1)(a)(ii). If no IPT mandate has been obtained, a statement to that effect. There is no general mandate obtained from shareholders on Interested Person Transactions. 16 14. Negative confirmation pursuant to Rule 705(5). Confirmation by the Board We, Lin Yan and Loo Cheng Guan being two Directors of C&G Environmental Protection Holdings Limited (the “Company”), do hereby confirm on behalf of the Directors of the Company that, to the best of our knowledge, nothing has come to the attention of the Board of Directors of the Company which may render the 3Q FY2014 financial statements to be materially false or misleading in any material aspect. BY ORDER OF THE BOARD Lin Yan Director 7 November 2014 Loo Cheng Guan Director 17

© Copyright 2026