GrainCorp Weekly Market Wrap 6 November 2014

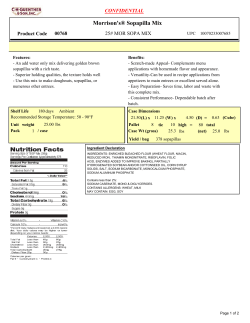

GrainCorp Weekly Market Wrap 6 November 2014 Australian FOB Indications Dec/Jan Protein (11% moisture Base) East Coast ASW Wheat East Coast APW Wheat East Coast AH Wheat APH Wheat 9% 10.5% 11.5% 13% 271 Feed Barley (East) Feed Barley (South) Feed Barley (West) Canola (East)(45% Oil) 260 278 296 317 Sorghum (December) N/A 311 Canola (South) (45% Oil) 478 Canola (West) (45% Oil) 489 FOB Indications USD/mt 253 244 477 North American FOB Indications Dec Protein (12% moisture Base) 2US PNW HRS / DNS 13% 292 US Gulf HRW 12% 275 US Gulf SRW 10% 249 US PNW SWW 12% 262 FOB Indications USD/mt FOB Indications USD/mt Jan FOB Indications USD/mt EU / Black Sea FOB Indications Dec Protein (12% moisture Base) FOB Indications USD/mt Dec/Jan 12.5% 248 Black Sea Feed Barley 212 French 11% 240 France Feed Barley 214 German 12% 250 Russian Weather & Crop Conditions Central Queensland wheat harvest is 98-100% complete. Southern Queensland harvest is more than 90% complete in the Western areas whilst some of the Eastern areas are only 40% complete. Overall yields are slightly higher than expected with good quality overall and a skew towards higher protein. Some thunderstorms in recent days have brought some rainfall that will be beneficial for sorghum planting however more will be required to see significant planting activity. Northern New South Wales (NSW) harvest is well underway for wheat and barley whilst durum has started but yet to reach full swing Central NSW harvest has experienced some minor delays due to some isolated storms and strong winds which knocked some windrowed canola around. The most North-Western areas have finished harvest whilst some of the more Eastern areas are only just getting started on barley. Whilst early harvested wheat was higher protein, anecdotal reports are suggesting ASW1/APW1 are the more predominant grades as harvest progresses Contact: Martin Swinyard, Commodity Analyst +1 403 571 7009 Thomas Lee, Commodity Analyst Ph: +612 9325 9164 © 2014 GrainCorp Operations Limited GrainCorp Southern NSW wheat harvest is yet to get going however barley and canola is at full pace in most areas. Some eastern areas have windrowed canola however are yet to harvest. Victorian barley and canola harvest are well underway in most areas except for the far Southern areas. Quality is mixed but overall surprisingly good given the hot and dry finish in many areas. Wheat harvest expected to pick up in the next week. South Australian harvest really picked up in the last week and is 20-30% complete. Many growers have been surprised with how well their malting barley varieties have been performing Western Australian harvest is in full swing with Northern Geraldton growers expected to be completed by the end of the week. Wheat US futures have been unable to sustain premiums built in previous weeks. As soymeal and soybeans broke lower, wheat and corn followed. Wheat was the only futures market that weakened overnight whilst the others showing small rallies. CBOT wheat has seen reasonably strong resistance beneath the 100 day moving average and it would take a strong event of some sort to see futures rally strongly. This week’s CFTC report will show if funds are still covering their short aggressively leading into the USDA report or if they a comfortable with their positions. Russian cash values have been supported higher this week whilst EU wheat is the cheapest into many of the Middle East tender markets. French is the dominant supplier to GASC which is evidence that there are no concerns around quality. Canadian feed wheat is the cheapest into Asia, yet interior bids have rallied following milling wheat and cheap FOB offers have probably thinned. Canadian milling wheat export sales have been quiet and prices are reasonably stable. The large HRS crop in the US continues to have impact on the Minneapolis-Chicago spread by dragging it lower. Argentina's crop remains susceptible to changes in quality as it completes its growth cycle. Expectations are for exports to be more than double that of last year, but well shy of some programs seen in previous years. Canola Australia’s canola market remains heavily elevated compared to export parity. Growers remain on the sideline, not pleased with prices as they are currently well below levels received in the past two seasons in AUD terms. This has meant that bids to the growers haven’t weakened closer to export parity as there is no risk whilst the growers remain on the sidelines. Globally, the US soybean complex continues to drive the greater oilseeds complex. The logistical issues with connecting the US crusher with the US meal consumer remain currently, but they are expected to ease in time as the supply chain fills. The export pace of both soybeans and soybean meal remains very strong from the US and this has contributed to the front end strength in both markets. Argentine farmers have increased their selling of old crop soybeans, assisting the Argentine crushers to lock in crush margins. This also will help increase the supply of products from Argentina, in time alleviating the demand pull on US products as sales switch from the US into Argentina. Sorghum Australian sorghum values rallied $8-10 earlier this week on the back of a lack of rainfall despite being forecast over the weekend. Some storm rainfall in recent days will make sorghum growers happy however further rain is needed to see any significant crop planted. The 30-45 day forecast doesn’t look pretty with nothing on the radar. A lack of new crop planting will influence the northern feed grain market and will impact the wheat and barley markets. Sorghum values remain uncompetitive into the feedlot market and many in the poultry industry will also begin recalculating their rations. Corn harvest is China is pressuring values lower however Australian values are uncompetitive against sorghum out the US Texas Gulf. Barley Values in Australian remain firm as marketers are competitively trying to accumulate grain from the grower. Domestic consumers remain uncovered on both feed and malting but growers also remain undersold. Grower selling has increased and there has been increased interest in malting and Hindmarsh varieties due to historically strong premiums above feed barley. European barley values have continued to firm on the back of strong demand and fast export pace. Malting premiums in Denmark have weakened yet remain firm. Winter barley planting in Ukraine is 80% complete whilst conditions in Russia remain cold and dry as they head into dormancy. Feed barley values in Argentina have weakened further to $195 FOB despite reports of frost concerns as harvest approaches. Contact: Martin Swinyard, Commodity Analyst +1 403 571 7009 Thomas Lee, Commodity Analyst Ph: +612 9325 9164 © 2014 GrainCorp Operations Limited GrainCorp Weekly Market Wrap 6 November 2014 This Report Last Report Change AUD/USD (Spot) $0.8568 $0.8767 -$0.0199 CBOT Wht USC/Bu (Dec 14) 523.75 541.78 -18.03 CBOT Corn USC/Bu (Dec 14) 369.50 377.25 -7.75 ASX Wht AUD/MT (Jan 15) $291.00 $290.00 $1.00 ASX Bar AUD/MT (Jan 15) $261.60 $251.50 $10.10 ASX Sor AUD/MT (Sep 15) $300.00 $282.00 $18.00 Contact: Martin Swinyard, Commodity Analyst +1 403 571 7009 Thomas Lee, Commodity Analyst Ph: +612 9325 9164 © 2014 GrainCorp Operations Limited

© Copyright 2026