Rating Rationale

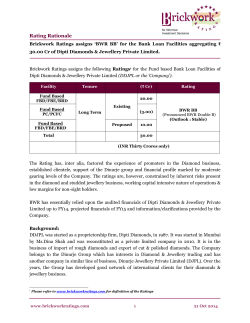

Rating Rationale Brickwork Ratings revises the ratings to ‘BWR BBB-’ and withdraws ‘BWR A4+’ of Kanva Fashions Limited’s Bank Loan Facilities enhanced from ₹ 32.66 Cr to ₹ 54.81 Cr Brickwork Ratings has revised the Ratings1 of Kanva Fashions Limited’s (“KFL” or “the Company”) Bank Loan Facilities enhanced from ₹ 32.66 Cr to ₹ 54.81 Cr as: Bank Canara Bank State Bank of Mysore (SBM) Facility Previous Limits (₹ Cr) Present Limits (₹ Cr) FB:TL-1 1.72 0.09 FB:TL-2 9.77 8.5 FB:TL-3 6 5.38 FB:TL-4 (KSSF) NA 8.65 FB:CC-1 15 17 FB:CC-2 (KSSF) NA 3.5 NFB: Letter of Credit 0.17 NA Total 32.66 43.12 FB:TL-1 (ATSS) 0.61 FB:TL-2 (ATSS) 0.79 FB:CC (ATSS) NA 6 Tenure Previous Rating Present Rating Long Term BWR BB+ (BWR Double B Plus) (Outlook:Stable) BWR BBB(BWR Triple B Minus) (Outlook:Stable) Short Term BWR A4+ (BWR A Four Plus) Withdrawn INR Forty Three Crores and Twelve Lacs Only Long Term NA BWR BBB(Pronounced BWR Triple B Minus) (Outlook:Stable) FB:CC (KYT) 4 FB: Car Loan (ATSS) 0.29 Total 11.69 INR Eleven Crores and Sixty Nine Lakhs Only 54.81 INR Fifty Four Crores and Eighty One Lakhs only Total Rated Limits 32.66 Note: The group entities availing limits from SBM have merged with Kanva Fashions Limited; FB: Fund Based; NFB: Non Fund Based; TL-Term Loan; CC- Cash Credit; ATSS- Aruna Textiles & Silk Sarees; KSSF: Kanva Sri Sai Fabrics 1 Please refer to www.brickworkratings.com for definition of the Ratings www.brickworkratings.com 1 10 Nov 2014 BWR has principally relied upon the audited financial results of FY12, FY13, FY14 and projected financials of FY15 & FY16 of Kanva Fashions Limited, publicly available information and information/clarification provided by the Company management. The rating factors, inter alia, the promoter's experience in same line of business, continuous focus on process improvement, taking the business internationally, healthy revenue growth, moderate financial risk profile and improved debt protection metrics. However, the rating strength are partially offset by limitations to decentralise delegation of authority, encapsulate a professional management team on the Board, demand seasonality in textile industry, ability to continue the conservative volume growth in the changing economic conditions, maintain increasing profitability margins and ability to consolidate the overheads with the resulting merged entities. Background Kanva Fashions Limited (“KFL” or “the Company”) formed in June 2010, was conscious strategy of the promoter by merging Kanva Marketing Limited formed in 1999 and Kanva Fashions formed in 2007, building up the Company from a turnover of Rs.11 Cr in FY10 to Rs.61 Cr in FY13. The ability of the Company to evolve by merging its group entities, led to further consolidating three of its other partnership concerns availing limits from State Bank of Mysore into the private limited Company Kanva Fashions Limited in February 2014. Kanva Fashions Limited strategically acquired these three of its entities viz. Kanva Sri Sai Fabrics (KSSF)- business of manufacturing of shirting fabrics, Aruna Textiles & Silk Sarees (ATSS)- business of weaving of sarees and Kanva Yarn & Threads (KYT)- business of yarn sizing by passing a resolution on February 01, 2014 to strengthen its core operations and emerge as an integrated textile unit. Further, it an attempt by KFL to leverage its growing reputation and achieve additional market share. The Bankers, State Bank of Mysore of the acquired entities and Canara Bank of the merged entity have agreed in-principle for forming a Consortium led by Canara Bank. The limits under review for rating are hence considered on a consolidated basis. The factory at Koratgere in the district of Tumkur is 80kms away from Bangalore and spread across ~50 acre land bank i.e ~22 lakh sq.ft. Comprising of Dyeing, Weaving, Knitting, Processing and Garment Unit each ~5 acre. Also apart from these units, the factory has Effluent Treatment Plant wherein it recycles 90% of waste water for reuse as an environment friendly initiative. It manufactures clothing for men, women and kids and has an installed capacity as: Particulars Installed Capacity Shirts & Trouser Fabric weaving unit (in terms of Meters) Saree Unit (number of sarees) 19,32,000 48,600 Dyed Yarn Unit (in terms of tons) 900 Dyed Fabric Unit (in terms of tons) 900 www.brickworkratings.com 2 10 Nov 2014 The unit operating at 70% of its installed capacity has its products presence in the states of Karnataka, erstwhile Andhra Pradesh and gradually expanding its wings across other parts of India, Also recently it has opened offices in South Korea and USA, as an initiative to increase international base and foray the export segment KFL has its flagship store “KANVA MART” at Rajaji Nagar, Bangalore which is a three storied structure encompassing shirts, trousers, inner-wears, sarees, accessories like belts and watches at it ground level. The Corporate office is on 2nd floor and has Design team for its clothing at 3rd floor. The 1st floor is being renovated to meet the mart’s growing demand KFL specialises in manufacturing of shirts, trousers, T-shirts, Jeans, Casual wear, Inner wear, Sarees, Ladies wear, Kids wear, Belts and watches. The Company leverages its expertise and enjoys flexible core manufacturing competencies in yarn manufacturing, knitting, weaving, dyeing, finishing, as well as cutting, sewing, seamless, and moulding. KFL has 16 Marts in operation and 24 in the pipeline. 11 marts of the 16 are across Bangalore and 5 across Karnataka, further it is looking for additional six units across Karnataka and ~8 units across the country. Going forward, it plans to further expand domestically as well as globally Promoter Profile Mr Narayanappa Nanjundaiah, the Chief Executive Officer of Kanva Fashions Limited, started this unit at Koratagere, as a measure to capitalise on the availability of land and maximise the available resources of labour thereby achieving socio-economic goal of providing livelihood to the local and nearby villages, along with its cost effective initiative for his business. Tumkur, with the recent visit of the Honorable Prime Minister is soon to be recognized as a SMART city. KFL’s Koratgere unit is the only textile factory in its vicinity providing employment to around 3000 employees. Mr Narayanappa Nanjundaiah has received various awards in the last few years for his contribution to society in the field of education and business productivity from government and non-government organizations. Management Profile Kanva Fashions Limited is owned and controlled by the Mr Narayanappa Nanjundaiah who has been instrumental in this line of activity since 1999 and leading the Company since 2010. The other key management personnel are the Directors Mr Harish S and Mr Devendra N with over 10 years industry experience, General managers – Mr. Rajesh and Mr Mahantesh heading retail and marketing operations respectively, and the Deputy General Manager – Mr Murugan who leads the fabric manufacturing division with more than 10 years’ experience in the textile business Financial Performance The Company has been generating major revenue from Manufacturing, and from Sale of Fabrics and Sarees. KFL’s net sales increased from ₹ 60.56 Cr in FY13 to ₹ 74.45 Cr in FY14. The www.brickworkratings.com 3 10 Nov 2014 Operating Profit increased from of ₹ 8.62 Cr in FY13 to ₹ 10.23 Cr in FY14. Although operating profit margins fell below 13% in FY14 as compared to over 14% in FY13, the Net Profit margin has improved from 2.71% in FY13 to 3.20% in FY14. The promoters funding in the form of unsecured loans to be retained during the entire tenor of loans shall remain critical. The Company has prudently merged its associate concerns as a cost reducing initiative and integrated its unit at Koratgere to achieve economies of scale in the long run. The Net worth of the Company has increased from ₹ 35.60 Cr in FY13 to ₹ 69.39 Cr in FY14. The debt has also increased from ₹ 23.90 Cr in FY13 to ₹ 51.85 Cr in FY14. The leverage has slightly deteriorated from 0.67x in FY13 to 0.75x in FY14. Increased inventory from Sarees business as result of consolidation is affecting the working capital cycle needs to be addressed by the Company going forward. The current ratio was 1.78x in FY13 and is 1.85x in FY14. Rating Outlook: The outlook is expected to be stable over the year. Going forward, enrolling of professionally qualified Board, and following of best practices for Corporate Governance and timelines of its profile shall remain key critical factors to the ratings. The ability to scale up its operations, manage the increasing inventories, achieve economies to scale shall remain the key rating sensitivities. Going forward, the Company's foray in the exports shall require efficient utilisation of working capital facilities, manage currency and country risks, consistently grow in scale of operations while maintaining the increasing streak of profit margins, supported with appropriate funding would be the other key rating sensitivities. Analyst Contact Relationship Contact [email protected] [email protected] Phone Media Contact 1-860-425-2742 [email protected] Disclaimer: Brickwork Ratings (BWR) has assigned the rating based on the information obtained from the issuer and other reliable sources, which are deemed to be accurate. BWR has taken considerable steps to avoid any data distortion; however, it does not examine the precision or completeness of the information obtained. And hence, the information in this report is presented “as is” without any express or implied warranty of any kind. BWR does not make any representation in respect to the truth or accuracy of any such information. The rating assigned by BWR should be treated as an opinion rather than a recommendation to buy, sell or hold the rated instrument and BWR shall not be liable for any losses incurred by users from any use of this report or its contents. BWR has the right to change, suspend or withdraw the ratings at any time for any reasons. www.brickworkratings.com 4 10 Nov 2014

© Copyright 2026